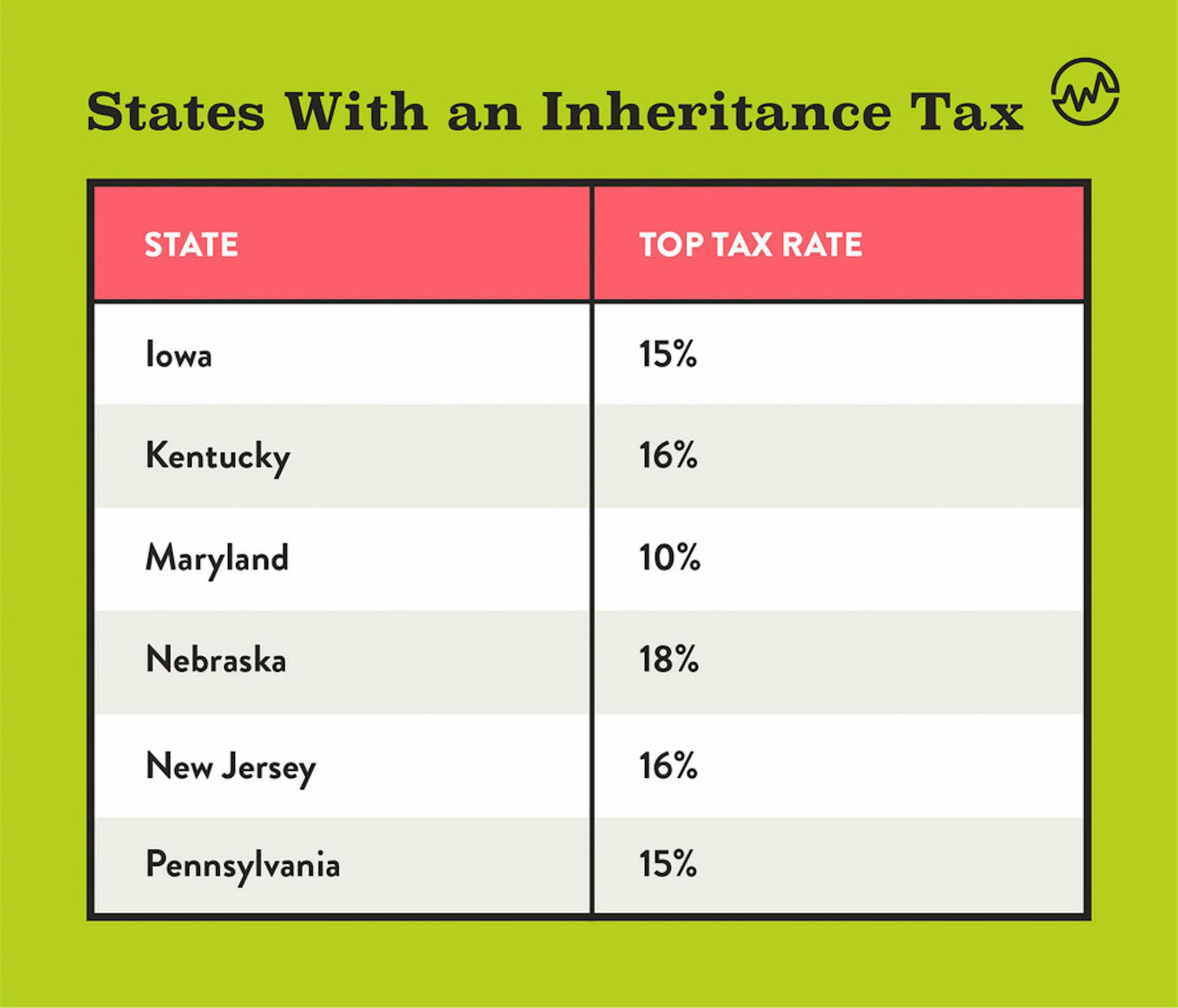

There's a federal estate tax, although it only applies to estates worth over $11.7 million. There are only 6 states in the country that actually impose an inheritance tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Eleven states have only an estate tax:

Does california have estate or inheritance tax. California residents may not be subject. Massachusetts and oregon have the lowest exemption levels at $1 million, and connecticut has the highest exemption level at $7.1 million. While there are several states that do not have estate or inheritance taxes, each state has its own set of rules depending on where you live and where the property is located.

The state’s government abolished the inheritance tax in 1982. The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold: The state controller's office, tax administration section, administers the estate tax, inheritance tax, and gift tax programs for the state of california.

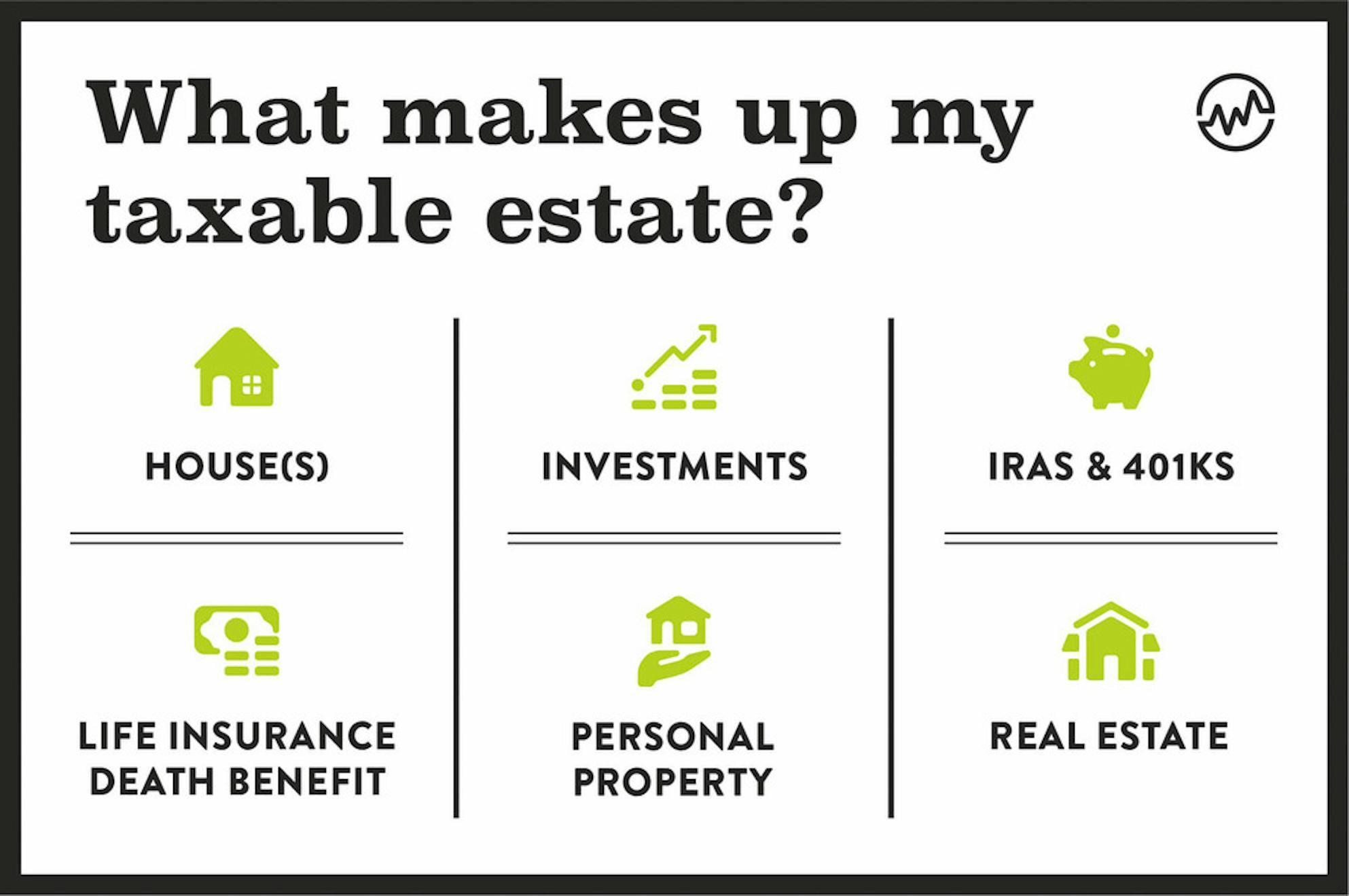

And although a deceased individual’s estate is usually responsible for the payment of estate taxes, a decedent’s beneficiaries are responsible for the payment of inheritance taxes. As of 2021, 12 states plus the district of columbia impose an estate tax; The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023.

The only time a resident of california would have to pay an inheritance tax is if they are the beneficiary of a person who lives in a state with an inheritance tax. No estate tax or inheritance tax colorado: Let's say you live in california—which does not have an inheritance tax—and you inherit from your uncle's estate.

Keep reading as financial planner la explains what you need to know about inheritances and estate taxes in california. California is a state where there is no inheritance or state estate tax. Federal estate tax in california.

It is not your responsibility. Does california impose an inheritance tax? However, california is not among them.

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. But 17 states and the district of columbia may tax your estate, an inheritance or both, according to the tax foundation. People often use the terms “estate tax” and “inheritance tax” interchangeably when, in fact, they are distinct types of taxation.

California also does not have an inheritance tax. But one perhaps surprising fact is that, unlike many other states, california does not have an estate tax, although many of its wealthy residents are indeed subject to the federal estate tax. They may apply to you and your inheritance.

The estate pays any tax that is owed to the government. Individuals unrelated to a deceased person, however, tend to be subject to inheritance tax. The estate pays any tax that is owed to the government.

But the good news is that california does not assess an inheritance tax against it’s residents. California inheritance tax and gift tax. If you are a california resident, you do not need to worry about paying an inheritance tax on the money you inherit from a deceased individual.

The trustee or executor will have paid the federal and california estate taxes, if any, as part of the administration process. Be suspicious of anyone saying they will save you from “the california inheritance tax” or “california death tax” or get you a “california estate tax exemption 2020” for now, no specific death tax, california specific. Twelve states and the district of columbia impose estate taxes and six impose inheritance taxes.

Regarding a separate inheritance tax, california has no such thing. No estate tax or inheritance tax connecticut: California residents are not required to file for state inheritance taxes.

There is no inheritance tax levied on the beneficiaries; The economic growth and tax relief reconciliation act of 2001, phased out the state death tax credit over a four (4) year period beginning january 2002. California is part of the 38 states that don’t impose their own estate tax on inheritances.

Like the majority of states, there is no inheritance tax in california. There is no inheritance tax levied on the beneficiaries; That being said, california does not have an inheritance tax.

The federal government does not assess an inheritance tax. Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent. Does california have an inheritance tax or estate tax?

During the administration period of the estate or trust, certain assets may Kentucky, for instance, has an inheritance tax that may apply if you inherit property located in the state. Eight states and the district of columbia are next with a top rate of 16 percent.

California legislators repealed the state inheritance tax in 1981 Certain states only impose an inheritance tax. Notably, only maryland has both an estate and an inheritance tax.

As of this writing, however, the bill is on ice. In fact, just six states do — iowa, kentucky, maryland, nebraska, new jersey and pennsylvania. Several states have their own estate taxes with lower thresholds, while five have inheritance taxes.

Your inheritance of $65,000 for income tax purposes is tax free. You would owe kentucky a tax on your inheritance because kentucky is one of the six states that collect a state inheritance tax. Connecticut, hawaii, illinois, maine, massachusetts, minnesota, new york, oregon, rhode island, vermont and washington.

If you are getting money from a relative who lived in another state, though, make sure you check out that state’s laws. No, canada does not have a death tax or an estate inheritance tax. There is also no estate tax in california.

It is typically assessed by the state where the beneficiary or heir lives and resides. There are a few complications to consider. He lived in kentucky at the time of his death.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Much Is Inheritance Tax Community Tax

If I Just Inherited Property Do I Need To Pay An Inheritance Tax Inheritance Tax Estate Planning Estate Planning Attorney

How To Avoid Estate Taxes With A Trust

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Californias Tax On Inherited Properties Hurts Minority Communities – Calmatters

Opportunities And Pitfalls For Foreign Inheritances And Beneficiaries Advisors Edge

State Estate And Inheritance Taxes Itep

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

Inheritance Tax How Much Will Your Children Get Your Estate Tax – Wealthfit

States With An Inheritance Tax Recently Updated For 2020

Webuyhomes In California Area Cash-fast We Buy Houses Being A Landlord Foreclosures

Map Of Income Tax Nonpayers By State Map Teaching Geography Happy Facts

States With No Estate Tax Or Inheritance Tax Be Strategic Where You Die Inheritance Tax Estate Tax Inheritance

What Is Inheritance Tax And Who Pays It Credit Karma Tax

How Much Is Inheritance Tax Community Tax

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Inheritance Tax How Much Will Your Children Get Your Estate Tax – Wealthfit

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney