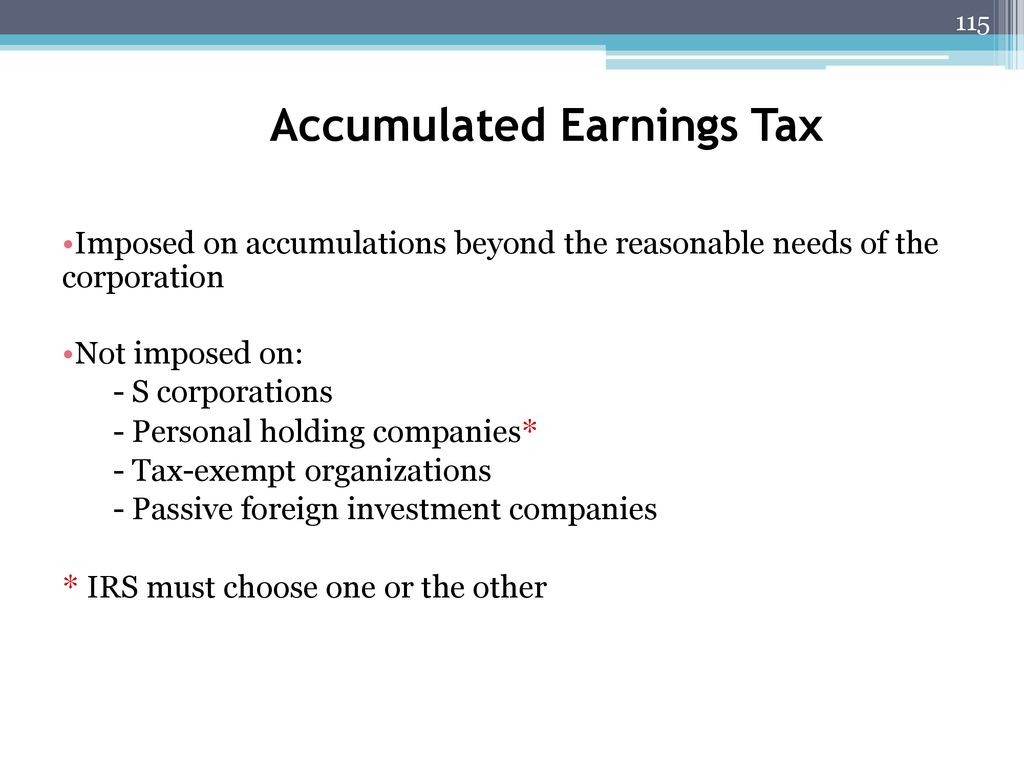

However, if a corporation allows earnings to accumulate beyond the reasonable needs of the business, it may be subject to. The penalty tax is applied to the corporation’s accumulated taxable income, which becomes.

Solved Determine Whether The Following Statements About The Cheggcom

The base for the accumulated earnings penalty is accumulated taxable income.

Accumulated earnings tax irs. Accumulated tax earning is a form of encouragement by the government to give out dividends, rather than keeping their earnings. What is the accumulated earnings tax? It is imposed by irs if the company is audited.

Internal revenue service (irs) sets the accumulated earnings tax scheme to prevent companies from excessively accumulating their income and to pay dividends instead. Further, the irs must establish: T o encourage corporations to pay dividends rather than accumulating earnings and allowing shareholders to avoid income taxes, the accumulated earnings tax imposes a penalty tax on earnings accumulated beyond the reasonable needs of a business under irc section 531.

The accumulated earnings tax imposed by section 531 shall apply to every corporation (other than those described in subsection (b)) formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation, by permitting earnings and profits to accumulate instead of being divided or distributed. Exemption levels in the amounts of $250,000 and $150,000, depending on the company, exist. Thus, it is only paid when the irs assesses the tax because, during an audit, it concluded that insufficient dividends were paid out compared to the amount of income accumulated.

The accumulated earnings tax is a charge levied on a company's retained earnings. It is a form of tax imposed by the federal government on firms and cooperation with retained earnings. The tax is in addition to the regular corporate income tax and is assessed by the irs, typically during an irs audit.

The causes of the accumulated earnings tax penalty and how to avoid it mable w. The accumulated earnings tax (aet) is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. The accumulated earnings tax is a penalty tax;

The tax rate on accumulated earnings is 20%, the maximum rate at which they would be taxed if distributed. The accumulated earnings tax rate is 20%. The accumulated earnings tax rate is 20%.

This tax can be assessed by the irs on accumulated retained earnings that have not been earmarked for a clear purpose. Accumulated earnings tax the aet is a 20 percent tax for each tax year on accumulated taxable income of corporations.1 while the aet hasn’t been widely imposed or litigated in recent years, it still applies to all corporations — with limited exceptions2. A corporation determines this amount by adjusting its taxable income for “economic items” to better reflect how much cash it has available to make dividend distributions.

The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its What is accumulated earnings tax? The irs also allows certain exemptions based on the required.

The tax rate on accumulated taxable income currently stands at 20%, and fortunately the american taxpayer relief act (atra) kept it from rising to a. The accumulated taxable income is the corporation's taxable income with various adjustments. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

In order for the irs to impose this tax, the company must be subject to an audit. The accumulated earnings tax is not a self assessed tax. The irs also allows certain exemptions based on the required need for the accumulated earnings.

The company has retained earnings in the business in excess of the reasonable needs of the business, and The accumulated earnings tax is computed on the corporation's accumulated taxable income for the taxable year or years in question. The tax is assessed at the highest individual tax rate on the corporation’s accumulated income and is in addition to the regular corporate income tax.

Also called the accumulated profits tax, it is applied when tax authorities determine the cash on hand to be an excessively high amount. Exemption levels in the amounts of $250,000 and $150,000, depending on the company, exist. The aet is a penalty tax imposed on corporations for unreasonably accumulating earnings.

In addition to other taxes imposed by this chapter, there is hereby imposed for each taxable year on the accumulated taxable income (as defined in section 535) of each corporation described in section 532, an accumulated earnings tax equal to 20 percent of.

Strategies For Avoiding The Accumulated Earnings Tax – Krd

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Bardahl Formula Calculator – Defend Against Accumulated Earnings Tax

Buwis Pdf Dividend Corporate Tax

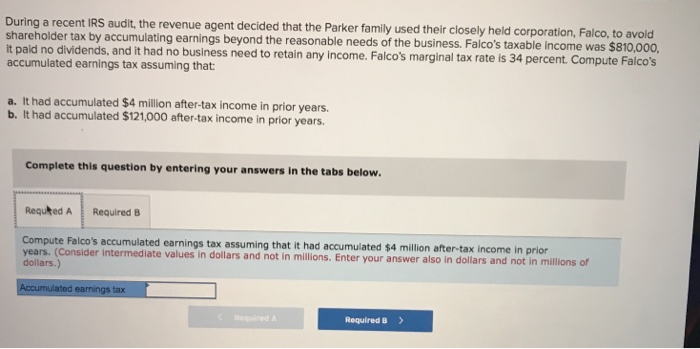

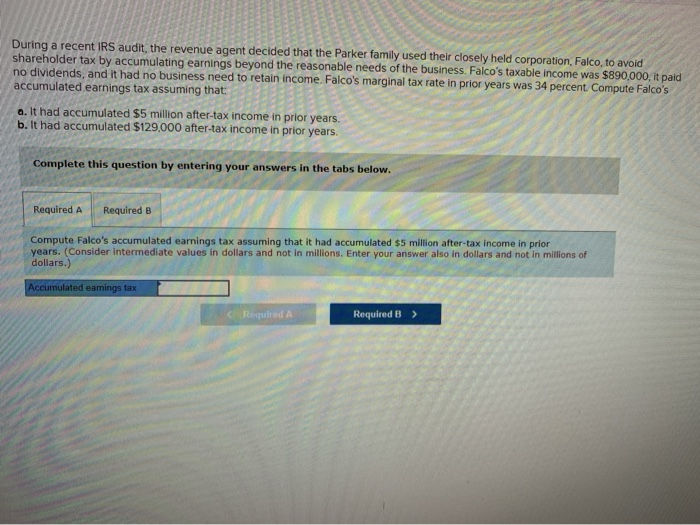

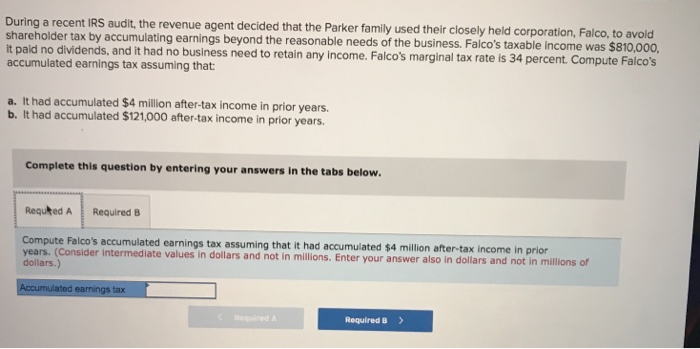

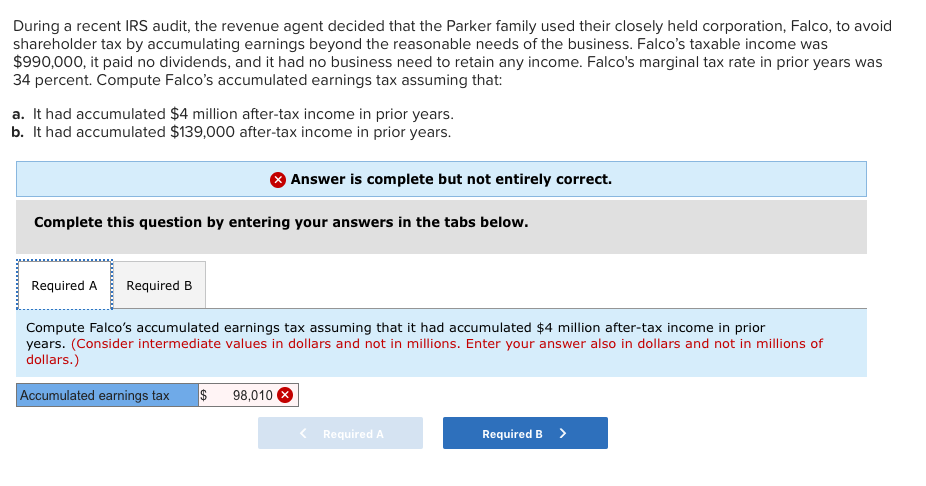

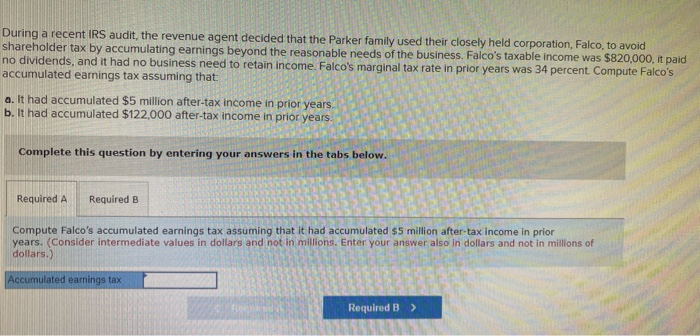

Solved During A Recent Irs Audit The Revenue Agent Decided Cheggcom

Irs Use Of Accumulated Earnings Tax May Increase

Solved During A Recent Irs Audit The Revenue Agent Decided Cheggcom

Corporate Tax Copyright Ppt Download

Ppt – Irc 987 And Calculation Of Earnings Profits Tax Pools Canada Puc Mexico Powerpoint Presentation – Id6794937

Simple Strategies For Avoiding Accumulated Earnings Tax – Tax Professionals Member Article By Mytaxdog

Earnings And Profits Computation Case Study

2

Solved During A Recent Irs Audit The Revenue Agent Decided Cheggcom

Cares Act Implications On Corporate Earnings And Profits Ep

Solved During A Recent Irs Audit The Revenue Agent Decided Cheggcom

How To Calculate The Accumulated Earnings Tax For Corporations – Universal Cpa Review

Solved During A Recent Irs Audit The Revenue Agent Decided Cheggcom

Earnings And Profits Computation Case Study

Solved During A Recent Irs Audit The Revenue Agent Decided Cheggcom