Tax policy and the budget: Find out more in our guide to income taxes in scotland.

Uk Autumn Budget 2021 – Implications For Scottish Budget 202223 Fai

2022/2023 (for whole weeks commencing from 3rd april 2022) earnings threshold:

Income tax rates 2022/23 scotland. 2 the role of income tax in scotland’s budget, page 23. £ 151.97 per week or 90% of average weekly earnings (whichever is the lower) £ 156.66 per week or 90% of average weekly earnings (whichever is the lower) higher rate for smp/sap Scottish income tax rates 2021/22:

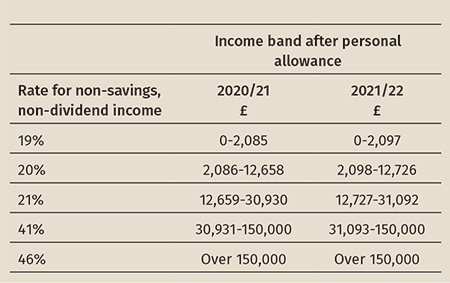

Income tax rates 2022/23 scotland. The income tax rates and bands payable by scottish taxpayers are set by the scottish parliament. On 25 february 2021 the scottish parliament set the following income tax rates and bands for 2021 to.

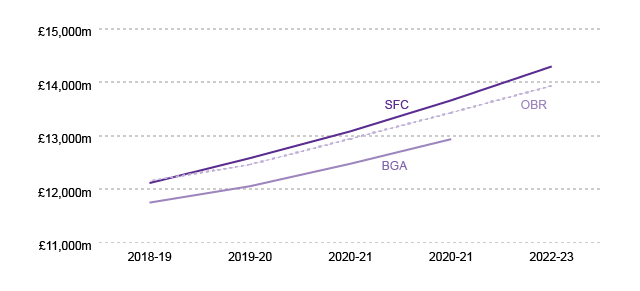

The chancellor announced that the basic rate band will be frozen at £37,700 for the tax years 2022/23 to 2025/26. The rate of income tax you pay depends on how much of your taxable income is above your personal allowance in the tax year. Receipts from scottish income tax are collected by hmrc and paid to the scottish government (via hm treasury).

Snp to freeze income tax rates until 2022. No changes were announced to the income tax rates so that the basic rate of income tax for 2021/2022 will remain at 20%, the higher rate at 40% and the top (or additional) rate of income tax at 45% for english, welsh and northern irish taxpayers (different rates apply to scottish taxpayers). Taxable income scottish tax rate;

This consultation seeks views on our overarching approach to tax policy, through scotland’s first framework for tax, and how we should use our devolved and local tax powers as part of the scottish budget 2022 to 2023. How scottish income tax works. The scottish rates for 2022/23 have not yet been announced.

Legislation will be introduced in finance bill 2021 to set the personal allowance for 2022 to 2023 at £12,570, and the basic rate limit for 2022 to 2023 at £37,700. Scottish rates and bands for 2021 to 2022. Standard rate for smp, shpp, spp, sap, spbp:

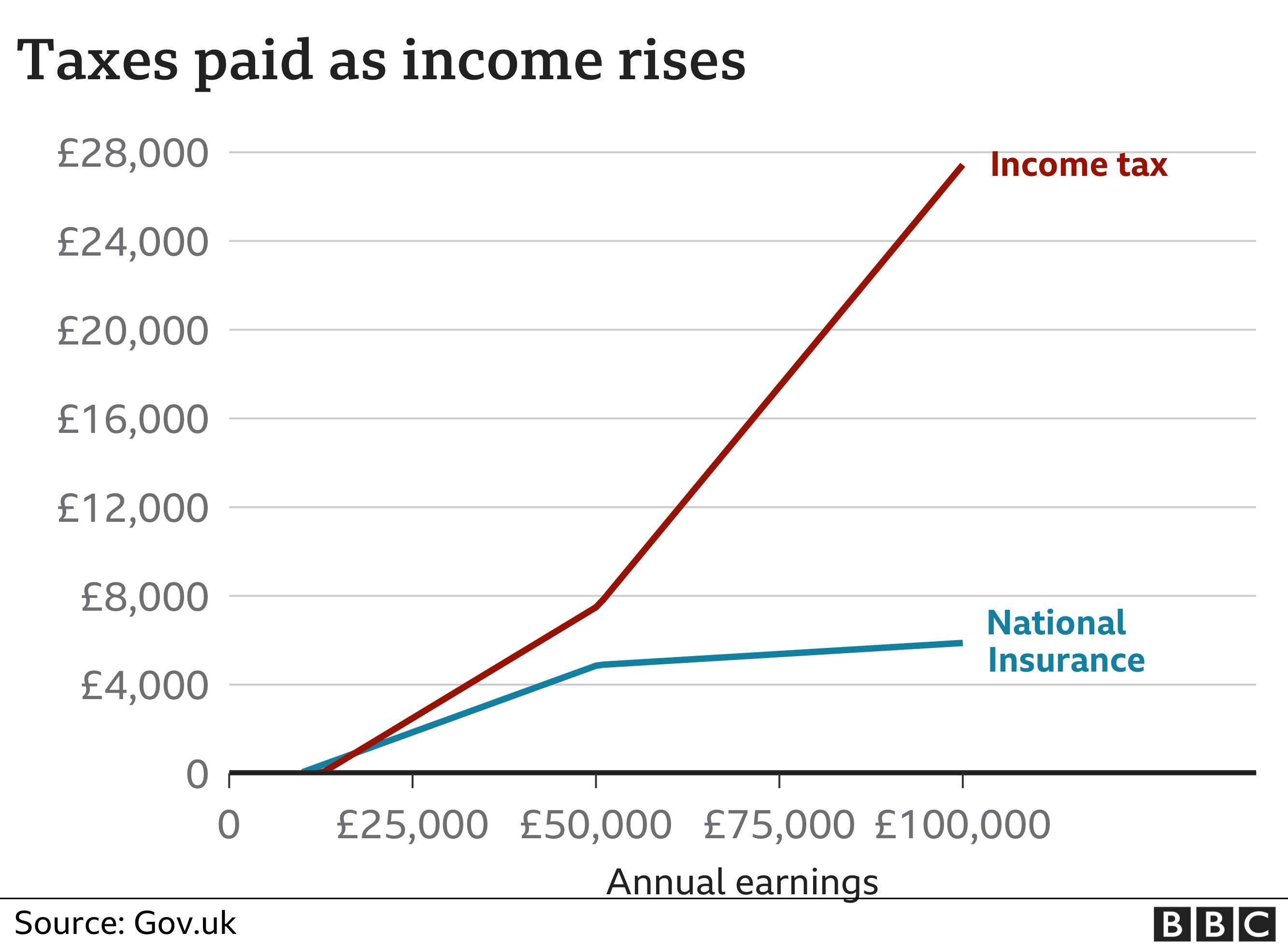

10,00,000 20% 20% above rs. Should the snp win at the next scottish parliamentary election in may, then no changes. The 54.25% marginal rate between £43,663 and £50,270, is due to the scottish higher tax rate of 41% starting at a lower level than the reduced nic rate, which is aligned with the 40% band in the rest of the uk.

The current tax year is from 6 april 2021 to 5 april 2022 and most people's personal allowance is £12,570. High income child benefit charge (hicbc) 1% of child benefit for each £100 of adjusted net income between £50,000 and £60,000. The national insurance contributions upper earnings limit and upper profits limit will remain aligned to the higher rate threshold at £50,270 for these years.

Your personal allowance is the amount of income you do not pay tax on. Income taxes in scotland are different. Scottish income tax bands 2021/22:

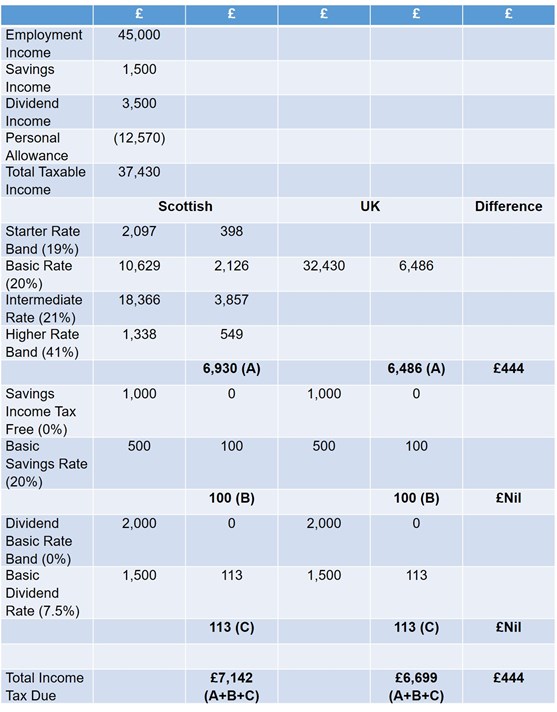

The scottish rates and bands do not apply for savings and dividend income, which are taxed at normal uk rates. This table assumes that scottish income tax rates and thresholds will remain at their present levels in 2022/23.

Tax Changes From April 2021

Preparing For Tax Year 20222023 Payadviceuk

Thepayrollcentrecouk

A Budget For Unprecedented Times Brodies Llp

Uk Tax Rates Thresholds And Allowances For Self-employed People And Employers In 202223 And 202122 The Accountancy Partnership

A Handy Guide To Scottish Income Tax Rates And Thresholds For 202122 – French Duncan – Professional Chartered Accountants

Tax Facts – 202223 Rsm Uk

Scottish Income Tax Diverges Further From Rest Of Uk To Raise More From High Earners – Institute For Fiscal Studies – Ifs

Preparing For Tax Year 20222023 Payadviceuk

National Insurance Contribution Changes 20212022 Payadviceuk

Draft Budget 2018-19 Taxes Scottish Parliament

Tax Rates 202122 Tax Bands Explained – Moneysavingexpert

Uk Tax Rates Thresholds And Allowances For Self-employed People And Employers In 202223 And 202122 The Accountancy Partnership

Income Tax Rates And Thresholds In Scotland 202122 Ifs Taxlab

Income Tax Explained Ifs Taxlab

Preparing For Tax Year 20222023 Payadviceuk

Scotlands Public Finances In 2022-23 And The Impact Of Covid-19 Finance And Public Administration Committee Call For Views Low Incomes Tax Reform Group

National Insurance Whats The New Health And Social Care Tax And How Will It Affect Me – Bbc News

Litrg Autumn Budget 2021 Round-up Low Incomes Tax Reform Group