The federal central tax office (bundeszentralamt für steuern) and the. Income tax is calculated based on the taxable income.

Accountant Accounting Admin Alone America American Bills Business Owner Calculator English Pxfuel

The german income tax is a progressive tax, which means that the average tax rate (i.e., the ratio of tax and taxable income) increases monotonically with increasing taxable income.

German tax calculator in english. German tax categories and german tax law in english. Our gross/net calculator enables you to easily calculate your net wage, which remains after deducting all taxes and contributions, free of charge. Filing your tax return is worth it!

You can expect a high tax refund. We have verified experts who translate.doc,.docx,.pdf. Solidarity surcharge (solidaritaetszuschlag), capped at 5.5% of your income tax.

Millions of euros in tax refunds for our customers. The german tax calculator is a free online tax calculator, updated for the 2021 tax year. Taxes are levied by the federal government (bundesregierung), federal states (bundesländer) and municipalities (gemeinden).tax administration is shared between two taxation authorities:

Register and discover how easy it is to get an average tax refund of more than 1.000 euro online. German tax burden for fy 2021: This income tax calculator is best suited if you only have income as self employed, from a trade or from a rental property.

The german income tax calculator is designed to allow you to calculate your income tax and salary deductions for the 2021 tax year. In addition to calculating what the net amount resulting from a gross amount is, our gross/net calculator can also calculate the gross. This is a genuine revolution in internation.

Owes annual german income tax of €2,701; You are required to file a tax return. If not, you can find this information on the employment tax statement.

German income tax rate in 2010 as a function of taxable income. Under the auspices of the oecd, 136 countries (as of 13 october 2021) have reached an agreement on a fair allocation of taxing rights and a global minimum effective tax at a uniform tax rate of 15%. You will most likely get a very high tax refund.

Hundreds of thousands of satisfied customers. Tax liability (income tax) germany charges a tax on the income earned by physical persons. Personal tax allowance and deductions in.

Fair taxation global corporate tax reform is on the way. The first german tax return in english for all expats. Save progress at any time when you register for a free account, only pay when.

Tax calculation example, using an income tax calculator provided by the german federal ministry of finance (bmf): To calculate the german income tax you owe on your wages, you can use the steuergo tax calculator. If you have been present in germany for over 183 days.

Taxable income is derived from total income from the seven types of income and several additions and reductions. An employee with an yearly income of 9.744 € won’t have to pay income tax, for married employees the limitation will be 19.488 €. You have to enter both spouses’ gross salaries and tick the box, whether you have children.

If your projected tax refund is less than eur 50 or if you are not obligated to file a tax return, filing your taxes with taxfix is free. Eur 124.094,37 total tax charge (income tax + soliz) = 41.37% When your estimated refund is higher than eur 50 or if you’re a mandatory filer, taxfix entails a fixed charge of eur 39.99 for each year you file.

For a quick estimation of whether you should consider a tax class change to 3 and 5, you can use this german tax class calculator. Your taxable (worldwide) income in fy 2021 is eur 300,000. Overall tax for the couple when paying tax separately:

Simply enter your annual salary to see a detailed tax calculation or select the advanced options to edit payroll information, select different tax states etc. German income tax calculator this program is a german income tax calculator for singles as well as married couples for the years 1999 until 2019. Whether you’re a german citizen or an expat, you are required by law to pay taxes if you earn money while living or working in germany.

You can do your tax return in germany in english. About the 2021 german income tax calculator. The rate of income tax in germany ranges from 0% to 45%.

Joint couple’s tax using class 3 and 5: Income tax, solidarity surcharge, pension insurance, unemployment insurance, health insurance, care insurance. You are a resident of germany since 2020 (irrespective of you citizenship).

Zasta is a different kind of tax software, as it serves as a platform to connect you to a professional tax advisor. Check in real time how high your return will be. The calculator is provided for your free use on our website, whilst we aim for 100% accuracy we make no guarantees as to the accuracy fo the calculator.

The income tax is an annual tax applied to the income earned in a calendar year (assessment period) from:

German Wage Tax Calculator Expat Tax

German Income Tax Calculator Expat Tax

Ey Blockchain Analyzer Tax Calculator Ey – Global

The Art Of Lowering Project Costs Financial Statement Analysis Financial Statement Accounting Services

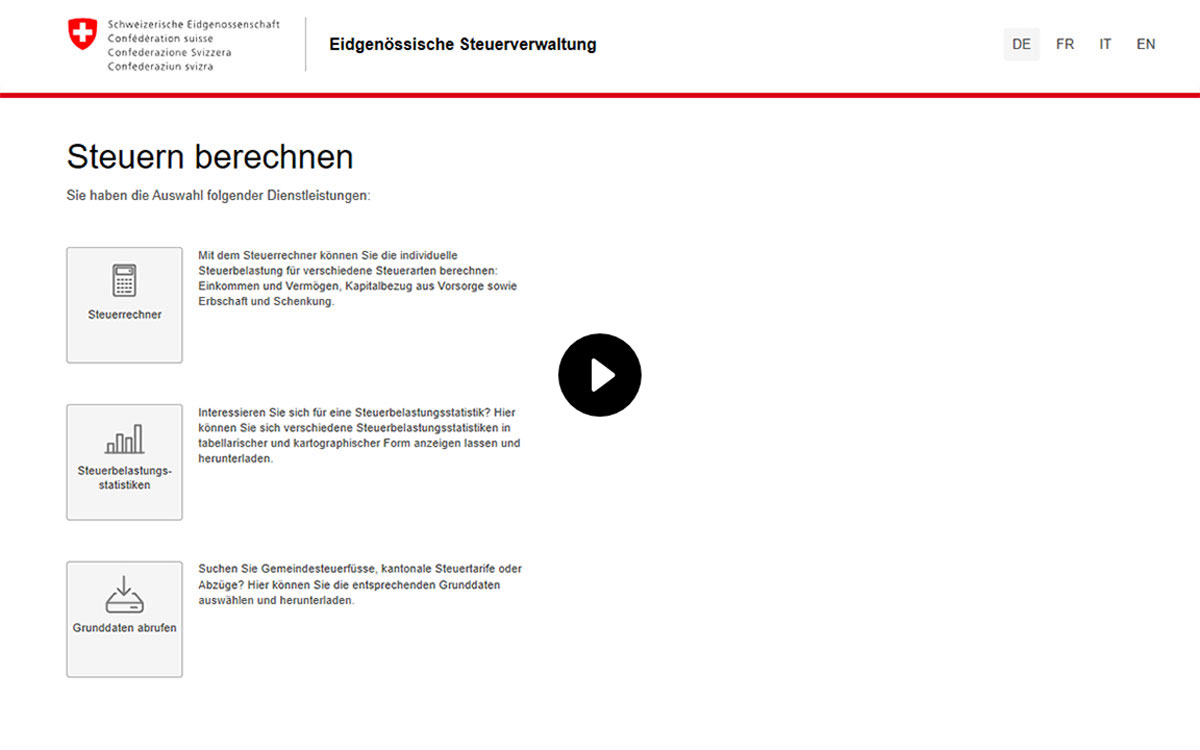

Tax Calculator Calculate And Compare Taxes Fta

How To Calculate Foreigners Income Tax In China China Admissions

At Cawston And Associates We Handle A Variety Of Complex And Simple Tax Problems If You Are Unsure What To Do Or W Bookkeeping Accounting Bookkeeping Services

Pin On Snapshot Storyteller Blog Posts

German Income Tax Calculator Expat Tax

Best English Accounting Software In Germany 2021 Update Accounting Software Invoicing Software Bookkeeping Software

Division Word Problems 43a Answers 4th Grade Math Worksheets Division Worksheets Grade 4 Math Printables

Invoice Tracker Excel Template Xls Microsoft Excel Templates Excel Templates Spreadsheet Template Excel Dashboard Templates

Freshbooks – Accounting Made Easy With Freshbooks – Freshbooks Small Business Accounting Accounting Software

Salary Taxes Social Security

How To Calculate Foreigners Income Tax In China China Admissions

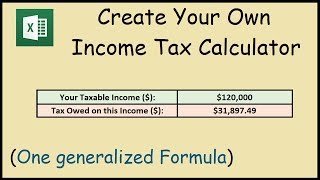

How To Create An Income Tax Calculator In Excel – Youtube

How To Create An Income Tax Calculator In Excel – Youtube

Medical Tourism Marketing Courses Trade Finance Sales Tax

How Is Taxable Income Calculated