Someone had dental implants that cost $70,000, evidently she chose. It’s almost time for americans to sit down and calculate their taxes for the year.

Dentrix Tip Tuesdays Automatically Creating Secondary Insurance Claims Dental Insurance Dental Insurance Plans Cheap Dental Insurance

Type of procedure does not make it non deductible for tax purposes.

Are full dental implants tax deductible. Per the irs, “deductible medical expenses may include but aren’t limited to the following: Uncertainties about whether a particular expense is tax deductible can be resolved if. Let’s say you make $40k a year.

The good news is, yes, teeth whiten tax deductible! Uncle sam states that any medical treatment above and beyond 7.5% of your agi is in fact tax deductible. By taking this deduction on your tax return you receive a tax refund of.

Like any other medical expense, it's important to The answer is yes, however we recommend you consult with your accountant before deducting the cost of dental implants on your taxes. You cannot claim relief for routine dental care.

Not all dental services are tax deductible; Dental expenses includes fillings, dentures, dental implants and other dental work that is not covered by your insurance plan. Can i deduct the cost of my all on 4 dental implants accountant's assistant:

Yes, dental implants are tax deducible. Yes, dental implants are an approved medical expense that can be deducted on your return. Please tell me more, so we can help you best.

A good thing to remember is that some 7.5% of your total gross income is tax deductible. Keep in mind that you can only deduct eligible expenses, which you have already paid for, regardless of when the services were provided. It also explains, “medical care expenses include payments for diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments that affect the structure or function of the body.”.

Overview most dental expenses can be used as medical expense deductions when filing your income taxes in canada. How much is a dental implant for one tooth? Dental expenses routine dental care.

Are dental implants deductible under medical expenses. The good thing to keep in mind is that any 7.5% of your total income is tax deductible. However, it’s not automatically deducted — you will need to itemize your deductions.

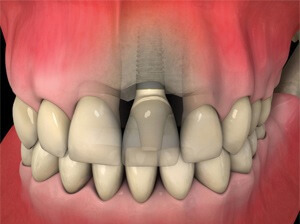

Are dental implants tax deductible? Because dental implants can be expensive, some patients want to know are dental implants tax deductible. Providing or repairing artificial teeth or dentures.

If your implant or cosmetic dentistry fee is $50,000, then $45,125 is fully tax deductible. You can only deduct expenses greater than 7.5% of your income. Dental implants are tax deductible, so that’s good news!!

So fully deductible (if exceed 10% agi) in 2019? There is a small catch though. The good news is, yes, dental implants are tax deductible!

If the implants improved dental function as well as appearance, this cost is deductible as a medical expense (schedule a) on the other hand, teeth whitening is considered cosmetic and not deductible. The deduction is not automatically deducted, however, so you will need to itemize your deductions in order to claim it. The only dental work that is not covered is cosmetic work, such as teeth whitening, which is not.

Are dental implants tax deductible? The short answer here is yes, they may very well be. In addition, dental implants would be included.

Doing surgery and temp teeth and implants in september 2019. In contrast, the cost of full mouth dental implants can vary between $ 7,000 and $ 90,000. Dental implants are tax deductible.

You would have to eat the first $3,000 of those expenses before it starts lowering your tax obligation. Will get permanent teeth in february 2020. Is there anything else the accountant should be aware of?

To help you with this cost the canada revenue agency allows dental expenses to be used as medical expense deductions when you file your income tax. The cost was $40,000 full set top and bottom arches The good news is that will include all of your medical (and dental) expenses, not just your dental implants.

A good things to remember is that anything 7.5% of your gross total income is tax deductible. One full arch of teeth, four dental implants. The good news is, yes, dental implants are tax deductible!

Paid full fees in late august 2019. The only exception is dental work that is purely cosmetic, such as teeth whitening. Payments of fees to doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists, and nontraditional medical practitioners…”.

The accountant will know how to help. This includes fillings, dentures, implants and other dental work not paid by your insurance plan. Seems irs pub says you cannot deduct prepayment for services generally if some services received in future tax year.

Are dental implants tax deductible. It also explains, “medical care expenses include payments for the diagnosis,. Please let me know if you have additional questions on this.

It is possible that your dental implants will get you a tax deduction from the internal revenue services. Veneers or rembrandt type etched fillings; Medical expenses are an itemized deduction on schedule a and are deductible to the extent they exceed 10% of your adjusted gross income (agi).

May 31, 2019 8:55 pm.

Pin On Tmtt

Disadvantages Of Dental Implants – Old Milton Dental Alpharetta Ga

Are Dental Implants Tax Deductible – Drake Wallace Dentistry

All On 4-6 Full Arch Dental Implant Courses – Itc Seminars

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Dont Throw Your Money Away Use Your Dental Insurance Benefits Before The New Year Call To Schedule Your Free C Dental Insurance Dental Benefits Dental

The Complete Guide To Getting Dental Implants In Thailand

Pr Process For Business Public Relations Business Public

How To Afford Dental Implants Without Going Broke Dental Implants Dental Implants

Pin On Beauty

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

Dental Insurance Bright Smiles Sunny Options Military Spouse

How Much Do Dental Implants Cost Cost Of Dental Implants

Are Dental Veneers And Implants Tax Deductible

Ts Bathroom Mall My Company Page Online Mall Company Page Online

Dental Implant Cost Santa Fe Nm – Taos Nm – Los Alamos Nm – Oral Surgery And Dental Implant Center Of Santa Fe

Dental Implants Navan Meath Navan Dental

Pin On Projects

Health Savings Accounts Medical Loans Health Savings Account Long Term Care Insurance