If they qualify, the custodial parent can claim these: The court that handles the child custody case can usually include the tax exemption as part of the order, giving a clear rule for who should use the exemption.

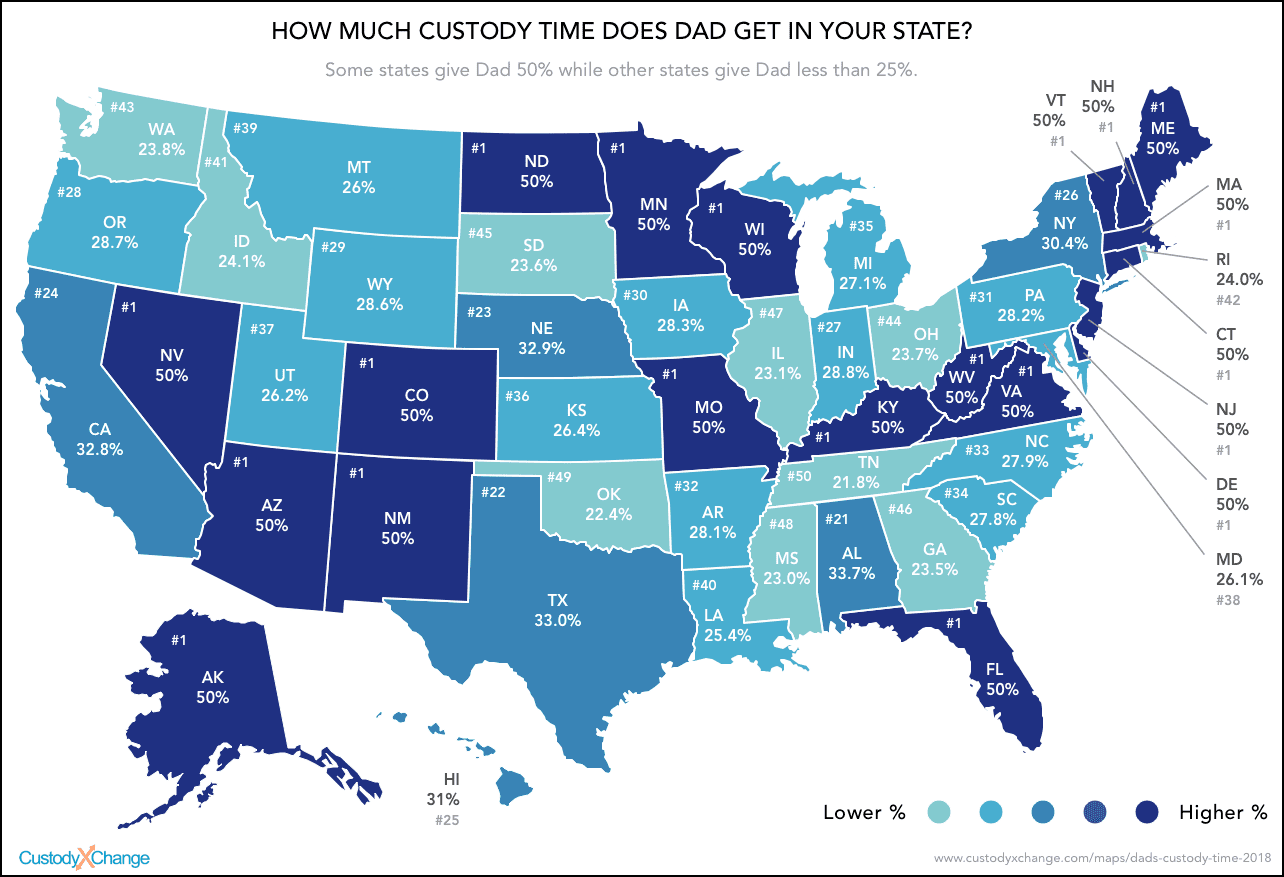

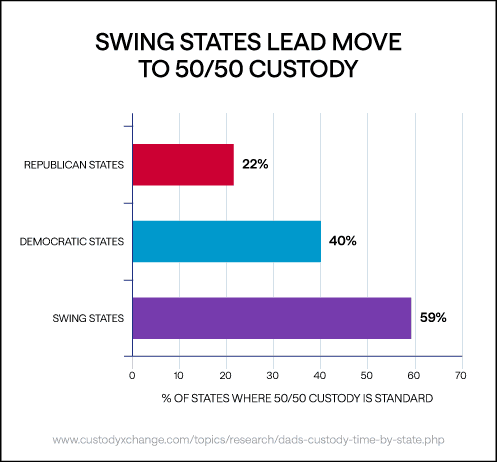

How Much Custody Time Does Dad Get In Your State

The information in this article is up to date through tax year 2021 (taxes filed in 2022).

Who claims child on taxes with 50/50 custody california. Head of household filing status; Where two or more taxpayers eligible to claim a specific dependant cannot agree on who will receive the credit, it is denied to all of them. The irs explains, “generally, the custodial parent is the parent with whom the child lived for a longer period of time during the year.”

In general, the parent who houses the child for most of the year is going to count as the custodial parent. Although you and your ex share your child’s expenses, irs rules allow only one parent to claim the child on their taxes. This can free up some.

The exemption for the child; In most cases, the custodial parent gets the deduction. If he had them for 50% or more of the time, and if he covers more than 50% their costs, he gets to claim them.

Often, the parent with the higher income will gain a larger tax benefit from claiming a child. Briefly, there are 5 tax benefits of having a child dependent: The credit for child and dependent care expenses;

Ok let me explain, uc is based on the adults circumstances on income and circumstances so it is available for unemployed or people on a low income to top up your salary, it is not available for people who earn money, ie your ex/ the child element of uc pays out for how ever many kids you have, check the gov website in actually fact it is really easy to understand what uc actually is and how it. I was told that irs required a parent with higher agi to claim a child as a dependent when we have the pure 50/50 physical and legal custody. The person with the highest agi if no parent can claim the child as a qualifying child;

The parent that has over 50 percent of the time is the custodial parent and gets the deduction. Any individual seeking legal advice for their own situation should retain their own legal counsel as this response provides information that is general in nature and not specific to any person's unique situation. Head of household filing status;

The parent with the higher adjusted gross income (agi) gets to claim the child if custody is split exactly 50/50, which is technically difficult when there are 365 days in. Transferring tax credit to your ex in a 50/50 custody arrangement. Unless ordered or agreed otherwise, those are the rules.

However, most cases involve the custodial parent with joint physical custody claiming the deduction. What can the custodial parent claim on their taxes? The 2021 child tax credit was temporarily expanded from $2,000 per child 16 years old and younger to $3,600 for children age 5 and younger and to $3,000 for children age 17 and younger.

The courts may also allow parents to. The irs has developed a basic tiebreaker rule to deal with this: There are numerous standard tax benefits to claiming a child as a dependent:

Who claims the child with 50/50 parenting time? Again, the rule for claiming children on your taxes is relatively simple: It is the parent who spends the most time with the children.

You may have sole physical custody, or you may share physical custody with your ex. Who gets the tax exemption in 50/50 custody cases? Here is a brief primer on child custody and taxes.

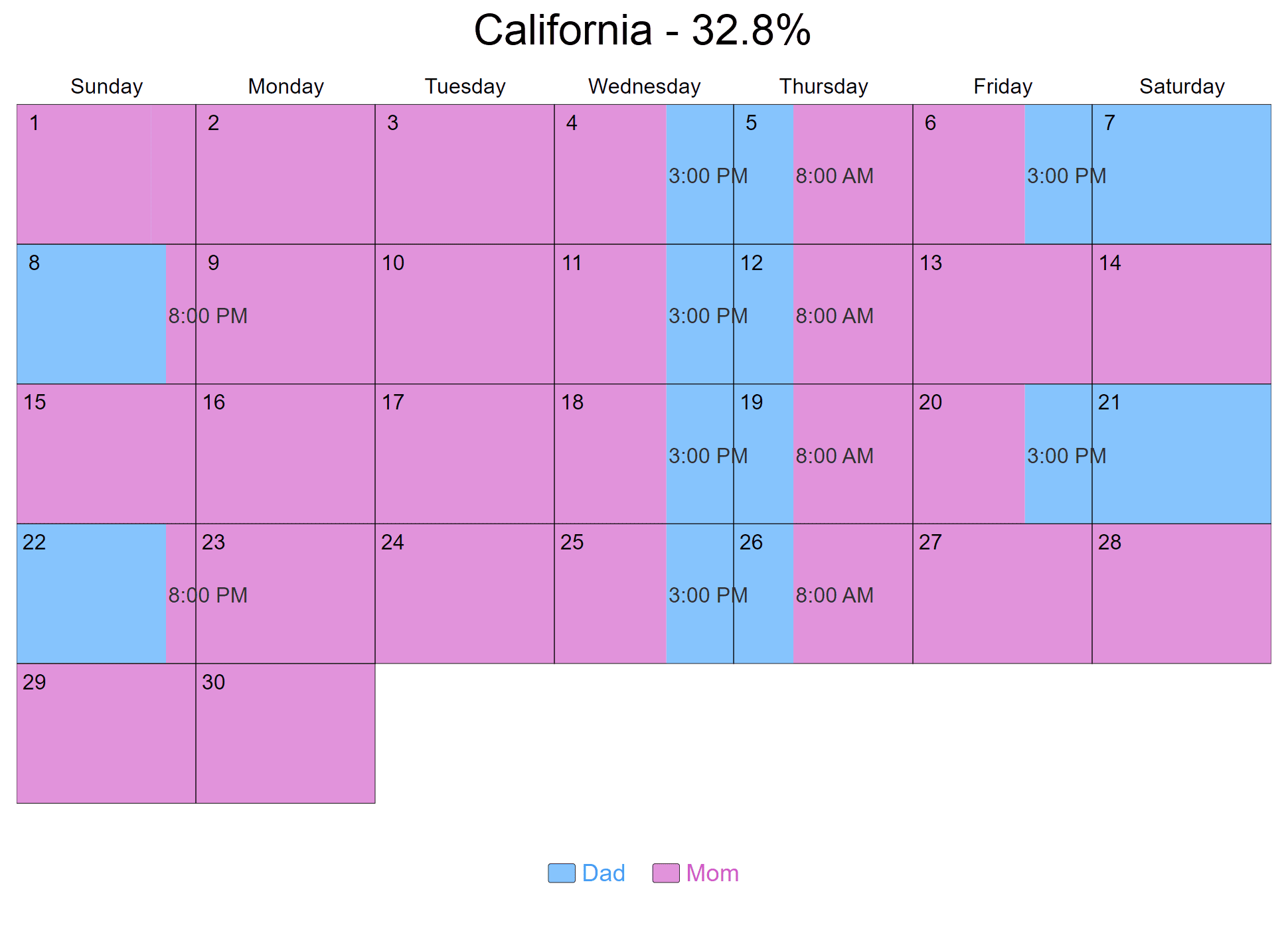

The income rule is the tie breaker if the number of days are equal. In california joint custody cases where parents share parenting time evenly, it may not be clear who should benefit from the tax exemption. Which parent claims the children on taxes with equal parenting time can be decided between the parents, and with the help of an accountant, you both may be able to work out an arrangement that saves you both on taxes.

The tax code assigns all 5 benefits to the parent who has custody more than half the time. If the other parent with lower agi were to file, i do need to provide a. (this is true for parents without an exact 50/50 custody split.)

The one who had custody for more than 1/2 of the year can claim the child as a dependent, child care expenses, earned income tax credit and, if eligible, head of household. A person with an agi higher than any parent if the parent can claim the child as a qualifying child but doesn’t; However, there are exceptions to this rule (such as transferring your tax credits to your ex).

There are all kinds of california child custody agreements. Dependent exemption, child tax credit, dependent care credit, head of household, and eligible for eic. | (equal) the parent who qualifies as the “custodial parent” under federal tax law is the one who claims the children as dependents.

However, two restrictions can cause issues: The parent who has a higher income for the tax year in question should claim the child. Only one person can claim a specific dependant.

50/50 custody and tax filing for claiming dependent. The parent who has custody for the greater part of the year typically gets to claim the child as a dependent for tax purposes. When parents divorce or separate, the law allows only one of them to claim their child as a tax dependent.

If you and another person share custody of a child throughout the year, and you each have a clearly established requirement under a court order or written agreement to make child support payments for that child, normally, neither of you would be able to claim the amount for an eligible dependant for that child. For shared custody arrangements, both parents would normally qualify to claim each child. Who claims child on taxes with joint custody?

California law states that in split 50/50 child custody agreements, the parent with the higher income can claim the child as a dependent on taxes. However, in this case, one of you may still be able to claim the amount, as long as you and the. By default, the irs gives this right to the custodial parent—that is, the parent with whom the child lives for more than half of the year.

The irs rule is whomever has the kids for the majority of the time claims them, and in cases with 50/50, the parent providing more than 50% of their costs claims them. Benefits available for claiming a dependent child.

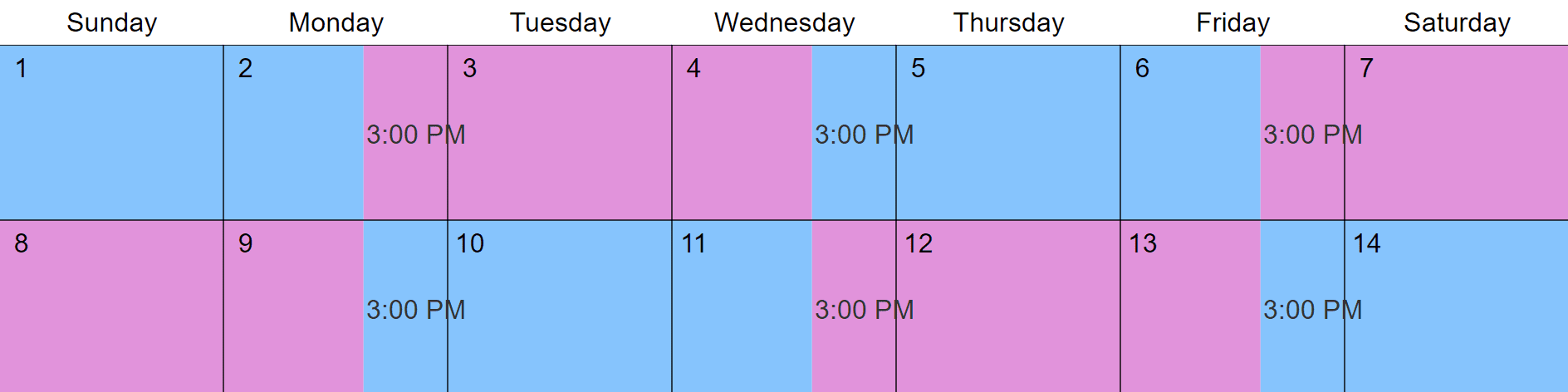

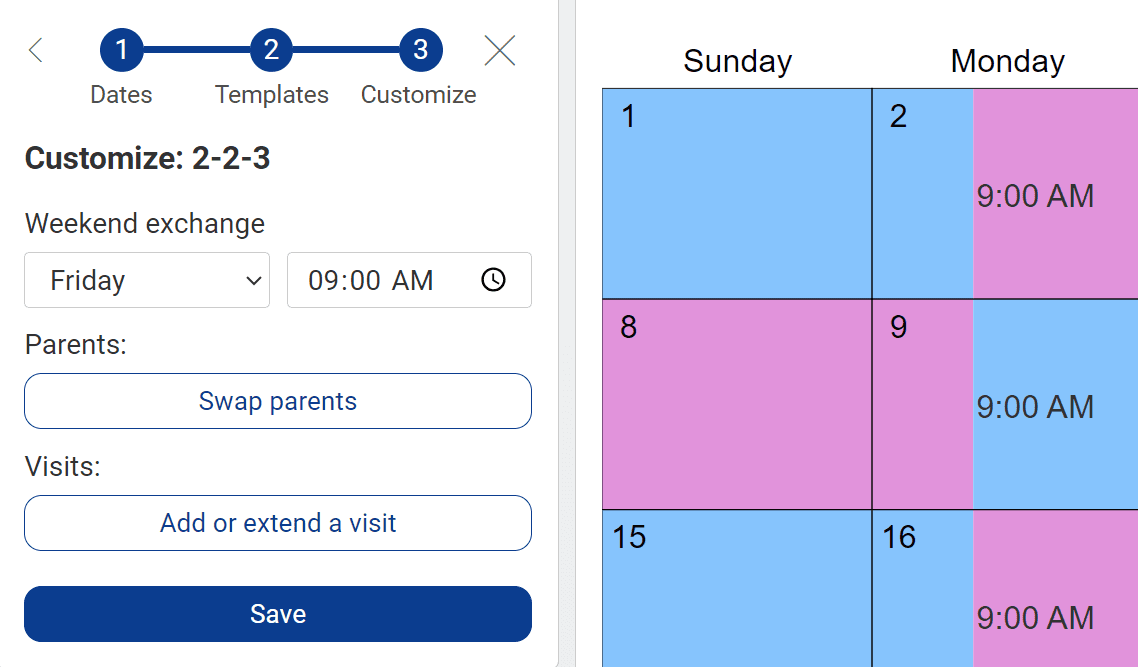

2-2-3 Visitation Schedule How Does It Work Why Would You Choose It

Why Isnt 5050 Custody The Default Resolution In Child Custody Cases – Quora

Who Claims A Child On Taxes With 5050 Custody In California – Her Lawyer

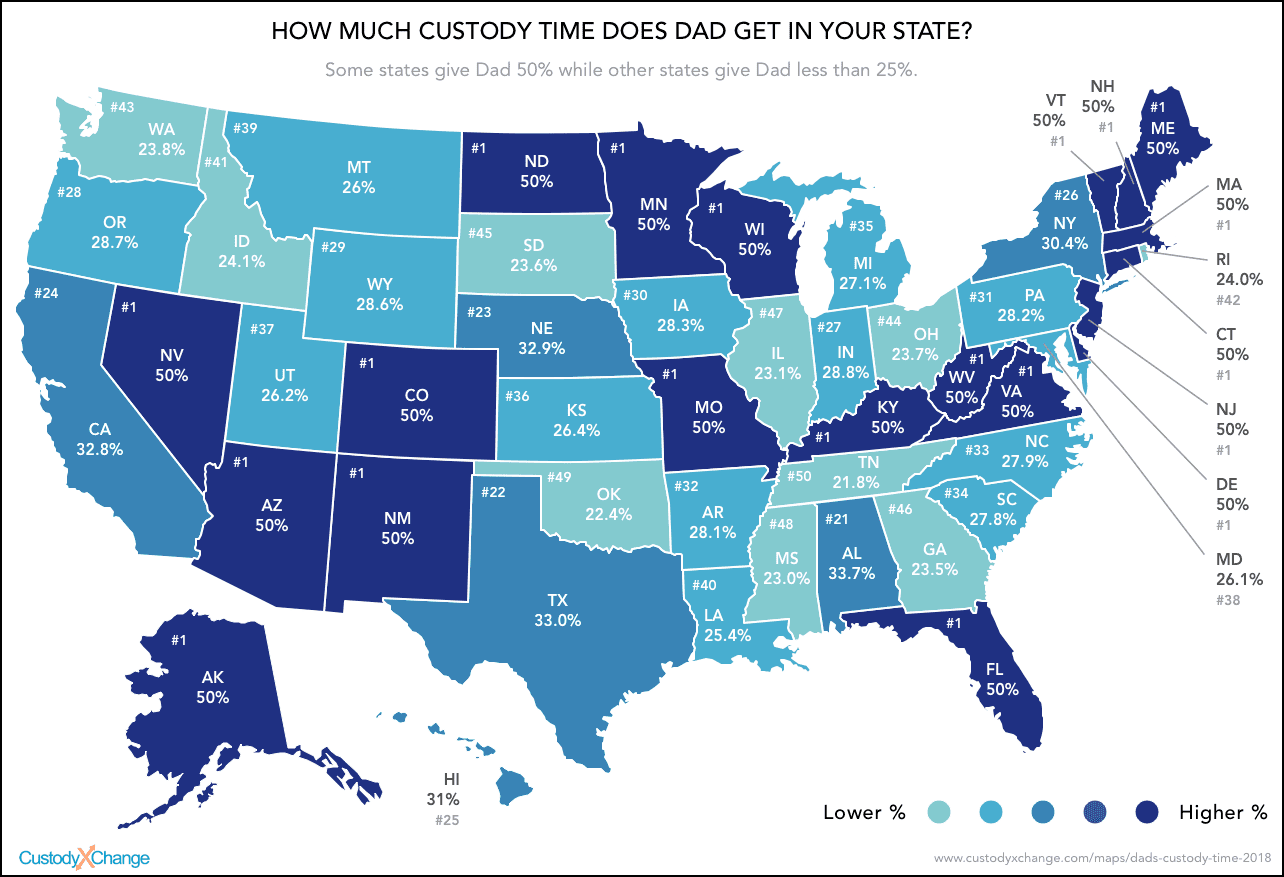

Child Support In Texas How It Works

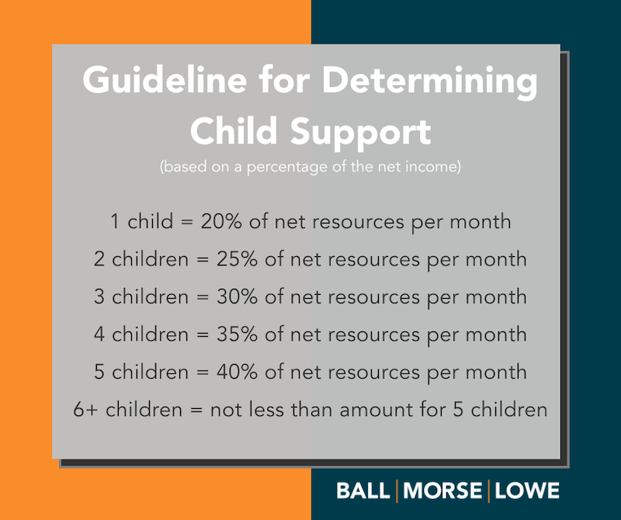

Free Infographics And Data Visualizations On Hot Topics – Knoemacom

Who Claims The Child With 5050 Parenting Time Equal – Griffiths Law

5050 Parenting Timevisitation Schedule Examples For More Information About Child Custody And Parenting Time C Joint Custody Custody Agreement Child Custody

2-2-3 Visitation Schedule How Does It Work Why Would You Choose It

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

Do I Have To Pay Child Support If I Share 5050 Custody

Joint Custody Schedules Which 5050 Schedule Is The Best Joint Custody Custody Kids Schedule

2

Child Support Reform Promotes Involvement Closes Pay Gap

How Much Custody Time Does Dad Get In Your State

Do I Have To Pay Child Support If I Share 5050 Custody

2-2-3 Visitation Schedule How Does It Work Why Would You Choose It

How Does Child Support Work In Sharing 5050 Custody

How Much Custody Time Does Dad Get In Your State

.png)

Is Property Split 5050 In A California Divorce