In order to complete your return, you. If you are no longer a titan client, you can still access your tax documents via our web portal (go to documents > your documents > statements).

Stash App Taxes Explained – How To File Your Stash Taxes – Youtube

From simple to complex taxes, turbotax® makes it easy to file your taxes.

Stash tax documents turbotax. Filing your income tax return. You made a withdrawal from your stash retire ira of $10 or more, or. You can pay your taxes online at irs.gov for free.

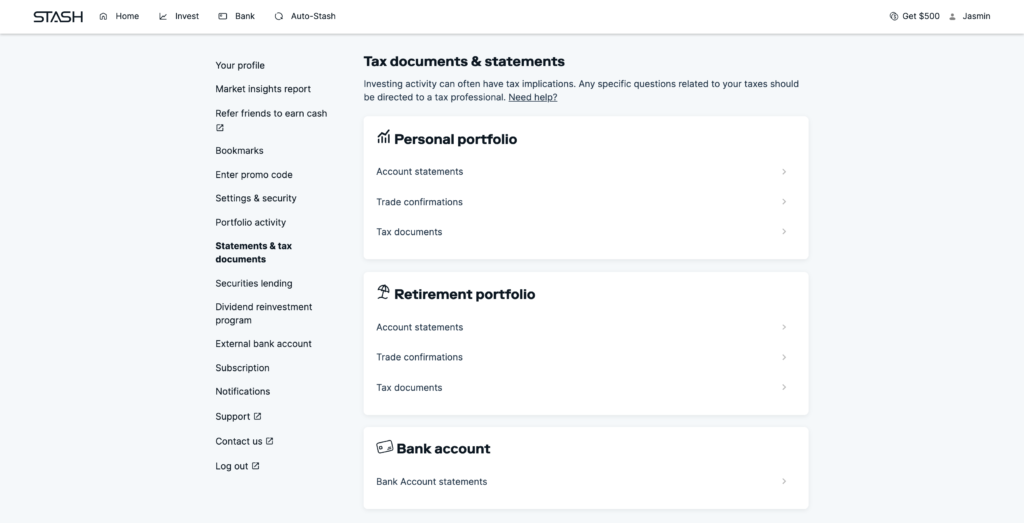

You can access your documents in the tax documents section of your stash profile. You received more than $10 in interest on your stash invest account. $0 federal + $0 state + $0 to file offer is available for simple tax returns only with turbotax free edition.

How to access your tax documents? you can access your yearly tax form directly from your mobile app: From simple to complex taxes, turbotax® makes it easy to file your taxes. You will have tax documents if:

A simple tax return is form 1040 only (without any additional schedules). Closing down your retirement portfolio for stash+ users early might incur irs penalties. Copy or screenshot your account number and type of tax document (is:

You’ll find your tax forms. Connect to a tax expert on your time. If you received paychecks through stash direct deposit, you should inform your employer about closing down your stash account on time.

Review the tax documents provided by stash. Yes, you can scan them if you like, but keep them somewhere safe. You can access them through the stash app by clicking here.

Ad join the millions who file with turbotax®. To find them in the app: If you manage your taxes with turbotax, you can easily import your apex tax form(s) via a turbotax integration with apex.

Don't see any tax documents? You received dividend payments greater than $10 from your stash invest investments in 2020. If you don't see any tax documents in your account, it's possible your account was opened towards the end of or after the 2020 tax year, and as a result did not experience any liquidity events that would.

Here’s what you need to know. Ad join the millions who file with turbotax®. Go to settings select statements and documents select tax documents to find them on the web:

† stash beginner costs $1/month. Stash is not a bank or depository institution licensed in any jurisdiction. $0 federal + $0 state + $0 to file offer is available for simple tax returns only with turbotax free edition.

Go to the help center. Even after closure, stash will email you about any relevant tax documents with a link where you can download them. Please see the pdf linked here for instructions.

However, there are also documents that you need to keep in case of an audit or post assessment, while other documents can be disposed of. Opening turbotax past returns depends on whether you used the online version or desktop version to prepare your return, but in either case, it's a simple matter of a mouse click if you know where to look. You can import all your tax information into turbotax from stash.

Through the apex integration with turbotax. And it is super easy. Advisory products and services are offered through stash investments llc, an sec registered investment adviser.

The easiest way to do this is through the stash app under settings>statements and documents>tax documents. I know, i just did this. Or on the web by clicking here.

Y ou can view your crypto tax documents on our website only. Annually, you need to complete the t1 general income tax and benefit return as well as associated territorial or provincial forms. Connect to a tax expert on your time.

Once logged in, your tax form(s) are located under the ‘documents’ dropdown in the top right hand corner of the website. Is a digital financial services company offering financial products for u.s. No charge for an ach payment.

Tap tax documents in quick access. ‡ stash growth costs $3/month. More than 50 million tax returns have been provided through the irs free file program.

Stash provides all tax forms securely online. It can work for people. If you have not received a 1099 form from stash, you should check your online stash account to see if a 1099 form has been provided for you.

Your wealthfront tax details can be imported into turbotax in a few easy steps. Click on your name in the top right corner of the screen, select statements & tax documents, and then tax documents. You should receive a 1099 summary form from stash which will reflect any interest or dividends earned, as well as whether any investment products were sold or traded.

A simple tax return is form 1040 only (without any additional schedules). You can also get copies of tax returns or transcripts directly from the irs.

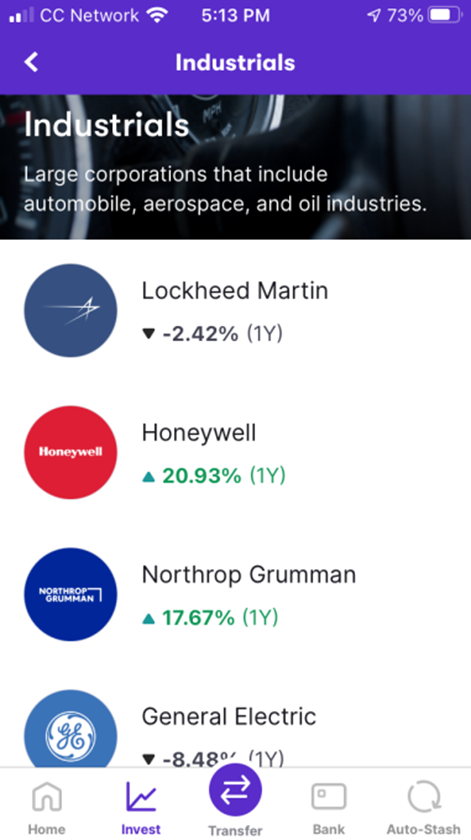

Stash Invest Review 2021 A More Flexible Micro-investing App

Stash 1099 Tax Documents – Youtube

Stash Vs Robinhood 2021

Your Guide To Tax Time – Stash Learn

How Investments Are Taxed – Stash Learn

Stash Vs Robinhood 2021

Stash App Tile Concepts Stash App App Stash

Stash App Taxes Explained – How To File Your Stash Taxes – Youtube

Stash App Taxes Explained – How To File Your Stash Taxes – Youtube

Stash Review 2021 Are The Features Worth The Cost

You Might Be Able To File Your Taxes For Free

Stash Review Pros Cons And Who Should Open An Account

Stash Invest App Review 2021 – Warrior Trading

The Stash 1099 Tax Guide

Your Stash And Taxes The Super Basics – Stash Learn

Stash App Taxes Explained – How To File Your Stash Taxes – Youtube

Where Are My Tax Documents Official Stash Support

Is Tax-efficient Investing Possible With Acorns Betterment Stash And Robinhood – Turbotax Tax Tips Videos

How To Cancel Stash 100 Working – Your Cancel Guide