No, never can funeral expenses be claimed on taxes as a deduction. Funeral expenses are not tax deductible because they are not qualified medical expenses.

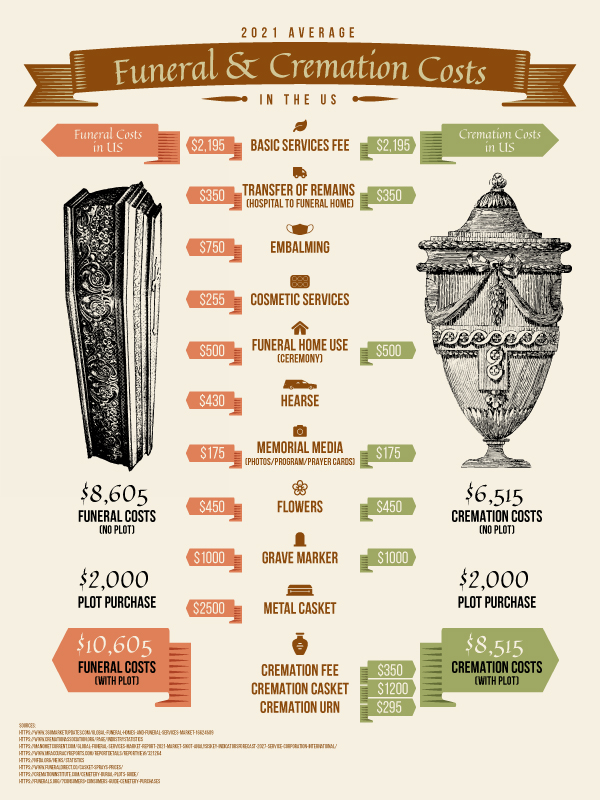

Funeral Costs And Cremation Cost What No One Is Talking About – Final Expense Direct Best Burial Insurance Rates Companies 2021

The costs of funeral expenses, including embalming, cremation, casket, hearse, limousines, and floral costs, are deductible.

Are funeral expenses tax deductible in california. Individual taxpayers cannot deduct funeral expenses on their tax return. According to internal revenue service guidelines, funeral expenses are not deductible on any individual tax return, including the decedent's final. You can deduct the final medical bills that you had to pay.

What funeral expenses are deductible? In order to deduct funeral expenses, filers should fill out schedule j which is attached to irs form 706. The amount of the expenses claimed from the succession will be deducted, if applicable, from the death benefit paid by retraite québec , provided the deceased gave entitlement to that benefit.

While the irs allows deductions for medical expenses, funeral costs are not included. Who cannot deduct funeral expenses? In the context of an individual's income tax returns — form 1040 — funeral and burial expenses are not treated as qualified expenses in the same way.

So the state board of equalization, which interprets tax law, wants to make sure california is getting its 8.25 percent cut. The irs deducts qualified medical expenses. Reimbursed medical expenses (such as prescription drug claims)

Qualified disaster relief payments in this case include amounts paid for an individual’s “reasonable and necessary personal, family, medical, living or funeral expenses incurred as a result. Funeral expenses tax deductible for estates only. This deduction is limited to the amount that exceeds 7.5 percent of your income and is grouped with other allowable itemized deductions:

Funeral expenses are part of the charges on the succession and can be claimed by the person who paid them. Funeral expenses should be itemized on line 1, section a, and the total of the expense should be entered under “total.” if the estate was reimbursed for any of the funeral costs, the reimbursed amount must be deducted from your total expenses before claiming them on form 706. Sometimes people mistakenly claim costs that are not eligible for tax deductions.

This may include government payments such as social security or veterans affairs death benefits. Body preparation services including embalming or cremation; Make sure you know what you can and can’t claim.

Funeral and burial expenses are only tax deductible if they’re paid for by the estate of the deceased person. The internal revenue service (irs) sets strict rules about what expenses can and cannot be deducted from your tax bill. The estate itself must also be large enough to accrue tax liability in order to claim the deduction.

If your loved one incurred fees from the hospital, use of medical equipment, lab services, prescriptions, medical supplies, or routine exams, you must itemize your tax return. In other words, funeral expenses are tax deductible if they are covered by an estate. Deductible medical expenses may include, but are not limited to the following:

In short, these expenses are not eligible to be claimed on a 1040 tax form. They are never deductible if they are paid by an individual taxpayer. If the cra finds a mistake, we will adjust your return.

Furthermore, the irs typically qualifies tax deductions on medical expenses. However, funeral expenses can qualify as tax deductions when the costs are paid out of a decedent’s estate. Funeral expenses are never deductible for income tax purposes, whether they’re paid by an individual or the estate, which might also have to file an income tax return.

Common adjustments are made for things such as: Qualified medical expenses must be used to prevent or treat a medical illness or condition. In other words, if you die and your heirs pay for the funeral themselves, they will not be able to claim any deductions for those expenses on their taxes.

As with any other creditor of the succession, supporting documents must be provided. It’s big business these days in the funeral business. Any expenses directly related to the burial and memorial service can be deducted as long as they are directly and reasonably related to the homegoing ceremony.

State and local taxes, real estate tax, mortgage interest, and charitable contributions. Unfortunately, funeral costs and car loans are not deductible. By itemizing your tax return, you will no.

Crowdfund A Funeral A New Way To Cover Funeral Costs – Us Funerals Online

Can I Deduct Funeral Expenses From My Income Taxes – Debtcom

Free Download Will Form Download California Last Will And Testament Form Last Will And Testament Will And Testament Templates

2

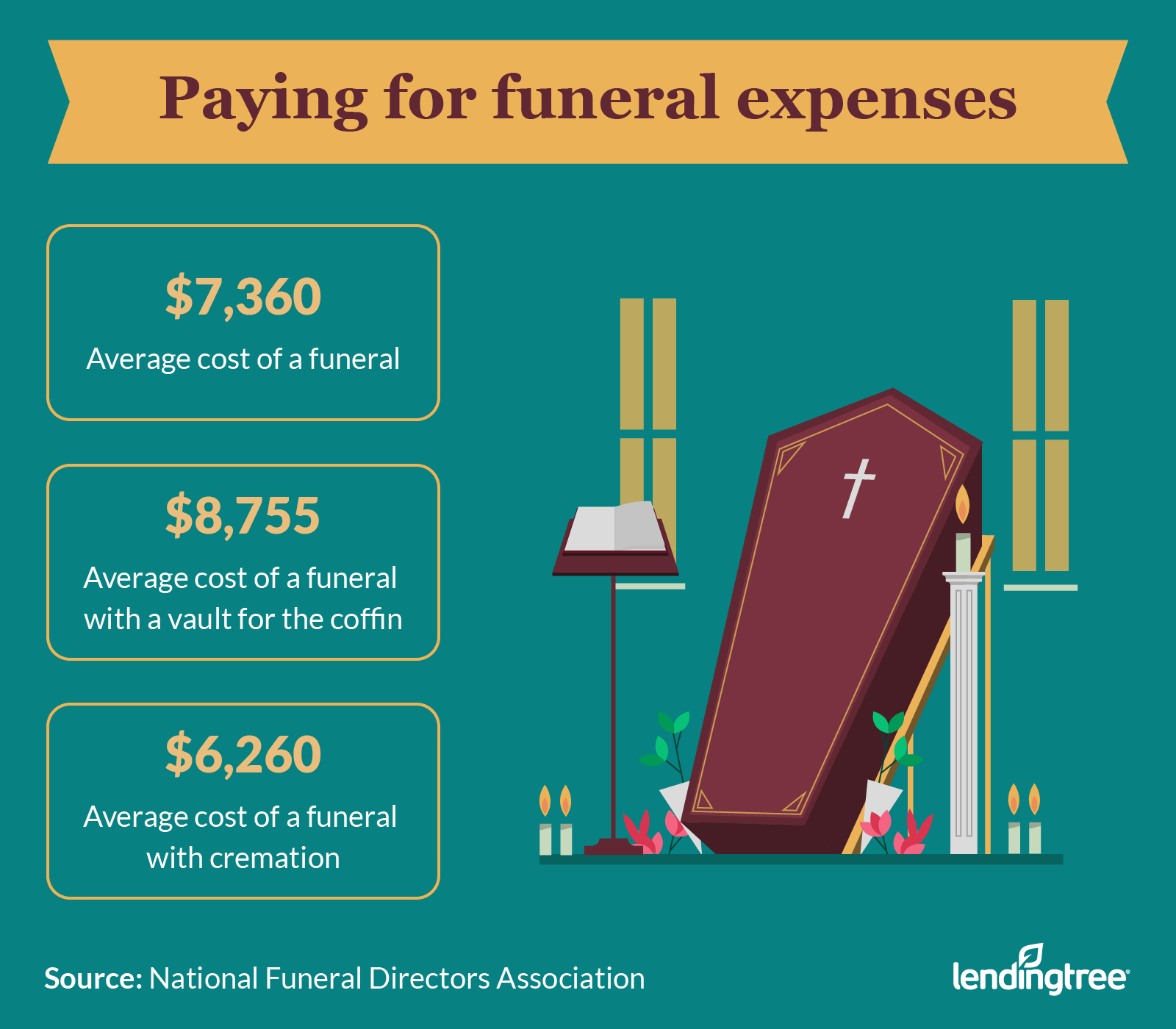

Can I Pay For A Funeral With A Loan Lendingtree

California

2

2

Funeral Costs And Cremation Cost What No One Is Talking About – Final Expense Direct Best Burial Insurance Rates Companies 2021

California Funeral Burial Insurance Costs Faqs Etc – Lincoln Heritage

2

2

Consumer Information

Will California Sample – Example Statutory Health Care Directive

2

2

Consumer Information

Help With Funeral Costs Burial Funds Programs Charities

Conference Registration Form Template Word Best Of Conference Registration Form 1 Fr Event Registration Registration Form Customer Satisfaction Survey Template