In this article, we will go over. Amazon flex uk | self employed | self assessment tax basics |.

Amazon Flex Uk Self Employed Self Assessment Tax Basics Registering Basic Tax Advice Easy – Youtube

Yes $930 taxable of which you will owe 15.3% for ss and medicare and then add in whatever your normal tax bracket is.

Amazon flex taxes uk. Tracking your mileage (and expenses!) is the key to saving on taxes—a.k.a. The company's indirect tax bill came to £1.06bn, up from £854m, driven by vat on increased sales and employee taxes, as it took on more people and increased wages. Simple answer no, but yes.

The percentage that you need to save for. Amazon will send you a 1099 tax form stating your taxable income for the year. Amazon flex rewards is a program exclusively for amazon flex delivery partners to thank you for all the work you do.

While amazon celebrated the rise in revenue collected from uk customers, it did not state how much corporation tax it paid in the uk in total last year. It seems that your full time job income and your flex income combine. For anything urgent please contact amazon flex support directly.

This is a community for amazon flex delivery partners based in the uk only. Amazon flex driver deliveries include: You are responsible for your own expenses and the costs you incur in.

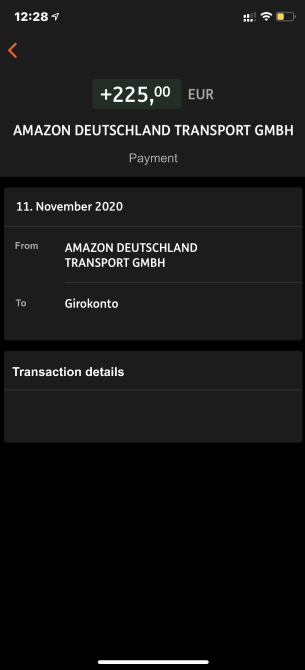

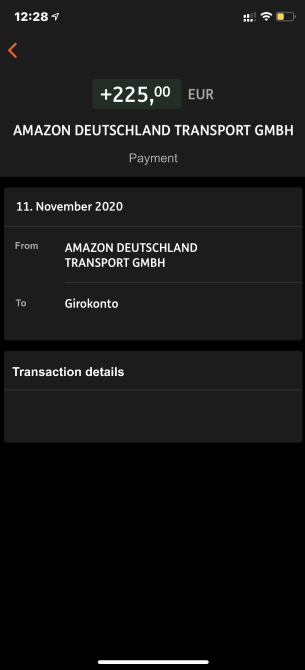

As a classified amazon flex 1099 self employed delivery driver you must also deduct your own expenses to decrease your tax bill. So if your profit is £13,000 for the year and your fuel is £3,000 for the year you pay tax on the 10k not the 13k. With amazon flex rewards, you can earn cash back with the amazon flex debit card, enjoy preferred scheduling, and access thousands of discounts as well as tools to navigate things like insurance and taxes.

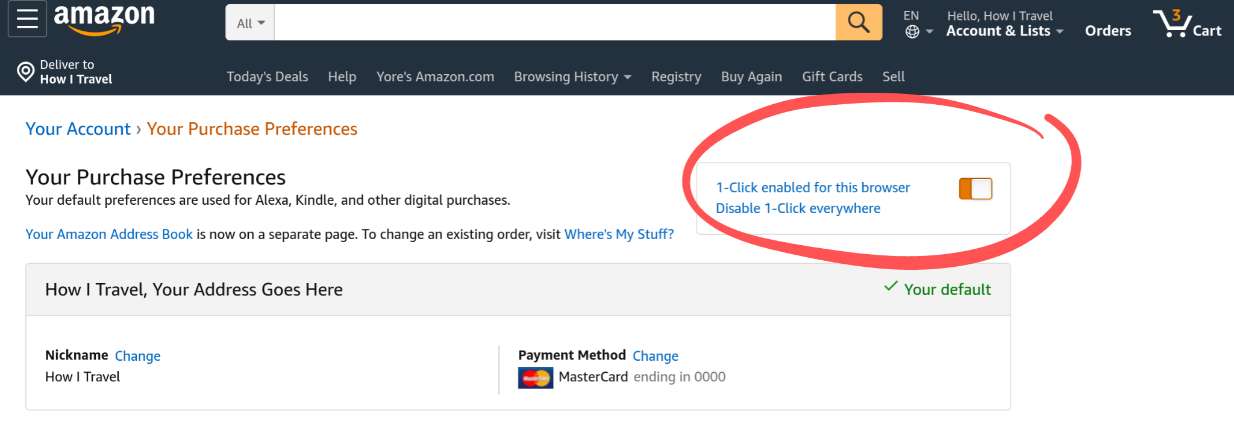

This includes miles that you drive to your first delivery pickup, between deliveries, and back home at the end of the day. For any other region see r/amazonflexdrivers. Taxes are not deducted from your paycheck, but you are required by the federal government to report the income on your taxes, meaning uncle sam will still get his cut) not all reviews loved the work, here’s a quote from one driver who thought the work was stressful:

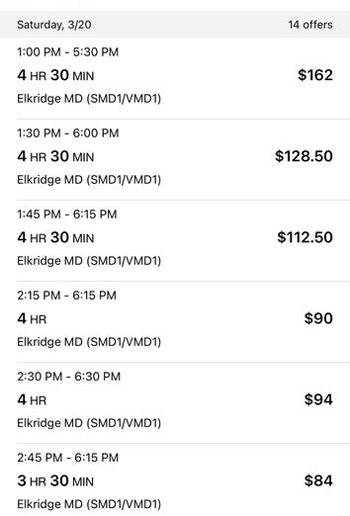

How they price them is. How to properly report your amazon flex earning using a 1099; From what i can make out, you would have to pay basic rate/20% of your flex income (providing you have made at least £12,500 from it and haven't made over 50k from it in the tax year).

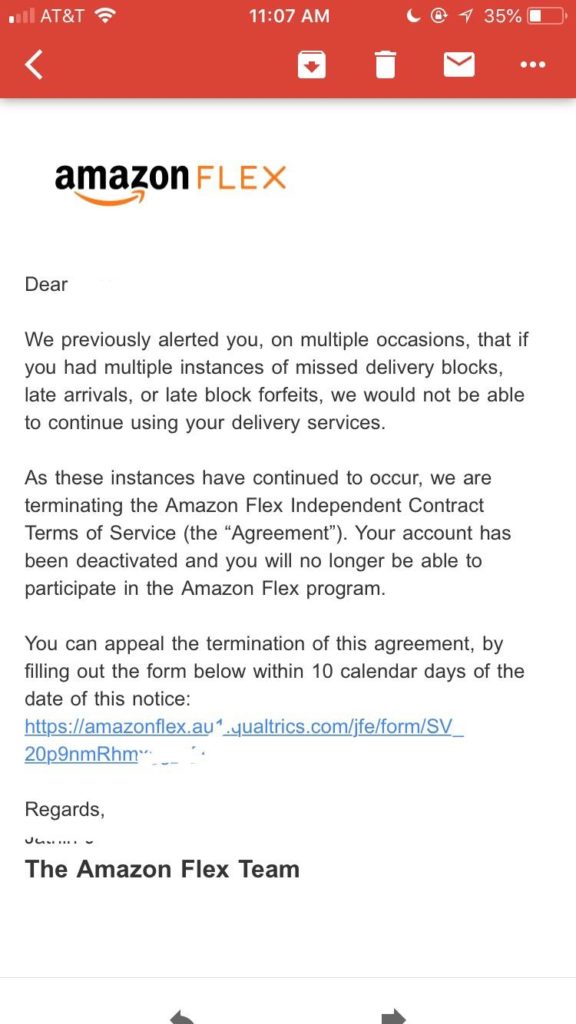

I am aware that being classed as self employed means i will need to fill in a self assessment tax form (my first one being due by january 2020 i guess?) and i have read up about the mileage allowance in this uk; Tax returns for amazon flex. You can become a self employed courier driver for amazon, which is referred to as amazon flex.

No affiliation to amazon, this is an unofficial community. However, some people have claimed that you often will make less than this and you have to bear in mind things like petrol costs, parking and general wear & tear of using your vehicle. You can't claim back petrol with amazon flex.

Are you making money by driving for amazon flex? Appreciate there is a worldwide community already so this is uk specific! How much can you earn driving for amazon?

Your income from amazon flex is not untaxed. My question is as follows in relation to amazon flex and claiming mileage. Having more money in your pocket.

According to a report in the times, amazon, which paid only £14.4m in corporation tax on total uk revenues of £13.7bn last year, will not have to pay the tax on goods it sells directly. What i mean by this is you can offset your fuel as an exspence when doing your tax return and your fuel is offset against your profits. Picked up at a delivery station and delivered to customers.

The company, which has made its founder and. First of all, you're using a 1099 for flex, not a 1040. While many drivers online speak highly about their earnings potential with flex, enjoying the flexible hours, weekly pay and “be your own boss” nature of the.

Amazon does not withhold your taxes for you. You’ll need to submit a tax return online declaring your income and expenses once a year by 31 january, as well as paying tax twice a year by 31 january and 31 july. No, you will not be reimbursed for mileage, parking, nor tolls, including the london congestion charge, ulez (ultra low emission zone) charge or caz (clean air zone) charge.

I'll be over my yearly personal allowance from my main job, so i'd have to submit a tax. That responsibility to pay your own taxes is on you. Amazon flex provides delivery services by using a fleet of gig worker drivers who use their own vehicles.

Taxes For Amazon Flex 1099 Delivery Drivers

Amazon Indonesia Does Amazon Ship To Indonesia Yes Heres How

Amazon Delivery Drivers Reveal Claims Of Disturbing Work Conditions

How To Do Taxes For Amazon Flex – Youtube

Amazon Indonesia Does Amazon Ship To Indonesia Yes Heres How

Amazon Indonesia Does Amazon Ship To Indonesia Yes Heres How

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Can You Deliver For Amazon Flex Driver Requirements Job Overview – Ridesharing Driver

Amazon Flex Filing Your Taxes – Youtube

Can You Deliver For Amazon Flex Driver Requirements Job Overview – Ridesharing Driver

Amazon Flex Uk Self Employed Self Assessment Tax Basics Registering Basic Tax Advice Easy – Youtube

Paye Tax Calculator Proamazoncoukappstore For Android

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Tax Guide For Self Employed Amazon Flex Drivers – Goselfemployedco

Amazon Drivers Get 60 Million In Withheld Tips Back Ftc Says Reuters

Everything You Need To Know About Amazon Flex – Gridwise

Everything You Need To Know About Amazon Flex – Gridwise

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Indonesia Does Amazon Ship To Indonesia Yes Heres How