17 aug 2021 qc 16608. Ad easy recipe costing, inventory(voice active), wastage tracking, nutritional info

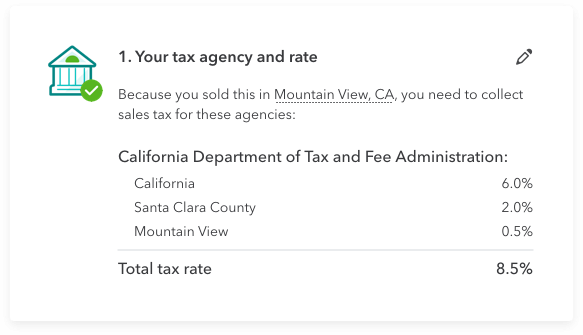

Understanding Californias Sales Tax

That means that, as of oct.

Food tax calculator pa. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: Using the united states tax calculator is fairly simple. A calculator to quickly and easily determine the tip, sales tax, and other details for a bill.

Percent of income to taxes = 32%. Mypath functionality will include services for filing and paying personal income tax, including remitting correspondence and documentation to the department electronically. Last updated november 27, 2020

Free vat (value added tax) calculator to find any value given the other two of the following three: This calculator is always up to date and conforms to official australian tax office rates and formulas. The following are the key rates applicable to gst on food services*:

For state, use and local taxes use state and local sales tax calculator. Also, gain some understanding of vat, or explore hundreds of other calculators addressing topics such as finance, math, fitness, health, and many more. Find out if you may be eligible for food stamps and an estimated amount of benefits you could receive.

Total price is the final amount paid including sales tax. 1, 2009, if you have one person in your household, you can qualify for snap if you earn less than $1,444 per month before taxes. Next, select the 'filing status' drop down menu and choose which option applies to you.

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Use tax is due when sales tax is not paid on cigarettes and little cigars brought into pennsylvania. This calculator helps you to calculate the tax you owe on your taxable income.

Using the united states tax calculator. The net before tax price, vat tax rate, and final vat inclusive price. Exact tax amount may vary for different items.

If you are filing taxes and are married, you have the option to file your taxes along with your partner. Use this app to split bills when dining with friends, or to verify costs of an individual purchase. Calculate a simple single sales tax and a total based on the entered tax percentage.

Cigarette tax is calculated by multiplying the number of cartons by the current tax rate. Determine your family's gross monthly income. This is an unofficial calculator and not an application.

Use this calculator to quickly estimate how much tax you will need to pay on your income. The pennsylvania state sales tax rate is 6%, and the average pa sales tax after local surtaxes is 6.34%. 2021 pennsylvania state sales tax.

The pennsylvania (pa) state sales tax rate is currently 6%. While pennsylvania's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. First, enter your 'gross salary' amount where shown.

Tuloy pa rin ang exemption ng mga minimum wage earner at ofw sa personal income tax. Depending on local municipalities, the total tax rate can be as high as 8%. Total estimated tax burden $18,072.

We strive to make the calculator perfectly accurate. Walang impormasyon na kinukuha ang dof mula sa mga datos na ipinabahagi sa tax calculator na ito para maprotektahan ang privacy ng lahat. There are three steps in calculating tax payments and total amounts due on cigarette and little cigar purchases.

In most cases, your employer will deduct the income tax from your wages and pay it to the ato. In order to receive food stamps in pennsylvania, your family's income before taxes must be below 130 percent of the poverty line. The provided information does not constitute financial, tax, or legal advice.

Check how much taxes you need to pay on cerb, crsb, cesb & crb and much more. This link opens in a new window. Net price is the tag price or list price before any sales taxes are applied.

Pennsylvania has a 6% statewide sales tax rate , but also has 69 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.122% on. 5% gst on restaurant services including room service and takeaway provided by restaurants located within a hotel featuring room tariff less than rs. Select state alabama alaska arizona arkansas california colorado connecticut delaware district of columbia florida georgia guam hawaii idaho illinois indiana iowa.

Pennsylvania is one of the few states with a single, statewide sales tax which businesses are required to file and remit electronically. Ad easy recipe costing, inventory(voice active), wastage tracking, nutritional info Your household income, location, filing status and number of.

Designed for mobile and desktop clients. This page describes the taxability of food and meals in pennsylvania, including catering and grocery food.

Pennsylvania Sales Tax – Small Business Guide Truic

Learn How Quickbooks Online Calculates Sales Tax

Calculator How Much Must You Earn At A Job In Another State To Maintain Your Quality Of Life Best Places To Live Cheapest Places To Live States In America

Budget Tax Calculator How Rishi Sunaks Changes Will Affect Your Finances Evening Standard

Is Food Taxable In Pennsylvania – Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

Sales Tax Calculator

Sales Tax Calculator

Understanding Californias Sales Tax

Freetaxusa Federal State Income Tax Calculator – Estimate Your Irs Refund Or Taxes Owed

Rhode Island Income Tax Calculator – Smartasset

Llc Tax Calculator – Definitive Small Business Tax Estimator

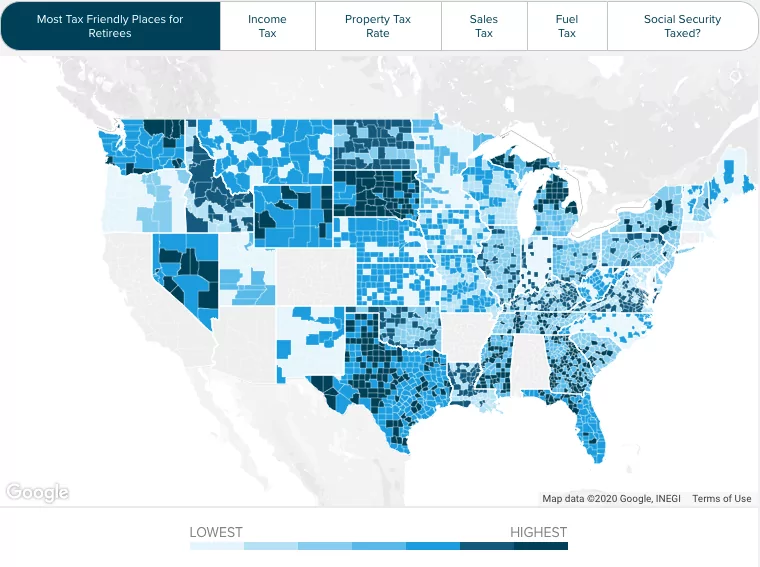

States With Highest And Lowest Sales Tax Rates

Sales Tax On Grocery Items – Taxjar

Tax Calculator For Freelancers – Banking For Freelancers With No Account Fees

Indiana Retirement Tax Friendliness – Smartasset

Llc Tax Calculator – Definitive Small Business Tax Estimator

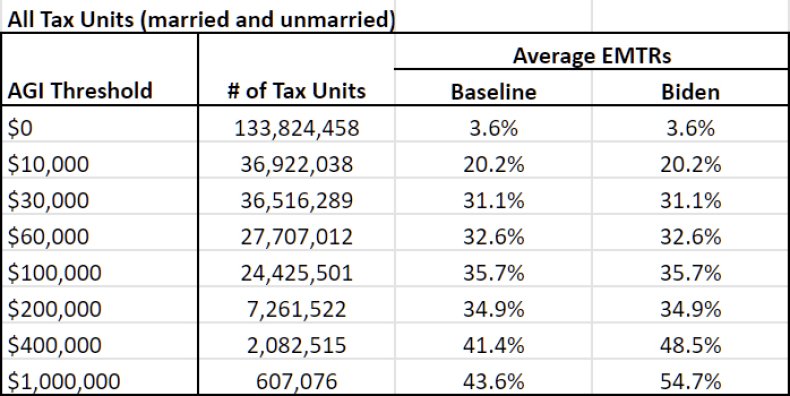

Joe Biden Tax Calculatorhow Democrat Candidates Plan Will Affect You

How To Charge Your Customers The Correct Sales Tax Rates