The correct business code is 492000 couriers & messengers. Click on view/provide tax information to review or update specific tax information.

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes – Money Pixels

Amazon flex rewards is a program exclusively for amazon flex delivery partners to thank you for all the work you do.

Amazon flex taxes canada. If you do not have an amazon.ca account, you will have to create one. That responsibility to pay your own taxes is on you. · provide tax and bank account information (to make sure you get paid).

If you’re an amazon flex customer anxiously awaiting a package, there’s one phone number you need to know. The percentage that you need to save for. The pay for each shift is fixed, meaning you make the same amount per hour, but the amount each block pays will vary based on your region, the time of day and the.

Amazon flex drivers can make about $18 to $25 per hour. Turbotax live tax expert products; My market seems to have a going rate of $18/hr for standard blocks (as opposed to large delivery blocks reserved for people with big vans and such) so a.

Tax returns for amazon flex. The different canadian sales tax are goods and services tax/harmonized sales tax (gst/hst); They offer a flat rate for each block.

The amazon flex support team is great when it comes to dealing with immediate issues regarding package deliveries. Premier investment & rental property taxes; What are the different taxes amazon may collect on my seller fees?

But there are issues with support, the app, and some policies. · watch the onboarding videos. Amazon flex pays its delivery drivers between $18 and $25 per hour.

Soon after amazon flex launched, however, the company started skimming drivers' tips, the ftc claims. And/or quebec sales tax (qst). One amazon flex driver in cleveland, chris miller, 63, told me that though he makes $18 an hour, he spends about 40 cents per mile he drives on expenses like gas and car repairs.

There is a discord server that was created and is maintained by the mods of /r/doordash but has been built to support any courier service. They have graciously invited amazon flex drivers to participate and have created a channel for flex on the server. You can access it using the this invite link:

You’ll need to submit a tax return online declaring your income and expenses once a year by 31 january, as well as paying tax twice a year by 31 january and 31 july. Amazon flex is a good opportunity to earn decent pay if you have access to a car. As a classified amazon flex 1099 self employed delivery driver you must also deduct your own expenses to decrease your tax bill.

· sign up for amazon flex using your amazon.ca account. In this article, we will go over. All online tax preparation software;

I have good experiences but seen very questionable practices from both delivery partners and delivery station employees. Unlike some gig apps, flex is very clear on payment. Manitoba retail sales tax (mb pst);

Amazon does not withhold your taxes for you. With amazon flex rewards, you can earn cash back with the amazon flex debit card, enjoy preferred scheduling, and access thousands of discounts as well as tools to navigate things like insurance and taxes. 12 tax write offs for amazon flex drivers 🚗.

How to properly report your amazon flex earning using a 1099; Knowing your tax write offs can be a good way to keep that income in your pocket! Earnings will vary depending on your location, of course, but those numbers represent a good rate for delivery work, and can make driving for amazon flex well worth the effort.

Hover over your email address at the top of the page. Saskatchewan provincial sales tax (sk pst); To provide us with your tax information online:

British columbia provincial sales tax (bc pst); · provide basic personal information (name, phone number, and vehicle information). Driving for amazon flex can be a good way to earn supplemental income.

Deluxe to maximize tax deductions;

Amazon In The Philippines Does Amazon Ship To The Philippines Yes Heres How

Everlance Mileage Tracker Expense Log Taxes Apps On Google Play

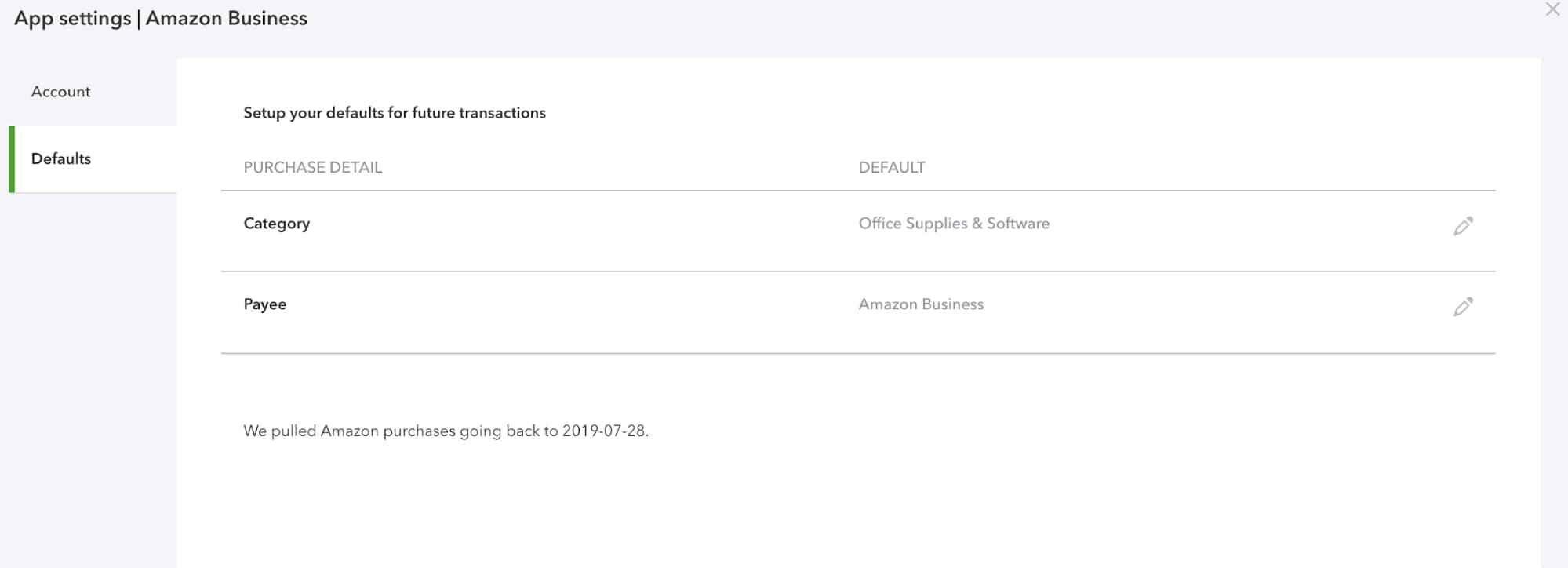

Connect Your Amazon Business Account To Quickbooks Online

Best Food Delivery Jobs And Apps In Canada Savvy New Canadians

Best Suv Canada 2021 Top Models Offers Leasecosts Canada

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes – Money Pixels

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes – Money Pixels

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes – Money Pixels

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes – Money Pixels

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes – Money Pixels

![]()

How Does Hmrc Know About Undeclared Income That You Have Not Paid Tax On Freshbooks

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes – Money Pixels

Best Suv Canada 2021 Top Models Offers Leasecosts Canada

6 Ways To Save Money On Your Taxes – Moneywise Ways To Save Money Ways To Save Saving Money

Amazon In The Philippines Does Amazon Ship To The Philippines Yes Heres How

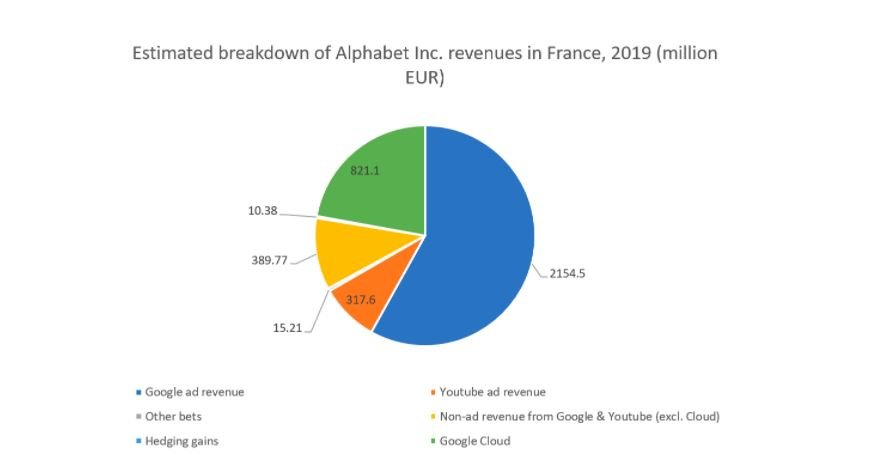

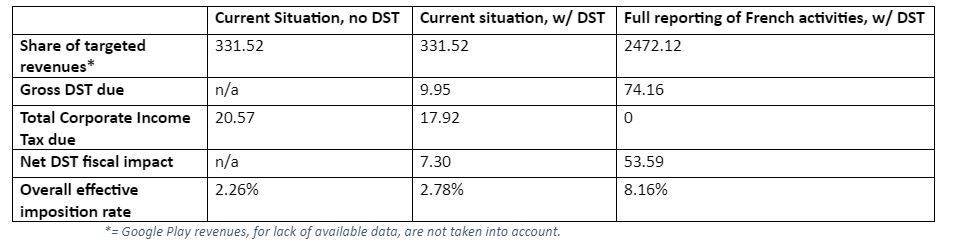

Digital Taxes A Fake Solution For A Real Problem

The Purple Harmony Pillow In Canada Wantboard

Digital Taxes A Fake Solution For A Real Problem

Amazon In The Philippines Does Amazon Ship To The Philippines Yes Heres How