A tax sheltered annuity (tsa) is a pension plan for employees of nonprofit organizations as specified by the irs, under sections 501 (c) (3) and 403 (b) of the internal revenue code. The chief advantage of a tsa is that it can help reduce your taxes.

Withdrawing Money From An Annuity How To Avoid Penalties

Choose a 403 (b) plan.

Tax sheltered annuity calculator. Suzy is a professor of rhetoric at a public university, with a $70,000 annual salary. How does a tax sheltered annuity work? Tax sheltered annuity a tax sheltered annuity, or tsa, is a long term retirement plan that provides a systematic, tax sheltered way to accumulate funds for retirement.

If someone works for a school or other qualifying teahouse organization covered under irc section 501(c) (3), they can accumulate money for your retirement in a special tax sheltered plan known as a 403(b). Under the partnership for compliance, trained and experienced irs The institution with which you established the tsa account derives profit from holding the principal, and it has agreed to pay interest to you for the privilege of using your money.

Use this calculator to help you determine how. You live longer than 10 years. There is no tax deduction for contributions made to a roth ira;

The payment that would deplete the fund in a given number of years. The early withdrawal penalty, if any, is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. But at age 72 the rmd table calls for.

Contributing to a roth ira could make a big difference in your retirement savings. An annuity is an investment that provides a series of payments in exchange for an initial lump sum. However, all future earnings could be sheltered from taxes, and qualified distributions are tax free, under current tax laws.

Assume your gross pay per pay period is $6,500. Deduct your contributions on line 15 of the 2020 schedule 1 (form 1040). Assume your gross pay per pay period is $6,500.00 and you are in the 33 percent tax bracket.

Round your answers to the nearest whole dollar.) question: (do not round intermediate calculations. The tool assumes that you will incur this 10%.

If you pull your funds out early, the bank profits less. If you withdraw money from your retirement account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax. It can provide a guaranteed minimum interest rate, with no taxes due on any earnings until they are withdrawn from the account.

Annuities held inside an ira or 401(k) are subject to rmds. If you transferred $100,000 to the ira annuity at age 72 you may receive $7,250 a year, or 7.25% of your premium in annual income (annuity rates change often, you can get your best annuity quotes from the blue calculator on this page). Employers can also contribute to employees' accounts.

Does the internal revenue service have any programs to help school systems comply with the law? Employees save for retirement by contributing to individual accounts.

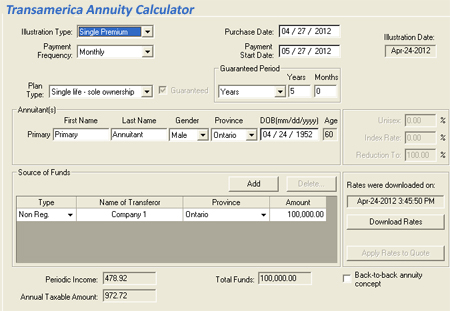

Transamerica Annuity Calculator Calculate Your Annuity Quote Using A Transamerica Annuities Calculator – Lifeannuitiescom

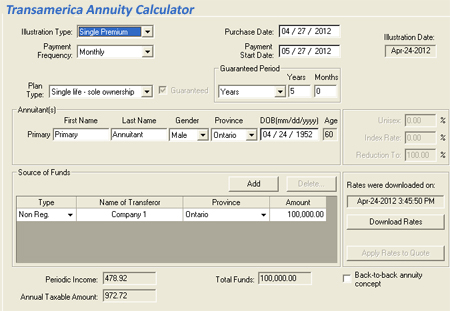

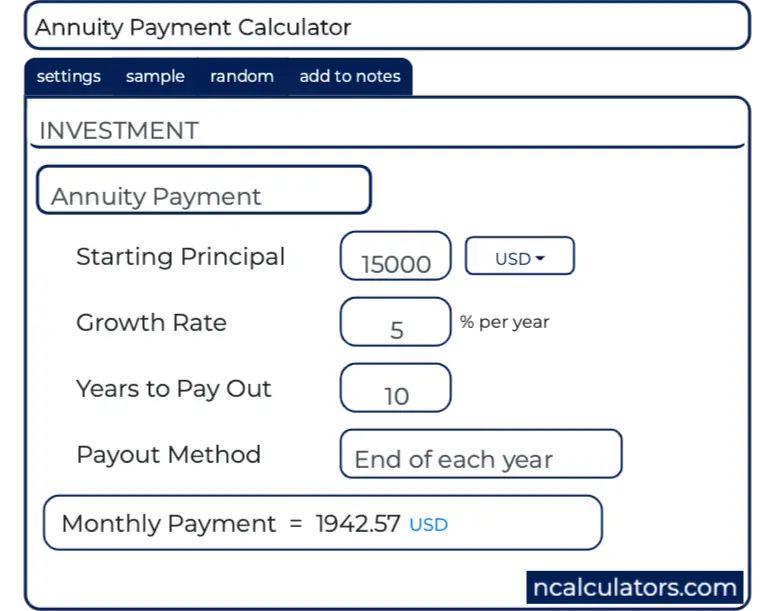

Free Annuity Calculator For Excel – Retirement Annuity Calculator

Retirement Calculator 49 Free Online Financial Planning Tools

What You Should Know About Tax-sheltered Annuities The Motley Fool

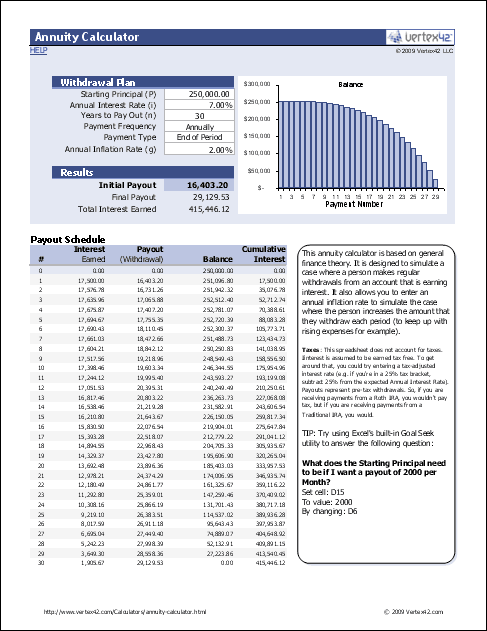

Annuity Payment Calculator

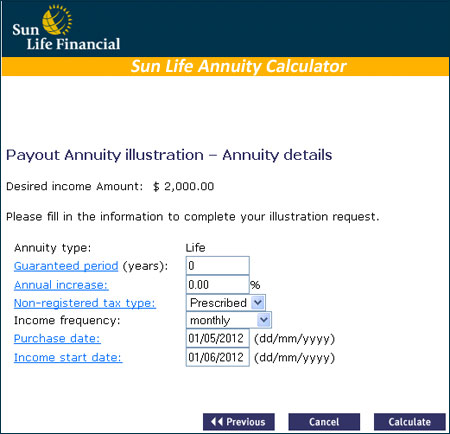

Sun Life Annuity Calculator Calculate Your Annuity Income – Lifeannuitiescom

Shutterstock – Puzzlepix

Free Annuity Calculator For Excel – Retirement Annuity Calculator

Fixed Index Annuity Calculator Let Us Find The Best Fit For You

Present Value Of Annuity Calculator

Computing The Value Of A Deferred Annuity Retirement – Youtube

Retirement Calculator 49 Free Online Financial Planning Tools

Annuity Investment Calculator Investment Annuity Calculator

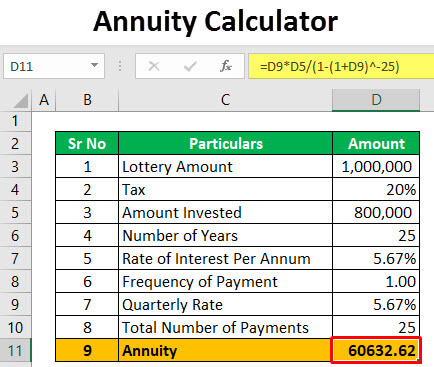

Annuity Calculator Examples To Calculate Annuity

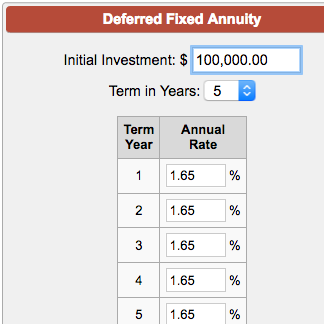

Deferred Fixed Annuity Calculator

Small Business – Chroncom

Obamacare Investment Tax – Problem For High-income Earners

What Is A Straight Life Annuity Retirement Watch

How To Figure Tax On Inherited Annuity