Salt cap repeal below $500k still costly and regressive. The plan reportedly would repeal the salt cap for 2022 and 2023 only.

Congress May Restore Your Property Tax Break But Just For A Little While Nj Congressman Says – Njcom

(it’s 63.2 percent for new jersey and 64.7 percent for california.)

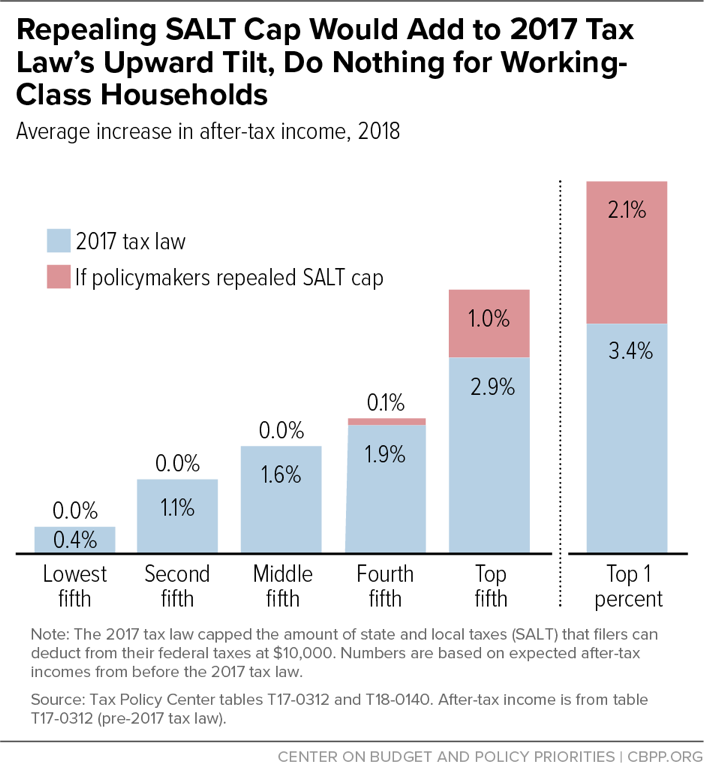

Will the salt tax be repealed. As president biden’s tax plans are considered in congress, the future of the $10,000 cap for state and local tax deductions (salt) is becoming an important part of the tax debate. And even with salt reducing the hit, state taxes will still raise top new yorkers’ effective rate to 66.2 percent. If congress fully repealed the salt cap, 96% of the tax savings would go to the top 20% of earners, according to the tax policy center.

Nov 19, 2021 | taxes. A possible compromise solution to reduce the havoc caused by the 2017 tax act would be to repeal the salt tax for those earning less than $400,000 per year. The tax policy center estimates that more than half the benefit of repeal would go to the top 1 percent of households, those making $824,000 or more.

Raising or repealing the $10,000 limit on the salt deduction, a change imposed by the 2017 republican tax overhaul, is one of the most politically charged aspects of the negotiation. No salt, no dice, the lawmakers added. Democrats represent all but one (calif.

We will continue to work with house and senate leadership to ensure the cap on the salt deduction is repealed, they said. The $10,000 cap would, in theory, resume in 2024 and 2025. Democrats want it repealed alongside the president’s broader proposals to raise revenue with tax increases, although the federal government would lose revenue if it removed the salt cap.

Certain members of the house and senate want the salt deduction cap removed, which would benefit primarily higher earners—and result in a $380 billion reduction of federal revenue. A host of moderate democrats say they won't support president joe biden's $3.5 trillion package without a repeal of the cap on state and local tax deductions, known as salt. “it would reduce their 2021 taxes by an average of only $20.

That would be a bad look for democrats who at the same time want to raise income taxes on business and the wealthy. Democrats reportedly are considering a plan to repeal the 2017 cap on the state and local tax (salt) deduction for 2022 and 2023 only. Salt” for his dedication to the issue, said there are enough democrats who will block the entire bill if the measure is not addressed.

The henrys — high earners, not rich yet — were treated well by. A group of blue state democrats has insisted on some salt fix as their price for. That could appease the progressive democrats without alienating most republicans.

Under the 2017 tax cuts and jobs act (tcja. It also is terrible policy. 54 rows some lawmakers have expressed interest in repealing the salt cap,.

Everything keeps coming up roses for the $200,000 to $500,000 set. According to press reports, the senate is considering repealing the $10,000 cap on the state and local tax (salt) deduction for those making $500,000 per year or less. House democrats have proposed to raise the $10,000 cap on state and local tax (salt) deductions to $80,000 and extend that higher limit through 2030.

Half the benefit to the top 1 percent. Raising the salt cap to $80,000 would reduce federal income tax liability by $55.9 billion in 2021, making it $35.3 billion less expensive than full cap repeal. Of course, repealing the salt cap isn’t just dishonest budgeting.

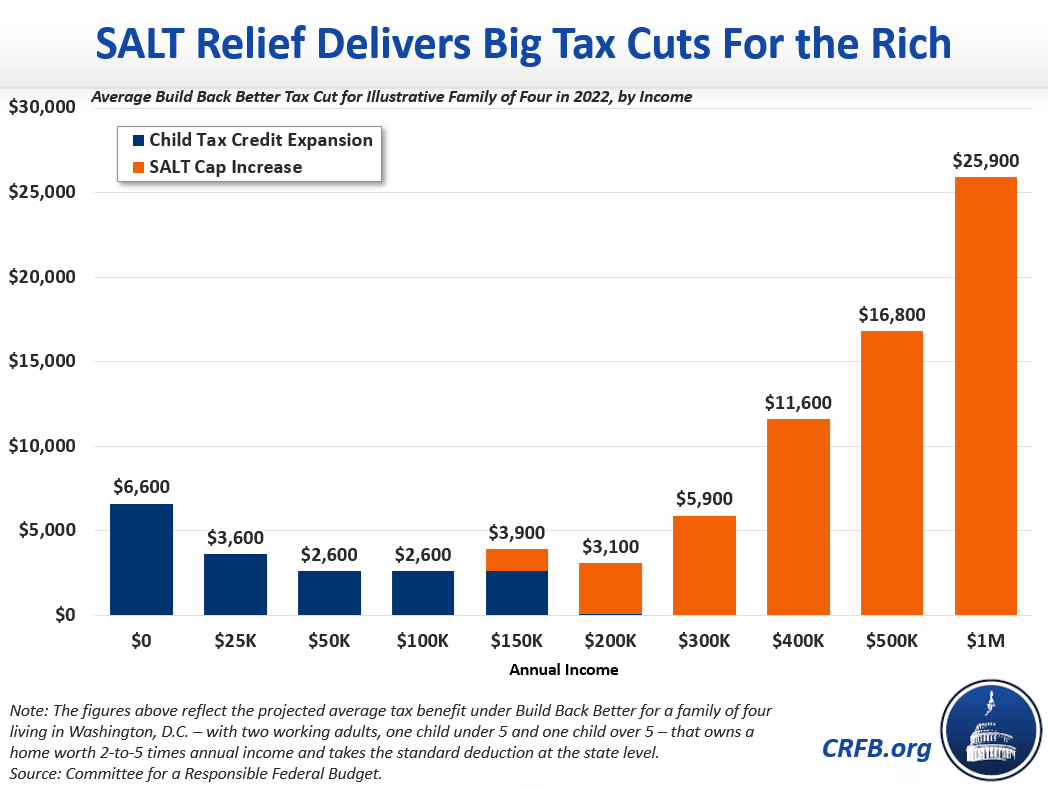

On average, they’d get a tax cut of about $35,000 in 2022. Blocking threat suozzi, known as “mr. We will continue to work with house and senate leadership to ensure the cap on the salt deduction is repealed.

How To Build A Fun Family Time Capsule – My Silly Squirts Family Fun Time Time Capsule Time Capsule Kids

Tpc Impacts Of 2017 Tax Laws Salt Cap And Its Repeal Center On Budget And Policy Priorities

How An 80000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400000 Or Less

Us Lawmakers Pepper Congress With Pleas For Salt Tax Break – Florida Phoenix

3 Money-saving Tax Tips For Homeowners Utah Listing Pro Save Money Tax Tips Homeowner Tips Tax Season Real Estate Ta Tax Money Tax Season Saving Money

Millionaire Sounds Off On Calls To Lift Salt Deduction Cap Itep

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill – Vox

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Respectful Tax Day Which Some Also Know As Legalized Plunder Day Every April 15th Or So Is Americas Official Deadline For Tax Day Income Tax National Debt

Respectful Tax Day Which Some Also Know As Legalized Plunder Day Every April 15th Or So Is Americas Official Deadline For Tax Day Income Tax National Debt

Bigger State And Local Tax Deductions Still Possible As Democrats Grapple Over Spending

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill – Vox

Opinion End Of Cap On Salt Deductions Would Help California Homeowners But Progressives Oppose – Times Of San Diego

Salt Heres How Lawmakers Could Alter Key Contentious Tax Rule

Pelosi Defends Salt Deduction In Dems Spending Bill Insists It Wont Benefit The Rich Fox Business

Gaming The Salt Cap May Be Congresss Worst Tax Idea Of The Year

Calls To End Salt Deduction Cap Threaten Passage Of Bidens Tax Plan

Will Biden Repeal Gops Tax Change That Reduced His Deductions By 352000 The Motley Fool

Dueling Salt Fixes In Play As Democrats Try To Close Budget Deal – Roll Call