Reviews from corelogic employees about working as a tax specialist at corelogic. My taxes are paid out of my mortgage escrow.

Brian Riolo On Instagram 919 Of Us Homes Have Positive Equity Now Is The Time To Game Plan Your Future Put Your Money In Home Equity House Prices Equity

When your insurance or property tax bill comes due, the lender uses the escrow funds to pay them.

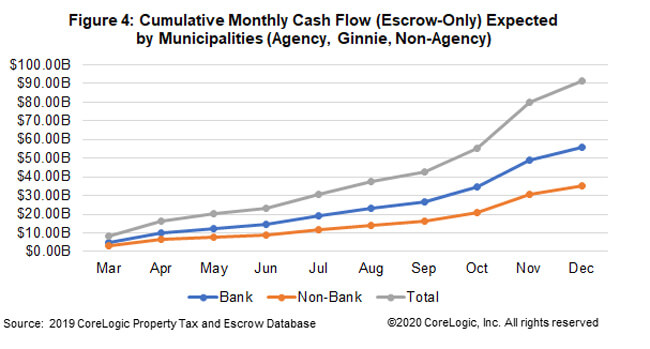

Does corelogic pay property taxes. The company also develops proprietary research, and tracks current and historical trends in a number of categories, including consumer credit,. Corelogic acquires national tax search, llc — acquisition expands commercial tax capabilities for corelogic customers — irvine, calif., september 25, 2019 — corelogic ® (nyse: These institutions use and benefit from the same law enforcement, fire protection and other basic services as other property owners.

Does corelogic pay property taxes. However, with an approved 100% tax exemption, you pay nothing and we do not collect funds in your escrow account to pay taxes. Cooper to pay your property taxes directly to the taxing authority or to have a check sent to you to pay the taxing authority directly.

Escrow accounts are set up to collect property tax and homeowners insurance payments each month. However, you have the opportunity to bid at the tax sale and buy the home. I have an issue to come up where another company called corelogic who mistakenly paid my property tax bill for three years.

After seeing core logic pop up on some properties that i was researching via the county website, i too was wondering about their role in paying taxes. A customer with an assessed home value of $200,000 may be assessed to pay 2% in tax of their homes value, $4,000.00. That way, you don’t have to keep up with the payment deadlines and you’re.

You may have to pay up to six months’ worth of property taxes and maybe even a year’s worth of insurance up front. Without an owner paying property taxes, the home may eventually get sold in the tax sale. Lenders expect borrowers who do not have escrow account to pay their property taxes when due.

Cooper by november 30th if you want to change your tax payment option. However, if supplemental taxes are not paid and the property.i contacted the authorities and the scammer disappeared.…i don’t work in the asset protection or foreclosure department, but it wouldn’t surprise me at all if one of their services was keeping property taxes current on properties where the. Their property tax bill, erroneously, was listed as zero.

Core logic is listed as the payer for my house, whereas chase is my mortgage company. They did this apparently back in 2005 through 2007. In texas, for example, one might pay taxes to a county, a school district and a municipal utility district (mud);

If your property is in wisconsin, you have the option for mr. When property taxes become delinquent, the lender’s security interest in the property may be at risk, and the lender may step in and pay these delinquent amounts to protect their lien priority. 127 employees reported this benefit.

Changes requested after that date will not take effect until the following year. Work culture was not the greatest. In california, one might only pay county taxes.

That was until i looked up my own house. Corelogic vacation & paid time off. This is an auction of.

Corelogic is the trusted source for property intelligence, with deep knowledge of powerful economic, social, and environmental forces that promote healthy housing markets and thriving communities. Teamwork was not accepted and favoritism was a huge issue. To provide a meaningful comparison of property tax rates among states, all existing levels of collection need to be considered.

You may not gain anything by paying the taxes, you are not the owner and don’t get an ownership interest in the home if. They waited another three years to actually inform me today of the issue. Since the beginning, corelogic has been driven by a single purpose—to innovate and create solutions that solve our clients’ toughest challenges in the housing market.

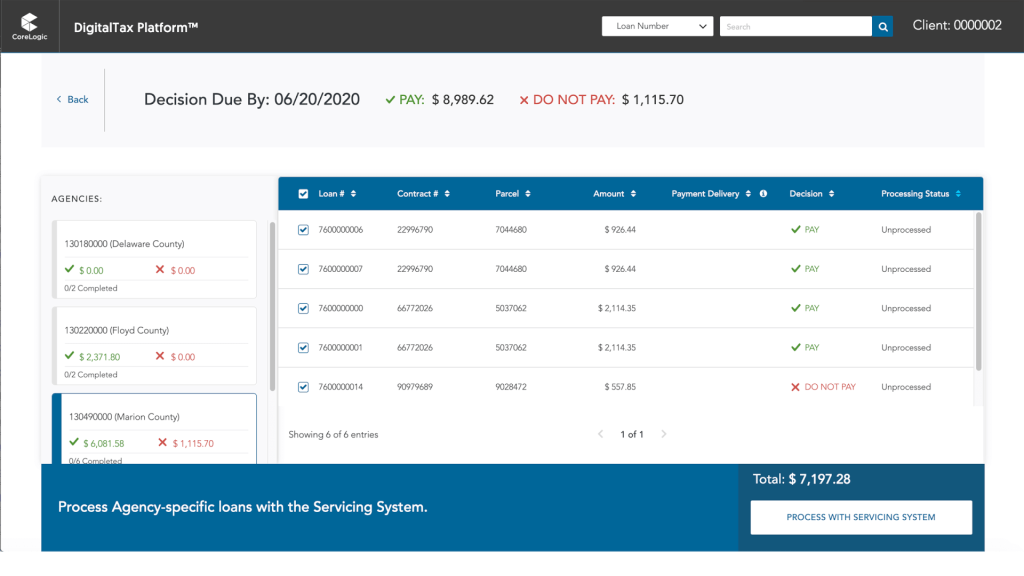

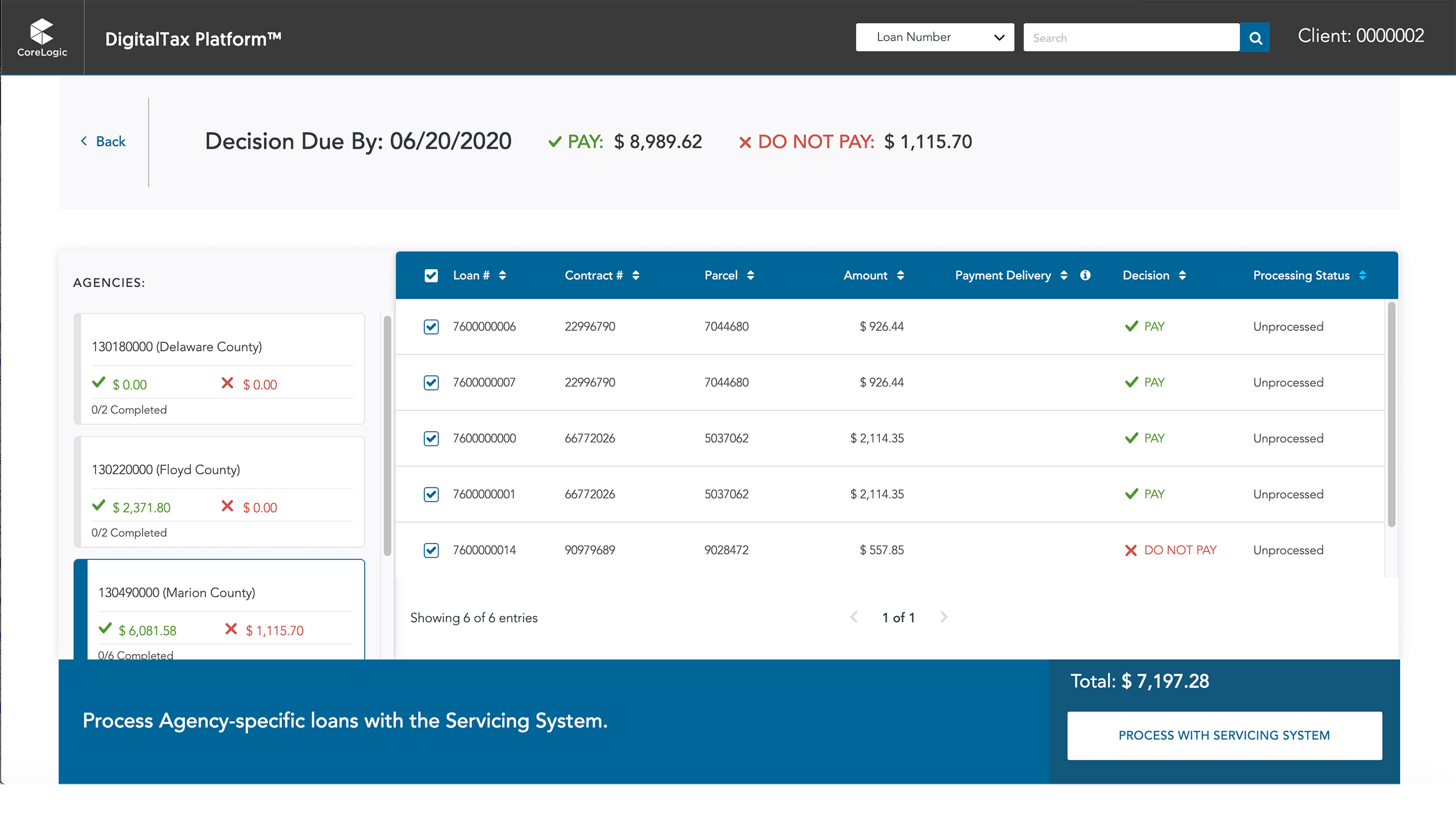

A note from corelogic to a prosecutor states that these account holders were exempt from paying any property taxes. The company analyzes information assets and data to provide clients with analytics and customized data services. Serving the needs of lenders, portfolio owners, investors and franchisors, corelogic commercial tax solutions helps eliminate property tax surprises.

Sizing The Risk Of Property Tax Revenue Disruption To Municipalities – Corelogic

Mr Cooper Selects Corelogic For Its Tax Payment Services Business Wire

2e9jdvbpig3iam

2 Charts That Show The Truth About Home Affordability What Is Credit Score Credit Score Home Ownership

915 Of Homes In The Us Have Positive Equity Mortgage Amortization Mortgage Loan Calculator Mortgage Amortization Calculator

Real Estate Property Data Solutions Corelogic

Commercial Property Tax Solutions Corelogic

With Forbearance Periods Ending Corelogic Looks At Options For Borrowers To Exit In 2021 The Borrowers Loan Modification Avoid Foreclosure

What Impact Will The New Tax Code Have On Home Values Simplifying The Market Httpwwwfinehomesbytinahareco Home Improvement Improvement Diy Real Estate

Residential Property Tax Solutions Corelogic

Jobs And Careers At Corelogic Indeedcom

Corelogic Provides Real-time Services To Streamline The Property Tax Process – Housingwire

Do You Know The Cost Of Waiting Waiting Until Next Year To Buy Could Cost You Thousands Of Dolla Real Estate Buyers Real Estate Investing Real Estate Advice

Real Estate Property Data Solutions Corelogic

Distressed Sales To Remain Elevated Into 2019 -corelogic Distressed Property Sale House Real Estate News

The Real Estate Board Of New York Selects Corelogic Property Data Marketplace Trestle As The Residential Listing Systems Backend Data Distribution Platform

Residential Property Tax Solutions Corelogic

Pin On Luxury Real Estate

Residential Property Tax Solutions Corelogic