Securities acquired at an undervalue. The finance bill change effectively restricts the amount which is excluded from being taxed as income under the disguised investment management fee rules by virtue of being carried interest.

Policy Paper Overview Capital Gains Tax Carried Interest – Govuk

5 employment income tax analysis.

Carried interest tax uk. The tax treatment of carried interest had also been well established in the uk, with capital gains tax treatment agreed with the government in the late 1980s. 4 carried interest income tax regimes. Others argue that it is consistent with the tax treatment of other entrepreneurial income.

Carried interest is tax advantaged in several other ways as well. The minimum cgt rate of 28% only applies to long term gains and does not apply to income included in carried interest distributions (income is taxed at 38.1% or 45%, which can make the The uk now has one of the highest rates of tax o n carried interest in europe and internationally.

And, under new uk tax rules, access to that tax treatment has been preserved for most private equity and venture capital funds. As reported in private equity comment earlier this month, with effect from 8 july 2015, all carried interest holders in the uk will pay tax at the full rate of capital gains tax (currently 28% for higher earners) without any allowance for the acquisition cost of the underlying assets. However, tweaking carried interest to tax it at 47% would, even on labour’s figures, make only a very small dent in this.

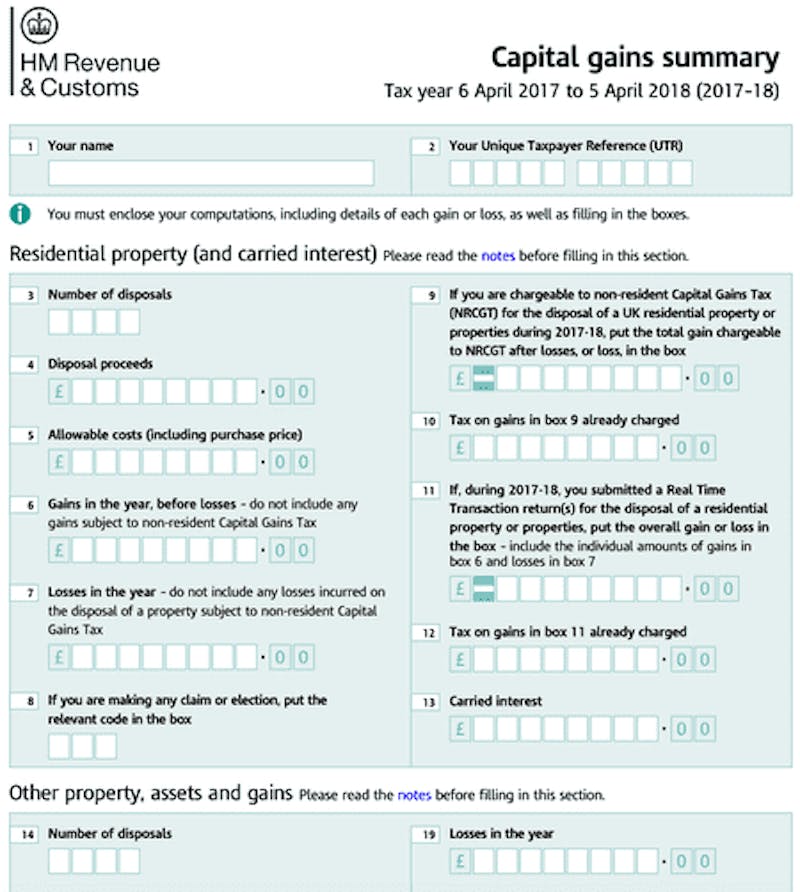

There is clearly a need to use the tax system to plug at least some of the funding gap and realistically taxes are going to have to rise. Other definitions of carried interest. This tax information and impact note deals with changes to the carried interest rules for capital gains tax announced at autumn budget 2017.

Those rules apply to carried interest arising on or after 8 july 2015 but also contained transitional rules. This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true, economic gain; The company pays corporation tax on the carried interest amount.

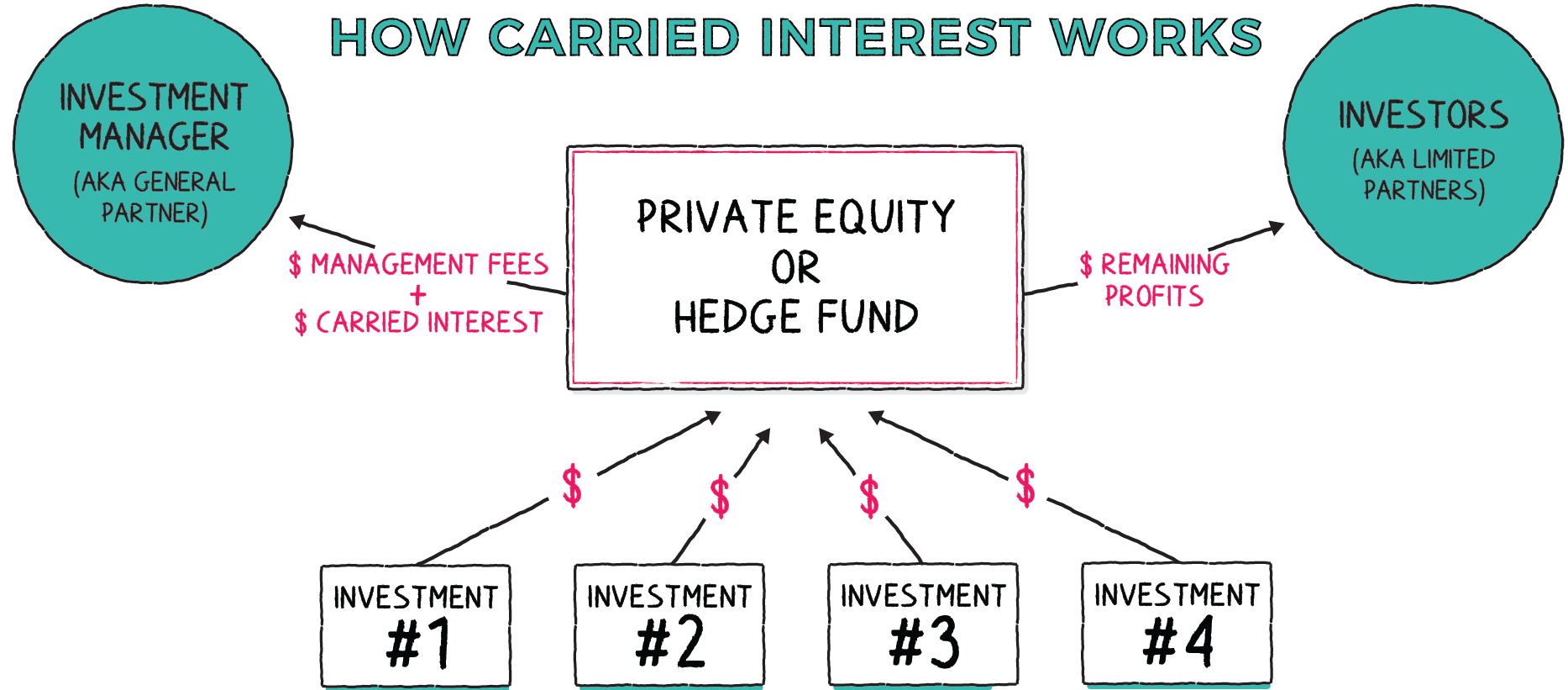

Carried interest, income flowing to the general partner of a private investment fund, often is treated as capital gains for the purposes of taxation. Tcga92/s103kg(2) provides that if carried interest meets the “deferred carried interest” conditions and arises to a company connected with an individual (a) or a person who is not connected. Priority of carried interest payment.

A key exemption from these rules is the ‘carried interest’ exemption, which if met means that amounts should be subject to capital gains tax at a lower rate of 28%. Even within this exemption amounts can still be brought back within the dimf rules if certain conditions are not met. However, the rate of cgt applicable to carried interest remains at 28%, whereas a rate of 20% applies to most other types of capital gain.

Under the current rules, carried interest—an individual fund manager's enhanced share of profits realized from investments—is taxed as capital gains at 28%, while income is taxed at a rate of at least 40% for those making above £50,000 (about $63,000). Carried interest holders' employment status. Moreover, those payments were taxed as capital gains at just 28%, instead of as income, at 45%.

Not everyone in private equity receives carried interest. A capital gains charge under the carried interest rules will therefore be levied on the fund manager. Before 2015, there was no specific uk regime for the taxation of carried interest.

From 6 april 2016 amounts of carried interest that arise from funds which do not hold their assets for 40 months or more can be classed as income based carried interest and will be charged to tax. 3 taxation of carried interest in the uk 23 by james mccredie and alicia thomas, macfarlanes llp the underlying rules — partnership taxation 26 special rules 28 taxation on award of carried interest 39 carry in other jurisdictions and direction of travel 41 summary of carried interest taxation 41 Carried interest rules were introduced in july 2015 to ensure that carried interest is subject to tax as a capital gain as a minimum.

Debevoisecom

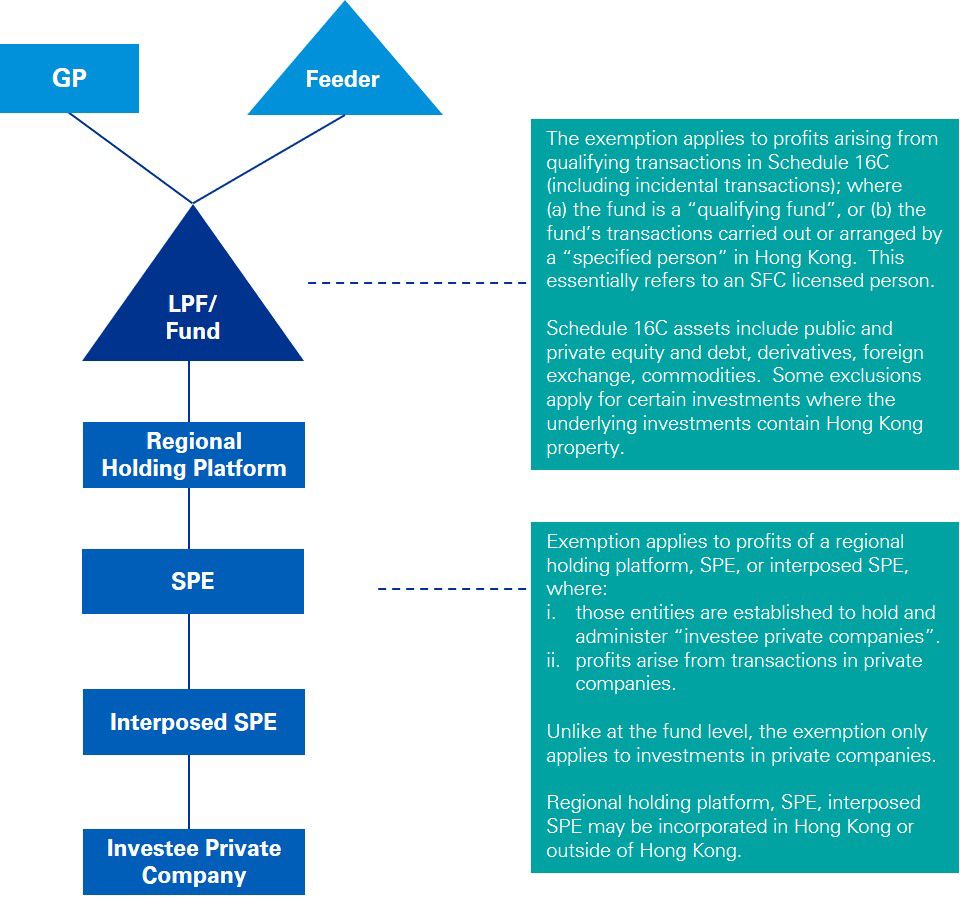

Asset Management Update – Kpmg China

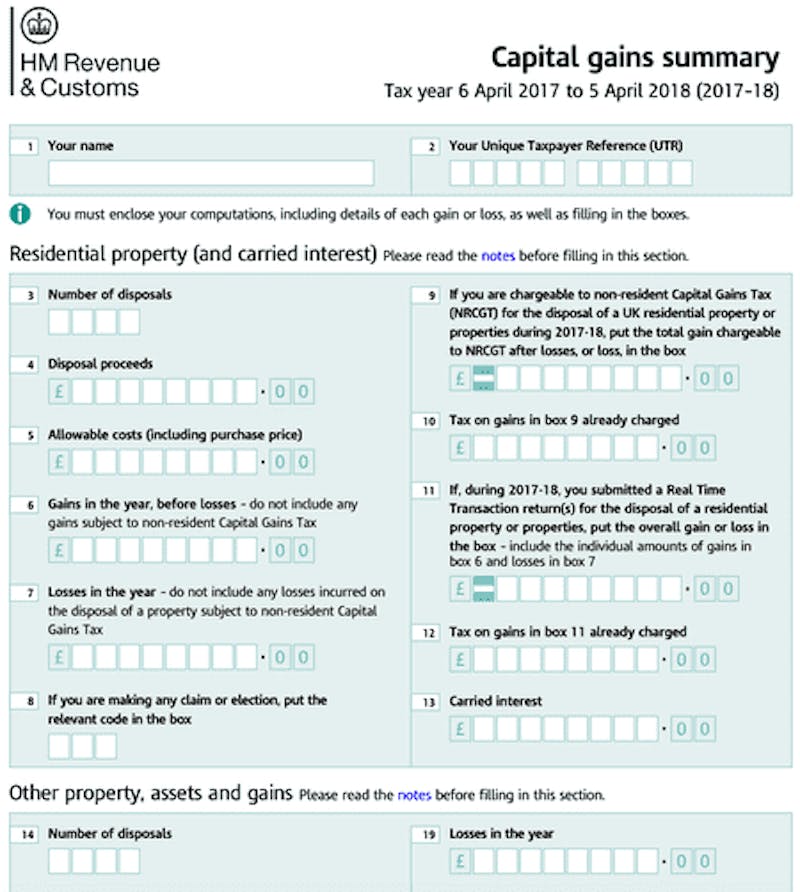

Capital Gains Tax Commentary – Govuk

Selling Your Home Low Incomes Tax Reform Group

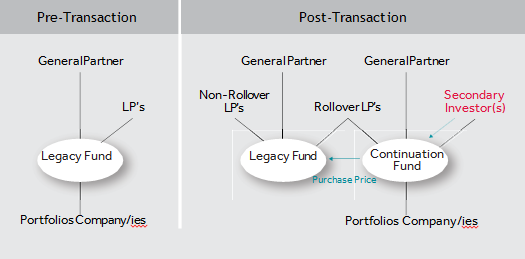

Navigating The Nuances Of Continuation Funds 12 2020 Publications Insights Publications Debevoise Plimpton Llp

Debevoisecom

Debevoisecom

Bvcacouk

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Pin On Economy Infographics

How Does Carried Interest Work – Napkin Finance

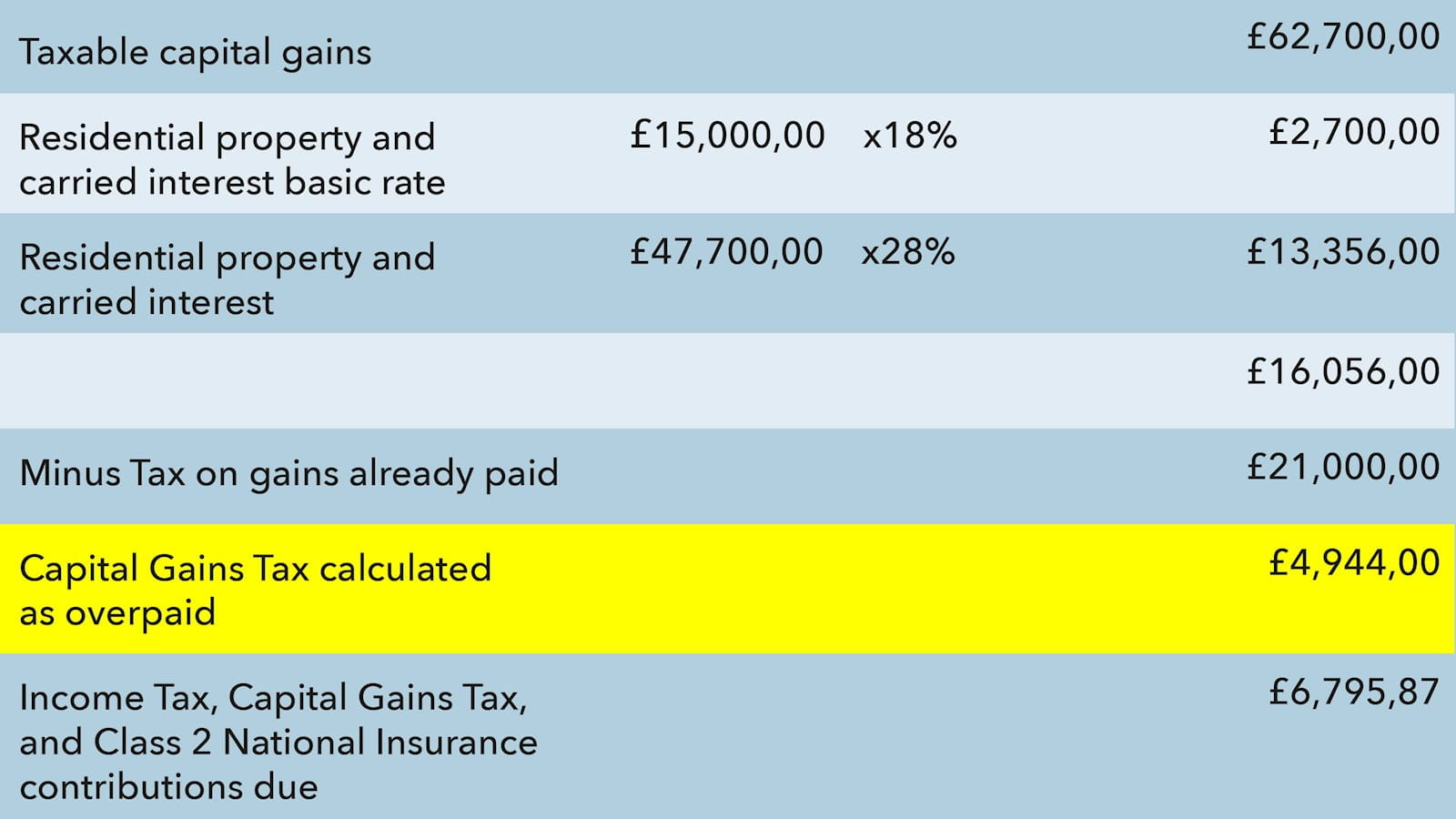

Offsetting Overpaid Cgt Against Income Tax Icaew

Basics Of Corporate Interest Restriction – Understand The Cir – Bdo

Definitive Guide To Carried Interest Book Private Equity International

Policy Paper Overview Capital Gains Tax Carried Interest – Govuk

How Does Carried Interest Work – Napkin Finance

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

Carried Interest In Private Equity Calculations Top Examples Accounting

Definitive Guide To Carried Interest Book Private Equity International