As anyone who shares your principal residence. Box if mail is not delivered to your home) apt.

Use Form 8915-e To Report Repay Covid-related Retirement Account Distributions – Dont Mess With Taxes

This is required per irs guidelines.

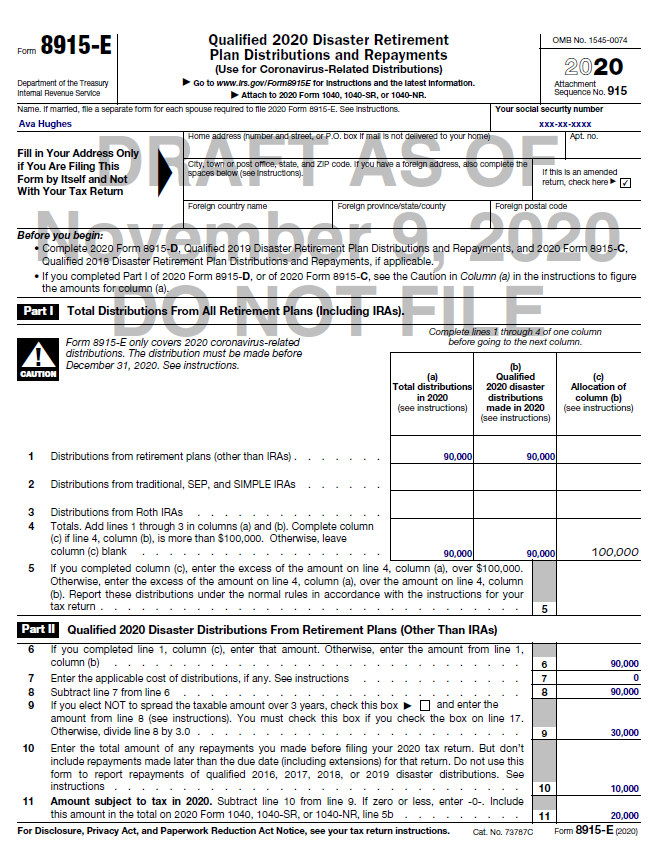

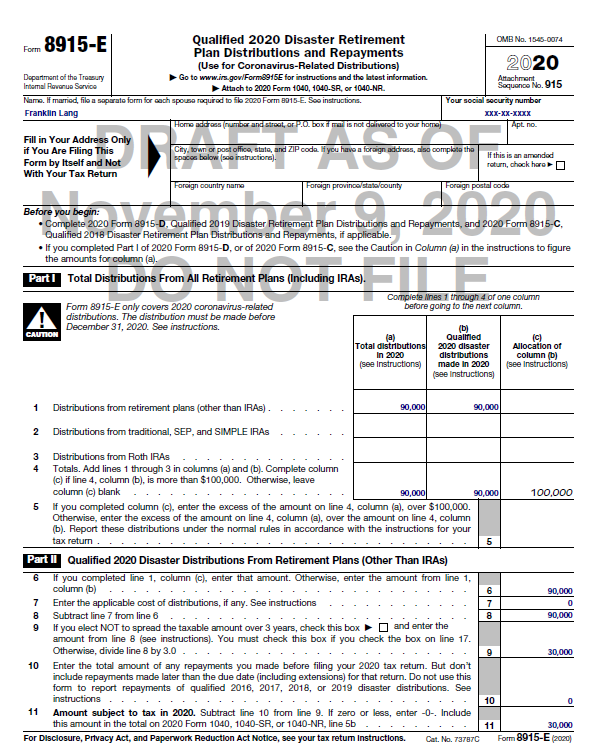

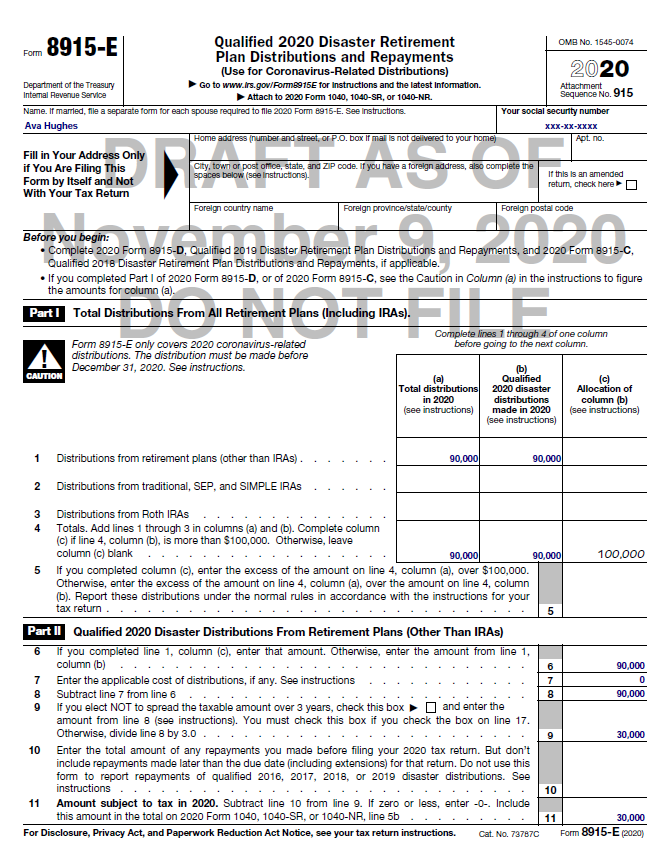

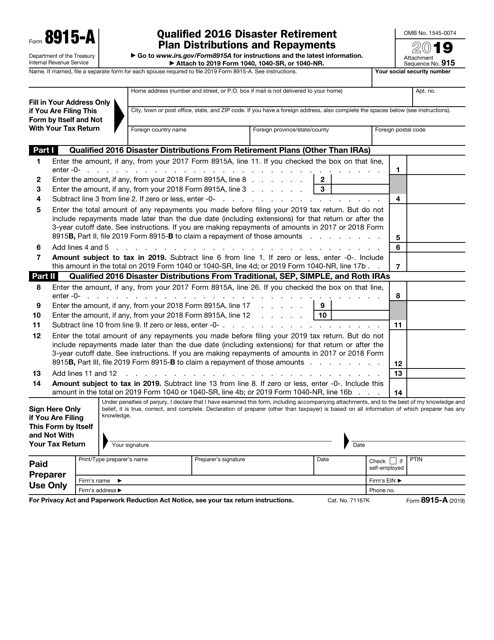

8915-e tax form instructions. Qualified 2016 disaster distributions can't Once the forms are final (should be by the weekend), you will see the options to. These instructions do not have a worksheet 1.

Plan distributions and repayments qualified 2020 (irs) form is 2 pages long and contains: And it defines a member of your household. The internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later.

Qualified opportunity fund 0121 02/17/2021 inst 8996: However, you still have to pay regular income tax on the withdrawal. The relief allows taxpayers to access retirement savings earlier than they normally would be able to.

Traditional, sep, simple, or roth. Your social security number before you begin (see instructions for details): All forms are printable and downloadable.

Were adversely affected by a qualified disaster listed in table 1 at the end of these instructions, and you received a distribution described in qualified 2018 disaster distribution requirements or qualified distribution requirements, later, that qualifies for favorable tax treatment. Instructions for form 8996, qualified opportunity fund Plan distributions and repayments qualified 2020 (irs) on average this form takes 14 minutes to complete.

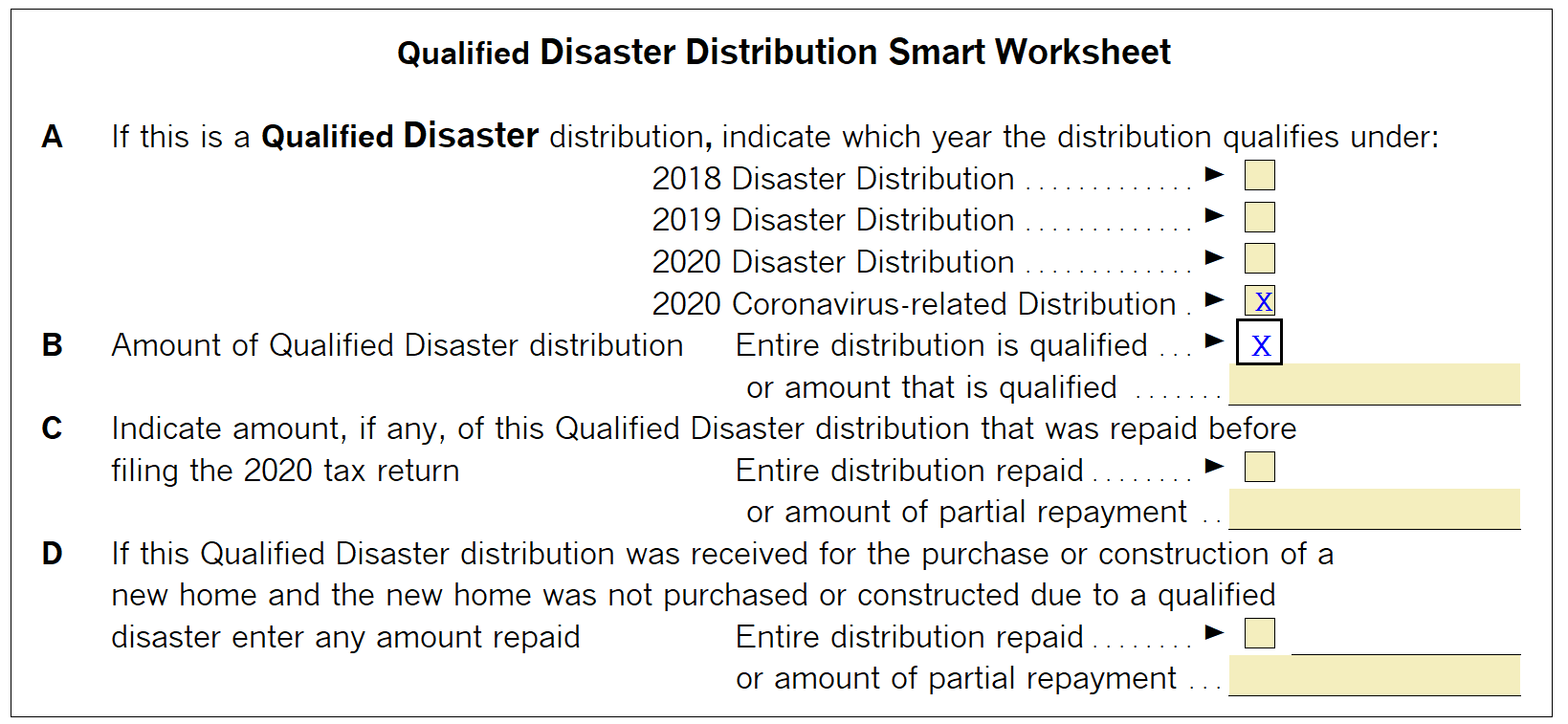

See the instructions for those forms for details. The distribution, whether an actual distribution or a plan loan offset, can be made from a variety of retirement plans: If the distribution comes from an ira that must be reported on form 8606, complete screen 8606 first.

The timing of your distributions and repayments will determine whether you need to file an amended return to claim them. Once completed you can sign your fillable form or send for signing. Fill in your address only if you are filing this form by itself and not with your tax return home address (number and street, or p.o.

National Association Of Tax Professionals Blog

Solved Irs Form 8915 E – Intuit Accountants Community

Generating Form 8915-e In Proseries – Intuit Accountants Community

Taxhow Tax Forms Form 8915-b

2

Form 8915-e For Retirement Plans Hr Block

8915 E – Fill Online Printable Fillable Blank Pdffiller

2

Publication 4492-a 72008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

Publication 4492-a 72008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

8915 E Form – Fill Online Printable Fillable Blank Pdffiller

Publication 4492-a 72008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

A Guide To The New 2020 Form 8915-e

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915-e Explained – Youtube

National Association Of Tax Professionals Blog

National Association Of Tax Professionals Blog

Form 8915-e – Basics Beyond

1040 Form Instructions 2016

Publication 4492-a 72008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service