Gold posts or fibreglass posts. Payments of fees to doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists, and nontraditional medical practitioners…”

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Will get permanent teeth in february 2020.

Are dental implants tax deductible in 2019. The rates are set at 17 cents per mile for tax year 2020 and 16 cents per mile for tax year 2021. Are dental implants payments tax deductible. You can lower the cost of visiting psychiatrists and psychiatrists.

Are dental implants tax deductible 2019 when you itemize, the irs allows you to deduct medical and dental expenses that exceed 7.5 percent of your adjusted gross income for tax year 2020. Paid full fees in late august 2019. Are dental implants tax deductible in 2019?

Only the portion of your medical and dental expenses that exceed $7 can be deducted for the 2020 tax year. May 31, 2019 8:55 pm. So fully deductible (if exceed 10% agi) in 2019?

You can only claim relief for. Read on for a brief summary of the internal revenue service’s rules on the matter. Are dental implants tax deductible 2019 when you itemize, the irs allows you to deduct medical and dental expenses that exceed 7.5 percent of your adjusted gross income for tax year 2020.

The irs allows you to lower the fee for preventive care, treatment, surgery and dental care and vision as appropriate medical expenses. 31, 2016 and ending before jan. The rates are set at 17 cents per mile for tax year 2020 and 16 cents per mile for tax year 2021.

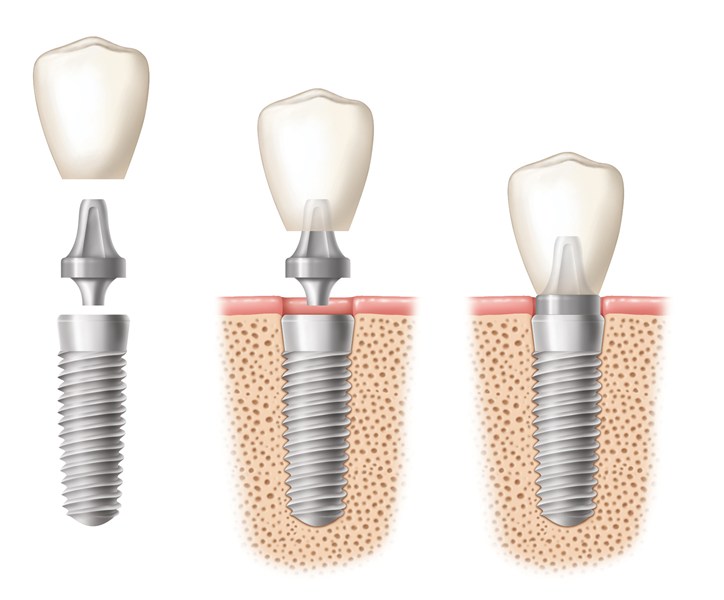

The good news is that will include all of your medical (and dental) expenses, not just your dental implants. The good news is, yes, dental implants are tax deductible! If the implants improved dental function as well as appearance, this cost is deductible as a medical expense (schedule a) on the other hand, teeth whitening is considered cosmetic and not deductible.

How to claim dental expenses. A good things to remember is that anything 7.5% of your gross total income is tax deductible. Are dental expenses tax deductible 2019?

If your implant or cosmetic dentistry fee is $50,000, then $45,125 is fully tax deductible. Other dental work not paid by your insurance plan; You can only deduct expenses greater than 7.5% of your income.

All thresholds are restored to. Have a form med 2 completed by your dentist. Dental implants are tax deductible, so that’s good news!!

This statement is relatively broad, but dental implants performed to prevent tooth loss, tooth decay, or. If you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to deduct expenses you paid that year for medical and dental care for yourself, your spouse, and your dependents. Are dental implants deductible under medical expenses.

Yes, dental implants are an approved medical expense that can be deducted on your return. Doing surgery and temp teeth and implants in september 2019. Inlays (a smaller version of a gold crown).

Now that the new year has begun, tax time will be here before you know it. If you have dependent children, their dental expenses are also tax deductible. If your treatment for implant or cosmetic dentistry is $50,000, then $45,125 is fully tax deductible.

Are dental procedures tax deductible? Medical expenses are an itemized deduction on schedule a and are deductible to the extent they exceed 10% of your adjusted gross income (agi). There is a small catch though.

By taking this deduction on your tax return, you receive a tax refund of roughly $11, 281. Tax laws vary by country, as all laws do. You may deduct only the amount of your total medical expenses that exceed 7.

The only exception is dental work that is purely cosmetic, such as teeth whitening. Payment options for implants dentistry blacktown. Seems irs pub says you cannot deduct prepayment for services generally if some services received in.

Veneers or rembrandt type etched fillings. Most dental expenses can be used as medical expense deductions when filing your income taxes in canada, including: If you itemize your deductions, you can deduct 5% of your adjusted gross income.

Fortunately, certain dental expenses can be deducted from your taxes. For future reference, keep in mind that for 2019, dental/medical expenses must exceed 10% of your agi to be eligible for deduction. However, it’s not automatically deducted — you will need to itemize your deductions.

In addition, the rule limiting the medical expense deduction for alternative minimum tax purposes to 10% of agi doesn’t apply to tax years beginning after dec. The deduction is not automatically deducted, however,. Yes, dental implants are tax deducible per the irs, “deductible medical expenses may include but aren’t limited to the following:

So, you should mention what country you’re in when asking this type of question in the us, you can look at the irs site linked below. 502 medical and dental expenses. It’s almost time for americans to sit down and calculate their taxes for the year.

Fund Georges Urgent Dental Surgery Rehabilitation Cameroon Baptist Convention Health Services

Frisco Tx Invisalign Cost – Frisco How Much Are Invisalign Clear Aligners 2021 Highland Oak Dental

Dental Implant Cost Santa Fe Nm – Taos Nm – Los Alamos Nm – Oral Surgery And Dental Implant Center Of Santa Fe

Dentrix Automatically Tracks Benefits Used And Deductibles Met For Patients When You Post An Insurance Paym Term Life Life Insurance Policy Term Life Insurance

Implants Covered By Dental Insurance Premium Benefits

Pin On Projects

Are Dental Veneers And Implants Tax Deductible

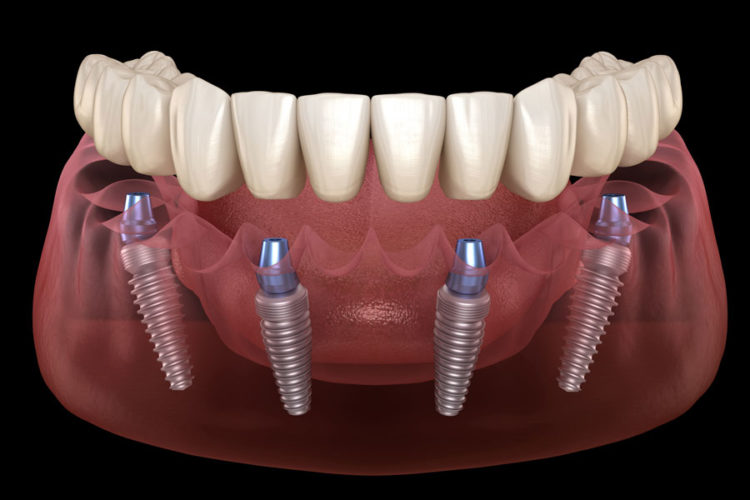

All On 4-6 Full Arch Dental Implant Courses – Itc Seminars

Wisdom Teeth Removal Cost How Much Are Wisdom Teeth Extraction 2021 Frisco Tx Highland Oak Dental

Woodland Hills Dental – Home Facebook

Dentrix Tip Tuesdays Automatically Creating Secondary Insurance Claims Dental Insurance Dental Insurance Plans Cheap Dental Insurance

Are Dental Implants Tax Deductible – Drake Wallace Dentistry

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Gettysburg Dentist Blog

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Using An Hsa For Cosmetic Dentistry Dr Steve Marsh Dds

/https%3A%2F%2Fd1l9wtg77iuzz5.cloudfront.net%2Fassets%2F4017%2F137059%2Fmax_width_extra_small_dental-implants.jpg%3F1454523493)

Dental Implant Cost Santa Fe Nm – Taos Nm – Los Alamos Nm – Oral Surgery And Dental Implant Center Of Santa Fe

Tax Tips Claim Back Your Dental Expenses North Queenland Family Dental

Disadvantages Of Dental Implants – Old Milton Dental Alpharetta Ga