Georgia's estate tax is based on the amount allowable as a credit for state death taxes on the federal estate tax return (form 706). While the federal estate tax doesn’t apply until the estate is worth over $11 million, inheritance taxes are applied at a much lower threshold.

Mcleod County Minnesota Treasurers Office Tax Receipts From Etsy Tax Payment Estate Tax Inheritance Tax

It is not paid by the person inheriting the assets.

How much is inheritance tax in georgia. Charitable and nonprofit organizations don’t pay a tax if the amount is less than $500 but 10 percent of anything over the amount. If the total estate asset (property, cash, etc.) is over $5,430,000, it is subject to the federal estate tax (form 706). Georgia residents do not even have to pay income tax on the money they inherit because it is not considered ordinary income.

The exact federal rules depend on the year in which your parent died. Georgia has no inheritance tax, but some people refer to estate tax as inheritance tax. Any deaths that occurred after july 1,.

Here are the ranges for each of the six states that collect inheritance tax: How much is the inheritance tax? Ad an inheritance tax expert will answer you now!

Any deaths after july 1, 2014 fall under this code. This means that you can give $14,000 to each of your children or grandchildren without being taxed. The estate is valued below £325,000;

The state income tax rates in georgia ranges from 1% to 6%. Inheritance taxes in iowa will decrease by 20% per year from 2021 through 2024. The federal estate tax only affects.02% of estates.

Capital gains tax rate calculator. Any deaths after july 1, 2014 fall under this code. Even with this welcome benefit, there are some returns that must be.

How much is the inheritance tax? (inheritance tax may also apply to life insurance death benefits, but you can avoid the tax by naming a beneficiary through your policy.) guide to new jersey inheritance tax There is an annual gift tax exclusion;

All other beneficiaries will pay an inheritance tax rate of 18% with the first $10,000 of value exempt from taxation. Inheritance tax rates vary widely. No estate tax or inheritance tax

As previously mentioned, the amount you owe depends on your relationship to the deceased. Use this link to find the probate court in bibb county or any georgia county. There is the federal estate tax to worry about, potentially, but the federal estate tax threshhold is current fairly high.

Estate taxes are only mandated in a handful of states, and thankfully, there is no georgia inheritance tax. However, the federal exemption equivalent was $3,500,000 for 2009, $5,000,000 for 2010. Other heirs pay 15 percent tax as a flat rate on all inheritance received.

Rates and tax laws can change from one year to the next. Georgia does not have any inheritance tax or estate tax for 2012. In the uk, you will not need to pay tax on inheritance if:

Ad an inheritance tax expert will answer you now! No estate tax or inheritance tax hawaii: For instance, in nebraska the exemption is good up to $40,000 for immediate family and only $15,000.

How much is georgia inheritance tax? You can use our georgia paycheck calculator to figure out your take home pay. In more simplistic terms, only 2 out of 1,000.

Georgia does not have an estate tax or an inheritance tax on its inheritance laws. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. The exclusion amount for 2017 is $14,000.

This fact is important to consider because the family or friends are the ones left paying the bill. Inheritance tax rates range from 0% up to 18% of the value of the inheritance. The annual gift tax exclusion is adjusted for inflation and is the amount of money or property you can give to each person of your choosing without being taxed.

For example, indiana once had an inheritance tax, but it was removed from state law in 2013. All inheritance are exempt in the state of georgia. Use this calculator to figure out how much state and federal capital gains taxes would be due upon sale.

Any inheritance above this threshold is left to a spouse or civil partner; The top estate tax rate is 16 percent (exemption threshold: **the rate threshold is the point at which the marginal estate tax rate kicks in.

The tax is paid by the estate before any assets are distributed to heirs. Only people who die with more than $11.7 million must pay the federal estate tax, and georgia does not have any special taxes for estates or inheritances. Anything above the threshold is left to a charity;

Iowa has an inheritance tax, but in 2021, the state decided it would repeal this tax by 2025. Heirs may have to pay tax on some inherited retirement accounts because they are subject to income tax as assets. Here’s a breakdown of each state’s inheritance tax rate ranges:

There are no georgia inheritance tax. Find more information on the uk. Map showing state inheritance tax rates.

Does Georgia Have Inheritance Tax

Just What Is Probate Estate Planning Checklist Funeral Planning Checklist Funeral Planning

Wills And Trusts Kit For Dummies – Aaron Larson – 9780470283714 In 2021 Dummies Book Estate Planning Checklist Setting Up A Trust

Pin By Audrey Kernodle On College Essay Structure Topic Sentences Essay

King Lear And His Accountant – New Yorker Cartoon Poster Print By Jb Handelsman At The Conde Nast Collection New Yorker Cartoons King Lear Poster Prints

Phenix City Alabama Divorce Lawyer Mark Jones Inheritance Tax Divorce Family Law Attorney

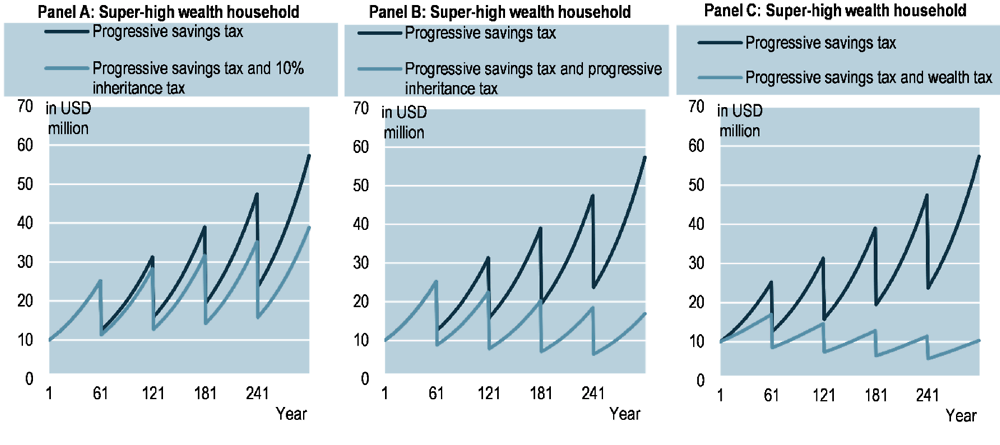

2 Review Of The Arguments For And Against Inheritance Taxation Inheritance Taxation In Oecd Countries Oecd Ilibrary

Is That Sponsor Taking Fair Compensation Or Ripping Me Off Whats Normal And Whats Out Of Line Are There Times When Inequality Inheritance Tax Exploitation

What You Need To Know About Georgia Inheritance Tax

Estate Tax Rules To Know In Georgia Bomar Law Firm Llc

Cara Mudah Pencatatan Akuntansi Saham Dan Obligasi Grand Canyon Lanskap Berjalan

Estate Tax Rules To Know In Georgia Bomar Law Firm Llc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Just What Is Probate Estate Planning Checklist Funeral Planning Checklist Funeral Planning

Pierre Bonnard Painting Arcadia Pierre Bonnard Painting Watercolor Paintings Abstract

Choose Your Own Adventure Part 1 Essay Essay Examples Persuasive Essay Topics

Mcleod County Minnesota Treasurers Office Tax Receipts From Etsy Tax Payment Estate Tax Inheritance Tax

Will It Will It Not New Direct Tax Law Dtc Proposals Income Tax Finance Quickbooks

What Is The Meaning Of Travel Insurance Our Deer Travel Insurance Travel Finance