You can claim the disability amount and up to $10,000 for these expenses ($20,000 if the person died in the year). Using this tax deduction can save you or your parent money on the cost of medical and care expenses that make up part of the cost of assisted living.

What Assisted Living Expenses Are Tax Deductible Boise Id

Your community should provide information about which portion of your charges are medical, and therefore how much of your assisted living fees are tax deductible.

Are assisted living expenses tax deductible in canada. The canada revenue agency (cra) has commented that all regular fees paid to a nursing home, including food, accommodation, nursing care, administration, maintenance, and social programming can qualify as eligible medical expenses. Assisted living may have skilled nurses on site, but not every resident needs nursing care. The cost of expenses must be greater than 7.5% of your agi.

Cannot perform at least two activities of daily living, such as eating, toileting, transferring, bathing, dressing, or continence; In some cases, even the room and board is deductible, as described below. Back to mom and dad and their potential whopping tax bill.

Citizen (or a legal resident of the u.s., canada or mexico), and the adult child must provide more than half of the family member’s total. In any case, the expenses are not deductible if they are reimbursed by insurance or any other programs. Only the portion of your monthly bill used to pay attendant care salaries can be deducted.

How assisted living expenses become tax deductibile. In order for assisted living expenses to be tax deductible, the resident must be considered chronically ill. this means a doctor or nurse has certified that the resident either: When a senior resides in an assisted living for personal reasons.

The trick is to determine if mom’s assisted living facility costs qualify as expenses for “medical care.” clearly nursing home expenses are deductible, but assisted living is a bit less certain. Don’t presume that the tax deduction is only limited to a portion of the cost the assisted living says is allocated to care. Certain conditions that must be met to qualify:

The total of the eligible expenses is $8,893. The family member must be a u.s. Is assisted living tax deductible in canada?

Salaries and wages for attendant care given in canada. In order for assisted living expenses to be tax deductible, the resident must be considered “chronically ill.” this means a doctor or nurse has certified that the resident either: Are assisted living expenses tax deductible in canada?

Generally, you can claim the entire amount you paid for care at any of the following facilities: In order for assisted living expenses to be tax. The canada revenue agency (cra) has commented that all regular fees paid to a nursing home, including food, accommodation, nursing care, administration, maintenance, and social programming can qualify as.

Generally, only the medical component of assisted living costs is deductible and ordinary living costs like room and board are not. This means a doctor or nurse has certified that the resident either: Is assisted living tax deductible in canada?

If the resident is in the assisted living facility for custodial and not medical care, the costs are deductible only to a limited extent. Simply add up the annual cost of assisted living, subtract 10% of your gross income, and the remaining balance is completely tax deductible. This difference can make it hard to know if your assisted living expenses will qualify.

To claim these expenses, you need to include a detailed statement of the nursing home costs. Residents who are not chronically ill may still deduct the portion of their expenses that are attributable to medical care, including entrance or. Based on the above statement, stephen’s eligible attendant care expenses are $8,893.

Your parents must also live within the us, mexico, or canada for you to qualify to receive the deduction. Overview attendant care costs, including those paid to a nursing home, can be used as medical expense deductions on your tax return. The wellness care plan will allow you to itemize the assisted living expenses as deductions from your taxes.

Are assisted living facility cost and expenses tax deductible? In order for assisted living expenses to be tax deductible, the resident must be considered “chronically ill.”.

Donate To St Annes Mead Of Southfield Michigan

Assisted Living Facility Executive Summary – Pdf Free Download

Can Dementia Patients Live In Assisted Living Yes Heres How Sandyside Senior Living

Can You Claim A Tax Deduction For Assisted Living – The Arbors

Assisted Living Facility Executive Summary – Pdf Free Download

Assisted Living Facility Executive Summary – Pdf Free Download

![]()

The Big Move My Mom 76 Is In Assisted Living And Owns A Rental Home How Can We Use It To Fund Her Long-term Care And Reduce Capital Gains

How To Pay For Nursing Homes Assisted Living

Senior Living Resources Traditions Of Hershey

![]()

What Tax Deductions Are Available For Assisted Living Expenses – Frontier Management

What Tax Deductions Are Available For Assisted Living Expenses – Frontier Management

What Assisted Living Expenses Are Tax Deductible Boise Id

![]()

What Tax Deductions Are Available For Assisted Living Expenses – Frontier Management

What Assisted Living Expenses Are Tax Deductible Boise Id

Does Medicare Cover Dementia Care

Assisted Living Costs A Place For Mom

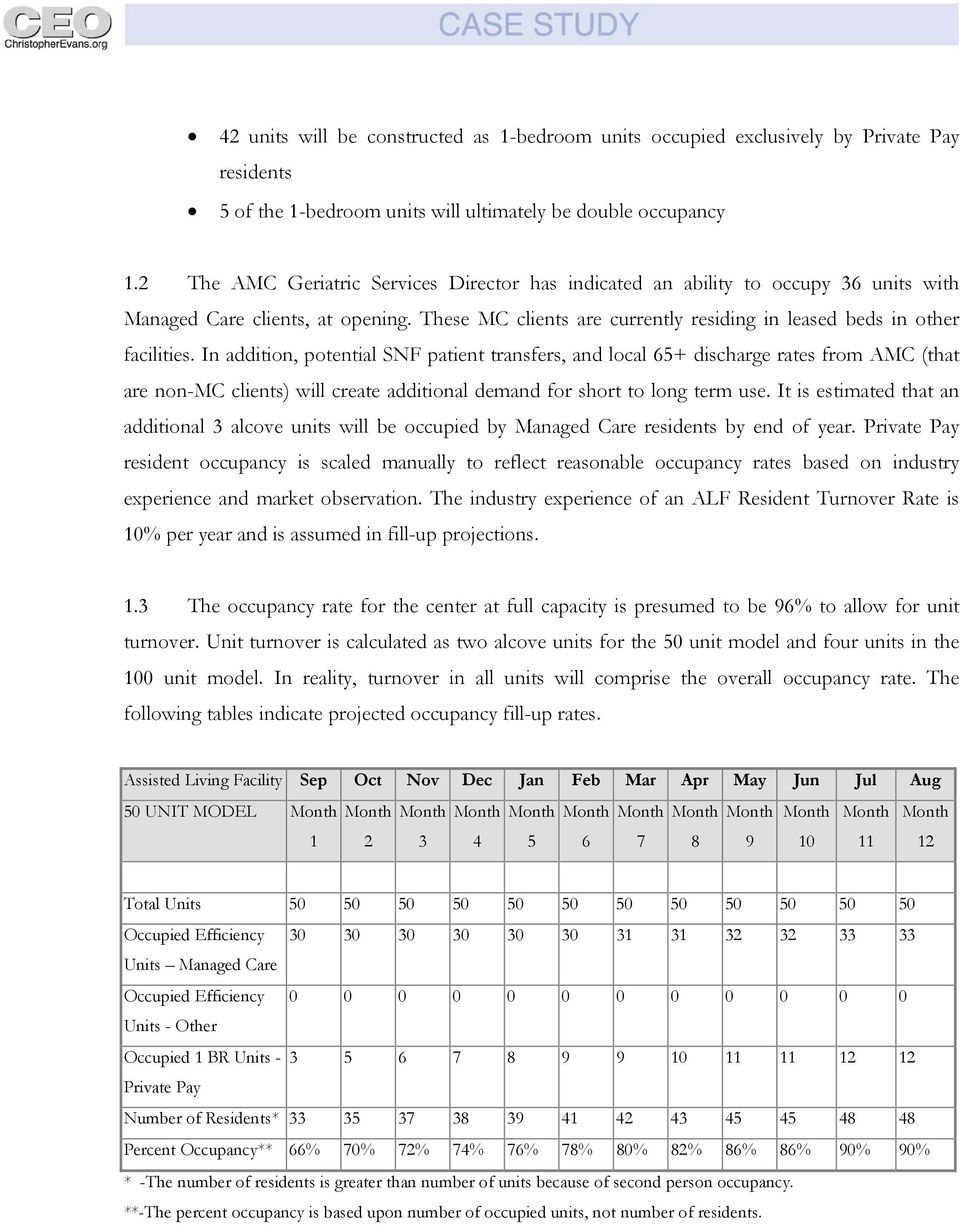

Assisted Living Facility Executive Summary – Pdf Free Download

Assisted Living Facility Executive Summary – Pdf Free Download

Assisted Living Facility Executive Summary – Pdf Free Download