The average salary for international tax accountant is $70,964 per year in the united states. As an international accountant, your salary can vary significantly depending on your level of experience, your level of acquired education and size of the company you work for.

List Of Accounting Skills Including The Top Skills Accountants Need A Job Description Salary Job Out Accounting Jobs Job Resume Examples Resume Skills List

Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession.

International tax accountant salary. A typical salary of a financial accountant in new zealand according to hayes 2020/21 salary guide was $95,000. The top paying industries at that time were school and employee bus transportation with an annual mean wage of $104,110 and the federal government with an annual mean wage of $100,260. A tax accountant salary at kpmg averages in the range of $46,000 to $62,000.

A master’s degree can also help tax accountants earn higher salaries. The firm did not immediately respond to a request for comment on the salary data. They have over 150,000 employees on their payroll and report an average annual profit of $23 billion.

A typical salary for a tax accountant was $90,000 and for a systems accountant was $95,000, according to the survey. Here are the salary ranges for consultants, accountants, auditors, and chief executives at the firm: According to a survey conducted by the association of international certified professional accountants (aicpa), a newly qualified cpa with less than one year of work experience can expect to earn an annual salary of about $66,000.

For tax accountants with the title of manager, the projected midpoint salary is $111,750. Senior tax accountants with a master of taxation earn an average salary of more than $73,000 per year, according to payscale, while tax accountants with a bachelor’s degree earn an average annual salary of about $57,000. Minimum salary at vitae international accounting services depends on the role you are applying for.

Not only do international tax accountants need to know how to account for the foreign earnings, and how they impact irs filings, but they should also know how taxation works in the foreign nation. Salary estimates based on salary survey data collected directly from employers and anonymous employees in madrid, spain. A minimum of three years of experience working on engagements involving international, mergers and acquisitions, and/or federal tax planning.

To learn more about compensation estimates, please see our faq. However, after around 5 years of working there, the average salary shoots up to around $106,000, so it pays to stick around. Actual compensation can vary considerably.

For processor the minimum salary is ₹2.9 lakhs per year, for executive accountant the minimum salary is ₹3.1 lakhs per year and so on. The median salary * for an accountant is $54,600. Tax law can present when.

Each salary is associated with a real job position. Senior associate, international tax salaries in houston, tx. [5] the united states taxes the worldwide income of its nonresident citizens using the same tax rates as for residents.

For those who have less than one year of experience as a tax accountant, the projected starting salary is $54,250. If you're considering a career as an international tax accountant. However, the top 10% of accountants are pulling in an average of $94,100.

The average tax accountant i salary in the united states is $59,138 as of november 29, 2021, but the range typically falls between $53,424 and $65,931. In addition, they earn an average bonus of 1.921 €. The average salary for an international tax manager is $115,034.

In 2019, ey applied for 6,761 visas. The bls reported a median annual salary of $71,550 for accountants and auditors in 2019. Average pwc hourly pay ranges from approximately $15.50 per hour for tax staff to $25.00 per hour for audit intern.

What is an international accountant's salary? Myanmar taxes the foreign income, except salaries, of its nonresident citizens, at a reduced flat rate of 10% (general tax rates for residents are progressive from 5 to 25%). Individuals and businesses often have income tax returns that reflect foreign and domestic earnings.

See all international accountant jobs * salary estimates (zipestimate) are not verified by employers; I’m a certified public accountant with 30 years diversified business experience operating as your certified public accountant with a specialty in international taxation preparation and planning. International tax preparer average salary is $56,063, median salary is $27,040 with a salary range from $27,040 to $114,108.

The starting salary midpoint for a tax accountant with one to three years’ experience in corporate accounting is expected to be $73,500 in 2020. Visit payscale to research international tax manager salaries by city, experience, skill, employer and more. Salary information comes from 9,661 data points collected directly from employees, users, and past and present job advertisements on indeed in the past 36 months.

International tax preparer salaries are collected from government agencies and companies.

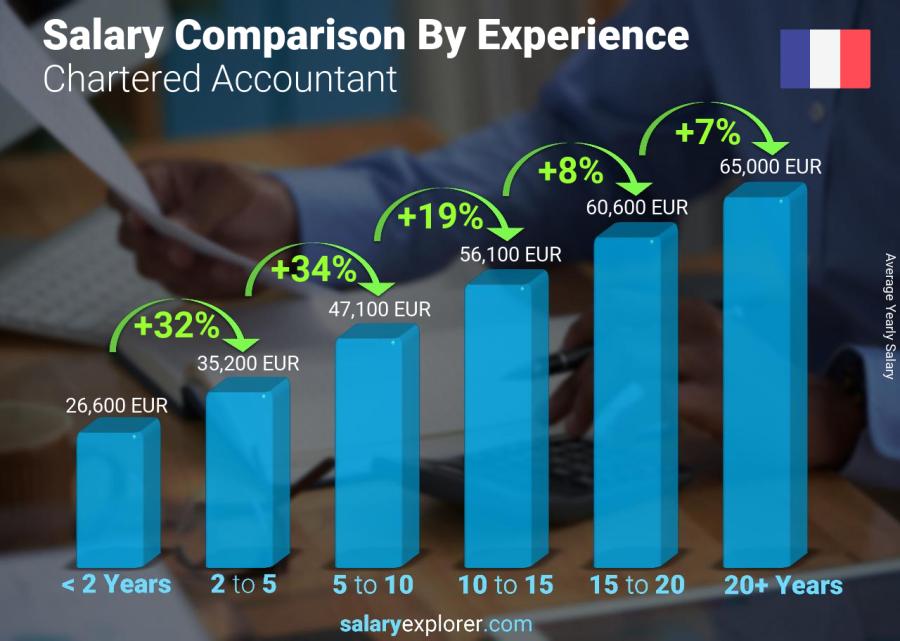

Chartered Accountant Average Salary In France 2021 – The Complete Guide

![]()

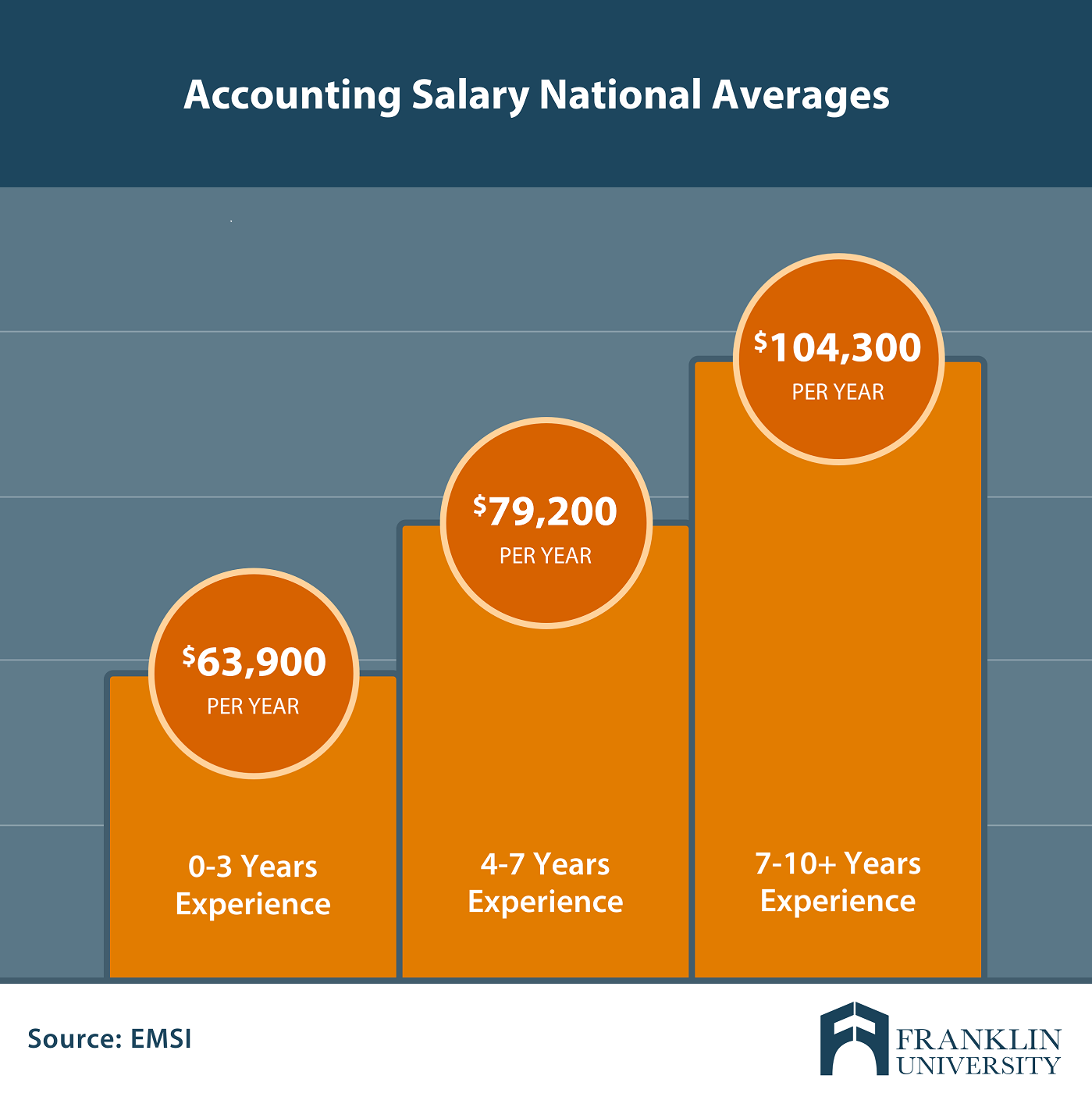

Cpa Salary Guide 2021 Find Out How Much Youll Make

Accountant Vacancy In Dubai Uae Maintains Customer Confidence And Protects Operations By Keeping Financial Information Con Accounting Jobs Engineering Jobs Uae

Salary Survey 2014 – Northern Ireland Accountancy – Financial Services Financial Services Financial Accounting Accounting Services

Todays Tax Accountant Salary Robert Half

Accounts Assistant Jobs In Dubai Accounting Jobs Dubai Uae Accounting And Finance

File Income Tax Returns Online With Gaurav Srivastava Financial Consultant We Handle All Cases Of Income Income Tax Return Income Tax Return Filing Income Tax

Increase Of Salary Criteria To Sponsor Dependent Pass Holders In Singapore – Paul Hype Page Co Singapore Sponsor Chartered Accountant

Accountant Salary Finance Jobs Salary Center Accountemps Accounting Career Finance Jobs Accounting And Finance

Regional Sales Manager Salary And Income Report By Stackmyjob 2019-2020 Income Reports Management Graphic Designer Salary

Tax Accountant Tax Accountant Accounting Career Advice

Are You An Accounting Firm In The Uk If Yes Outsourcing The Accounting Tax Work Definitely Comes With Adva Accounting Firms Accounting Business Development

Due Diligence Audit In Dubai Marketing Audit Audit Make Business

Chartered Accountant Services Provide Audit And Tax Services Mumbai Chartered Accountant Tax Services Accounting

Masters Degree In Accounting Salary What Can You Expect

Learn Accounting Online Accounting Jobs Learn Accounting Accounting Career

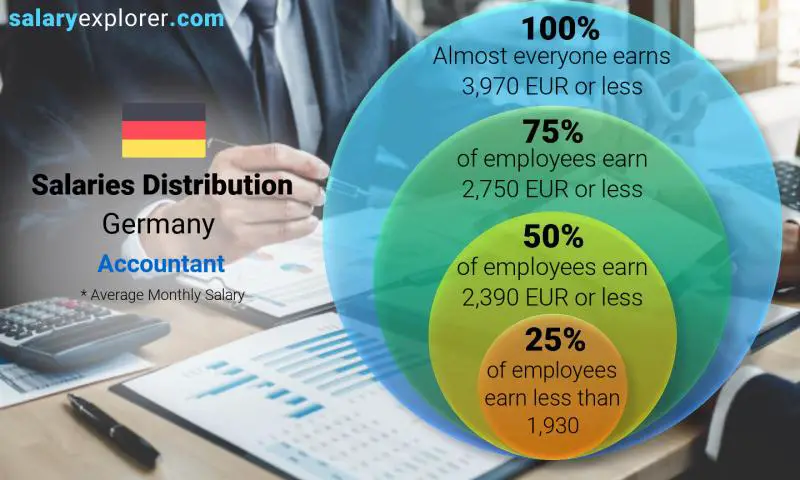

Accountant Average Salary In Germany 2021 – The Complete Guide

Personal Tax Tip Canada – If You Are A Business Owner Of A Canadian Corporation You Have A Number Of Options To Get How To Get Money Dividend Retirement Fund

Portrait Of A Cpa – Infographic Accounting Accounting Jobs Certified Public Accountant