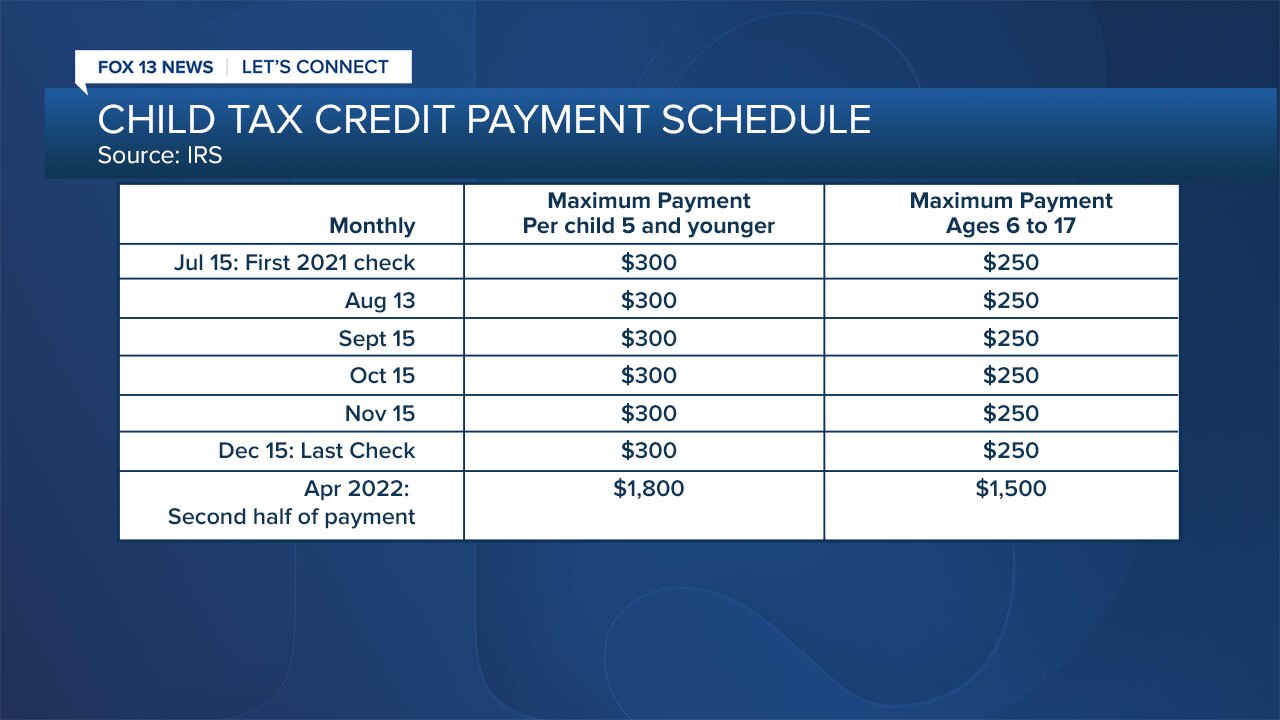

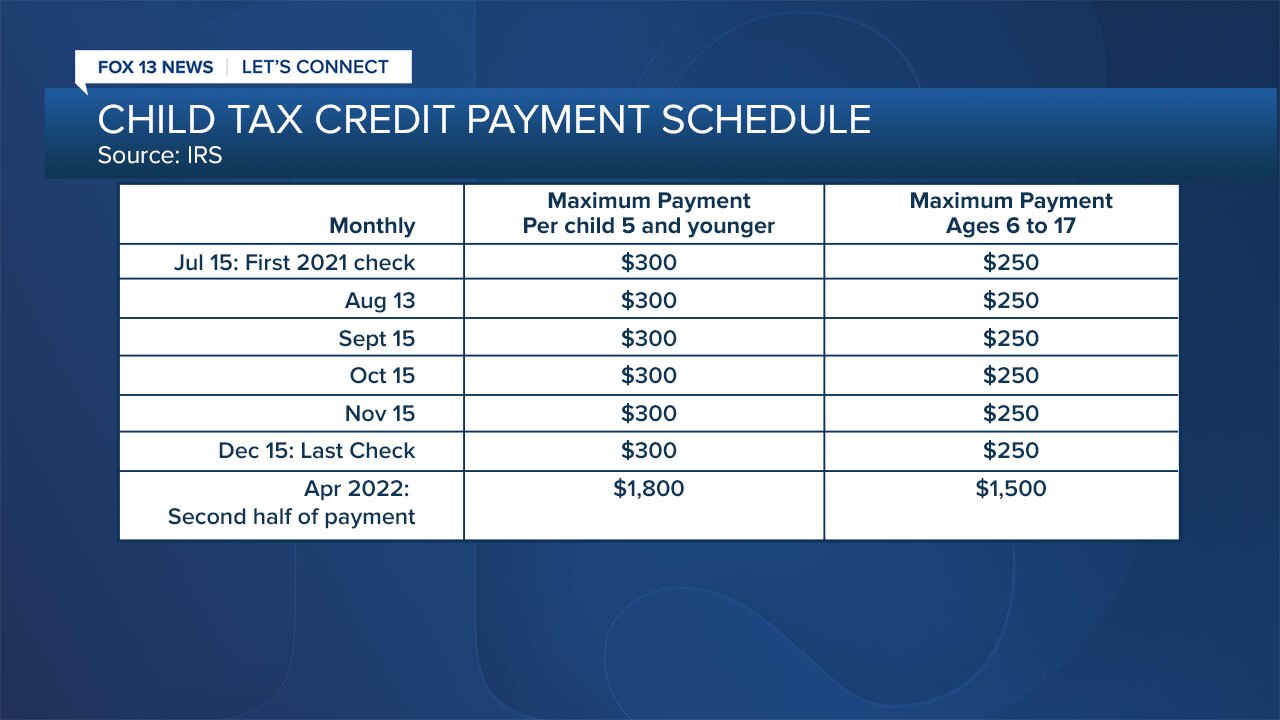

The second half of the credit will be applied when families file their 2021 taxes next spring. Those who signed up will receive half of their total child tax credit payment, up to $1,800, as a lump sum in december.

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

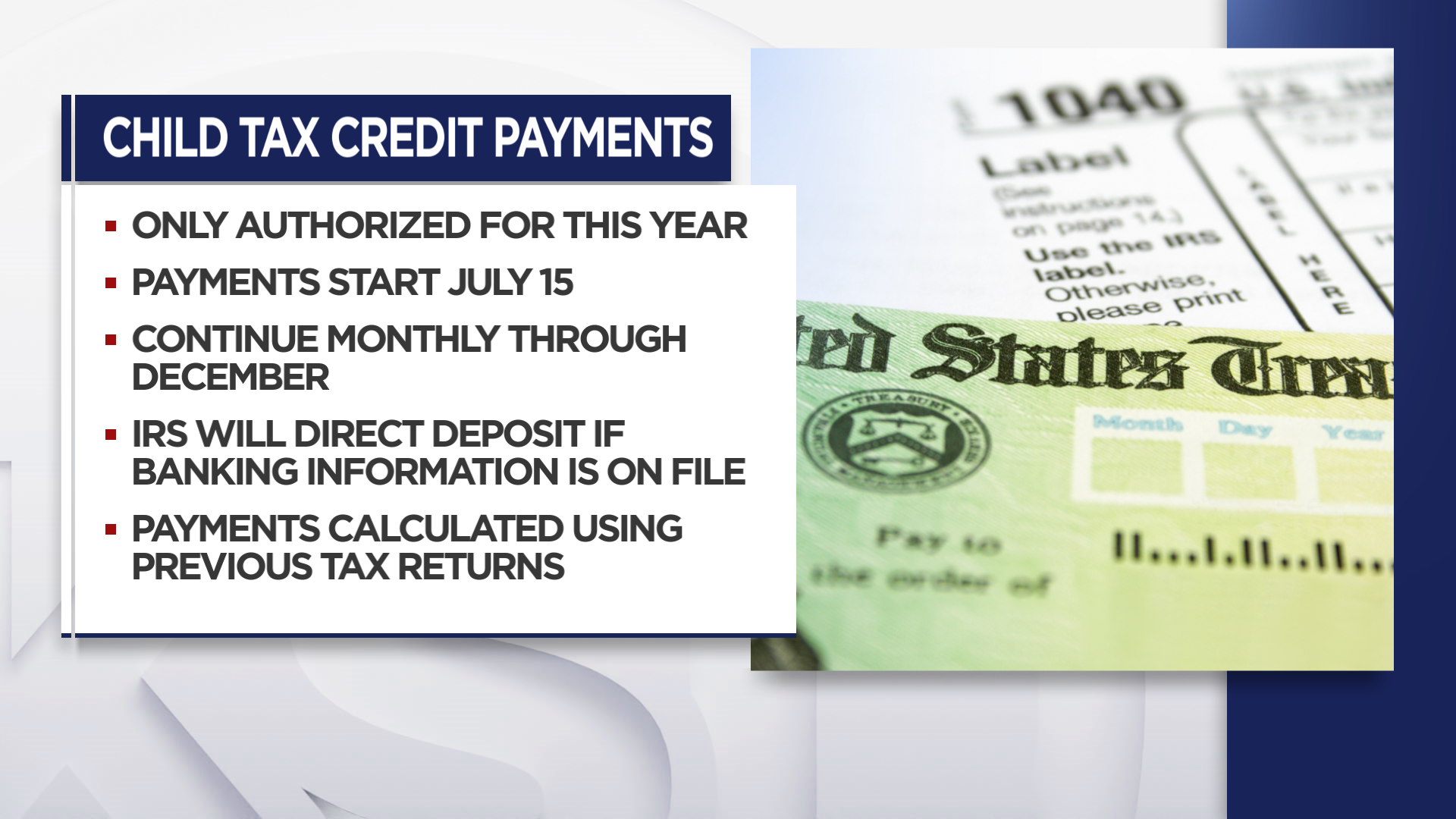

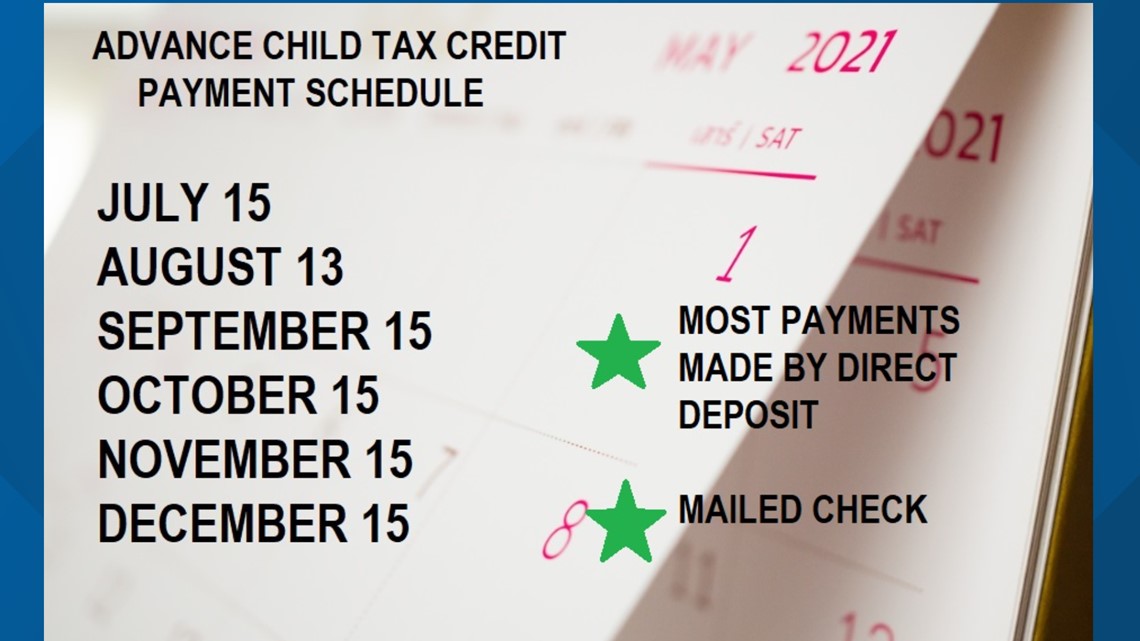

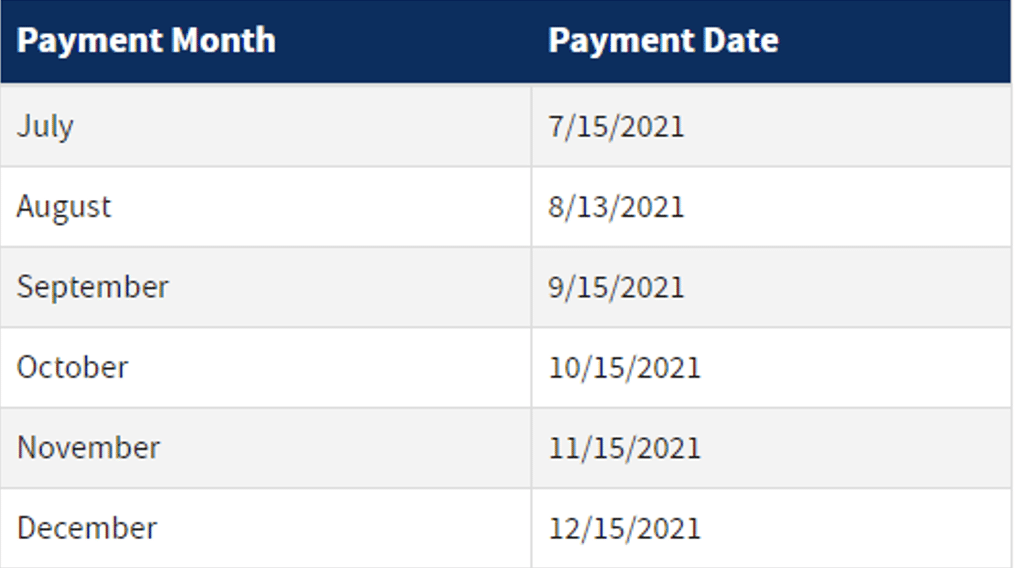

The first half of the credit is being delivered in monthly direct deposits through december of $300 for children under 6 and $250 for those aged 6 to 17.

Child tax credit december 2021 payment. Changes made before midnight on november 29 will only impact the december 15 payment, which is the last scheduled monthly payment for 2021. 15 will receive their first child tax credit payment of $1,800 on dec. Based on the guidance published by the irs in their contingency plan, it does not seem likely that the december child tax credit payment will be impacted.

In total, the six payments amount to half of the full value of the tax credit, or up to $1,800 for each child, under 6, and up to $1,500 for each child, ages 6 to 17. The 2021 advance monthly child tax credit payments started automatically in july. 15 for the full sum of the six child tax credit.

December 13, 2021 * haven't received your payment? The deadline to do so is 15 november, so those who get their submissions in before monday could receive a lump sum worth up to $1,800 per child in december, covering all the missed payments. Families will be able to claim the remaining value of the credit during tax season.

The child tax credits are worth $3,600 per child under six in 2021, $3,000 per child between six and 17 and $500 for college students aged up to 24. If you have a baby anytime in 2021, your newborn will count toward the child tax credit payment of $3,600. The expanded tax credit delivers monthly payments of $300 for each eligible child under 6, and $250 for each child between 6 to 17 years old.

15, with a deadline of nov. The last batch of 2021 child tax credit payments will be distributed on wednesday, dec. The second half will come when families.

29 to make changes for that installment. 1 was the deadline to change income, banking or address information for that payment. The child tax credit is $3,600 annually for children under age 6 and $3,000 for children ages 6 to 17.

The next child tax credit check goes out monday, november 15. For example, a family with one qualifying child under 6 that signs up on nov. The first payment arrived in july and installments include up to $300 a month for each child aged 5 and younger or up to $250 each month for children between ages 6 to 17.

Depending on how they chose to take that money, some recipients will be getting as much as $1,800. T he last payment for child tax credit schedule in the us will be paid on wednesday december 15, 2021 with news that recipients could receive a further 1,800 dollars per child. The final payment for 2021 will be dec.

The child tax credits are worth $3,600 per child under six in 2021, $3,000 per child aged between six and 17, and $500 for college students aged up to 24. The child tax credit was a part of the $1.9 trillion stimulus package passed by congress earlier this year, and was intended to help buoy families through. The payments were split over 6 months, with a portion being sent monthly, equivalent to about $300 per child.

15 is also the date the next monthly child tax credit payment will be sent out. Wait 5 working days from the payment date to contact us. The current credit is worth $3,600 for each child under six and $3,000 for those between six and seventeen.

The expanded child tax credit boosted the benefit to $3,600 for each child under 6, and $3,000 for kids ages 6 to 17, with half of those amounts provided in. Goods and services tax / harmonized sales tax (gst/hst) credit The remainder can be claimed when filing 2021 taxes in 2022.

Here's what to know about the fifth ctc check. When you file your 2021 tax return in 2022, you will need to report the amount of. Even though child tax credit payments are scheduled to arrive.

Children who are adopted can also qualify if they're us citizens.

Ed Markey On Twitter The Next Advanced Child Tax Credit Payment Arrives This Friday August 13 Families Can Now Receive Their Monthly Payments Faster By Adding Or Updating Banking And Direct Deposit

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Irs Child Tax Credit 2021 Non Filers Cahunitcom

What Is The Child Tax Credit And How Much Of It Is Refundable

Ea_hqrg-etgyqm

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

September Child Tax Credit Payments Are Here What Happens If Irs Misses You – Fingerlakes1com

Child Tax Credit Payment Begin In One Month July 15 Wfmynews2com

Payments For The New 3000 Child Tax Credit Start July 15 Heres What You Should Know – Brinker Simpson

Mvvr9adxdy_dcm

What To Know About The First Advance Child Tax Credit Payment

Child Tax Credit Dates Last Day For December Payments Marca

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Heres How To Check On Your Payment

Decembers Payment Could Be The Final Child Tax Credit Check What To Know – Cnet

C3ofhavar8fjdm

Mwokkzbekroh7m

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Tga3zq52ndhjam

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month