In the online application, enter your. Although the department of revenue does not give notice of a lien to credit reporting agencies, the lien is a public record.

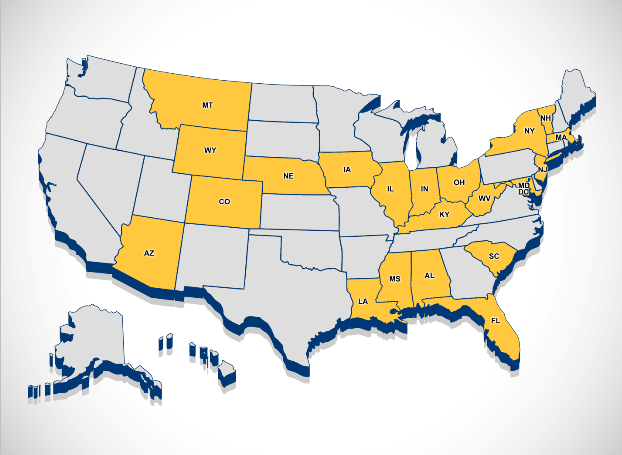

Which States Are The Best For Buying Tax Liens – Alternative Investment Coach

Montgomery county tax records search (alabama) perform a free montgomery county, al public tax records search, including assessor, treasurer, tax office and collector records, tax lookups, tax departments, property and real estate taxes.

Alabama tax lien search. Or when all properties are sold. We create and update gis maps with multi layers of data. You can perform a lien search online, via infotracer.com or through the county recorder, clerk, or assessor's office website.

Property information may be found on the revenue website and property maps are located at www.walkercountymaps.com. Download all data for alabama in a csv format. This is findlaw's hosted version of alabama code title 40.

Once you have found a property for which you want to apply, select the cs number link to generate an online application. Use tax is collected on items brought to the state of alabama by. Another option would be to contact the title company.

Tax liens in conecuh county, al buy tax liens and tax lien certificates in conecuh county, al, with help from foreclosure.com. Find alabama residential property records including property owners, sales & transfer history, deeds & titles, property taxes, valuations, land, zoning records & more. All searches must be done by you.

Our reports can be used for lien position information, foreclosure, audits, deed in lieu of foreclosure, etc. Listed properties will be published april 9, 2021 under the tax collector’s page or on the www.govease.com website. You can also contact the commissioner of revenue for the state to see if there are any tax liens that did not sell on the county level:

The jefferson county tax assessor is charged with responsibility to discover, list, assess, apply exemptions, abatements, current use, and process real and personal property tax returns. Close the search browser or toggle between browsers to return to this page. The lien bears interest at the bid rate from the first day following the purchase of the tax lien.

If the state purchased the property at the tax sale and later sells the property to a private party (also a “tax purchaser”), the tax purchaser is entitled to a tax deed granting him “all the right, title, and interest of the state in and to such lands” and providing him “all the rights, liens, powers, and remedies, whether as a plaintiff or defendant, respecting said lands as an. A lien is a charge against or interest in specific property that is taken as security for the satisfaction of a debt. You may search for transcripts of properties currently available by county, cs number, parcel number, or by the person’s name in which the property was assessed when it sold to the state.

The relatively high interest rate makes tax liens an attractive investment. Ray, iv lanier ford shaver & payne p.c. A lien may be voluntarily created by agreement of the parties, or it may arise by operation of statute.

A property search reporting all judgments, liens, etc. Home buyers and investors buy the liens in tuskegee, al at a tax lien auction or online auction. Free alabama property records search.

Check your alabama tax liens rules. The jefferson county gis tax map system is considered the leader in the state of alabama. On subject property which also checks for judgments on all names in title on the property as shown on warranty deed and/or names given by client.

Use this page to navigate to all sections within the title 40. The lien is usually recorded in the office of the judge of probate of the county where the taxpayer resides or owns property. You'll need the address of the property or the owner's name.

Basics of alabama lien law charles a. Where is tax lien sale held? By submitting this form you agree to our privacy policy &.

There is an endorsement fee of $5.00 for each certificate. When is tax lien sale held? Alabama department of revenue property tax division p.o.

The taxpayer will be unable to sell or transfer his property until the tax lien has been paid. The tuscaloosa county tax lien sale takes place annually. Current as of january 01, 2019 | updated by findlaw staff.

Each search option opens in a new browser window. The tax collector is responsible for the collection of taxes on real property, personal property, manufactured homes, automobiles, motorcycles, motor homes, trailers and airplanes. An example of a voluntary lien is the interest that.

153 rows liens by date. Simple search (no images) by debtor name. If you do not see a tax lien in alabama (al) or property that suits you at this time, subscribe to our email alerts and we will update you as new alabama tax liens are published.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner.

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Wheres My State Refund Track Your Refund In Every State

How To Find Tax Delinquent Properties In Your Area Rethority

Tax Lien Sale Jefferson County Co

How To Use The Internet To Investigate Your Next Date Coworker Or New Friend Without Being Creepy Investigations New Friends Public Records

Property Tax Alabama Department Of Revenue

Pin On Tax Lien Certificate School

How To Find Alabama Tax Delinquent Properties – Youtube

2

Tax Certificate And Tax Deed Sales – Pinellas County Tax

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Alabama Tax Sales Tax Liens Tax Deeds – A Goldmine For Real Estate Investors – Youtube

Property Tax Dekalb Tax Commissioner

Tax Sale Grant County Indiana

Dr Jim Afremow On Twitter In 2021 College Football Playoff Nick Saban Alabama

Weve Helped Hundreds Of Huntsville Home Buyers Find The Perfect Home Just Let Us Know What You Are Looking Fo Air And Water Signs Skyline Earth Pictures

Property Tax Comparison By State For Cross-state Businesses

Tax Lien Investing For Foreigners – Tax Lien Investing Tips

Madison County Sales Tax Department Madison County Al