Recently, changes made to the ctc program is making it possible for families to receive advance payments beginning summer 2021. They are based on the taxpayer's most recent filing from 2020 or 2019 and are.

Used Tesla Model Y For Sale With Photos – Cargurus

Not to mention tesla get's the credit back for model y.

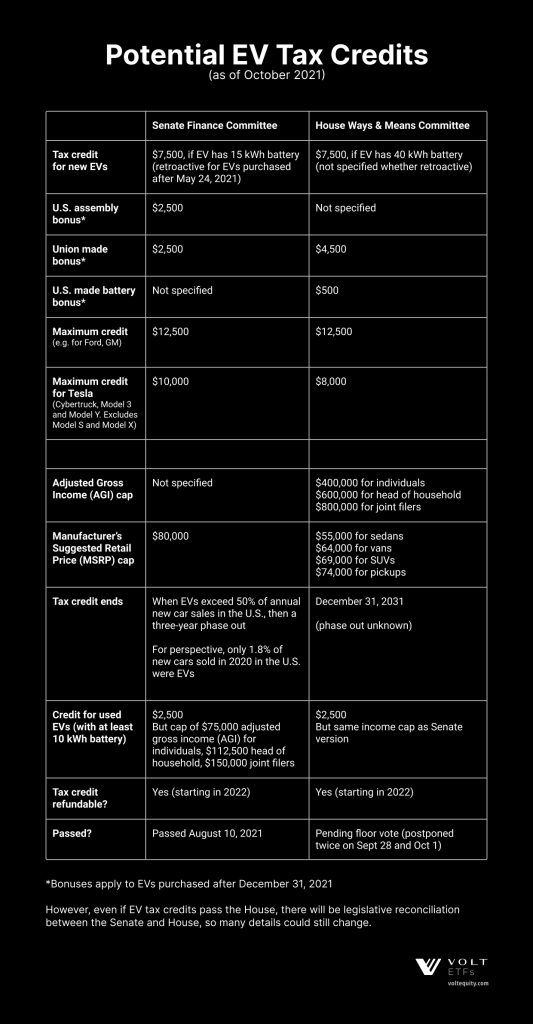

Tesla tax credit 2021 nj. As of october, 2021, the only two companies to begin phasing out are tesla and general motors. But when combined with the federal tax credit of up to $7,500, ev drivers in the garden state can get as much as $12,500 off new evs, depending on the car. A proposed reformation of the ev tax credit threshold will enable gm and tesla to regain access for their future ev customers up to $7,000 in tax credits on a new sales limit of 400,000 electric vehicles in the u.s.

New jersey solar panel tax credits. We have reached the funding cap for this fiscal year. Tesla 2021 model s long range 412;

After already burning through their 200k credits. The legislation creates a state rebate, giving consumers a credit of $25 per mile of electric range for their car, up to a max of $5,000. I think i read on this forum it will be summer 2021 if i'm not mistakenm it seems like sales tax is still exempt for ev, but any idea if the $5,000 rebate will happen again?

It puts automakers who were early proponents of electric vehicles, like tesla and gm, at a disadvantage. Funding is allocated on a fiscal year basis and incentives are available only while funding lasts. Tesla 2021 model y long range awd 326;

The state rebate also applies to. Tesla motors makes electric vehicles and, in the us, people had a federal tax credit of $7,500 for tesla. $5,000 $0 (you save $3,200) $43,990 tesla 2021 model y performance awd

With the two added, the ev credit you get is $7,500. Once the process has begun, purchasers of electric vehicles are eligible to claim 50% of the credit if the vehicle was acquired in the first two quarters that the 200,000 limit had been reached. The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in new jersey.

That means you’ll spend 7 percent less on your solar equipment. The risk you somehow get a tesla unexpectedly quick before year end and then the car wouldn't be eligible for any tax. The third quarter of 2021 was a record quarter in many respects.

These advance payments are prepayments of the taxpayer's estimated 2021 ctc. When you purchase your home solar system, you will be 100 percent exempt from any sales tax, due to the pv energy sales tax exemption. This means that any vehicle that can get an electric range.

The child tax credit (ctc) program can help reduce the federal tax you owe for each qualifying child. Vehicles would have to be made in the united states starting in 2027 to qualify for any of the $12,500 credit. $0 (you save $7,425) $112,090;

Solar energy and utilities can also earn you a rebate of $300 per kilowatt up to $2,400. The $5k nj rebate program is closed now due to funding, as of october 15. My guess is the risk comes from stretching that timeframe out further to lose whatever funding might be there for those that initially qualified.

If the updated incentive program bill is passed by congress this year (2021). I ordered on 7/6 12:16 am est and in their system it’s processed as 7/5. Charge up nj * ev rebate nj state sales tax (6.625%) cost after incentives;

For teslas, this isn’t a problem as the minimum is well over this threshold. Perhaps more impressively, this level of profitability was achieved while our. Any idea on what phase 2 in nj will look like?

Tesla finally provided answer why my order did not have 2k rebate. I just need to vent. $14,500 approximate system cost in new jersey after the 26% itc in 2021:

Your federal tax balance would then fall to $2,500 owed. It varies based on the size of the battery but because tesla uses big batteries they qualify for the full amount of federal tax credit. $0 $0 (you save $5,300) $79,990 tesla 2021 model s plaid;

That's a nj program risk, not from tesla i think. On top of these revenue streams, new jersey has also granted residential solar a couple tax breaks to help keep the costs down. This perk is commonly known as the itc, short for “investment tax credit”.

The $7,500 tax credit to 200,000 electric vehicles per manufacturer. You can get a tax credit of 25% for any alternative fuel infrastructure project, including building an electric charging station. Relaxed area for all around discussion on tesla, this is the official lounge.

Your charge up new jersey incentive application meets our eligibility criteria for your tesla model 3 for $5,000.00. If you install your photovoltaic system in 2020, the federal tax credit is 26% of the cost of your solar panel system.

Used Tesla Model S For Sale In Providence Ri – Cargurus

Used Tesla Model Y For Sale With Photos – Cargurus

Evgo Electric Vehicle Ev Charging Stations – Ev Fast Chargers

Used Tesla Model 3 For Sale Available Now Near Raleigh Nc – Cargurus

Used Electric Cars For Sale

Used Tesla Model 3 For Sale Available Now Near Raleigh Nc – Cargurus

Used Tesla Model Y For Sale With Photos – Cargurus

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Used Electric Cars For Sale

Used Tesla Model Y For Sale With Photos – Cargurus

Used Tesla For Sale In Stamford Ct – Cargurus

So How Much Would Buying A Tesla Really Cost You

0ike2s7uwce46m

Used Tesla Model 3 For Sale Available Now Near Raleigh Nc – Cargurus

Used Tesla Model Y For Sale With Photos – Cargurus

Used Tesla For Sale In Bowling Green Ky – Cargurus

Used Tesla For Sale In Stamford Ct – Cargurus

Used Tesla For Sale In Appleton Wi – Cargurus

Used Tesla For Sale In Appleton Wi – Cargurus