But 17 states and the district of columbia may tax your estate, an inheritance or both, according to the tax foundation. Do you have to pay taxes on an inheritance in texas?

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas does not have a state estate tax or inheritance tax.

Does texas have state inheritance tax. 6 states have inheritance taxes. Twelve states and the district of columbia impose estate taxes and six impose inheritance taxes. Most of the taxes in texas are sales taxes, as well as taxes on businesses and specific industries.

Eleven states have only an estate tax: No estate tax or inheritance tax. But there is a federal gift tax that people in texas have to pay.

Maryland is the only state to impose both. Connecticut, hawaii, illinois, maine, massachusetts, minnesota, new york, oregon, rhode island, vermont and washington. Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent.

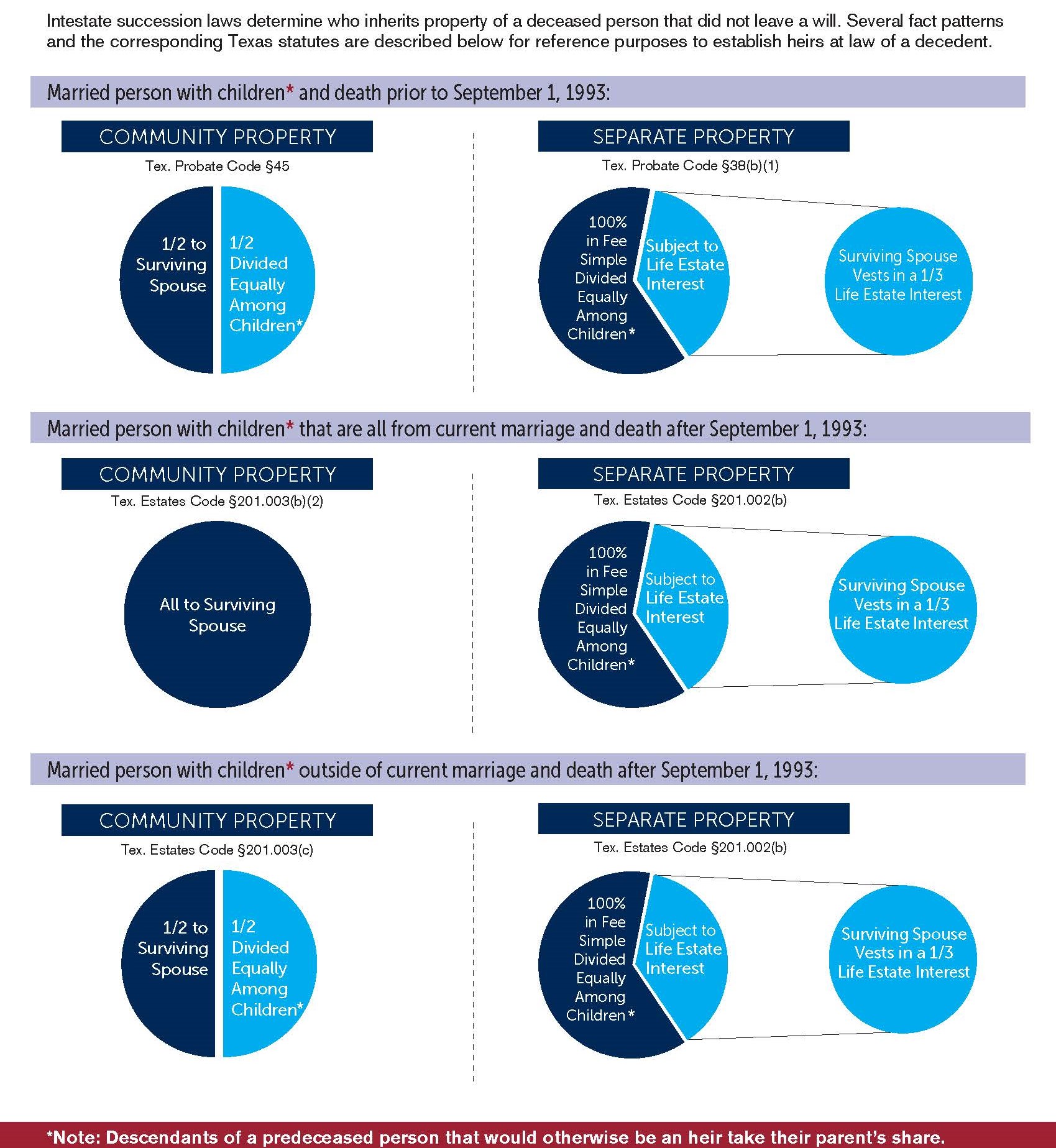

The texas medical privacy act is a legal act implemented by the. However, if you die without a will, the distribution of your assets will be left up to the state’s intestate succession process. All 6 of these states exempt spouses, and some fully or.

In addition, texas will not impose inheritance related taxes for beneficiaries of texas estates. A brief (ish) introduction to texas inheritance and estate taxes. Most of its laws surrounding inheritance are straightforward.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the. Nebraska has the highest top rate at 18%, and maryland has the lowest top rate at 10%. No estate tax or inheritance tax.

Maryland is the only state to impose both now that new jersey has repealed its estate tax. There is a big exception to the “no inheritance tax” rule, however. So there is no filing requirement when a gift is made.

The texas medical privacy act helps protect your medical privacy. Understanding how texas estate tax laws apply to your particular situation is critical. The federal government does not have an inheritance tax, though it has a federal estate tax.

4 the federal government does not impose an inheritance tax. Inheritance taxes, unlike estate taxes, apply a tax rate based relationship of the decedent to the beneficiary, meaning it applies even if the estate is relatively small. No estate tax or inheritance tax.

If you have a loved one who dies in pennsylvania and leaves you money, you may owe taxes to that state. Maryland is the only remaining state that has both a state estate tax and a state inheritance tax. Texas also has no gift tax, meaning the only gift tax you have to worry about is the federal gift tax.

The state of texas does not have an estate tax, however residents may still be subject to federal estate tax laws. The state repealed the inheritance tax beginning on 9/1/15. There are no inheritance or estate taxes in texas.

Texas repealed its inheritance tax law in 2015, but other tricky rules can apply depending on what you do with the money or property. Texas also does not impose a gift tax or an inheritance tax. However, texas residents still must adhere to federal estate tax guidelines.

There is also no inheritance tax in texas. But one tax that comes about as close as possible to being theft is the estate tax. Does texas have a death tax.

You can give a gift of up to $15,000 to a person without having to pay a federal gift tax. Texas does not impose a state inheritance or estate tax. However, in texas, there is no such thing as an inheritance tax or a gift tax.

Are there inheritance taxes in the state of texas? If you live in texas and are thinking about estate planning, this guide will walk. Twelve states and the district of columbia impose estate taxes and six impose inheritance taxes.

Some states also impose a state estate tax. Eight states and the district of. Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent.

The dedicated estate planning attorneys at ibekwe law, pllc in texas can help you address your estate planning concerns with this ironclad privacy. Inheritance tax is a state tax only; No estate tax or inheritance tax

What are the estate tax rates in texas? The top estate tax rate is 16 percent (exemption threshold: It also does not impose tax for texas residents that inherit assets that are domiciled in other states.

You’re in luck if you live in texas because the state does not have an inheritance tax, nor does the federal government. The tax did not increase the. T he short answer to the question is no.

No estate tax or inheritance tax. In texas, as well as nationwide, if you are a named beneficiary of an individual retirement arrangement, commonly referred to as an ira, then your share of the distribution is added to your ordinary income and will be taxed at your personal income tax rate. Who pays state inheritance tax

No estate tax or inheritance tax. Washington has been at the top for a while, but hawaii raised. Texas is one of only seven states that have no personal income tax.

Texas does have a property tax , but it's collected by cities, counties, and school districts, not by the state itself. There is a 40 percent federal tax, however, on estates over $5.34 million in value.

Are Social Security Benefits Taxable You Better Believe It Uncle Sam Can Tax Up To 85 Of Your M Social Security Benefits Social Security Retirement Benefits

United States Map Of States With No Income Tax Alaska Washington Nevade Wyoming Texas South Dakota And Florida As Well As S Income Tax Income Retirement Budget

Struggling With Loan Approval Consider A Fha Loan

What Are The Inheritance Laws In Texas Republic Of Texas Inheritance Texas

Which Us States Tweet The Most About Tesla Data Dataviz Gluuio Tesla Infographic Piktochart Us States Texas Usa Data

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Taxes Family Law Attorney Divorce Lawyers Divorce Attorney

Texas Intestacy Law

Talking Taxes Estate Tax – Texas Agriculture Law

Do I Have To Pay Taxes When I Inherit Money

Form Templates Will Forms Remarkable Pdf Living Texas Oregon Pladevia Last Will And Testament Will And Testament Templates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Line Of Inheritance – What Happens When Theres No Will Infographic Probate Wills Probate Infographic Inheritance

Legal Representation Is Important To Winning Child Custody Custody Lawyer Child Custody Custody

Pin On Will And Trust Law

9 States With No Income Tax Florida Nevada Texas Income Tax Inheritance Tax Income Tax Brackets

Texas Inheritance And Estate Taxes – Ibekwe Law

Texas Has The Fifth-highest Property Taxes In The Nation But Do We Get What We Pay For – Candysdirtcom

What Texas Residents Need To Know About Federal Capital Gains Taxes