Estimate the state tax deduction or credit you could receive for your 529 contribution this year. Although your contributions to a 529 college savings plan are not tax deductible, you still receive a benefit.

Oregon College Savings Plan Tax Deduction Limits For 2013 – Oregonlivecom

In 2019, individual taxpayers were allowed to deduct up to $2,435 for contributions made to the oregon college savings plan, while those filing jointly could deduct $4,865.

Are 529 contributions tax deductible in oregon. Oregon 529 plan tax information. Oregon gives a tax credit for 529 contributions. This state offers no tax deduction for 529 plans.

Are 529 contributions tax deductible. But, like anything, there are rules that apply. Some states require you to contribute to their state's plan, while other states allow you to take the tax deduction for contributions to any state's plan.

Check with your 529 plan or your state to find out if youre eligible. Single filers can deduct up to $2,435. A 529 plan allows you to save for college or higher education while receiving some type of tax benefit.

Credits for oregon 529 college savings network and able account contributions. Most states limit the amount of annual 529 plan contributions eligible for a state income tax benefit, but annual 529 plan contributions are fully deductible in: You do not need to be the owner of the account to contribute and claim the tax credit.

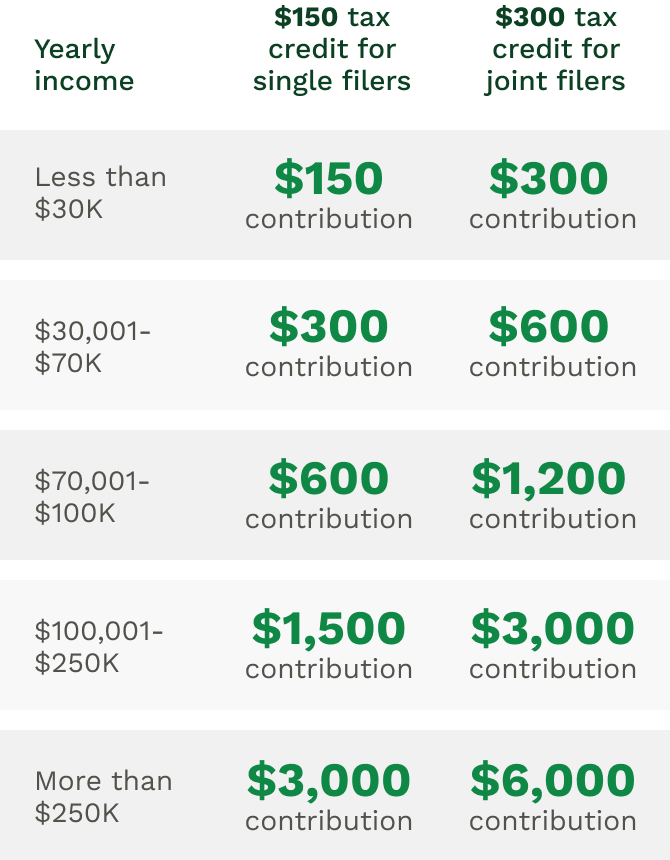

If you are a resident of oregon, contributions made to any account in the oregon college savings plan are eligible to receive a state income tax credit up to $300 for joint filers and up to $150 for single filers. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Where do i enter contributions for 529 college savings program in a 1040 return using worksheet view?

Here are the special tax benefits and considerations for using a 529 plan in oregon. And oregonians can still take advantage of this perk based on the contributions they made before december 31, 2019. One of the big perks of using a 529 plan to save for college is that many states offer a tax deduction for contributions to the plan.

The credit replaces the current tax deduction on january 1, 2020. Starting with contributions made in tax years beginning on or after january 1, 2020, a tax credit based on your contributions to an oregon college or mfs 529 savings plan account or. Contributions and rollover contributions up to $2,435 for a single return and up to $4,865 for a joint return are deductible in computing oregon taxable income.

Federal tax deduction for 529 plans. For more on the changes to the oregon plan, continue reading or 529 part 2 here. Families can deduct up to $4,865 worth of these contributions from their state tax returns.

Ohio residents can deduct up to $4,000 per beneficiary per year on their state taxes. 5% tax credit on contributions up to $4,080 for joint accounts. There is also an oregon income tax benefit.

Artist's charitable contribution (reported on the nonresident return form) Oklahoma allows individuals to deduct up to $10,000 per year and joint filers to deduct up to $20,000. 529 qualified state tuition plans are entered at state level.

The contributions made to the 529 plan, however, are not deductible. Tax savings is one of the big benefits of using a 529 plan to save for college. The tax credit went into effect on january 1, 2020, replacing the state income tax deduction.

For more information about 529 contributions, visit: Never are 529 contributions tax deductible on the federal level. All oregon tax payers are eligible to contribute to an oregon college savings plan, mfs 529 savings plan or oregon able savings plan and claim the state tax credit.

5% tax credit on contributions up to $2,040 for individuals. 10% tax credit on contributions up to $2,500 for individuals. However, some states may consider 529 contributions tax deductible.

In the past, contributions to the oregon 529 plan were deductible on your oregon state income tax return, up to certain limits. Limits on annual 529 state income tax benefits. For a short window of time, oregon taxpayers can qualify for both a deduction and a credit over the next four years.

Below is a list of all the states that have a line for the qualified tuition plans.

Tax Benefits Oregon College Savings Plan

Tax Changes Ahead For Oregons 529 Plan Vista Capital Partners

Our Thoughts On Oregons 529 Plan Northwest Investment Counselors

How Much Is Your States 529 Plan Tax Deduction Really Worth

Does Your States 529 Plan Pay For Itself Morningstar

Oregon 529 Plan How To Save On Your Contributions – Brighton Jones

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

When It Comes To 529s How Good Is Your States Tax Benefit Morningstar

Why We Are Using The 529 Plan To Save For College

Oregon 529 Contribution – I Thought Oregon Gave A Tax Break For 529 Contributions But My Turbotax Premier Version Does Not Give Me A Place To Enter It

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2019 Kap Kksp Partners

Taxes Faqs Oregon College Savings Plan

The Or 529 Plan – No More Tax Deduction For Savers Springwater Wealth Management

Oregon College Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Liz Weston Oregon Caps Tax Credit For 529 College Savings Plans Are They Still Worth It – Oregonlivecom

Saving For College The Oregon College Savings Plan – The H Group – Salem Oregon

Oregon Able Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Taxes Faqs Oregon College Savings Plan

2018 Oregon College Savings Plan Tax Deduction – Tax Walls