Uk capital gains and income tax support. Are you prepared for tax season?

The Uk Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Hmrc doesn’t consider cryptoassets to be a form of money, whether exchange tokens, utility tokens or security tokens.

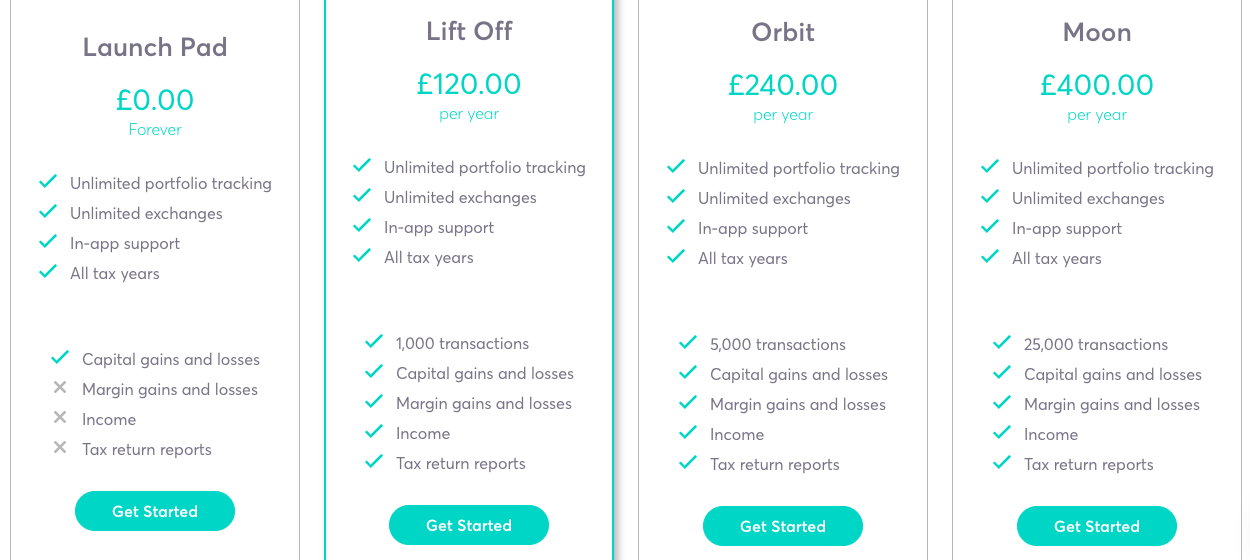

Crypto tax calculator uk. Crypto tax calculator is one of them, designed specifically for hmrc tax laws. See your crypto capital gains and income since your first investment. Advice and answers from the cryptotaxcalculator team.

So, is there a crypto tax in the uk? However, when it comes to taxing them, it depends on how the tokens are used. Uk crypto tax guide (2021) the tax collecting body of the uk, hmrc ( her majesty's revenue and customs ), has started to more aggressively enforce its crypto tax policies.

The way you work out your gain is different if you sell tokens within 30. The original software debuted in 2014. Crypto tax calculator help center.

Taxscouts is a team of accountants who can help you file your tax form for just £119. Bitcoin.tax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. Simply upload or add the transaction from the exchanges and wallets you have used, along with any crypto you might already own, and we'll calculate your capital gains.

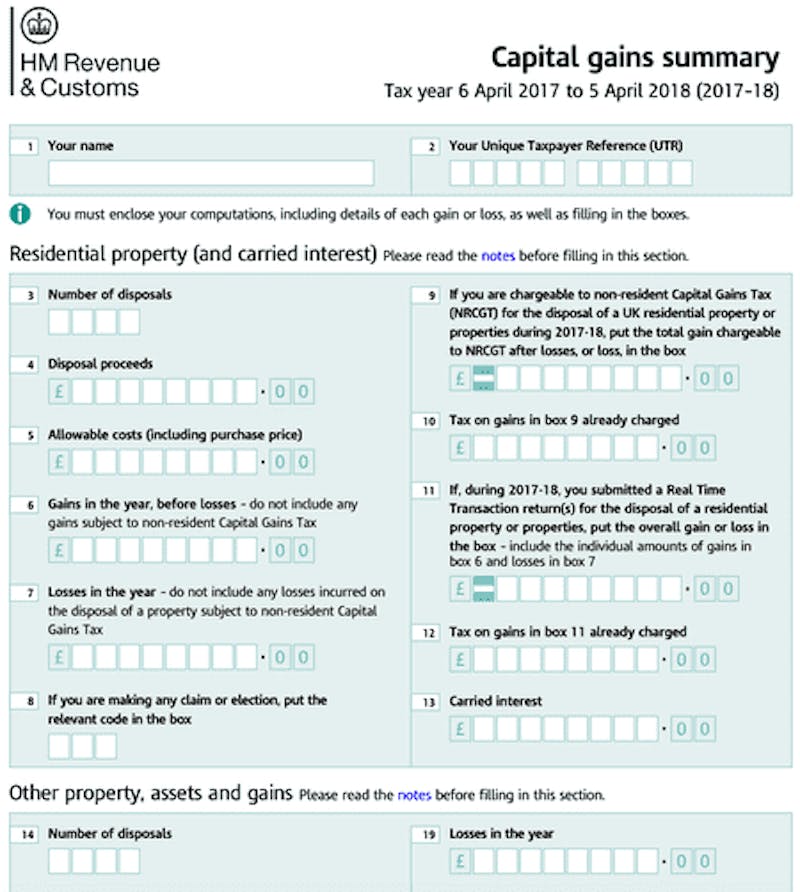

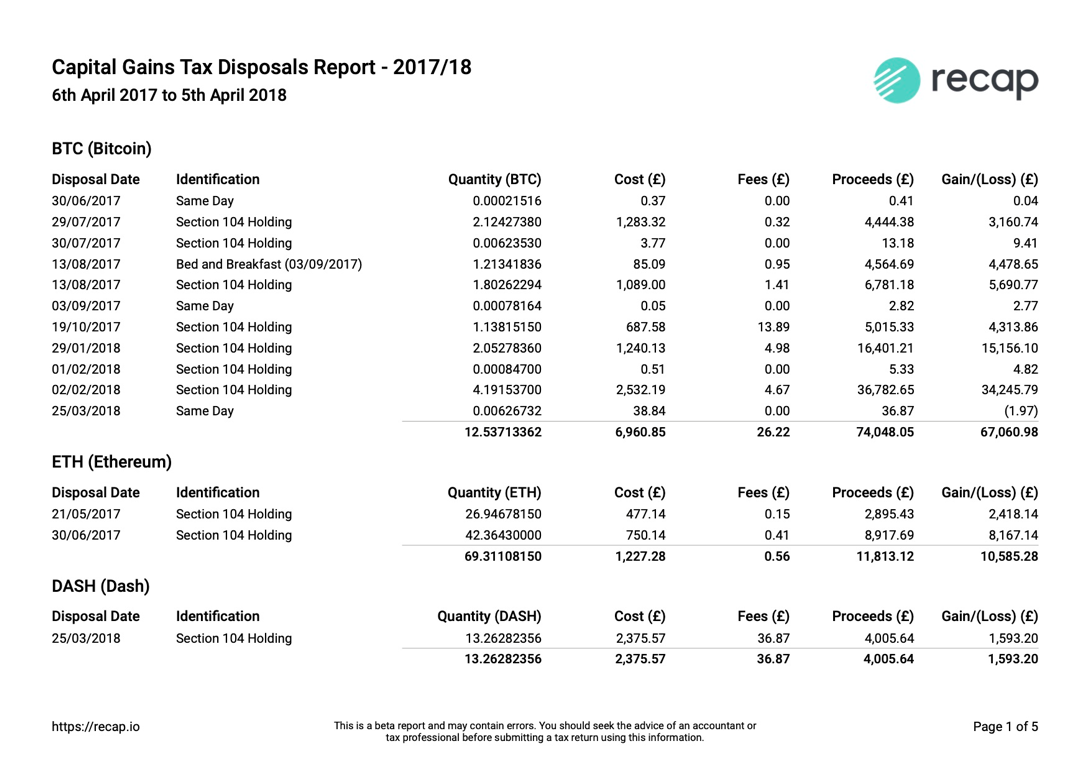

Hmrc has published guidance for people who hold. Capital gains tax (cgt) breakdown. My crypto tax is a london based regulated professional accountancy firm that exclusively focuses on providing tax compliance, reporting and tax planning services for the cryptocurrency community in the uk.

Generate a comprehensive disposal report for your accountant. This is a local company that knows all ins and outs in order to stick to all the regulations we have in our kingdom. This tax solution has in a short time become very popular in the uk and is today used by several thousand individuals to make it simple to calculate and report their crypto taxes.

20 are subject to tax. Demystify crypto taxes ← all blog post / tag: Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

Ideally, you’ll want to submit your tax return before this point as you also need to pay any taxes due by midnight on the 31st january 2022. As cryptocurrencies like bitcoin have grown in popularity over the years, so has the amount of people who are making money by investing or trading them. You pay £127 at 10 % tax rate for the next £1,270 of your capital gains.

With the government specifically targeting crypto, it’s essential that you understand the tax consequences of owning crypto. You pay no cgt on the first £12,300 that you make. These profits are taxed at different rates.

Investors, traders, miners, and thieves. Straightforward ui which you get your crypto taxes done in seconds at no cost. When to file uk crypto taxes.

You need to report any income from crypto or capital gains from crypto in your self assessment tax return by this date. With over 300,000 users, cointracking.info is one of the oldest and most trusted cryptocurrency tax calculators on the market today. Crypto.com tax offers the best free crypto tax calculator for bitcoin tax reporting and other crypto tax solutions.

You pay £1,286 at 20 % tax rate on the remaining £6,430 of your capital gains. My crypto tax is a division of my accountancy team limited, my accountancy team is a modern forward thinking chartered management. You can easily import all transactions from exchanges like coinbase and binance automatically, and generate your crypto tax reports with the click of a button.

Read the ultimate crypto tax guide. The rate you pay on crypto taxes depends on your income level and how long you have held the crypto. Get help with your crypto tax reports.

Best crypto tax calculators to use in the uk taxscouts. A concise guide on how to use cryptotaxcalculator. Calculate and report your crypto tax for free now.

Full integration with popular exchanges and wallets in canada with more jurisdictions to come. To check if you need to pay capital gains tax, you need to work out your gain for each transaction you make. The uk tax deadline is the 31st of january 2022.

Helpful guides to resolve issues when calculating your taxes. The ultimate uk crypto tax guide 2021. Discover how much taxes you may owe in 2021.

Since then, its developers have been creating native apps for mobile devices and other upgrades. Whilst cryptocurrency is a relatively new asset, the regulations surrounding it are still being formed. This manual sets out hmrc’s view of the appropriate tax treatment of cryptoassets, based on the law as it stands on the date of publication.

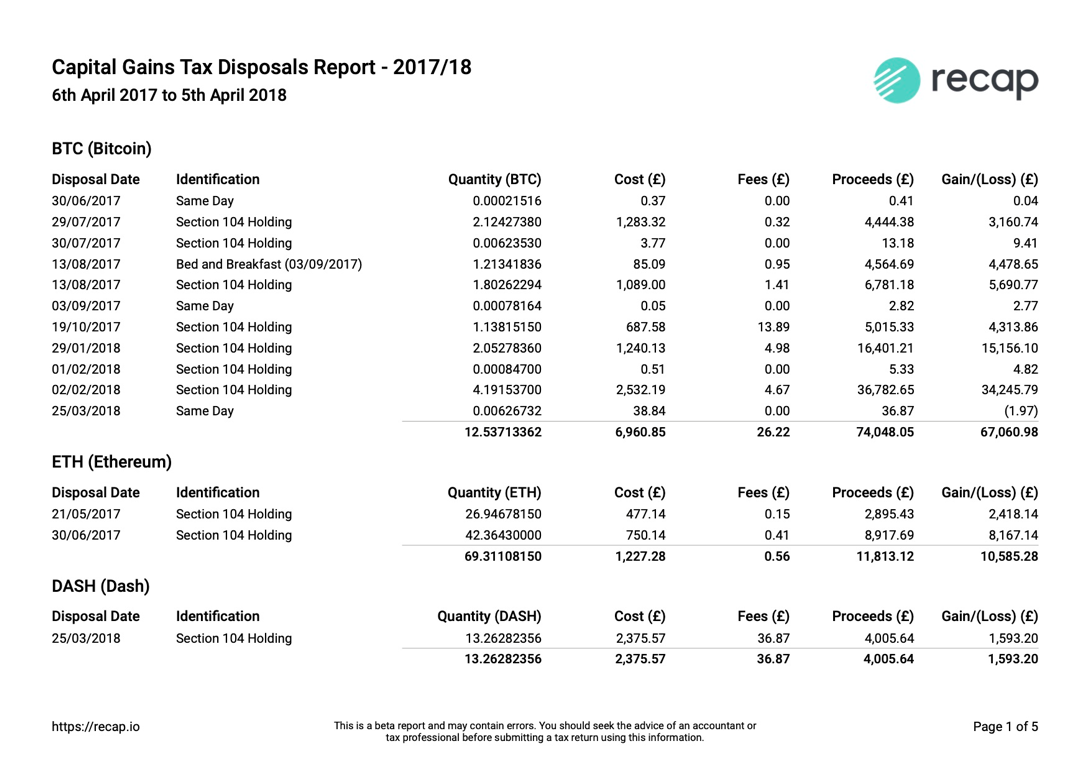

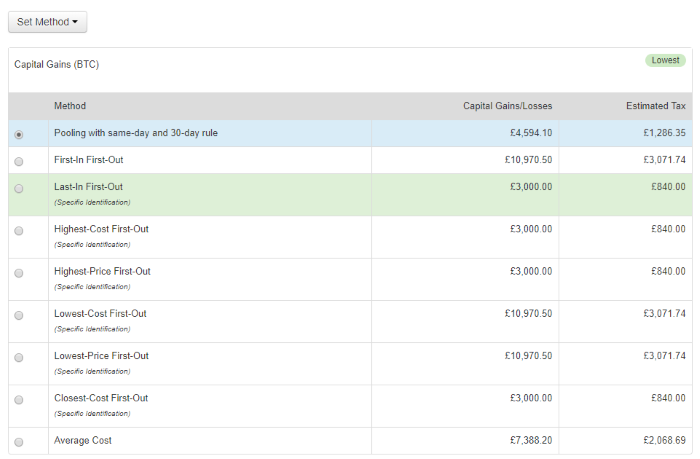

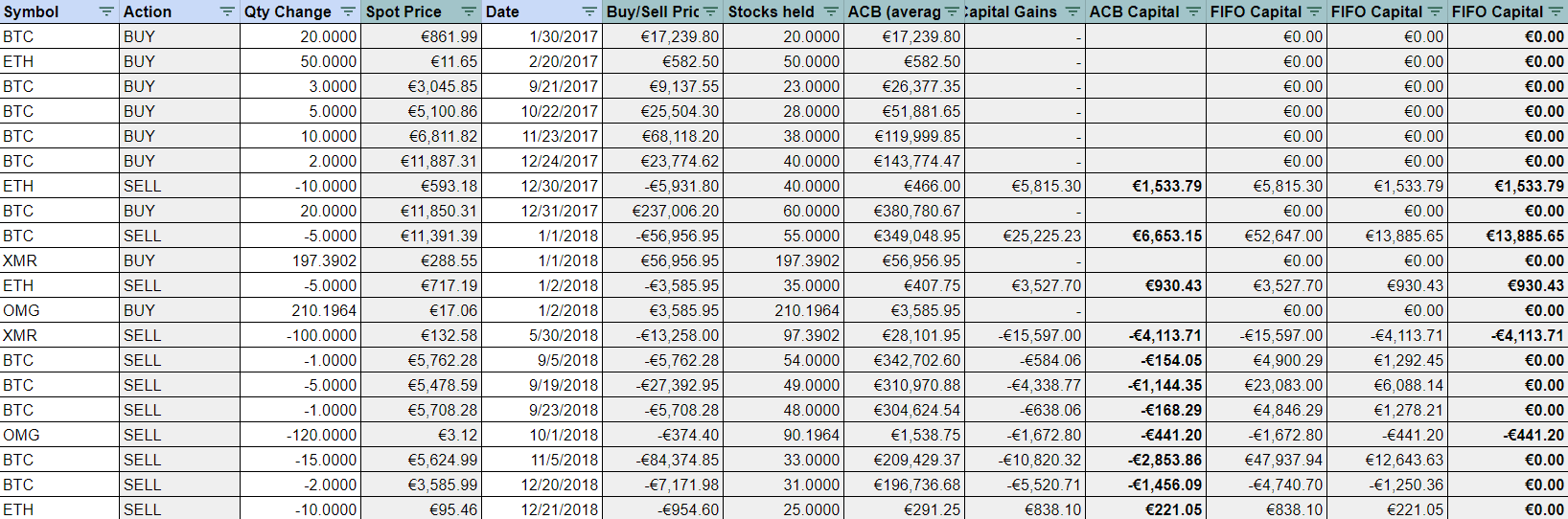

7 articles in this collection written by shane brunette. Calculate your gains by applying same day, 30 day and asset pooling rules. As the cryptosphere gained more traction, revenue authorities came knocking and started talking about the need for crypto traders and investors to pay tax.

Bitcoin And Crypto Tax In The Uk With New Hmrc Policy

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Cryptocurrency Taxes In The Uk The 2022 Guide Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

![]()

Cointracking – Crypto Tax Calculator

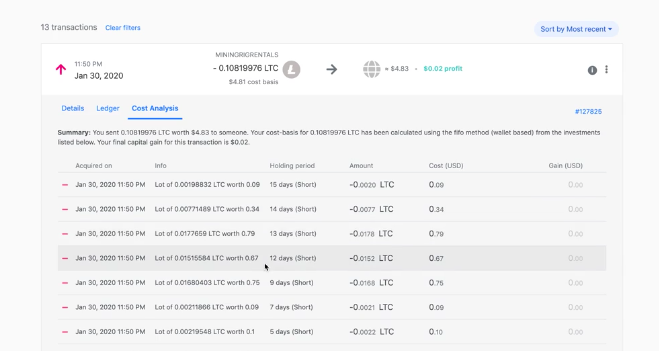

Uk Cryptocurrency Tax Guide Cointracker

Best Bitcoin Tax Calculator In The Uk 2021

Crypto Tax Calculation Via Google Sheets Fifo Abc By Ha Duong Token Economy

Cointracking – Crypto Tax Calculator

Crypto Tax Calculator

Uk Crypto Tax Guide 2021 Cryptotradertax

Wades Cryptocurrency Trading Journal Tax Calculator Spreadsheet Amazoncouk Software

Best Bitcoin Tax Calculator In The Uk 2021

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

How To Calculate Your Crypto Taxes For Your Self-assessement Tax Return Recap Blog

Best Bitcoin Tax Calculator In The Uk 2021

Calculate Your Crypto Taxes With Ease Koinly