No longer for the rich. When you are in the state taxes section for oregon, there is a screen titled political contribution credit where you are able to enter the amount of your oregon political contributions you are referring to.

Are Political Contributions Tax Deductible Hr Block

That’s not a mere “deduction.” this is an actual credit against any money you owe the state of oregon.

Are political contributions tax deductible in oregon. For purposes of claim preclusion, all issues regarding taxpayer's income tax liability for tax year constitute same claim. Donations to offpac qualify for a tax credit of up to $100.00. Donate to support oregon democrats!

However, four states allow tax breaks for political donations to candidates or parties. These donations are not tax deductible on federal returns. It is not deductible for federal.

In most states, you can’t deduct political contributions, but four states do allow a tax break for political campaign contributions or donations made to political candidates. Your business can't deduct political contributions, donations, or payments on your tax return. They offer a tax credit for part or all of your contribution, up to a certain amount.

While charitable donations are generally While no state lets you deduct political contributions, four of them—arkansas, ohio, oregon, and virginia—actually do something better: Political contributions are tax deductible like charitable donations, right?

Political contributions as public relations or advertising expenses If you owe taxes, you can subtract your contribution from what you owe. Click here to search your donations online.

Taxpayers can donate all or a portion of their personal income tax refund to any or all of the 29 charities approved by the charitable checkoff commission. States which offer a tax credit, not tax deductions, to political donations include: While there is no tax benefit in michigan or in my brother’s home state for giving to federal, state, and local candidates, several other states do offer varying tax benefits for political donations.

Oregon's political contribution tax credit: Artist's charitable contribution (reported on the nonresident return form) Your contribution can help us protect gun rights and cost you nothing.

Political contributions as credit against oregon tax return, (1974) vol 37, p 159. Donations to basic rights oregon are the most flexible gifts for us to use. Americans donations to political campaigns are less that 10%.

Please note the deadline to make a donation and claim your tax credit is midnight on december 31. (2) the amendments to ors 316.102 (credit for political contributions) by section 49 of this 2019 act apply to tax years beginning on or after january 1, 2020, and before january 1, 2026. (1) a credit may not be claimed under ors 316.102 (credit for political contributions) for tax years beginning on or after january 1, 2026.

Federal multicandidate pacs may contribute up to $5,000 for the general election. Contributions or gifts to alek for oregon are not deductible as charitable contributions for federal income tax purposes. An individual may contribute up to $5,600, while couples may contribute up to $11,200.

Political contributions are not deductible on your federal return, but they are deductible in montana and can lead to a tax credit in arkansas, ohio, and oregon. Oregon tax credits political contribution credit. Mostly rich people give large donations and small minority contribute 200$ or less.

(6) a partnership or s corporation may make political contributions on behalf of its partners or shareholders. However, it would be the opposite scenario in the case of qualified charities. The short answer is no.

Of revenue, 15 otr 13 (1999) atty. What can encourage people make donations, if they are not tax deductible? If you have not made a donation to oregon firearms political action committee in 2015, please consider the advantages.

A state can offer a tax credit, refund, or deduction for political donations. This screen will be seen after the adjustments summary screen. Political donations are not tax deductible on federal returns.

Arkansas, ohio and oregon offer a tax credit, while montana offers a tax deduction. Can i deduct political contributions on my state income tax return? Some states provide tax incentives for political donations.

The credit may be claimed on the individual tax return, subject to all of the limitations in ors 316.102 and this rule. The same goes for campaign contributions.

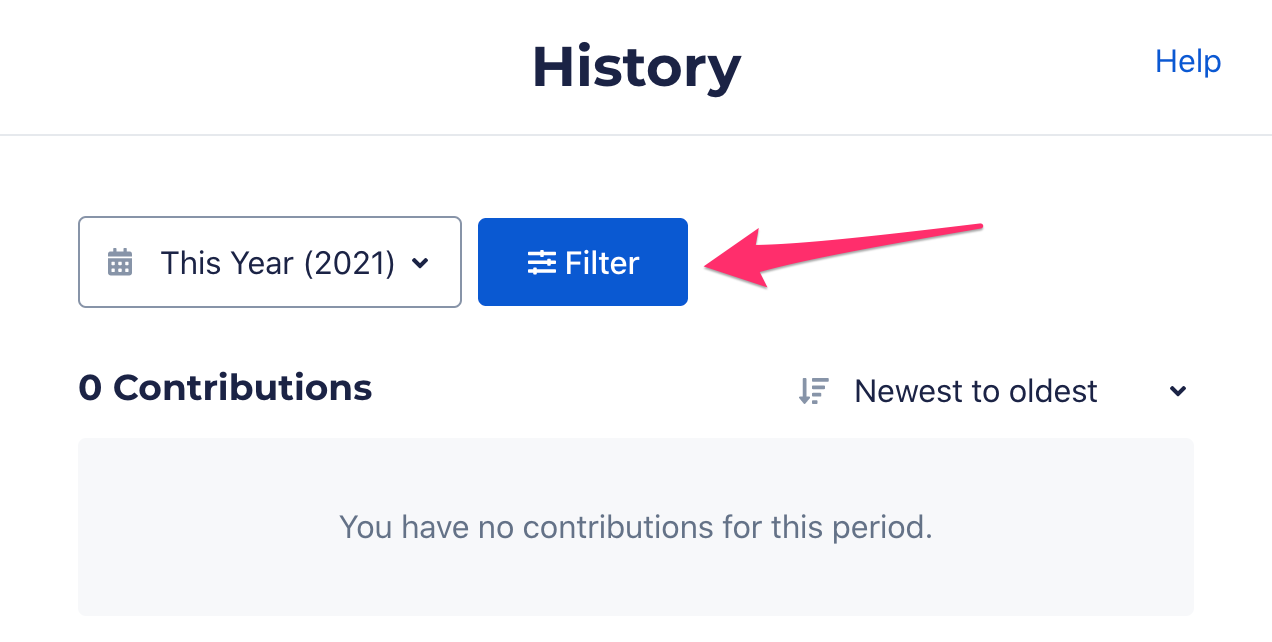

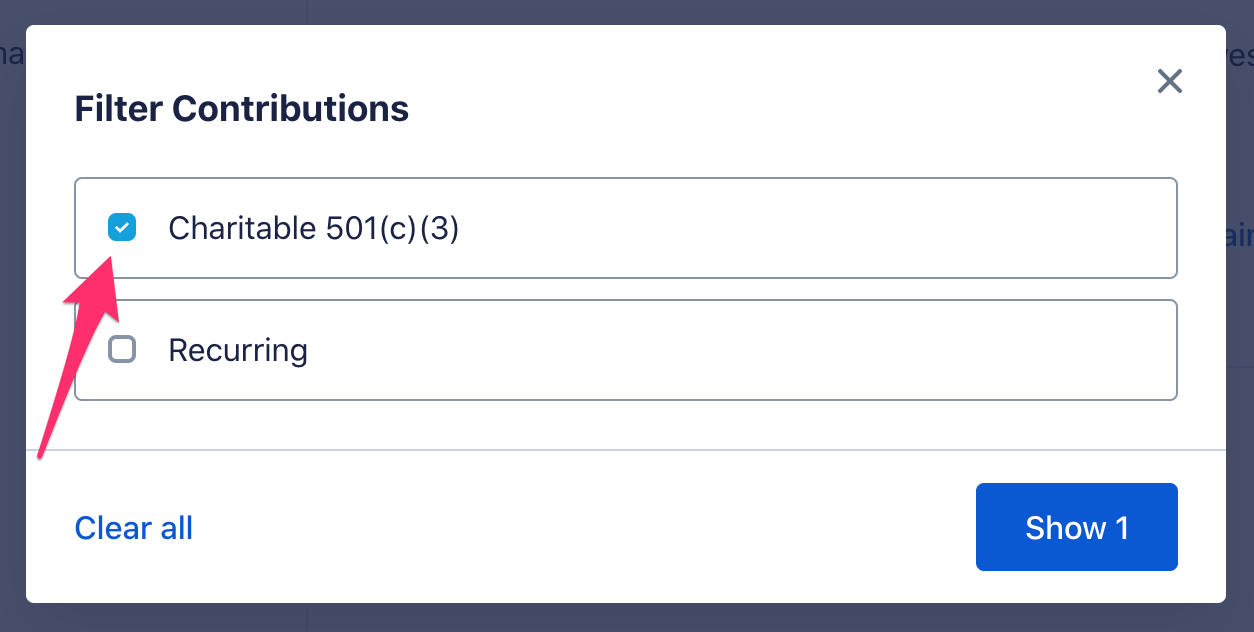

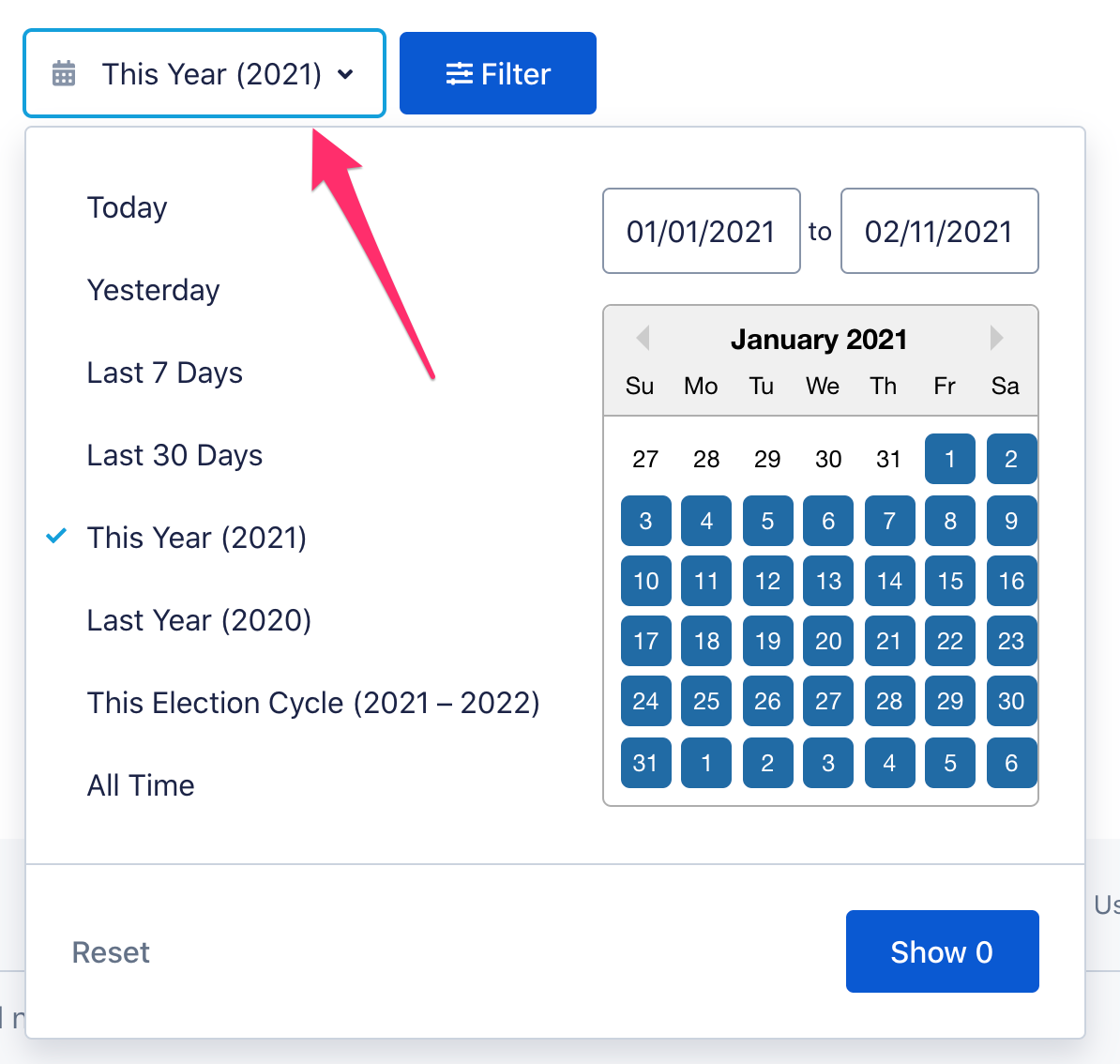

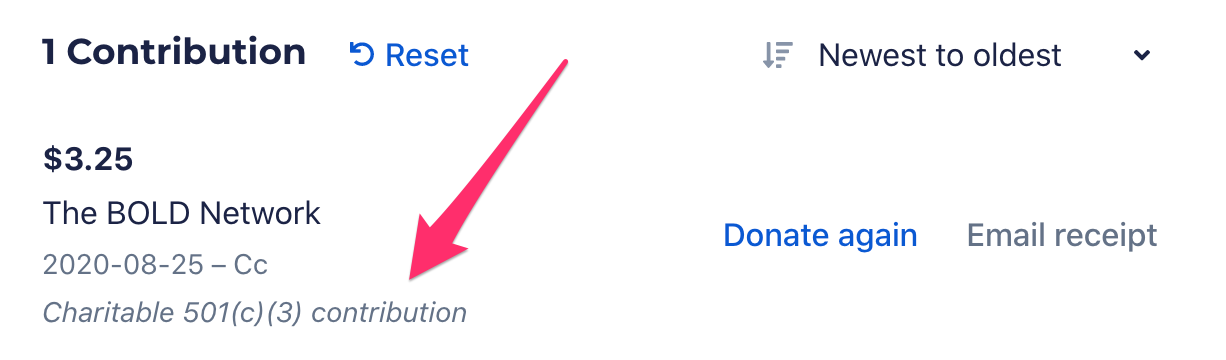

Are My Donations Tax Deductible Actblue Support

Rumah Cerdas Widyaiswara

Are My Donations Tax Deductible Actblue Support

Are Political Donations Tax Deductible Credit Karma Tax

![]()

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Moneys Power In Politics Give Everyone A Share Cnn

Pin On Bernie Sanders For President 2016

Pin On Xbox

Help Us Distribute The Christian Voters Guide Oregon Family Council

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible – Turbotax Tax Tips Videos

![]()

Are My Donations Tax Deductible Actblue Support

States With Tax Credits For Political Campaign Contributions Money

Donate – Basic Rights Oregon

Are Political Contributions Tax Deductible Hr Block

2

Free Donation Receipt Templates Samples – Pdf Word Eforms

Pin By Crib Line On Kids Eat Free Usa Map Us State Map State Map Of Usa