During the year ending dec. Can i deduct my union dues in 2020?

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

If you actually work for the union as a union rep.

Are union dues tax deductible in 2020. Consult your tax advisor to confirm. This is a result of the tax reform bill signed into law on december 22, 2017. Educator expense tax deduction renewed for 2020 tax returns.

The 2019 tax season was the first time union members could no longer deduct the cost of items such as tools, uniforms, subscriptions to trade journals, and many other items besides union dues that are often necessary for workers to do their jobs and earn a living. Eligible educators can deduct up to $250 of qualified expenses you paid in 2020. Dues are deducted from twenty (20) pay periods from september through early june of each year.

However, you can deduct contributions as taxes if state law requires you to make them to a state unemployment fund that covers you for the loss of. Are professional dues tax deductible in 2020? Union dues may be tax deductible, subject to certain limitations.

You can't deduct voluntary unemployment benefit fund contributions you make to a union fund or a private fund. No, employees can’t take a union dues deduction on their return. This publication explains that you can no longer claim any miscellaneous itemized deductions, unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses.

New bill would restore tax deduction for union dues, other worker expenses. Can i deduct union dues? Prior to 2018, an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business expenses, if the total of the dues plus certain miscellaneous itemized expenses reached a certain level.

The dues tax is imposed on the amount actually paid by a member and received by the club. The following are deductions for union dues that you might be qualified to make on your federal income tax return. The amount of union dues that you can claim is on box 44 of the t4 slip issued by your employer.

A reminder for tax season: Can i deduct my union dues in 2020? Major tax reform was approved by congress in the tax cuts and jobs act (tcja) on december 22, 2017.

The club pays $500 ($5,000 x 10%) in dues tax This formula has not changed. Or direct employee, you will have additional deductions.

To get to the correct location to enter your union dues, in your federal return, type union dues in. Statement of remuneration paid at the. Only union membership dues are deductible, and union members may not deduct initiation fees, licenses or other charges.

Professionals who are required by law to pay dues for professional boards or parity or advisory committees may also deduct those fees. As a unionized employee, your union dues, initiation fee and any union publications are all deductible. Can i deduct union dues now?

However, there are a few exceptions, and if your union dues meet one of them you are in luck What professional expenses are tax deductible? This tax reform affects almost everyone who itemized deductions on tax returns they filed in previous years.

Please download our union rep. For example, as an initiation fee, a club requires each of its that members purchase a bond having a face value of $5,000, full payment of the bond to be made intwo years. Under current federal law, union dues are generally not deductible.

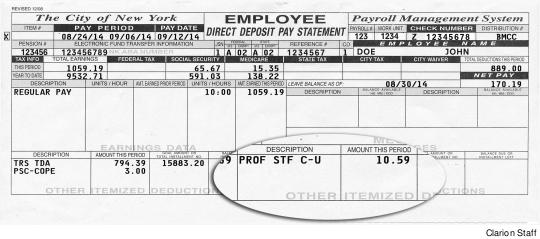

Subparagraph 8(1)(i)(iv), paragraph 8(5)(c) cra publications: Four years after the income tax deduction for union dues was ripped out of the u.s. We have printed a chart you can use to compute the amount deducted on your behalf and remitted to the uft.

Bill seeks to make union dues tax deductible. You can only deduct certain types of union dues or professional membership fees from your income tax filings. The 2019 tax season was the first time union members could no longer deduct the cost of items such as tools, uniforms, subscriptions to trade journals, and many other items besides union dues that are often necessary for workers to do their jobs and.

For instance, membership dues paid to business leagues, trade associations, chambers of commerce, boards of trade, real estate boards, professional organizations and civic or public service organizations are deductible. Where do i place that info? Union dues in california are deductible on ca tax form, correct.

For tax years 2018 through 2025, union dues are no longer deductible on your federal income tax return, even if itemized deductions are taken. However, most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the tax cuts and jobs act (tcja) that congress signed into law on december 22, 2017. 31, 2020, the city of new york and other employers deducted union dues for the uft from those uft members who were so designated.

Tax reform changed the rules of union due deductions.

Deducting Union Dues Drake17 And Prior

Tax Time Remember These Deductions Your Union Won For You

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Deducting Union Dues On Nys Taxes – Uup Buffalo Center

Intermediate Accounting Seventeenth Edition Kieso Weygandt Warfield Chapter

Bill Seeks To Make Union Dues Tax Deductible – Iam District 141

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Are Union Dues Deductible

Tax Receipts For The 201920 Financial Year Have Now Been Sent If You Have Not Received Your 201920 Tax Receipt Via Email And Dont Receive It In The Post In The Next

Membership Dues Tax Deduction Info – Teachers Association Of Long Beach

Union Dues Opseu Sefpo

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Tax Deductions In 2020 And 2021

Union Dues Deductible On State Taxes Not On Federal Taxes – Hawaii State Teachers Association

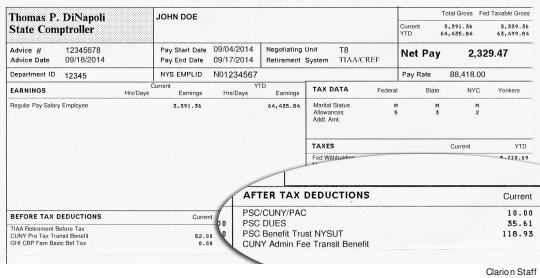

Are You A Union Member Psc Cuny

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Are You A Union Member Psc Cuny

Intermediate Accounting Seventeenth Edition Kieso Weygandt Warfield Chapter

Bill Seeks To Make Union Dues Tax Deductible – Iam District 141