The deduction is not allowed for any portion of premiums for which you have been reimbursed, have claimed a deduction for federal income tax purposes, have claimed another virginia income tax deduction or subtraction, or have claimed a federal income tax credit or any virginia income tax credit. In most cases, political contributions are not considered a viable business expense and therefore are nondeductible.

States With Tax Credits For Political Campaign Contributions Money

The short answer is no.

Are political contributions tax deductible in virginia. Federal election law requires we request the name, mailing address, occupation, and name of employer for each individual whose contributions aggregate in excess of $200 in a. This doesn’t just mean that donations made to candidates and campaigns are excluded from being tax deductible. If you made a contribution to a candidate or to a political party, campaign, or cause, you may be wondering if your political contributions are tax deductible.

The same goes for campaign contributions. While writing checks to a political party may not help your tax bill, there are ways to financially support a cause you believe in and still take a tax benefit in the process. The answer is no, as uncle sam specifies that funds contributed to the political campaign cannot be deducted from taxes.

Political contributions are not deductible on your federal tax return. While no state lets you deduct political contributions, four of them—arkansas, ohio, oregon, and virginia—actually do something better: Are voluntary contributions from my virginia return tax deductible?

You can't deduct contributions made to a political candidate, a campaign committee, or a newsletter fund. In this sense, our state’s laws track federal law, which generally. $1,500 for contributions and gifts to political parties;

They offer a tax credit for part or all of your contribution, up to a certain amount. “political contributions deductible status” is a myth. Can you deduct political contributions from your taxes?

You should keep records for all tax deductible gifts and contributions you make. If you are one of those citizens, and you were hoping for a tax break, unfortunately, you won't find one here. You may also like to volunteer for political organizations.

The credit does not apply to contributions made to candidates for federal office. Section 7871 of the internal revenue code provides that indian tribal governments are treated as states for purposes of determining whether and in what amount any contribution or transfer to or for the use of such government is deductible under irc section 170 (relating to income tax deduction for charitable, etc., contributions and gifts). View solution in original post.

Are political donations tax deductible? Vpap is a trusted, nonpartisan source for information about virginia politics. Arkansas, ohio, oregon, and virginia offer a tax credit for political contributions.

Political candidate contribution tax credit. Here's what you need to know. Vpap is a trusted, nonpartisan source for information about virginia politics.

Vpap is a trusted, nonpartisan source for information about virginia politics. Vpap is a trusted, nonpartisan source for information about virginia politics. Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate aren't deductible.

In addition, dominion energy does not make payments to influence the outcome of ballot measures. Contributions to a political action committee are not deductible as charitable contributions or for federal income tax purposes. To claim a deduction, you must have a written record of your donation.

For people that want to donate money to a political campaign, it is essential to think if one can deduct it from your tax return. $1,500 for contributions and gifts to independent candidates and members. Copyright © 2021, media research center.

2021 Election Turnout

State Tax Levels In The United States – Wikipedia

Joinrenew Realtor Association Of Prince William

Money

2021 Industry Advocates

2

Pdf Role Of Audit Committee In Tax Avoidance Of Family And Non-family Firms Evidence From Indonesia

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction – Vox

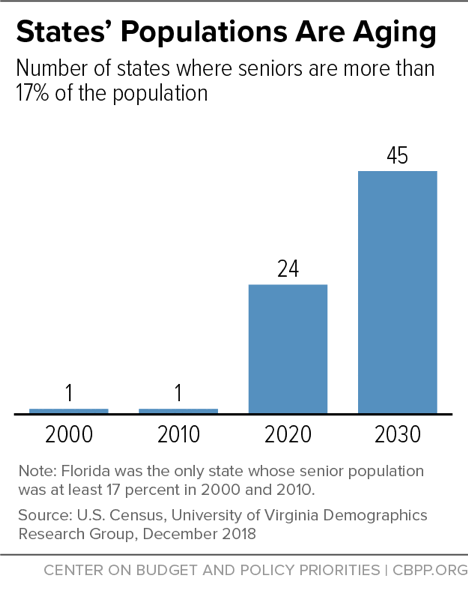

States Should Target Senior Tax Breaks Only To Those Who Need Them Free Up Funds For Investments Center On Budget And Policy Priorities

Record Turnout In Virginia

Early Voting By Party

.png?sfvrsn=1b7d820d_0)

2021 Industry Advocates

Onevirginia2021 Foundation

Tax Report Is Your Political Donation Deductible – Wsj

How Much Should You Donate To Charity – District Capital

Are Political Contributions Tax Deductible Hr Block

Influencemaporg

Dlsvirginiagov

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age