Buying stock in real estate is an investment. An interest offered or purpose, with the goal of providing favorable tax consequences.

Tax Shelters For High W-2 Income Every Doctor Must Read This

Traditional tax shelters have included investments in real estate, oil and gas, equipment leasing, and cattle feeding and breeding programs.

Tax shelter real estate definition. The equipment leasing tax shelters, which provide investment As an example, let's assume that a property has a cash flow of $5000 (in other words, the cash income from the property exceeds cash expenditures by $5000 for the year). The term tax shelter is used to describe a variety of ways to protect income, or earnings, from federal or state taxes.

A tax shelter reduces a property's taxable income. So a real estate tax shelter is a good option if you want to invest and reduce your taxable income at the same time. The irs allows some tax shelters, but will.

Individuals looking to avoid paying income taxes to the federal government are sometimes tempted to enter into agreements involving tax shelters that are deemed illegal. Any tax shelter (as defined in section 66629d) (2) (c) (ii). The tax shelter and passive activity losses.

Most investors don’t think they are involved in a tax shelter but as we look at the definition of a syndicate, things begin to change. For example, making a donation to a qualified charity, itemizing your deductions and deducting that donation reduces your tax liability in that year. A tax shelter is a way of arranging the finances of a business or a person so that they.

Most business owner’s depth of understanding of a tax shelter is that it has something to do with the avoidance or evasion of tax, which makes sense. Definition of tax shelter patrick lancer, real estate agent century 21 elite locations inc. Think of tax shelters as your financial bottom line’s best friend.

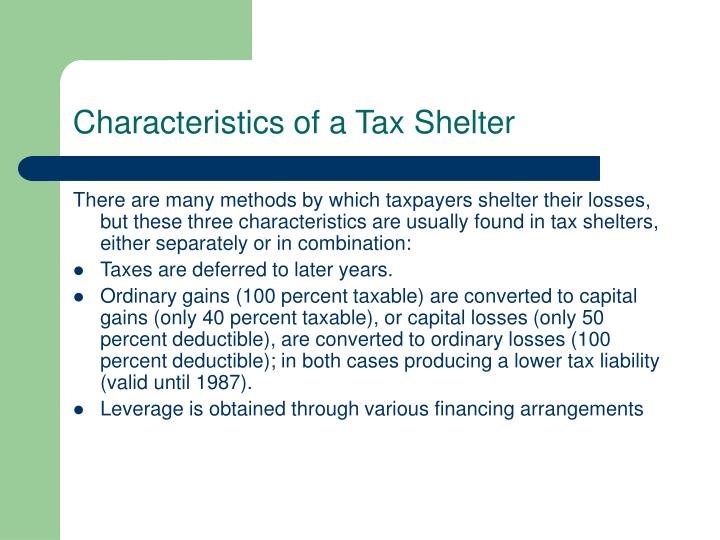

On the other hand, tax evasion is used to lower the amount of taxes owned by using intentionally illegal methods that are considered a federal offense, and punishable by law. A tax shelter, as cumulatively defined by irc sections 448, 1256 and 461, is any partnership or entity, other than a c corporation, that has more than 35% of losses in a tax year allocable to limited partners or limited entrepreneurs. Any syndication (with the meaning of section 1256 (e) (3) (b), and.

A tax shelter is defined differently under various code sections, with one of the broadest definitions used in this case. An entity, such as a partnership or investment plan, formed with tax avoidance as a main purpose. By definition, tax shelters are methods which help you reduce your tax bill.

448(a)(3) prohibition defines tax shelter at sec. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source. A tax shelter is used to lower the amount owed in taxes in a legal manner, as defined by the irs and the tax code.

448(d)(3), which states that [t]he term 'tax shelter' has the meaning given such term by section 461(i)(3). sec. Use of this form is generally limited to the ownership of a residence. So, the investor has $5000 spendable cash in his or her pocket.

The definition of a tax shelter therefore becomes a critical factor in determining tax consequences for a business that otherwise could be a small business. The abusive tax shelter is a type of investment that is considered illegal as it allegedly diminishes the income tax liability of an investor without affecting the investor’s income or their assets. A tax shelter is a way of minimizing or eliminating your tax liability, either permanently or temporarily.

461(i)(3) provides that the term tax shelter means: Investments, usually in limited partnership, that can protect of defer shelter) part of the income from current taxes. Historically, real estate has proved to be a significant tax shelter.

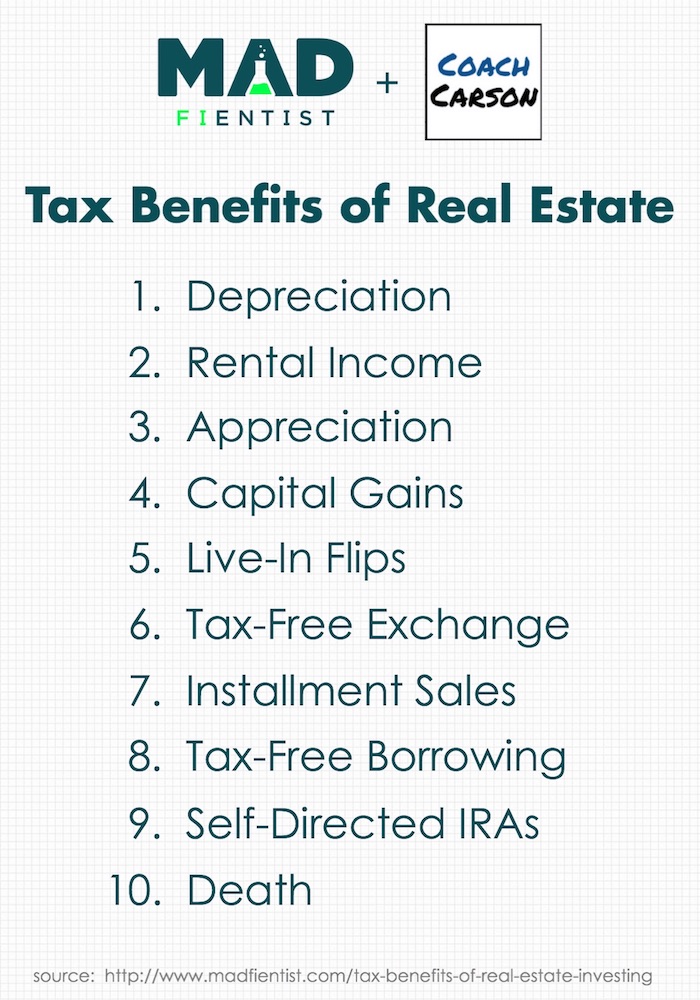

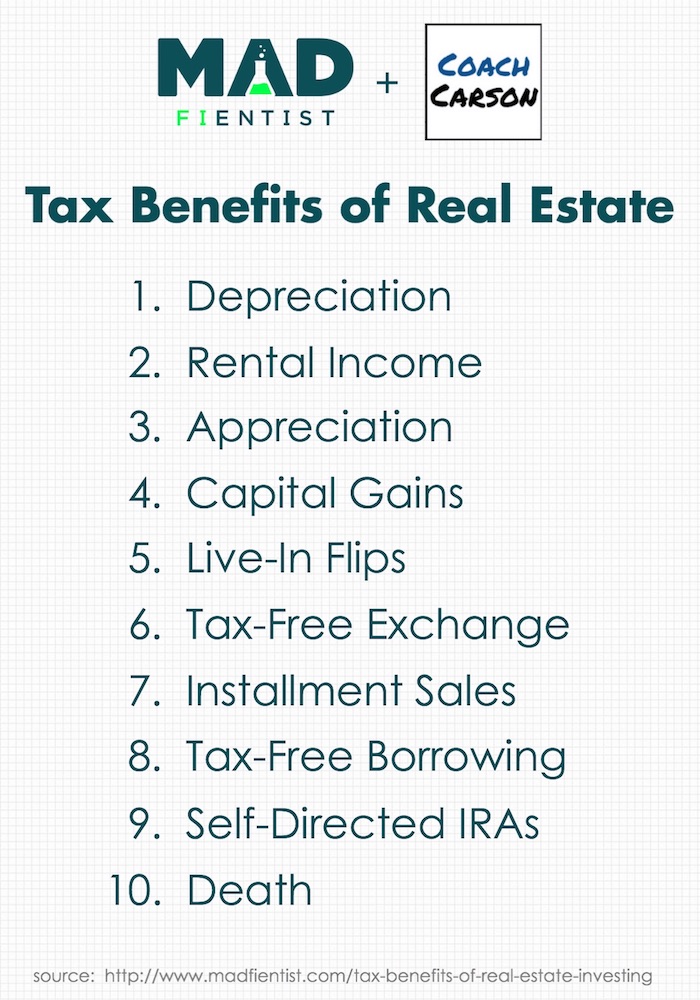

Tax shelter law and legal definition. Be carefully examined since the basic duties and liabilities of the parties are controlled by statute and case law. Real estate investors have a few unique tools to minimize their tax burden:

| meaning, pronunciation, translations and examples

905 Tax Shelter Photos – Free Royalty-free Stock Photos From Dreamstime

Al Montasser Business Law Consultancy Centre – Legal Consultants

Ppco Silicon Valley Accounting Firmreal Estate Partnerships Beware Interest Deductions May Be Limited By Tax Shelter Status – Ppco Silicon Valley Accounting Firm

Running For The Tax Shelter – Turbotax Tax Tips Videos

Using Your Real Estate Investments As A Tax Shelter

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under – Ppt Video Online Download

What Is A Tax Shelter

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under – Ppt Video Online Download

Real Estate Development Definition Process And Management – Grin

Tax – Wikipedia

Ppt – Tax Shelter Powerpoint Presentation Free Download – Id69636

What Is A Tax Shelter Taxes Us News

The Boom In Tax Shelters – The New York Times

Tax Shelters For Real Estate Investors Morris Invest

The Incredible Tax Benefits Of Real Estate Investing

Tax Shelter Difference Between Tax Shelter And Tax Evasion

How Is A Tax Shelter Calculated In Real Estate

The Top Tax Court Cases Of 2018 Who Qualifies As A Real Estate Professional

Tax Shelters Definition Types Examples Of Tax Shelter