Effectively connected earnings and profits equals the earnings and profits attributable to income effectively connected. Dalaguete on october 18, 2018 a corporation that permits the accumulation of earnings and profits beyond the reasonable needs of the business is subject to the 10 percent improperly accumulated earnings tax (iaet).

Demystifying Irc Section 965 Math – The Cpa Journal

The tax is in addition to the regular corporate income tax and is assessed by the irs, typically during an irs audit.

Accumulated earnings tax calculation. The accumulated earnings tax imposed by section 531 shall apply to every corporation (other than those described in subsection (b)) formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation, by permitting earnings and profits to accumulate instead of being divided or distributed. Exemption levels in the amounts of $250,000 and $150,000, depending on the company, exist. The irs also allows certain exemptions based on the required.

What is the accumulated earnings tax? The tax rate on accumulated earnings is 20%, the maximum rate at which they would be taxed if distributed. What is accumulated earnings tax?

Irc section 535(c)(1) provides that reasonable needs of the business may be used to reduce accumulated taxable income. A corporation determines this amount by adjusting its taxable income for “economic items” to better reflect how much cash it has available to make dividend distributions. This calculation allows a business to determine whether a distribution paid to shareholders would be treated as a taxable dividend, a nontaxable return of capital, or capital gain.

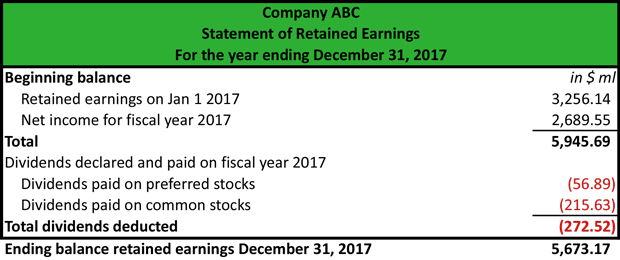

Terms similar to accumulated retained earnings The calculation of accumulated retained earnings is as follows: If the accumulation is justified to be within the reasonable needs of the business, the iaet is not imposed.

Generally, a corporation’s “accumulated taxable income” is calculated as follows: Treat each distribution as a distribution of these. Also called the accumulated profits tax, it is applied when tax authorities determine the cash on hand to be an excessively high amount.

Accumulated earnings tax can be reduced by reducing accumulated taxable income. The accumulated earnings tax rate is 20%. This tax is imposed by the irs to prevent corporations from piling up earnings and not distributing them to shareholders in the form of dividends, thus.

Given that there has been little change, other than rates, in the taxation of accumulated earnings, the guidelines may still be useful in planning and in dealing with examining agents. The accumulated earnings tax is basically a 15% tax on the corporation’s “accumulated taxable income” for the tax year. Calculation of accumulated retained earnings.

Accumulated earnings tax the aet is a 20 percent tax for each tax year on accumulated taxable income of corporations.1 while the aet hasn’t been widely imposed or litigated in recent years, it still applies to all corporations — with limited exceptions2. The accumulated earnings tax may be imposed on a corporation for a tax year if it is determined that the corporation has attempted to avoid tax to. The worksheets also contain an illustration of how a corporation could analyze its exposure to the accumulated earnings tax, and a sample taxpayer’s statement pursuant to §534(c) and regs.

What is “accumulated taxable income”? A distribution is only a dividend if it exceeds current year e&p and/or accumulated e&p after 1913. Accumulated earnings tax corporations must pay an additional accumulated earnings tax of 20%, in addition to the regular corporate taxes, if the corporation doesn't distribute or pay dividends.

The aet is a penalty tax imposed on corporations for unreasonably accumulating earnings. Calculation of the branch profits tax. The accumulated earnings tax is a charge levied on a company's retained earnings.

This tax can be assessed by the irs on accumulated retained earnings that have not been earmarked for a clear purpose. The base for the accumulated earnings penalty is accumulated taxable income. Figure the available accumulated earnings and profits balance on the date of each distribution by subtracting the prorated amount of current year earnings and profits from the accumulated balance.

The accumulated earnings tax is computed by multiplying the accumulated taxable income (irc section 535) by 20%. The accumulated earnings tax base = the accumulated taxable income: The remaining $283,000 distribution amount will be absorbed by.

The regular corporate income tax.

Demystifying Irc Section 965 Math – The Cpa Journal

Sale Of Stock Of A Cfc Example Of The Potential Benefit Of Code 1248b – International Tax Blog

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession – Ppt Download

What Are Accumulated Earnings – Definition Meaning Example

Irs Use Of Accumulated Earnings Tax May Increase

Earnings And Profits Computation Case Study

Determining The Taxability Of S Corporation Distributions Part Ii

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

What Are Retained Earnings Definition Bdcca

Earnings And Profits Computation Case Study

Determining The Taxability Of S Corporation Distributions Part Ii

Cares Act Implications On Corporate Earnings And Profits Ep

Corporate Distributions

What Are Accumulated Earnings Profits Accounting Clarified

Demystifying Irc Section 965 Math – The Cpa Journal

Determining The Taxability Of S Corporation Distributions Part I

Demystifying Irc Section 965 Math – The Cpa Journal

Earnings And Profits Computation Case Study

Overview Of Improperly Accumulated Earnings Tax In The Philippines – Tax And Accounting Center Inc – Tax And Accounting Center Inc