The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Determining which taxes apply to a particular hotel charge becomes confusing very quickly.

Vrbo Accounting Excel Worksheet Excel Template For Vacation Rentals On Vrbo Vacation Rental Management Rental Property Management Rental Income

Multiply the tax on hotel bill by the percentage above to get the tax charged per day:

Hotel tax calculator texas. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. The following will calculate automaticially: (for use only when rate is above the allowable rate) $15.00 $125.00 3.00 $15.00 $0.12 $1.80 $5.40 $0.00 $0.00 $0.00 $0.

Texas tax code chapter 351 and tax code chapter 352 give municipalities the authorization to levy a tax on a person who pays for the use of a hotel room, as defined by tax code chapter 156. Convention hotels located within a qualified. Compare that to the national average, which currently stands at 1.07%.

Hotel occupancy tax receipts by quarter and by. If you have questions about hot,. The statute governing the maximum city hotel tax rate (texas tax code 351) has been amended 11 times, and currently caps the tax at 7 percent, 8.5 percent or 9 percent, depending on factors such as the city’s population and its proximity to the gulf of mexico, the state of louisiana, lake palestine or.

Retailers, including hotel and motel operators, can search our records and obtain online verification of an organization's exemption from texas franchise tax, sales and use tax, and hotel occupancy tax. Federal tax, state tax, medicare, as well as social security tax allowances, are all taken into account and are kept up to date with 2021/22 rates Below is a summary of key information.

Failure to comply may result in tax liabilities, fines, penalties, and interest. Quick reference guide for hotels. Hotel and short term rental tax calculator.

The purpose of the local hotel occupancy tax is to promote tourism and the convention and hotel industry. Charts that show the taxability of various sales, services and purchases a hotel makes Sports and community venue projects can levy hotel taxes at rates varying up to 2 percent, except for dallas county which can impose a hotel venue tax at a rate of up to 3.

Cities and some counties and special purpose districts can each levy local hotel taxes, generally at rates varying up to 7 percent; If you make $55,000 a year living in the region of texas, usa, you will be taxed $9,295.that means that your net pay will be $45,705 per year, or $3,809 per month. The 2020 census revealed that the texas population had grown by 16% (or 4.

Please read and adhere to the hotel occupancy tax reporting, payment requirements, and exemptions. Sales tax, hotel tax, and mixed beverage tax can all appear on the same invoice, and both hotel operators and hotel guests frequently contact thla with questions about how to figure out which tax […] Suite 1045 austin, tx 78704 physical location 811 barton springs rd.

All payments should be mailed to: The state hotel tax rate is 6 percent. 5 things to know about texas business personal property tax.

This is not an official tax report. It winds up being a little less than 15% + $3.50 per day. The typical texas homeowner pays $3,390 annually in property taxes.

The hot tax and str registration forms are now available online at galveston occupancy tax. Governed under chapter 156 of the texas tax code, the state hotel occupancy tax is administered by the texas comptroller. A refund may be applied where allowable by forwarding a properly documented and completed city of san antonio claim for refund of city hotel occupancy tax form to the city of san antonio, revenue collections division, p.o.

This tool is provided to estimate past, present, or future taxes. Texas has among the highest combined hotel occupancy tax rates of any major metropolitan areas in the nation, with houston at 17 percent and san antonio at 16 ¾ percent. 54 rows [3] state levied lodging tax varies.

Multiply the tax per day by the number of days traveled to get the total reimbursable tax: Your average tax rate is 16.9% and your marginal tax rate is 29.7%.this marginal tax rate means that your immediate additional income will be taxed at this rate. Texas has one of the highest property tax rates in the country, with most properties seeing substantial tax increases year over year.

Texas has a 6.25% statewide sales tax rate , but also has 815 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.377% on top.

100 Bill Accounting Business Card Business Cards Business Card Design Customizable Business Cards

Receipts Tracking App For Taxes Calendar App Best Calendar App Family Calendar App

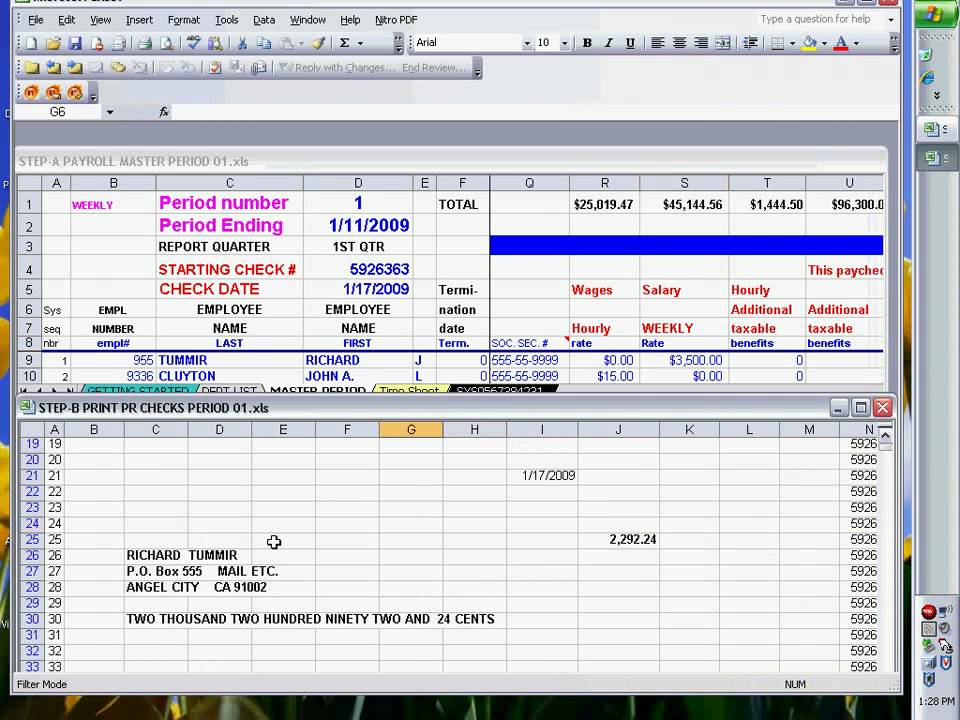

Payroll Checks Using Excel Ready To Print Payroll Checks Payroll Payroll Template

Home Equity Loan Home Equity Loan Home Equity Equity

Pin On Hotel

Catchy Apartment Slogans And Popular Taglines – Brandongaillecom Property Management Marketing Apartment Management Apartment Marketing

South Tx Community Changes Hands Rio Grande Valley Rio Grande Community

10 Reasons Why A Logo Should Never Cost Less Than 200 – Apex Creative Elevate Your Brand Graphic Design In Scottsdale An 10 Things The Borrowers 10 Reasons

Pin On Statistics And Probability

Herbal Supplement Business Plan In 2021 Essay Writing Writing Services Essay

Vacation Rentals Huge Rents Any Profits Zillow Blog Rental Property Vacation Rental Management Rental

Modern Professional Damask Accountant Business Card Zazzlecom In 2021 Accounting Humor Business Card Modern Accounting

Home Equity Loan Home Equity Loan Home Equity Equity

The Latest Figures From Banking Payments Federation Ireland Bpfi Show That The Value Of Contactles Credit Card Processing Prepaid Card Financial Management

Pin On Dark Spots

Casio F-91wc-4aef Digital Pink Watch Digital Pink Pink Watch Casio

Sample Cashier Letter Letter Sample Sample Resume Sample Proposal Letter

Sample Financial Letter Lettering Financial Letter Sample

Do You Know How Much You Pay In Federal State And Local Taxes Bean Counter Tax Federal Income Tax