2) click your account > login & security. Canadian individuals, for example, are given a social insurance number.

A Step-by-step Guide To Filing Doordash Taxes1099write-off

Click the download pdf link.

Amazon flex tax documents canada. · provide basic personal information (name, phone number, and vehicle information). Exemption certificates will be available to download for orders where you are responsible for the taxes (tax was calculated using your tax settings) and an atep customer applied their exemption, or when taxes were refunded on an fba order by amazon customer service. Also i do not make any other stops on the route, so i would think that starting odometer and ending odometer would suffice.

Tax returns for amazon flex. The irs only requires amazon flex to send drivers the. To download tax exemption documents, go to the exemption certificates tab and search by order id or date range for exemption.

If your local tax authority does not issue an income tax identification number, a u.s. If you do not have an amazon.ca account, you will have to create one. They are both forms that are used to report your yearly income.

Amazon business or subsidiary for which you are supplying tax. · sign up for amazon flex using your amazon.ca account. To obtain your amazon flex debit card account and routing numbers, open your amazon flex card app and tap on direct deposit.

You’ll need to submit a tax return online declaring your income and expenses once a year by 31 january, as well as paying tax twice a year by 31 january and 31 july. If you’re an amazon flex customer anxiously awaiting a package, there’s one phone number you need to know. Professional sellers have access to all three sales tax reports following these instructions:

The amazon flex support team is great when it comes to dealing with immediate issues regarding package deliveries. To provide us with your tax information online: Amazon will send you a 1099 tax form stating your taxable income for the year.

Set your own hours, listen to your own tunes, and get paid. Hover over your email address at the top of the page. Select reports and click tax document library.

1) sign in to amazon.in using the email address and password that is currently associated with your amazon flex account. Keeper helps you to save tax on other expenses as tax write offs. We would like to show you a description here but the site won’t allow us.

Tin must be provided if you wish to claim a reduced rate of. There are up to about 50 addresses on a route so that seems like it would be ridiculous to track. · watch the onboarding videos.

Select a location on your computer and click save. To save the form to your computer, while it is open in adobe reader, click file, then save as, and then pdf. · provide tax and bank account information (to make sure you get paid).

To assist us with locating your account, please include the following information when sending your documentation to amazon: Make quicker progress toward your goals by driving and earning with amazon flex. Adjust your work, not your life.

Click on view/provide tax information to review or update specific tax information. Are you making money by driving for amazon flex? 3) next to email, click edit.

Go to the amazon flex app > menu> settings > personal information > bank account and insert your amazon flex debit card account and routing number. Under sales tax reports, click generate a tax report. Or download the amazon flex app.

A w2 form is issued when you are considered an employee of a company. From there, select the tax document library. A foreign tax identification number is issued by your local tax authority and is used for income tax reporting purposes.

Canadian Tax System Doing Business In Ontario – February 25 2013 S

A Step-by-step Guide To Filing Doordash Taxes1099write-off

Amazoncom 12v Rgb Neon Rope Lightled Neon Flex Led Strip Lights Alexa Compatible Silicone 164ft Multi-color Changing Wifi Bluetooth Phone App Control Dimmable Silicone Ip65 Waterproof For Party Diycuttable Tools

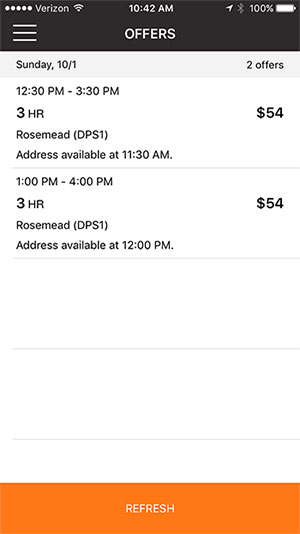

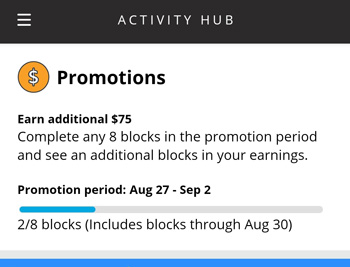

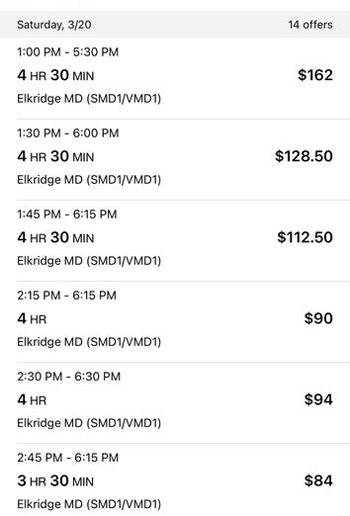

Can You Deliver For Amazon Flex Driver Requirements Job Overview – Ridesharing Driver

Canadian Tax System Doing Business In Ontario – February 25 2013 S

Trind Nail Repair Natural Promotes Nail Growth For Damaged Nails Formaldehyde Free Amazonca Beauty Personal Care

A Step-by-step Guide To Filing Doordash Taxes1099write-off

Can You Deliver For Amazon Flex Driver Requirements Job Overview – Ridesharing Driver

Petunjuk Teknis Pelaksanaan Seleksi Pengadaan Pppk Untuk Jabatan Fungsional Guru Pada Pemerintah Daerah Tahun 2021 Bkd Kalimantan Tengah

Can You Deliver For Amazon Flex Driver Requirements Job Overview – Ridesharing Driver

Due Diligence Under Fema By Ca Sudha G Bhushan

Malco Ty34 25 Quantity Pack Nylon Ties 36-inch For Flex Duct Installations Cable Ties – Amazon Canada

Amazoncom Power Onoff Board Reset Switch Cable For Playstation 2 Ps2 70000 Slim Slimlite Replacement Part Video Games

Can You Deliver For Amazon Flex Driver Requirements Job Overview – Ridesharing Driver

Fender Stratocaster Left-hand Neck – Maple Fingerboard Amazonca Musical Instruments Stage Studio

Cost Optimization On Aws

Air Canada Baggage Fees Policy 2021 Update

Can You Deliver For Amazon Flex Driver Requirements Job Overview – Ridesharing Driver

Can You Deliver For Amazon Flex Driver Requirements Job Overview – Ridesharing Driver