The $0.07 fee for each extension of taxes shall not be retained by the lake county treasurer nor by the lake county clerk, but the fee shall be paid to the taxing bodies of the county. Through our legal services and guidance, we are able to analyze your property and determine if there is a basis to appeal your assessed value—and ultimately reduce your real estate tax liability.

Property Taxes Lake County Il

Delinquent taxes & prior years sold.

Lake county real estate taxes illinois. Our services for cook county, and lake county, il the team at robert h. (8 days ago) the median property tax in lake county, illinois is $6,285 per year for a home worth the median value of $287,300. 1.5% interest on 2nd installment & 6% interest on the 1st installment.

The median property tax on a $287,300.00 house is $6,291.87 in lake county. The tax offices are working in the 2020 year, which corresponds to the property tax bill property owners will receive in early may of 2021. After clicking the button, the status will be displayed below.

If you do not know your pin. See detailed property tax report for 580 s genesee st, lake county, il. Lake county collects, on average, 2.19% of a property's assessed fair market value as property tax.

Lake county collects the highest property tax in illinois, levying an average of $6,285.00 (2.19% of median home value) yearly in property taxes, while hardin county has the lowest property tax in the state, collecting an average tax of $447.00 (0.71% of (6 days ago) the exact property tax levied depends on the county in illinois the property is located in. Registration begins for tax buyers.

The median property tax on a $287,300.00 house is $3,016.65 in the united states. Property taxes are determined at local levels, and pay for services such as schools, libraries, park districts, fire protection districts and others. 3% interest on 2nd installment & 7.5% interest on the 1st installment.

Lake county collects the highest property tax in illinois, levying an average of $6,285.00 (2.19% of median home value) yearly in property taxes, while hardin county has the lowest property tax in the state, collecting an average tax of $447.00 (0.71% of median home value) per year. The state of illinois does not have a statewide property tax. Lake county collects, on average, 2.19% of a property's assessed fair market value as property tax.

Lake county collects the highest property tax in illinois, levying an average of $6,285.00 (2.19% of median home value) yearly in property taxes, while hardin county has the lowest property tax in the state, collecting an average tax of $447.00 (0.71% of The median property tax in lake county, illinois is $6,285 per year for a home worth the median value of $287,300. The median property tax on a $287,300.00 house is $4,970.29 in illinois.

Rosenfeld & associates, llc, attorneys at law, specializes in real estate tax law. The exact property tax levied depends on the county in illinois the property is located in. Lake county has one of the highest median property taxes in the united states, and is ranked 15th of the 3143 counties in order of median property taxes.

1 hours ago the exact property tax levied depends on the county in illinois the property is located in.

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Taxes Fees Long Grove Illinois

Houses For Sale In White Eagle Subdivision Naperville Illinois 60564 – Youtube Naperville Illinois Naperville Youtube

2

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work – Chicago Real Estate Closing Blog

Lake County Appeal – Home Facebook

Amended 2019 Lake County Property Tax Bills Lake County Il

The Cook County Property Tax System Cook County Assessors Office

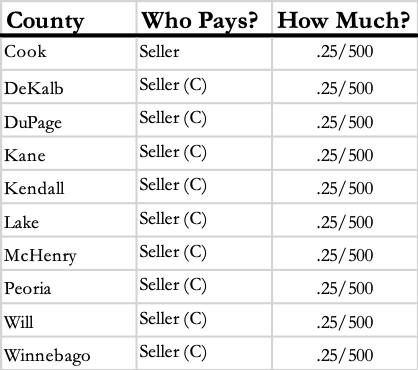

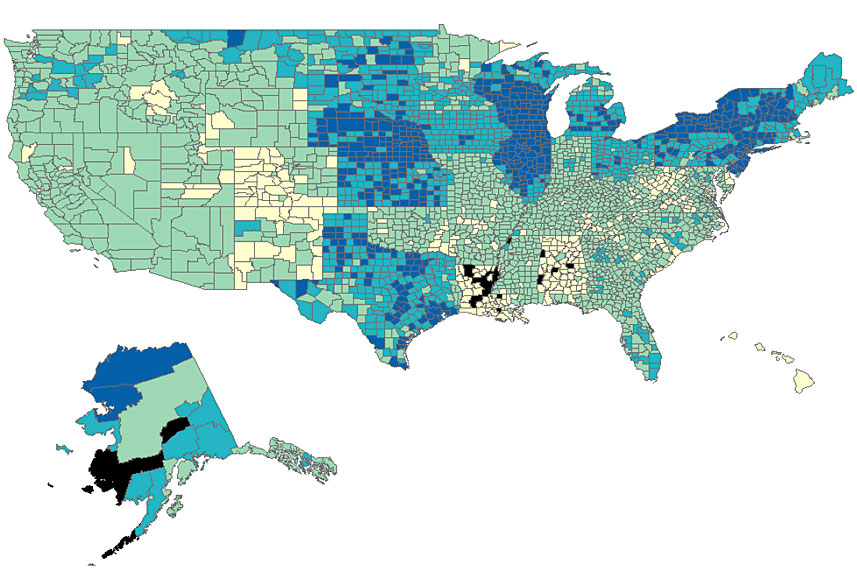

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Tax Extension Lake County Il

Illinois Now Has The Second-highest Property Taxes In The Nation Chicago Magazine

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Lake County Appeal – Attorney Owner Lake County Appeal

Lake County Appeal – Home Page

2021 Best Places To Live In Lake County Il – Niche

Dual Addresses In Unincorporated Lake County Lake County Il

Assessments Lake County Il

Property Taxes Lake County Il

25 Ways You Know Youre From Lake County Il