Along with not being able to deduct your political contribution, you also have limits on what you can contribute. Federal political contributions are donations that were made to a registered federal political party or a candidate for election to the house of commons.

Are My Donations Tax Deductible Actblue Support

A lot of people assume that political contributions are tax deductible like some other donations.

Are donations to election campaigns tax deductible. Individuals may donate up to $2,800 to a candidate committee per election, up to $5,000 per year to a pac and up to $10,000 per year to a local or district party committee. No, donations to political parties are not tax deductible. Claiming a credit for federal political contributions.

Resources for charities, churches, and educational organizations. Resources for social welfare organizations. Individuals cannot deduct contributions made to political campaigns on their federal tax returns, regardless of whether they itemize or claim the standard deduction.

You cannot deduct expenses in support of any candidate running for any office, even if you are spending money on your own campaign. The federal election commission says that you can donate up to $2,700 per candidate per election, up to $10,000 to. Donations to this entity are not tax deductible though.

If a campaign receives a donation exceeding these limits, it must follow a protocol for handling the excess funding. Thus, donations used before or after the campaign. These limits apply to all contributions, except contributions from a candidate’s personal funding.

These organizations do not have contribution limits and donors do not need to be disclosed publicly. In most states, you can’t deduct political contributions, but four states do allow a tax break for political campaign contributions or donations made to political candidates. “however, this will not be feasible unless income tax credits are provided for contributions to municipal campaigns.”

The irsstates, “you cannot deduct contributions made to a political candidate, a campaign committee, or a newsletter fund. While there is no tax benefit in michigan or in my brother’s home state for giving to federal, state, and local candidates, several other states do offer varying tax benefits for political donations. Although campaign contributions are not tax.

While you can’t write off campaign contributions, you can set aside $3 of your taxes to go to the presidential election campaign fund on your 1040 federal income tax return. You can check the box to donate the funds and it will not affect your taxes or deductions. You can receive up to 75 percent of your first $400 of donation as credit, followed by 50 percent of any amount between $400 and.

The simple answer to whether or not political donations are tax deductible is “no.” however, there are still ways to donate, and plenty of people have been taking advantage of. This includes political action committees (pacs), as well. Political contributions are tax deductible like.

The omnibus election code further clarifies that only donations that were spent during the campaign period would be exempt from donor’s tax. Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political. This money is split between the parties and helps finance the presidential primary and general election campaigns.

Resources for labor and agricultural organizations. Is supporting the presidential election campaign fund tax deductible? The answer is no, political contributions are not tax deductible.

Generally donations to these entities are used for advocacy, but not direct electoral purposes where you’re asking someone to support or oppose an issue. The same goes for campaign contributions. Political contributions are not tax deductible, though;

If you made a contribution to a candidate or to a political party, campaign, or cause, you may be wondering if your political contributions are tax deductible. A state can offer a tax credit, refund, or deduction for political donations. Qualification and registration fees for primaries as well as a legal expenses related to a candidacy are not deductible either.

If you are one of those citizens, and you were hoping for a tax break, unfortunately, you won't find one here. When filing your taxes, you have the option to set aside $3 of your taxes to go towards the presidential election campaign fund when you complete your 1040 federal income tax return form. Is supporting the presidential election campaign fund tax deductible?

So the answer is no: Political donations are not tax deductible on federal returns. Arkansas, ohio and oregon offer a tax credit, while montana offers a tax deduction.

Unlike charitable donations, which are tax deductible, donations to a political party or pac are not tax deductible.

How The Cares Act Sweetened Tax Breaks For Cash Donations In 2020

Are Political Contributions Tax Deductible Hr Block

Are Political Contributions Tax Deductible – Turbotax Tax Tips Videos

Are Political Contributions Tax-deductible Personal Capital

Are Political Contributions Tax Deductible Anedot

Are Political Donations Tax Deductible

Are Campaign Donations Tax Deductible Priortax

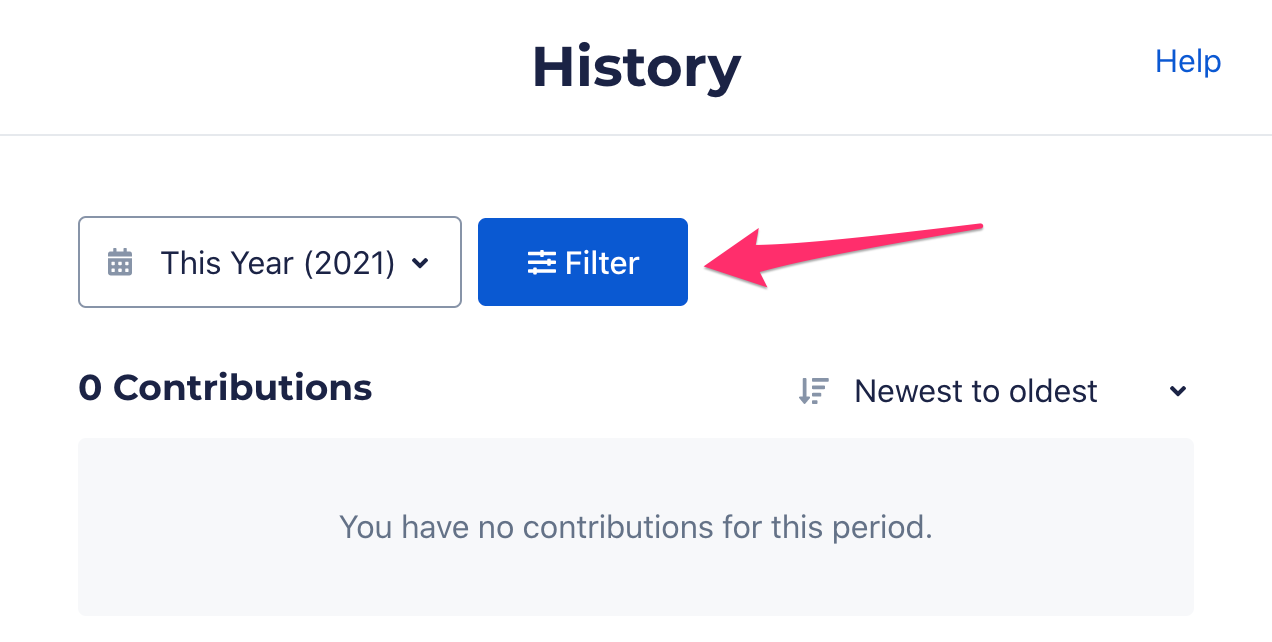

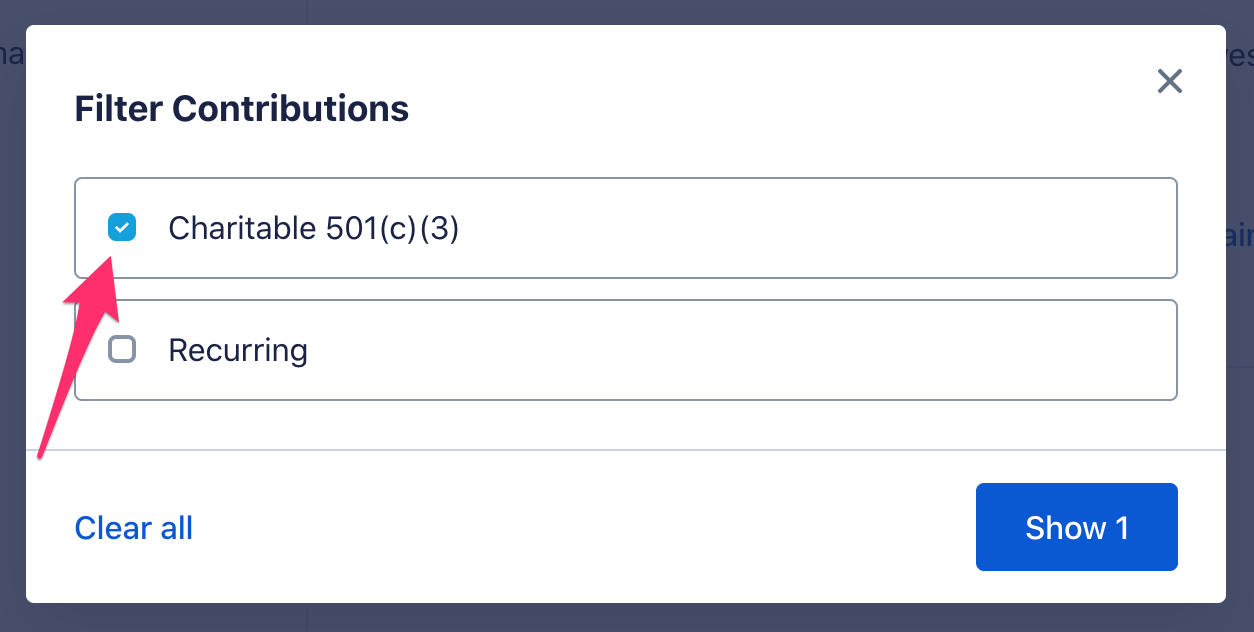

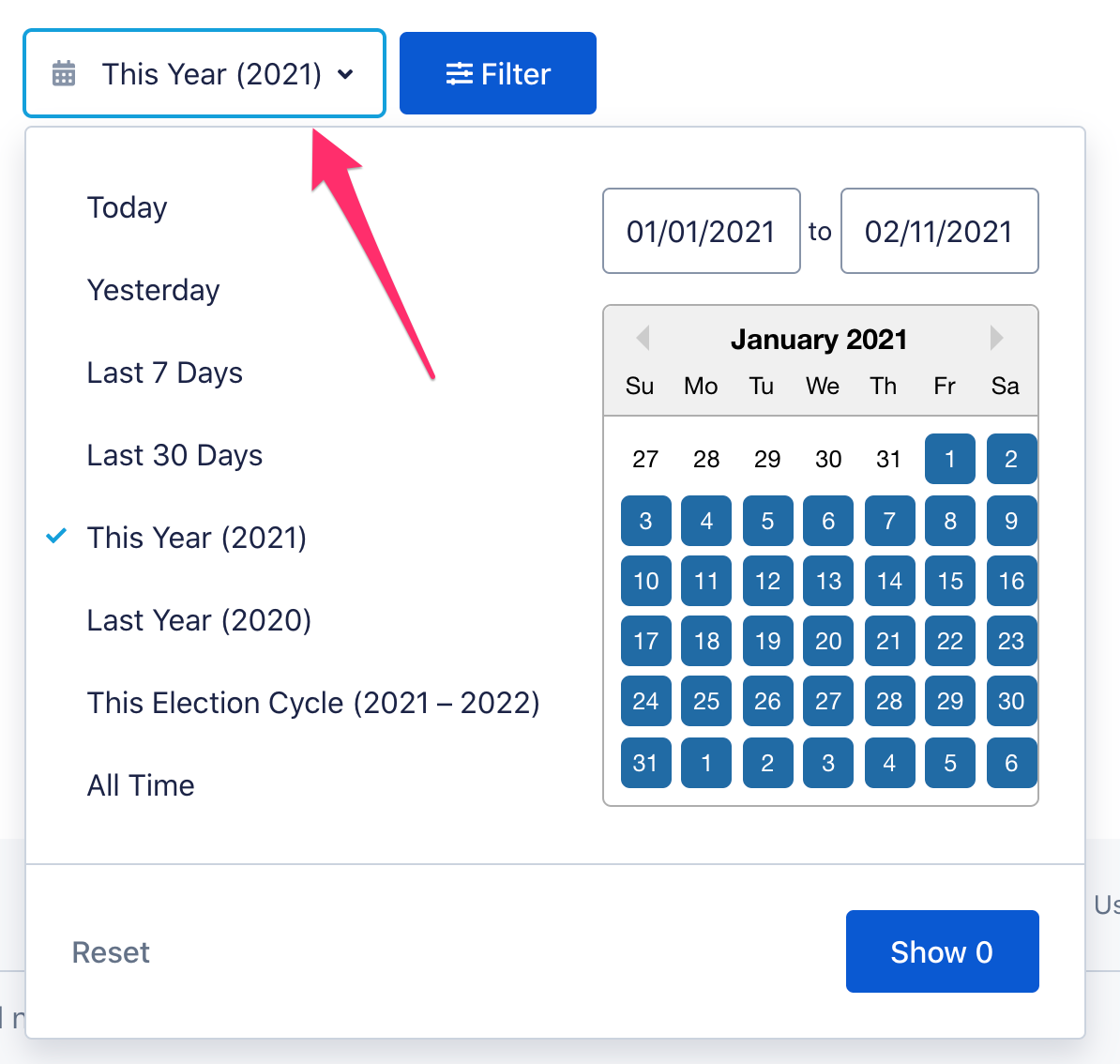

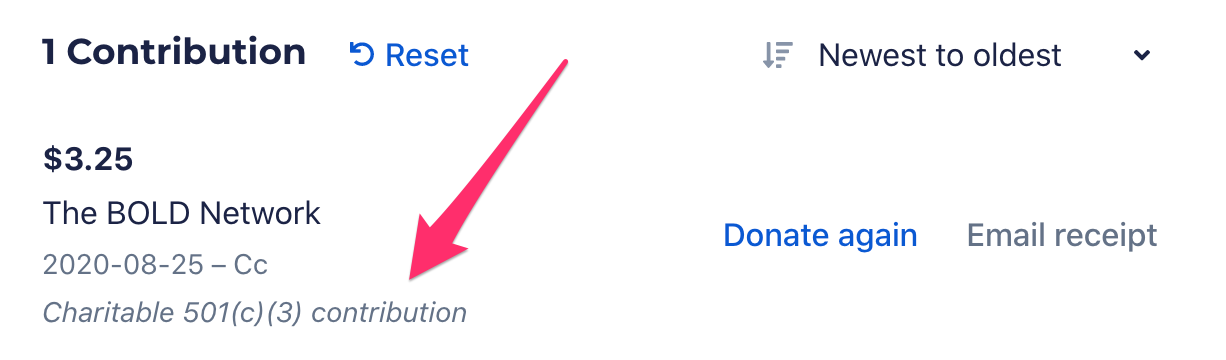

Are My Donations Tax Deductible Actblue Support

Deduction Under Section 80g Of Income Tax Act 1961 For Donation

Are My Donations Tax Deductible Actblue Support

Charitable Deductions On Your Tax Return Cash And Gifts

Are Political Contributions Tax Deductible Hr Block

Are Your Political Contributions Tax Deductible Taxact Blog

How Much Should You Donate To Charity – District Capital

Are My Donations Tax Deductible Actblue Support

Are Political Donations Tax Deductible Credit Karma Tax

Are Campaign Contributions Tax Deductible

Tax Deductible Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Rece Receipt Template Letter Template Word Donation Form

Is Your Donation Tax-deductible – Charity Navigator