Under the current proposal, “gains realized prior to sept. Therefore, there could be an additional 8% tax on a transaction that closes in 2022 vs 2021.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Income from capital gains is classified as “short term capital gains” and “long term capital gains”.

Will long term capital gains tax change in 2021. Gains realized after that date would be taxed at a. As you can see above, individual taxpayers and heads of household will have to pay the additional 3.8% tax on income over $200,000. There are exceptions to this, such as when it was 15% from 2004 to 2012.

It also includes income thresholds for biden’s top rate proposal and the 3.8% niit: September 13, 2021, 9:48 am edt updated on september 13, 2021, 3:17 pm edt rate would rise from 20% under house panel’s proposal biden had wanted to boost rate to 39.6% for highest earners The proposal is bumping this up to 39.6%.

Currently, the capital gains tax rate for wealthy investors sits at 20%. We've got all the 2021 and 2022 capital gains tax rates in one. While it is unknown what the final legislation may contain, the elimination of a rate increase on capital gains in the draft legislation is encouraging.

The past ten years have seen a drastic drop on canadian tax rates and this. Will long term capital gains increase my tax bracket. Single filers with income over $523,600

Historically, capital gains tax has sat around 20%. There is a change on the horizon, which can take place as soon as 2022. For 2021 the top tax bracket includes the following taxpayers:

13 will be taxed at top rate of 20%; Capital gains tax rates for 2021 Tax increases in 2022 if you’re selling your privately held company, a key consideration may be closing the transaction before january 1, 2022 when new tax increases are likely to take effect.

House democrats propose raising capital gains tax to 28.8% published mon, sep 13 2021 3:33 pm edt updated mon, sep 13 2021 4:06 pm edt greg iacurci @gregiacurci The 2020 tax brackets are 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. See more tax changes and key amounts for the 2021 tax year;

The current proposal increases capital gains taxes to 25% (plus 3.8% net investment income tax) and provides that the top capital gains tax rate will kick in. A transition rule would protect gain recognized in 2021 that arise from transactions entered into prior to september 13, 2021 pursuant to binding written contracts.

Mutual Funds Taxation Rules Fy 2020-21 Capital Gains Dividends

Capital Gains Tax 101

Capital Gains Tax Calculator For Relative Value Investing

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

What You Need To Know About Capital Gains Tax

Long Term Capital Gain Ltcg Tax On Stocks And Mutual Funds Budget 2018 – Insurance Funda

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Definition 2021 Tax Rates And Examples

Understanding The Tax Implications Of Stock Trading Ally

What You Need To Know About Capital Gains Tax

Mutual Funds Taxation Rules Fy 2020-21 Capital Gains Dividends

Nft Tax Guide What Creators And Investors Need To Know About Nft Taxes Taxbit Blog

Capital Gains Taxes Explained Short-term Capital Gains Vs Long-term Capital Gains – Youtube

Long Term Capital Gain Ltcg Tax On Stocks And Mutual Funds Budget 2018 – Insurance Funda

Long-term Capital Gains Tax Rates In 2018 The Motley Fool

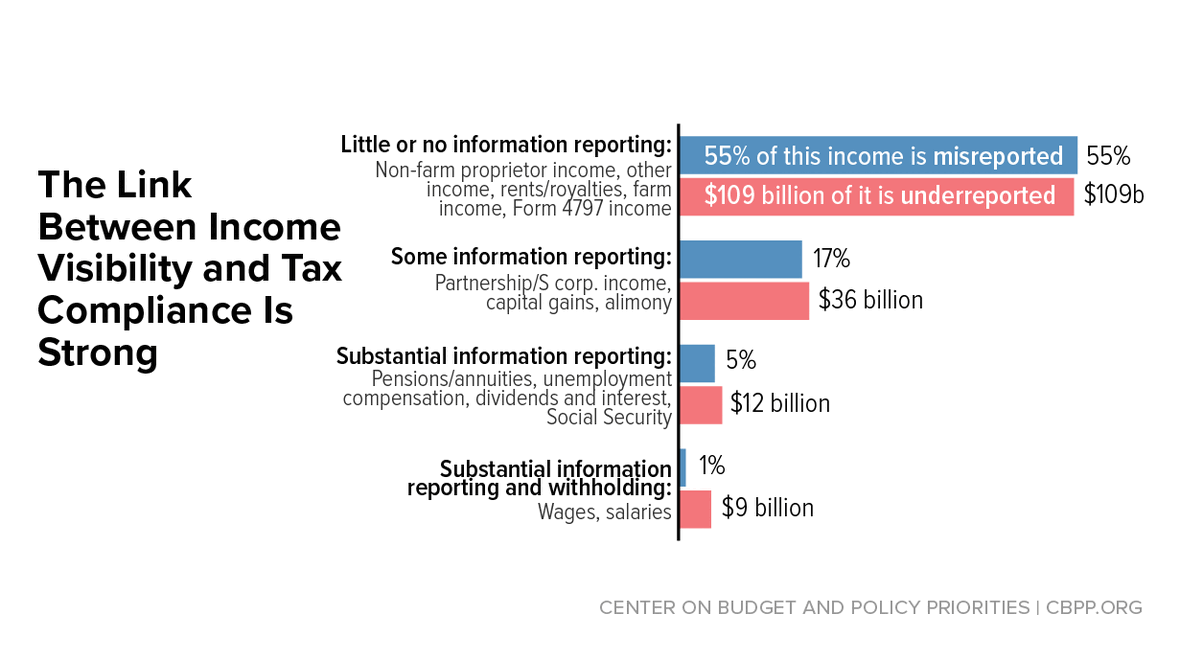

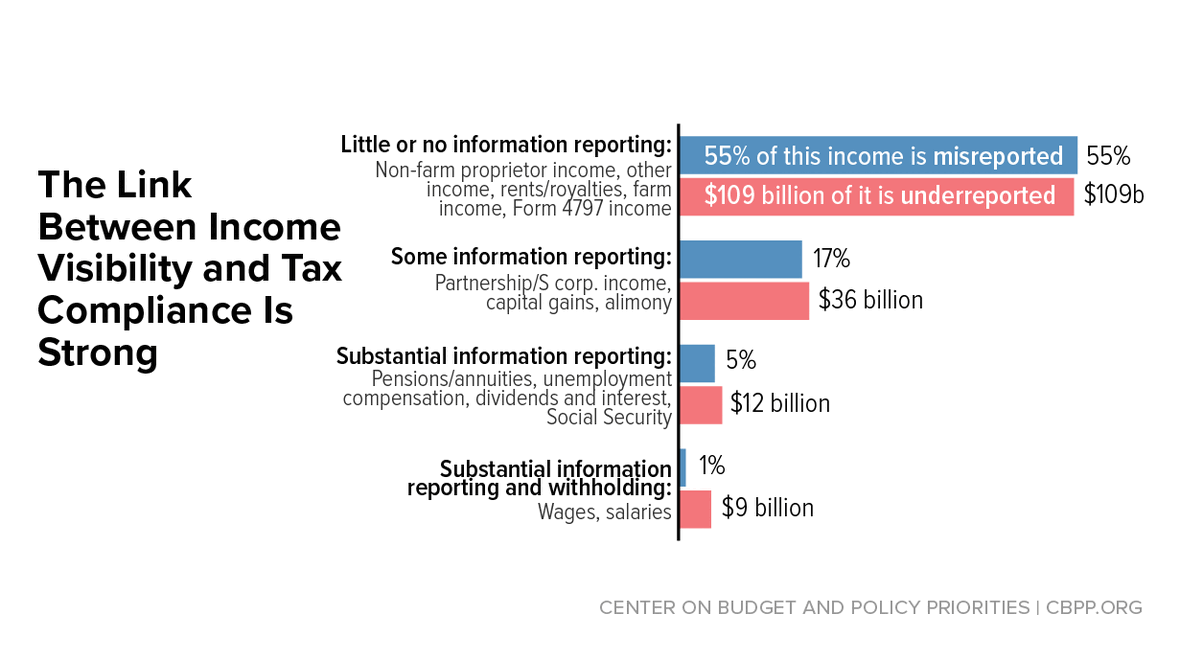

Build Back Better Requires Highest-income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Whats In Bidens Capital Gains Tax Plan – Smartasset

Section 54 54f Of Income Tax Act-capital Gains Exemption

How To Pay 0 Capital Gains Taxes With A Six-figure Income