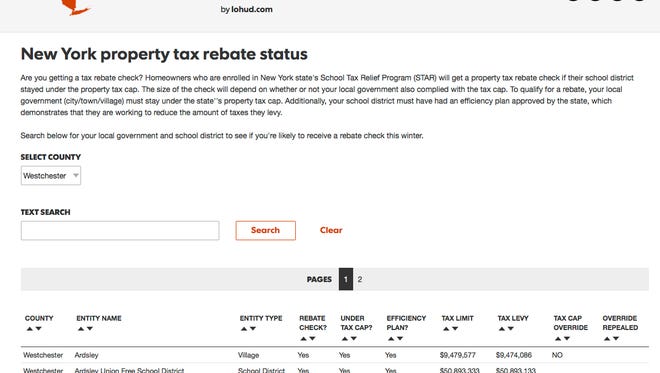

New york mailed out advance payment of the property tax freeze, property tax relief and star credits to qualified taxpayers.the property tax freeze credit amount was based on the amount of increase in local property taxes on primary residence. Taxes on goods raise the cost of living.

2

For more information on property tax relief, see star.

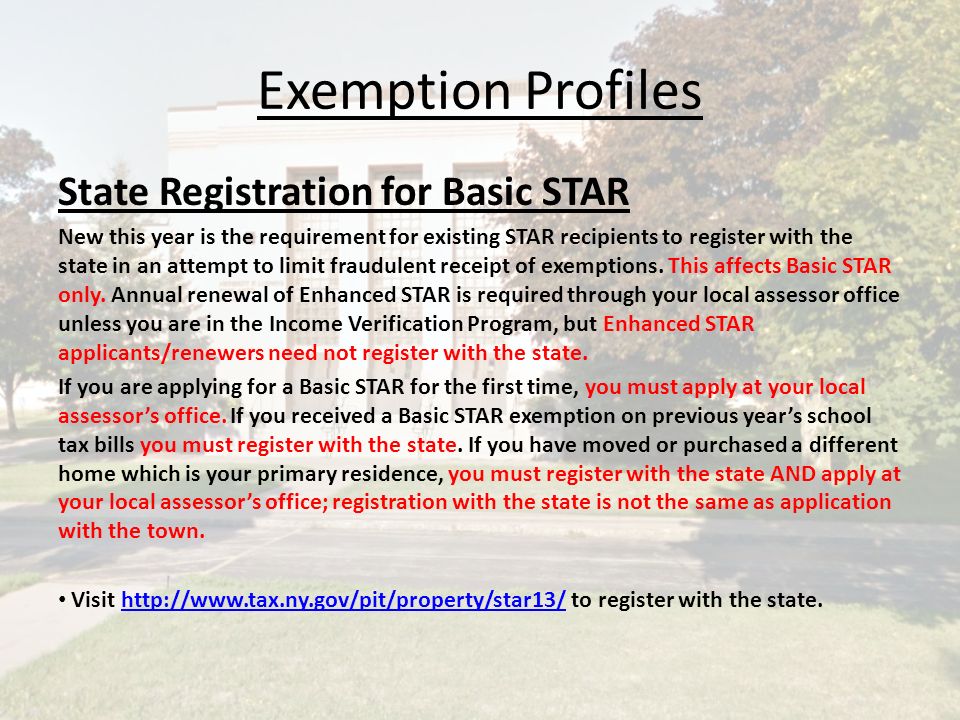

Http://www.tax.ny.gov/pit/property/star/eligibility.htm. Who can apply homeowners not currently receiving the star exemption who meet the program's eligibility requirements may apply for the star tax credit with the new york state department of taxation and. If you are using a screen reading program, select listen to have the number announced. You do not need to register for star if you are a longtime homeowner with an existing star exemption.

The last year of the program was 2016. These changes will impact many nassau county homeowners seeking relief from high property tax bills. So if you made under $75,000, the rebate this year is 85% of your star savings.

Star property tax relief program there have been some changes in how certain homeowners will apply for star, and in how they receive their star benefit. Homeowners only have to enroll in ivp once. Enter the security code displayed below and then select continue.

A new law this year required all property owners age 65 and over who are eligible for enhanced star to complete a form with their local tax. The dollar value of the credit will. The property tax freeze credit was a tax relief program that reimbursed qualifying new york state homeowners for increases in local property taxes on their primary residences.

In 2016, star was changed by state law from a property tax exemption to an income tax credit. Unless directed by the nys department of taxation and finance, existing ivp participants are not required to take. The star program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older.

The property tax relief credit is doled out on a sliding scale based on income. So if your star savings is $1,000. The lower price of real estate makes home ownership more affordable.

Owners who were receiving the benefit as of march 15, 2015, can continue to receive it. New applicants who qualify for star will register with new york state instead of applying with their assessor. Star rebate program in new york to undergo drastic change

This requirement applies to property owners who received basic star benefits and are applying for enhanced star and those already receiving enhanced star benefits but who did not register for the income verification program (ivp). After that, new york state verifies income eligibility automatically. The following security code is necessary to prevent unauthorized use of this web site.

How new york just made it easier to get a check. If the price of land drops to near zero, there is no value left to speculate with. If you are eligible, you will receive the credit in the form of a check.

It’s important to know exactly what these changes are, and what you need to do to continue participating in these programs. Important information about new star program changes important information about new star program changes the school tax relief (star) program provides eligible homeowners in new york state with property tax relief through the basic. New york state recently made several important changes to its star (school tax assessment relief) program.

New applicants who qualify for star will register with new york state instead of applying with their assessor. Astbury claims that a property tax heightens speculation, but a tax on land value does the opposite, since it reduces the purchase price of land. “property tax credit checks are currently being mailed to eligible property owners, said james gazzale, a tax department spokesman.

New applicants must apply to the state for the credit.

Senator Obrien Reminds Homeowners To Reapply For Star Property Tax Exemption Ny State Senate

Budget Fact Sheets Marcellus School District

2

Regina Keenholts – Coldwell Banker Prime Properties – The Star Deadline Is Fast Appropaching Dont Miss Out On Great Tax Refunds For More Information Httpswwwtaxnygovpitpropertystarstar -exemption-programhtm Facebook

Senator Obrien Reminds Homeowners To Reapply For Star Property Tax Exemption Ny State Senate

2

2

Townofswedenorg

Property Tax Exemptions A Brief Discussion On Benefits Qualifications – Ppt Download

Lincolninstedu

Srk12org

Did You Get Your Tax Rebate Check Yet Heres How Many Havent Gone Out

Ny01913833schoolwiresnet

Brian Barnwell – For Homeowners And Tenants This Is A Reminder That You Must Apply For Property Tax Exemptions By Submitting An Application By March 15 Please Review The Flyer For Details

Townofauroracom

Ferraramgmtcom

Awaiting A Rebate Check Stay Calm State Says

2

Star Resource Center