If you, your spouse, or your dependent is in a nursing home primarily for medical care, then the entire nursing home cost (including meals and lodging) is deductible as a medical expense. As of 2013, if you earn between $3,333 and $25,278, you may claim a refundable medical expense supplement of $1,142 plus 25 percent of your allowable medical expenses for the year;

2

Most rent expenses can’t be claimed either, with the exception being any portion of the rent that goes to services that help a person with daily tasks, such as laundry and housekeeping.

Are nursing home expenses tax deductible in canada. You receive a canada revenue agency rebate for a portion of your medical expenses, including nursing care, which exceeds your tax bill. What qualifies as medical expenses when filing taxes?. The size of your metc will depend on your eligible expenses, your net income for the tax year, and the province in which you live.

The medical expense tax credit can be claimed for costs associated with nursing and retirement homes that are paid by you or your spouse. However, to effectively claim medical expenses, the person for whom they are paid is expected to qualify as a dependent on your income tax return, but note that this requirement can vary for dependents. The total of the eligible expenses is $8,893.

Yes, in certain instances nursing home expenses are deductible medical expenses. Nursing home expenses you may claim income tax (it) relief on nursing home expenses paid by you. You may be able to claim a metc if your medical expenses exceeded $2,397 or 3% of your net income, whichever is less.

If you earn over that amount, your. You may need a prescription for special shoes or inserts to claim these expenses as a tax deduction. Nursing home costs are tax deductible if the primary reason for residence in a nursing home is to receive medical care.

Administrative costs and operating costs can’t be deducted. Salaries and wages for attendant care given in canada. You can claim the disability amount and up to $10,000 for these expenses ($20,000 if the person died in the year).

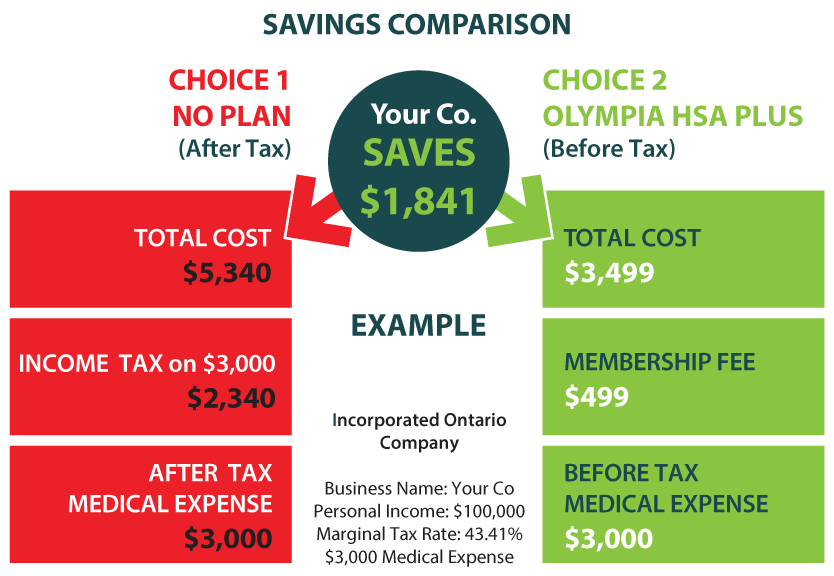

The medical expense tax credit (metc) can be claimed for costs associated with nursing and retirement homes that are. The canada revenue agency (cra) has commented that all regular fees paid to a nursing home, including food, accommodation, nursing care, administration, maintenance, and social programming can qualify as eligible medical expenses. The federal and ontario governments have tax credits available to taxpayers, including those paid for medical expenses.

When ohip does not automatically cover a stay in a nursing home, you can use it as a tax deduction. Should he receive medical care while residing in the home, you can claim those costs as a deductible expense, along with any nursing services that might be provided. Regarding the primary question, “is home care for the elderly tax.

Yes, in certain instances nursing home expenses are deductible medical expenses. Is elder care expenses tax deductible? The federal and ontario governments have tax credits available to taxpayers, including those paid for medical expenses.

Nursing and retirement home expenses are considered medical expenses by. Typically, you can deduct nursing home expenses for yourself, your dependents or your spouse. The current accommodation rates still apply.

If you, your spouse, or your dependent is in a nursing home primarily for medical care, then the entire nursing home cost (including meals and lodging) is deductible as a medical expense. Not all nursing home expenses can be claimed. If you need laser eye surgery to correct your vision, it represents a tax deductible expense.

Solved • by turbotax • updated july 27, 2021.

Medical Expenses

What Healthcare Expenses Are Tax Deductible In Canada

The Top 9 Tax Deductions For Individuals In Canada

Pp Accounting – Home Facebook

2

![]()

What Tax Deductions Are Available For Assisted Living Expenses – Frontier Management

Can You Claim Tax Back On Physiotherapy

Health Spending Account Hsa Coverage List Of Eligible Expenses

Chapter 5 Health

Medical Expenses Eligible For Deduction On Your 2019 Tax Return – Think Accounting

Curtailing Income Tax Relief For Cosmetic Medical Expenses

The Best Health And Dental Insurance For The Self-employed In Canada

Income Tax Of An Individual – Lembaga Hasil Dalam Negeri

Pdf Assistive Devices Coverage Ontario Compared To Other High-income Jurisdictions

Tax Tips For People With Dementia And Their Caregivers Alzheimer Society Blog

How To Deduct Medical Expenses On Your Taxes – Smartasset

What Medical Expenses Can I Claim On My Taxes In Canada

Claiming Medical-expense Tax Credits – Good Times

Curtailing Income Tax Relief For Cosmetic Medical Expenses