Questions answered every 9 seconds. The us tax rates applicable to “long term capital gain” (gain on capital property owned for more than 12 months) are generally 15% or 20% (there are technically 3 tax brackets on capital gains for this purpose:

Possible Changes Coming To Tax On Capital Gains In Canada – Smythe Llp Chartered Professional Accountants

The only minor difference is that capital gains must be expressed in canadian dollars for the purpose of calculating an investor’s tax liability.

Capital gains tax canada vs us. Canada did not tax capital gains. It’s treated the same whether you sold it 1 day or 50 years after you. Federal estate tax is unified with a transfer tax regime that includes gift taxes, something we don’t have in canada.

Income from capital gains counts as half, so if you're very rich and live in ontario, your rate is about 23% and less than that in alberta. There are many rules around paying (and not paying) capital gains. Convention between canada and the united states of america with respect to taxes on income and on capital.

Resident for tax purposes (and assuming you are not a resident of canada for tax purposes) then afaik you would only owe a capital gain tax to the irs but not to the canada revenue agency. Generally, only capital gains accruing subsequent to december 22, 1971, as to publicly traded shares, and december 31,1971, as to other property, are subject to taxation. It would result in paying taxes in the us as the canadian taxes paid on the 50% portion of the capital gain.

There is a tax treaty between canada and the united states. Under canadian tax law, individuals need to pay tax only on 50 percent of their capital gain instead of paying tax on 100 percent of the capital gain. The canadian capital gains tax can seem hard to understand at times.

The commission acknowledged that the taxation of. Questions answered every 9 seconds. The origin of capital gains taxation in canada can be traced to the carter commission, appointed in september 1962 to thoroughly review the canadian tax system.

In canada, 50% of the value of any capital gains are taxable. In the u.s., the situation is reversed. We've got all the 2021 and 2022 capital gains tax rates in.

Ad a tax advisor will answer you now! It doesn’t matter how long you owned the property for. You will pay about 28.2% in income taxes (marginal rate) but the average tax rate is 20.22%, and you will pay $10,109 in taxes.

But if you are a u.s. Stocks is identical to the capital gains paid on canadian securities. However, canadian capital gains taxes resulting from deemed dispositions on death are deductible from the gross estate for u.s.

That said, it’s helpful for any investor to have a good foundation on. If you have $50,000 in capital gains in bc, you will pay 14.1% tax (50% of your capital gains are taxed at the marginal rate) and average tax. Ad a tax advisor will answer you now!

At the time of death. 13 (exempt for certain property if established requirements are met); See income tax act § 115.

Capital gains are treated as other income subject to 15% rate. Should you sell the investments at a higher price than you paid (realized capital gain) — you'll need to add 50% of the capital gain to your income. You won't get dual taxed on the same gain.

Canada taxes nonresidents at a rate of 25% on capital gains realized from the Investors pay canadian capital gains tax on 50% of the capital gain amount. Capital gains are subject to the normal cit rate (23% or 13% for entities producing goods);

In 1966, the commission's report recommended, among other things, that a tax be imposed on capital gains. If you’re feeling overwhelmed and uncertain if you need to pay capital gains or not, it’s best to discuss your particular situation with a credible accountant or financial advisor. Fortunately, the capital gains tax paid on investments in u.s.

This means that if you earn $1,000 in capital gains, and you are in the highest tax bracket in, say, ontario (53.53%), you will pay $267.65 in canadian capital gains tax on the $1,000 in gains. Since the basis of taxation of estates is different in canada and the united states, no foreign tax credit is permitted. This means the tax rate on capital gains in canada is half of your marginal tax rate (the rate top rate bracket your income falls into).

53 Explanation Interpretation Of Article V Under Us Law Canada Us Tax Treaty Rental Income Interpretation Real Estate Rentals

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Long Term Capital Gain Tax Rate For 2018-19 Capital Gain Capital Gains Tax What Is Capital

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax Capital Gain Integrity

How High Are Capital Gains Taxes In Your State Tax Foundation

6 Canadian Tax Tips To Remember Business Tax Tax Credits Tax

A 95-year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Pin On Business News

Singapore Is Turning Into An Attractive Location For Hnis Including Many From India With Laws Tailored To Attract Foreign Ca Singapore Student Cost Of Living

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Red China Taxes Capital Relatively Lightly Tax Foundation Capital Gains Tax Tax Countries Of The World

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Capital Gains Tax Capital Gain Integrity

Pin On Lugares Que Visitar

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

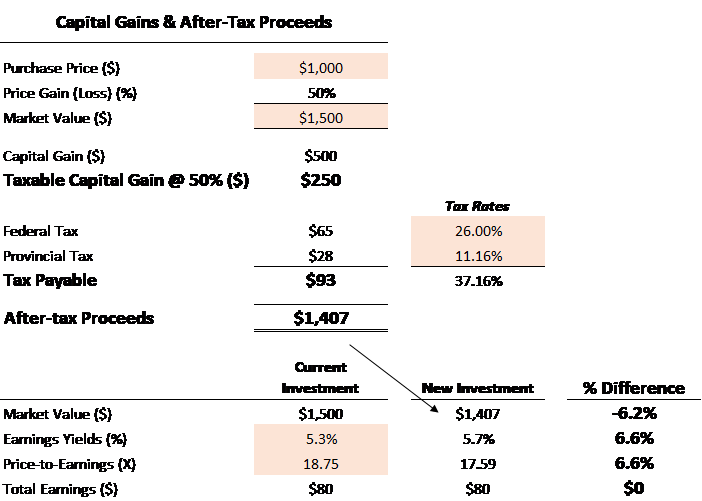

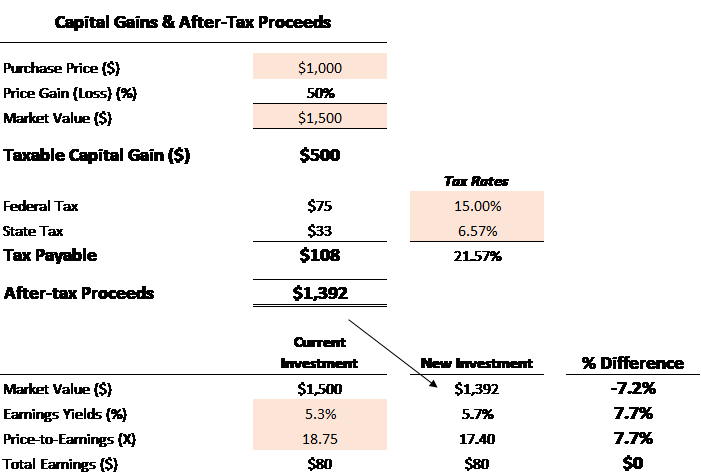

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Tax Calculator For Relative Value Investing