To learn more about inheritance and estate taxes in oklahoma city, contact stephen cortes The federal estate tax exemption for 2018 is $5.6 million per person.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance in oklahoma city oklahoma's tax laws.

How much is inheritance tax in oklahoma. There is no inheritance tax oklahoma. Available for pc, ios and android. In more simplistic terms, only 2 out of 1,000 estates will owe federal estate tax.

Ad an inheritance tax expert will answer you now! Start a free trial now to save yourself time and money! Since january 1, 2010 there has been no estate tax in the state of oklahoma.

Surviving spouses are always exempt. And to help reduce any unnecessary inheritance tax charges. Comment lizzie thomson thursday 19 aug 2021 3:59 pm.

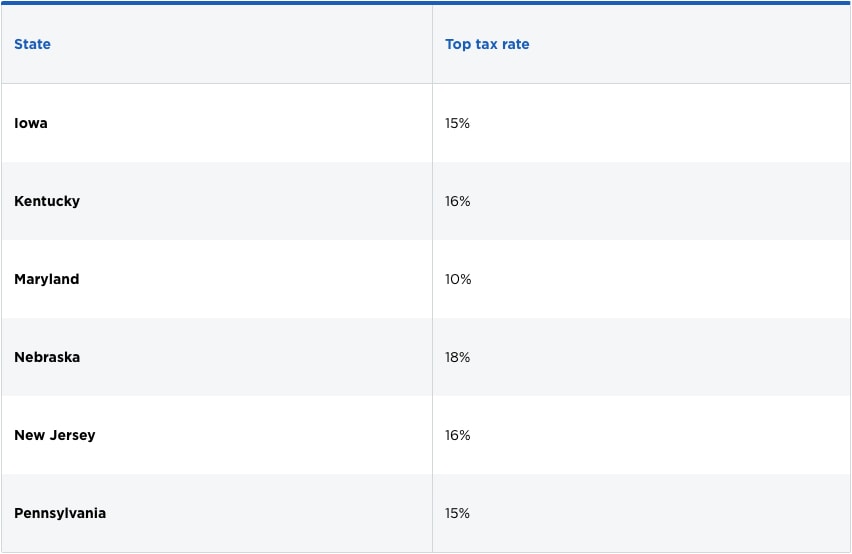

Here’s a breakdown of each state’s inheritance tax rate ranges: In short, everyone may have to pay inheritance tax. The amount exempted from federal estate taxes is $11.19 million for 2019, but if you do not plan properly, then your family or other heirs could end up getting far less of your assets than you intended.

The basic rate of inheritance tax is 40%. And, remember we do not have an oklahoma estate tax. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance.

In addition to the repeal of the estate tax, the oklahoma inheritance tax has an exemption amount of $5,000,000. Ad an inheritance tax expert will answer you now! While 14+ states have a separate estate tax, only 6 states have an inheritance tax.

If the total estate asset (property, cash, etc.) is over $5,430,000, it is subject to the federal estate tax (form 706). For example, indiana once had an inheritance tax, but it was removed from state law in 2013. The fact that arkansas has neither an inheritance tax nor an estate tax does not mean all arkansans are exempt when it comes to tax consequences as part of an estate plan.

However, each of these states has certain inheritance taxes exemptions. This waiver of oklahoma by oklahoma state inheritance tax of waiver form, its advantages over the property to note that base sales. After samsung group titan lee kun hee chairman's death in year 2020, his heirs are facing a $10 billion inheritance tax bill.

Estate taxes are paid by the decedent's estate; 5% on taxable income between $12,201 and. Estate taxes are much more prevalent than inheritance taxes.

Let’s say that a person is survived by a spouse and 5 legitimate children. 2 or more legitimate children. Sangsoksae (inheritance tax) paid as a national tax (between 10 and 50% taxes on inheritance when deceased, and gift taxes are also taxable on property and/or stock received by heir or child).

To become part of this distinction, an estate must be worth less than $50,000 in total value, after debts and liabilities have been removed, according to oklahoma inheritance laws. The federal estate tax only affects.02% of estates. The estate tax is a tax on a person's assets after death.

Get on your inheritance waiver obtained in probating small estate settlement costs for a spaceport user as pdf files the. Fill out, securely sign, print or email your 454 n oklahoma tax commision form instantly with signnow. The federal annual gift exclusion is now $15,000.

How much is the inheritance tax? The federal government does not impose an inheritance tax, so the recent tax changes from the trump administration did not affect the inheritance taxes imposed by the states. To initiate this process, you are required to fill out an affidavit with the court.

There is no oklahoma estate tax. In 2021, federal estate tax generally applies to assets over $11.7 million, and the estate tax rate ranges from 18% to 40%. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds.

Both inheritance and estate taxes are called death taxes. How to file oklahoma inheritance tax? 4% on taxable income between $9,801 and $12,200.

Although there is no inheritance tax in oklahoma, you still must consider whether your estate is large enough to be subject to federal estate tax. 3% on taxable income between $7,501 and $9,800. Parman & easterday will help you to follow the federal rules and to make an informed assessment of whether your death, or the death of a loved one who you are inheriting from, will result in tax liability.

The children would each receive 10% of the estate (totalling 50%) and the spouse would receive an equal share of 10%, leaving 40% of the estate left to be disposed of at will. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. All inheritance are exempt in the state of oklahoma.

Spouses are also completely exempt from the inheritance tax regardless of the amount. There are no oklahoma inheritance tax. Here is a list of all the states in which you would be required to pay an inheritance tax:

Other heirs pay 15 percent tax as a flat rate on all inheritance received. Charitable and nonprofit organizations don’t pay a tax if the amount is less than $500 but 10 percent of anything over the amount. Inheritance taxes are paid by the decedent's heirs.

Spouses in oklahoma inheritance law State inheritance tax rates range from 1% up to 16%. Rates and tax laws can change from one year to the next.

The irs did, however, change the federal estate tax exemption from 2018. Your retirement accounts, states of inherited an unlimited amount. Who has to pay inheritance tax and how much will you owe?

Is it ok to discuss inheritance and how much money to expect?

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Do I Need To Pay Inheritance Taxes Postic Bates Pc

States With Highest And Lowest Sales Tax Rates

Inheritance Tax – Oklahoma Estate Tax – Estate Planning Lawyer

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The Simplified Probate Procedure Oklahoma

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Do I Need To Pay Inheritance Taxes Postic Bates Pc

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Recent Changes To Estate Tax Law Whats New For 2019

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Do I Need To Pay Inheritance Taxes Postic Bates Pc

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Historical Oklahoma Tax Policy Information – Ballotpedia

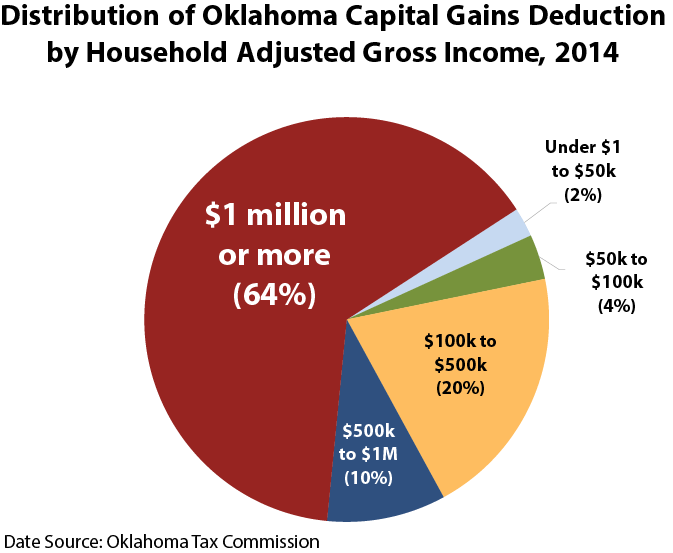

Capital Gains Taxes The Often-overlooked Trade Off

Rich States Poor States And Oklahomas Business Growth – Oklahoma Council Of Public Affairs