A business and occupation tax is imposed on any persons (s) engaging or continuing with the state in any public service or utility business, except railroad, railroad car, express, pipeline, telephone and telegraph companies, water carriers by steamboat or steamship and motor carriers. Extracting timber, extracting for hire timber.

Top State Corporate Income Tax Rates In 2014 Tax Foundation

***for manufacturing gross reciepts over $8 billion, the b&o rate drops to 0.00025.

B&o tax states. When paying the b & o tax to the department of revenue, you declare your income in different categories. The deadlines for filing a b&o tax return vary depending on the size of your business. When do i file a washington state business & occupation taxes return?

It is measured on the value of products, gross proceeds of sale, or gross income of the business. For products manufactured and sold in washington, a business owner is subject to both the manufacturing b&o tax and the wholesaling or retailing b&o tax. Washington’s b&o tax is calculated on the gross income from activities.

Tennessee imposes no income tax on regular earnings and a small tax on income from investments. A washington state superior court granted summary judgment for banking associations, holding that the state’s additional 1.2% business and occupation (b&o) tax imposed on certain financial institutions violates the “commerce clause” of the u.s. Seattle, bellevue, and many other cities across washington require businesses to file for b&o taxes on a periodic basis depending on their estimated annual income;

However, you may be entitled to the multiple activities tax credit (matc). This includes the value of products, gross proceeds of sale, or the gross income of the business. The tax itself is measured by the value of products, gross proceeds of sales, or the gross income of.

Businesses pay a washington b&o tax rate depending on their classification. Washington’s b&o tax recognizes three main categories of businesses, which it treats differently and subjects to different tax rates: Tax rates may apply to businesses categories other than those above.

No deduction is allowed for labor, materials, taxes or other costs of doing business. For example, taxpayers falling under the “retailing” classification are subject to a 0.471% rate, whereas service providers generally pay tax at a 1.5% rate. Washington state business and occupation tax (b&o) the washington state business and occupation tax (b&o tax) is measured on a company’s gross receipts.

Exemptions, deductions, or other exceptions may apply in certain circumstances. For example, if you extract or manufacture goods for your own use, you owe b&o tax. Monthly filers of course file every month.

The washington state business & occupation (or b&o) tax is a tax that is imposed against a person or company that is engaged in certain business activities. Washington, unlike many other states, does not have an income tax. Regardless of the frequency, city taxes are always due on the last day of the month.

Taxes are due on the 25th of every month for. There are multiple states with gross receipts tax: Business and occupation (b&o) tax | washington state and city of bellingham.

However, if this same business also engages in $80,000 worth of wholesale transactions delivered to washington customers, the taxpayer reaches the economic nexus threshold and is subject to both the service and other b&o tax on its consulting services at the rate of 1.5 percent, and wholesaling b&o tax on its wholesale sales at the rate of 0.484 percent. Slaughtering, breaking and processing perishable meat; Washington state taxes business based on revenue, much like city taxes, except that the state tax return is more complex (it has more tax categories, more tax types, and more types of deductions).

The state b&o tax is a gross receipts tax. The following chart gives the rates for each main category: Most washington businesses fall under the 1.5% gross receipts tax rate.

Business owners should be aware of the gross receipts tax requirements in these states and to take action to prevent liabilities from accumulating over time. The b&o tax for labor, materials, taxes, or other costs of doing business. Delaware, nevada, ohio, oregon, tennessee, texas, and washington.

B & o tax rates. For starters, if you’re not collecting sales tax and your revenues fall under a specified threshold ($28,000 for most businesses) you don’t need to file a b&o tax return at all. “our b&o tax tripled when that went away,” he notes.

Washington state doesn’t have income tax like most states, but business owners do need to pay business and occupation (b&o) tax, and this is usually on a state and city level. Unlike the retail sales tax, a sale does not have to occur for a business to owe b&o tax. The b&o tax is a gross receipts tax with tax rates that vary depending on the particular business activity of the taxpayer.

Washington is the only state in the country that taxes businesses this way. Additional b&o tax imposed on financial institutions. It applies to the gross income of the business.

Thresholds are subject to change. However, your business may qualify for certain exemptions, deductions, or credits. The manufacturing b&o tax rate is 0.484 percent (0.00484) of your gross receipts.

The b&o tax is a gross receipts tax, assessed against an entity for conducting business in washington. Contact the city finance department for more information. Like seattle, your filing frequency for washington state b&o depends on your expected annual revenue.

Low property taxes help reduce the tax burden as well.

2

A Guide To Business And Occupation Tax – City Of Bellingham Wa

2018 Tips For Marketplace Sellers Filing Your Washington Sales Tax Return – Taxjar Support

State Supreme Court Upholds Bo Tax On Large Banks In Washington

Washington State Sales Use And Bo Tax Workshop

Editorial What Would You Change About States Tax System Heraldnetcom

How High Are Corporate Income Tax Rates In Your State – Tax Foundation Of Hawaii

2

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self-employed Women

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy – Washington State Wire

Washington State Sales Use And Bo Tax Workshop

Wa Sales Boand Use Tax

Business And Occupation Bo Tax Washington State And City Of Bellingham

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self-employed Women

2

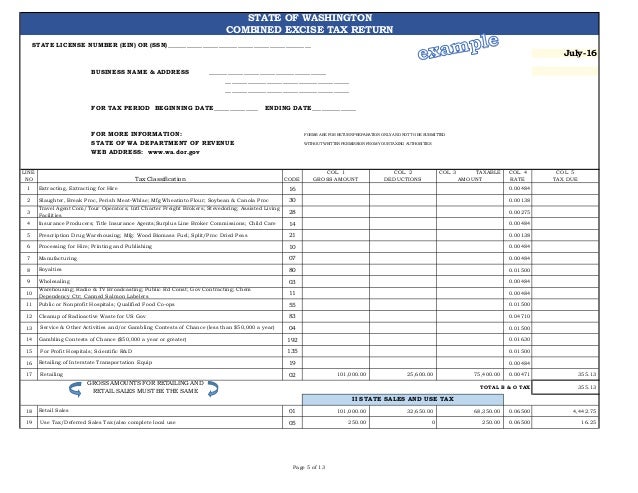

Tax Filing Example Washington Department Of Revenue

How Washington Rideshare And Delivery Drivers File State Taxes – Rideshare Dashboard

State Income Tax – Wikiwand

2