There are various types of union dues and professional membership dues you can deduct when filing your taxes. Here’s how the internal revenue service describes the tax treatment of lobbying :

Bill Seeks To Make Union Dues Tax Deductible – Iam District 141

Supporters of the democrats’ proposal may argue they are simply restoring a tax deduction that was.

Are union dues tax deductible 2021. No, employees can’t take a union dues deduction on their return. The green new deal is union friendly. Prior to 2018, an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business expenses, if the total of the dues plus certain miscellaneous itemized expenses reached a certain level.

Are professional dues tax deductible in 2020? 08/13/2021 09:50am edt | updated august 13, 2021. Supporters of the democrats’ proposal may argue they are simply restoring a tax deduction that was previously available, but that’s not quite right.

There is also a provision making union dues tax deductible, another huge union subsidy. There is also a provision making union dues tax deductible, another huge union subsidy. If you’re the primary beneficiary of the union dues and your employer pays them on your behalf, you cannot claim a tax deduction, and you may have to pay taxes on this benefit.

Bill seeks to make union dues tax deductible may 2, 2021 the 2019 tax season was the first time union members could no longer deduct the cost of items such as tools, uniforms, subscriptions to trade journals, and many other items besides union dues that are often necessary for workers to do their jobs and earn a living. A 10 per cent discount will be applied if dues are paid in full by 31 march 2021. Union members could benefit from a tax break that democrats are considering as part of their new $3.5 trillion budget plan.

New bill would restore tax deduction for union dues, other worker expenses april 21, 2021 four years after the income tax deduction for union dues was ripped out of the u.s. Supporters of the democrats’ proposal may argue they are simply restoring a tax deduction that was previously available, but that’s not quite right. Members who pay by payroll deduction please check your group certificate.

The 2019 tax season was the first time union members could no longer deduct the cost of items such as tools, uniforms, subscriptions to trade journals, and many other items besides union dues that are often necessary for. The green new deal is union friendly. A $4500 tax credit is available for electric vehicles only if the car is union made.

A coalition of more than 600 business groups across the country is condemning a democratic proposal in congress to make compulsory union dues tax deductible. The amount of union dues that you can claim is shown in box 44 of your t4 slips, or on your receipts and includes any gst/hst you paid. Union dues are tax deductible so please keep your receipts for your records and remember to advise us if you change your address.

Support for union dues deductions. Under current federal law, union dues are generally not deductible. However, there are a few exceptions, and if your union dues meet one of them you are in luck

Union dues or professional membership dues you can claim. If you belong to a union or professional organization, you can deduct certain types of union dues or professional membership fees from your income tax filings. However, most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the tax cuts and jobs act (tcja) that congress signed into law on december 22, 2017.

In 2017, republicans eliminated tax deductions for workers and instead gave massive tax cuts for large, profitable corporations. This is a result of the tax reform bill signed into law on december 22, 2017. You can claim a deduction for union fees, subscriptions to trade, business or professional associations and payment of a bargaining agent's fee.

Union dues are no longer tax deductible for tax years 2018 through 2025, union dues are no longer deductible on your federal income tax return, even if itemized deductions are taken. Subparagraph 8(1)(i)(iv), paragraph 8(5)(c) cra. At the end of each financial year, we will issue a payment receipt for your tax records.

Can teachers claim union dues on taxes? A $4500 tax credit is available for electric vehicles only if the car is union made. Labor groups are pushing lawmakers to include a provision that would allow workers to deduct the cost of union dues from their taxable income.

France Taxing Wages 2021 Oecd Ilibrary

Tax Relief For Employees Work Expenses Should Not Be Limited To Union Dues

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

Tax Time Remember These Deductions Your Union Won For You

Claiming A Deduction For Union Or Professional Dues – Virtus Group

Are Our Union Dues Tax-deductible In Canada Express Digest

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Why All Workers Should Be Able To Deduct Union Dues – Center For American Progress

Bill Seeks To Make Union Dues Tax Deductible – Iam District 141

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png)

Payroll Taxes And Employer Responsibilities

Deducting Union Dues Drake17 And Prior

Membership Dues Tax Deduction Info – Teachers Association Of Long Beach

Union Dues Opseu Sefpo

Deducting Union Dues On Nys Taxes – Uup Buffalo Center

New Bill Would Restore Tax Deduction For Union Dues Other Worker Expenses

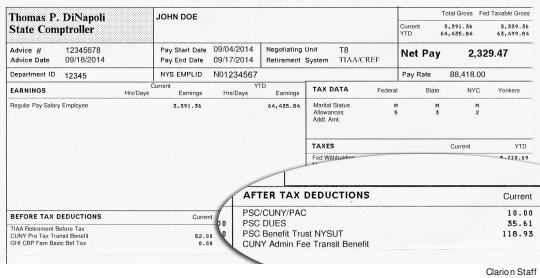

Are You A Union Member Psc Cuny

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News