What does your 2019 tax return has been assessed mean? I’m so confused because i feel like i should be and really needed this money.

The Revenue Administration-gap Analysis Program In Technical Notes And Manuals Volume 2017 Issue 004 2017

Unlike an additional tax return, a tax inspection involves a penalty of 20% of the additionally assessed tax.

Additional tax assessed meaning. This usually happens when sars disallows some of your expenses and therefore issues an additional assessment showing the extra tax that is due. I would not worry about but do keep an eye on your mail. Just noticed on my transcript additional tax assessed $0.00 right around the time i filled in jan.

When additional tax is assessed on an account, the tc is 290. Here is what you definitely need to know about the sample irs tax transcript containing the transaction code 290: I have a question about something on my tax transcript.

The 23c date is the monday on which the recording of assessment and other adjustments are made in summary manner on form 23c and signed by a service center officer. Your property tax assessment is determined on a certain date. Code 290 is indeed an additional tax assessment.

Anyways, i still haven't received my unemployment tax refund and there. The transaction code is 290. As to why it was done, there is absolutely no way for me to even guess without looking at the transcript, and understanding all of the details of your case.

The code 971 on your 2020 transcript was probably the letter you got from trump back in april. From my knowledge, this means that they've audited my account and i don't owe anything. Is the message something to be concerned about?

The 20201605 on the transcript is the cycle. Additional tax assessed basically means that irs did not agree with the original amount assessed and increased the tax you owe. I live in california and the franchise tax board propose to assess additional tax base on information obtained form the internal revenue service under section 6103(d) of the internal revenue code.

From the cycle 2020 is the year under review or tax filing. (keep in mind that there are several other assessment codes, depending on the type of assessment.) There is a relationship between the assessed value and the tax liability.

It means that your return has passed the initial screening and, at least for the moment, has been accepted. The higher the assessment, the higher the tax bill. I was accepted 2/10 and no change or following messages on transcript since.

Sars owes you r16.6k as per your assessment. To subject to a tax, charge, or levy each property owner was assessed an additional five dollars Your property tax bill is based on the assessed value of your property, any exemptions for which you qualify, and a property tax rate.

The assessment leads to an “assessed value,” which is a base number used in the calculation of the property tax. Additional assessment (this means more tax is due!) if however, sars is of the view that your supporting documents do not match your tax return, they may issue you an ‘additional assessment”. Any guidance is helpful bc.

Your assessment has been concluded and reflects an amount payable by you of r10 662.00. you think oh no!, but ignore this and continue reading to the bottom. Two of them for this filing. In some jurisdictions, the assessed value is meant to equal the market value of property.

If it shows $0.00 it generally means that a freeze or hold has been lifted. Those are the placeholders for the irs very old computer checking your eip1 and eip2 eligibility. Meaning your account was flagged because not all income reported to them was reported on your return.

The important issue is whether the balance due claimed by the irs is correct in your opinion. A normal 2020 transcript for someone eligible for both stimulus checks will look something like the following (dates might be a bit different if you got a check or a prepaid card instead of direct deposit): Accessed means that the irs is going through your tax return to make sure that everything is correct.

Possibly you left income off your return that was reported to irs. My transcript finally updated, but it says “code 290: In its recent judgement, the sac dealt with the question whether an unlawfully initiated and continued tax inspection always results in the unlawfulness of tax assessment notices issued based on such an inspection.

The minus sign means that according to their records you owe a negative amount i.e. The meaning of code 290 on the tax transcript is “additional tax assessed”.

Types Of Income Tax Assessment Objectives Time Limits Legalraasta

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling South African Revenue Service

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

Jd0pqlj6_ckarm

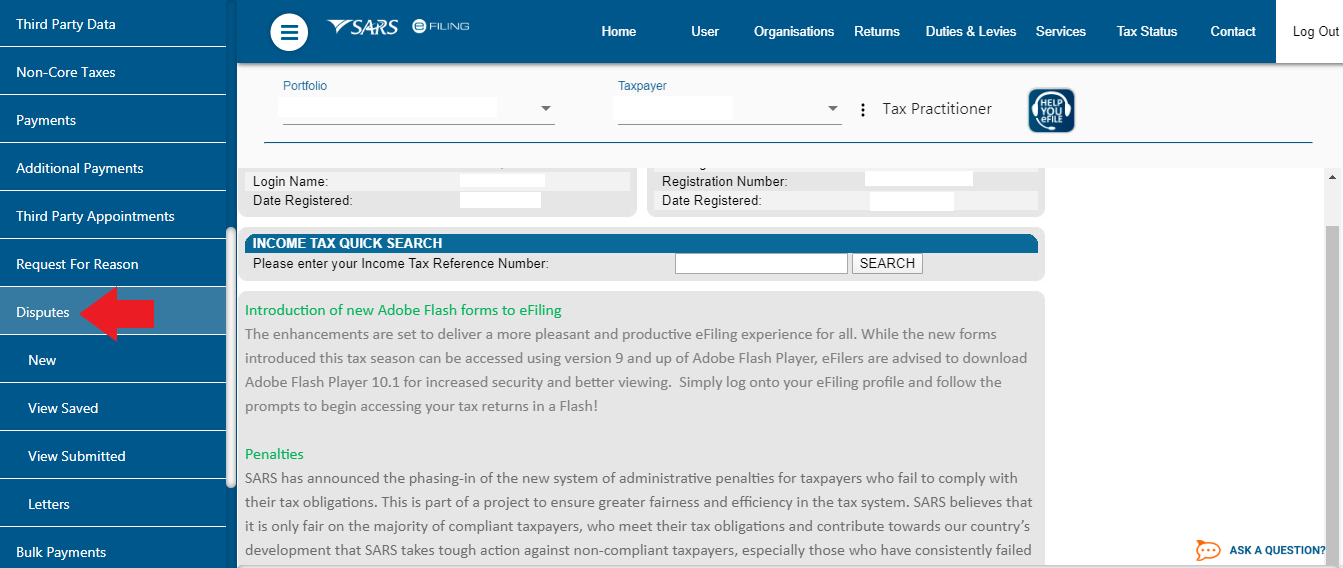

9 Steps To File An Objection To Your Tax Assessment Taxtim Blog Sa

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

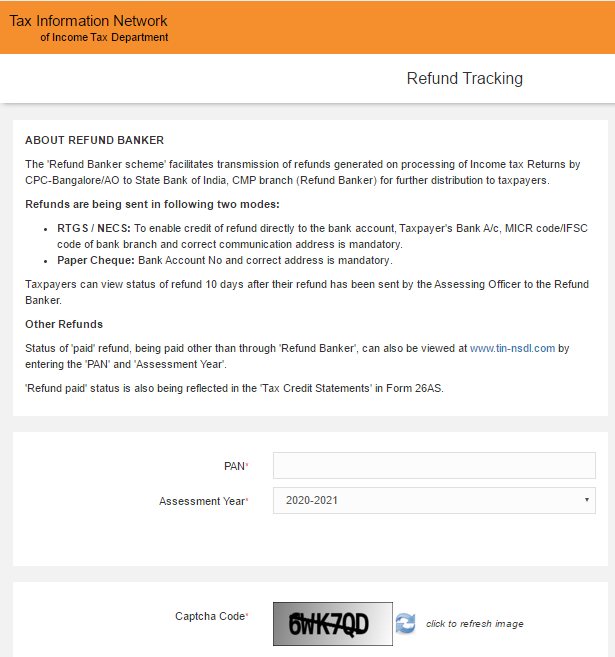

Income Tax Refund Status How To Check Itr Status Online

Understanding Californias Property Taxes

Irs Code 290 What Does It Mean On 2020 2021 Tax Transcript Solved

Income Tax Refund How To Check Claim Tds Refund Process Online

Ad Valorem Tax – Overview And Guide Types Of Value-based Taxes

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

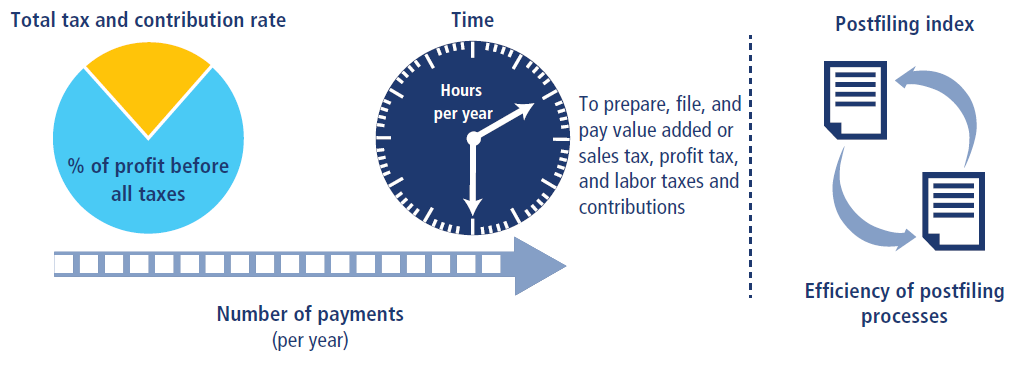

Methodology For Paying Taxes

9 Steps To File An Objection To Your Tax Assessment Taxtim Blog Sa

Letter Of Intimation Under Section 1431 Of Income Tax Act Scripbox

Follow-up On Auto-assessments 2021 South African Revenue Service

Irs Code 290 What Does It Mean On 2020 2021 Tax Transcript Solved

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn