Otherwise employee pays 100%.) for employers of 25 or more employees, 60% of medical insurance portion of. Each year, the department of financial services sets the employee contribution rate to match the cost of coverage.

How The Tcja Tax Law Affects Your Personal Finances

The premium rate also increased in 2020, and employers can deduct up to 0.27% of employees’ gross wages, up to an annual cap of $196.72, to fund nys pfl insurance.

Ny paid family leave tax rate. New york paid family leave is insurance that is funded by employees through payroll deductions. In 2021, the contribution is 0.511% of an employee’s gross wages each pay period. You may request voluntary tax withholding.

Any benefits you receive under this program are taxable and included in your federal gross income. The maximum annual contribution is $423.71. The weekly contribution rate for new york paid family leave is 0.511% of the employee's weekly wage (capped at new york state's current average weekly wage of $1,450.17).

Paid family leave benefits now at target levels; 55% of employee's aww, up to 55% of saww: The new york department of financial services (dfs) is responsible for developing the rates and rate structure for the ny paid family leave program.

The weekly benefit amount will be 67% up to $971.61 per If employer of 25 or more employees, 40% of medical insurance portion, otherwise employee pays 100%) for employers of 25 or more employees, 60% of medical insurance portion of. 2020 ny paid family leave premium rate information.

Assist loved ones when a spouse, domestic partner, child or parent is deployed abroad on active military service. 0.75% (employees pay 100% of family leave portion. Rates will be announced by september 1 each year to be effective january 1 for the upcoming calendar year.

The maximum annual contribution is $385.34. 0.75% (employees pay 100% of family leave portion. 67% of employee's aww, up to 67% of saww

The premium rate for family leave benefits for coverage beginning january 1, 2019 shall reflect 0.153% of an employee’s gross wages each pay period up to and not to exceed an annual maximum employee contribution of $107.97. New york paid family leave is insurance that may be funded by employees through payroll deductions. The maximum contribution will be $385.34 per employee per year.

Bond with a newly born, adopted or fostered child, care for a family member with a serious health condition, or. In 2020, these deductions are capped at the annual maximum of $196.72. In 2021, employees who take ny pfl will receive 67% (increased from 60% in 2020) of the lesser of their average weekly wage (aww) or the statewide average weekly wage (saww) for up to 12 weeks of leave (up from 10 weeks in 2020).

An employee’s wages are capped at $1,305.92 per week, which means the. If employer of 25 or more employees, 40% of medical insurance portion; This rate is the same for all employees regardless of gender or age.

The new york department of financial services announced that the 2021 paid family leave (pfl) payroll deduction rate will increase to 0.511% of an employee's gross wages each pay period, up from 0.270% for 2020. In 2020, eligible employees can receive 60% of their average weekly wage (aww), up to a maximum of $840.70 per week, for up to 10 weeks under nys pfl. Your employer will not automatically withhold taxes from these benefits;

Rate for paid family leave will be 0.511% of the employee’s weekly wage (capped at the new york average annual wage of $75,408.84). 1887 to inform agencies of the 2021 rate for the new york state paid family leave program. The weekly contribution, determined by the state, is by employee and is 0.126% of an employee’s weekly wage.

If you are eligible for paid family leave, you pay for these benefits through a small payroll deduction equal to 0.270% of your gross wages each pay period. The maximum 2021 annual contribution will be. 2021 paid family leave rate increase share on december 23, 2020, the office of the state comptroller issued state agencies bulletin no.

50% of employee's aww, up to 50% of saww: The weekly contribution rate for new york paid family leave is 0.511% of the employee's weekly wage (capped at new york state's current. In 2022, the employee contribution is 0.511% of an employee’s gross wages each pay period.

Use the calculator below to view an estimate of your deduction. Rate is based on an employee’s salary. Paid family leave also provides:

Average weekly wage of $1,450.17). No deductions for pfl are taken from a businesses tax contributions. 60% of employee's aww, up to 60% of saww:

Paid family leave act rates are set by new york state and are state mandatory. If your employer participates in new york state’s paid family leave program, you need to know the following: Therefore, a maximum contribution of $7.41 per week per employee in 2021, regardless of age, gender, or

Salary Taxes Social Security

Missouri Income Tax Rate And Brackets Hr Block

Understanding Californias Sales Tax

Progressive Proportional And Regressive Taxes Boundless Economics

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

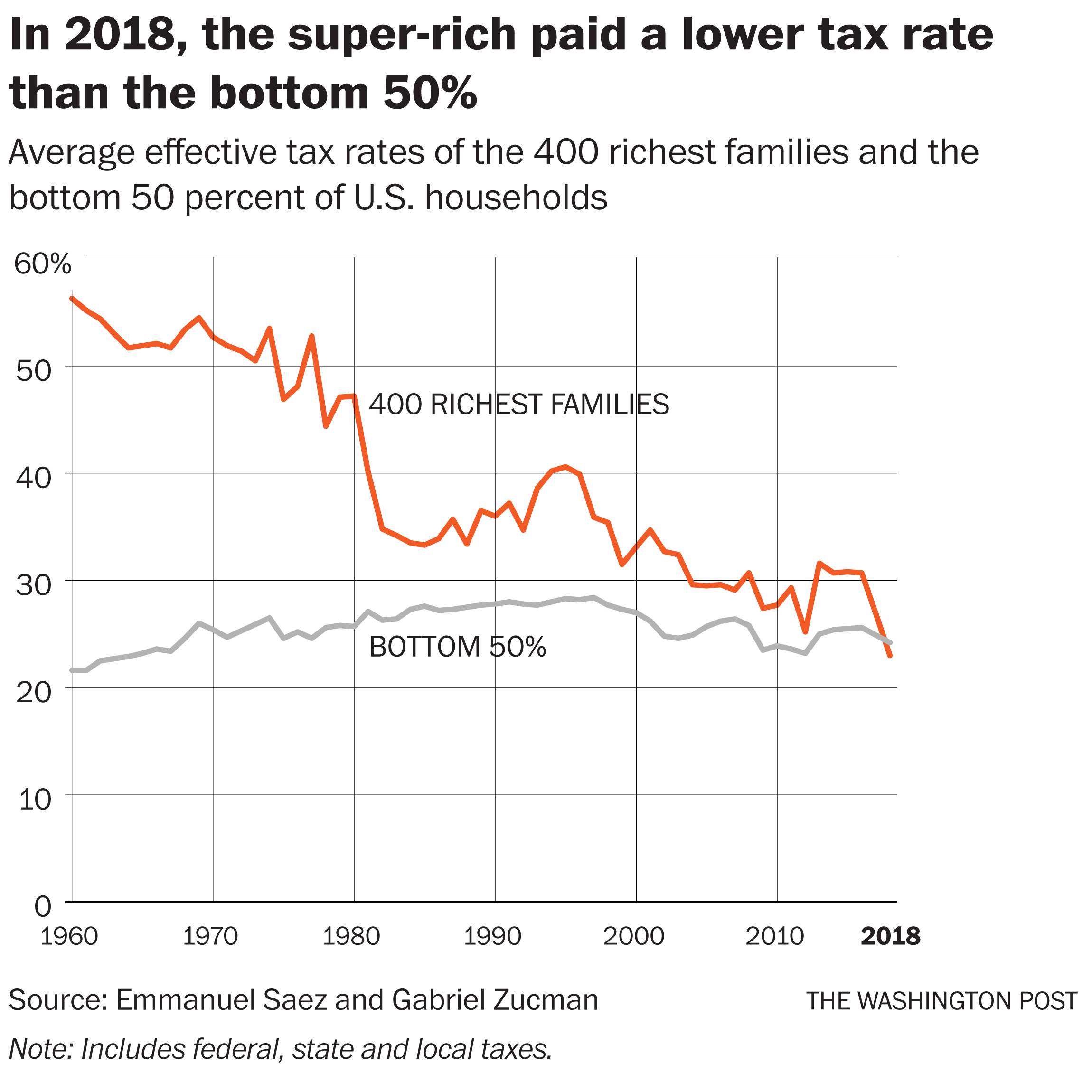

For The First Time In History Us Billionaires Paid A Lower Tax Rate Than The Working Class – The Washington Post

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

What Is Fica Tax Contribution Rates Examples

How Are My Taxes Affected By Receiving A Lump Sum Of Income – Wwwchadpeshkecom

Disability Living Allowance Child Claim Form Dla1a Dla Child A Guide Explaining The Full Process Of The Disability Living Allowanc Disability Allowance Carer

Wayfair And Your State Sales Tax Obligations In 2021 Business Structure Sales Tax Tax

:max_bytes(150000):strip_icc()/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How The Ideal Tax Rate Is Determined The Laffer Curve

Understanding Californias Sales Tax

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Cryptocurrency News Crypto And Visa Pay With Crypto Irs 1040 Crypto Question Cryptocurrency News Visa Visa Card

How Much Should I Set Aside For Taxes 1099

How To Calculate Basic Tax Rate With Vlookup

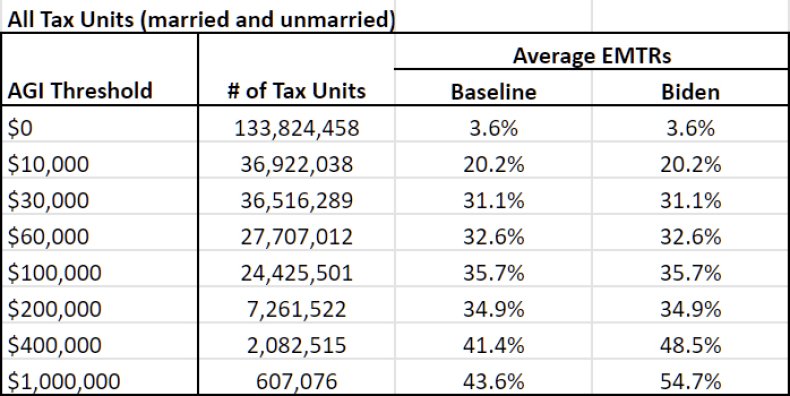

Joe Biden Tax Calculatorhow Democrat Candidates Plan Will Affect You

Payroll Tax What It Is How To Calculate It Bench Accounting