Otherwise, the statewide transit tax payment is due quarterly on or before the last day of the month following the end of. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds.

File Payroll Taxes Issue 39 Mvpstudiomvp-studio-plan Github

Oregon employers must withhold 0.1% (0.001) from each employee’s gross pay.

Oregon statewide transit tax form 2021. The tax was part of house bill 2017 from the 2017 legislative session, also known as the transportation package. 2021 form or stt 1. Failure to report all employees with correct ssns may result in penalties.

Nonresident employers who are outside of oregon's taxing jurisdiction may deduct, withhold, report, and remit the statewide transit tax for oregon resident employees similar to oregon income tax withholding. All forms are printable and downloadable. Revenue from the statewide transit tax will go into the statewide transportation improvement fund to finance investments and improvements in public transportation services, except for.

Available for pc, ios and android. Those nonresident employers who are currently performing courtesy income tax withholding for oregon resident employees should have received a letter. What is the oregon transit tax?

Employers that expect their statewide transit tax liability to be less than $50 per year may request to file and pay the tax annually instead of quarterly. Oregon drake accounting ® : Due date for annual filers (agricultural employers or form oa domestic filers), the statewide transit tax payment is due on the last day of the month following the end of the tax year (january 31).

Ad access any form you need. Business identification number (bin) quarter year note: Withhold the state transit tax from oregon residents and nonresidents who perform services in oregon.

Taxpayers who have not yet filed should check with their tax preparer or software provider if. With the release of drake accounting ® 2018 version 2.17.2.0 , the oregon oq form has been updated in the software for the 3rd and 4th quarters to reflect the update of payroll state wide transit tax. Does das facilitate the oregon state wide transit tax?

Available for pc, ios and android. Complete, edit or print your forms instantly. The oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

The statewide transit tax is imposed on the wages of each employee, but the employer is responsible for withholding, reporting, and remitting the statewide transit tax. Once completed you can sign your fillable form or send for signing. (1) an employer required to withhold and remit statewide transit taxes to the department under ors 320.550 (tax on wages) must submit a statewide transit tax return and any schedules required to be filed with the return by the due date in section (4) of this rule.

Quarter that payroll was paid to employees (1, 2, 3, or 4) 2021 form or stt 2. Taxpayers who have not yet filed should check with their tax preparer or.

Reporting and payment due dates. Pay online at www.oregon.gov/dor or make check payable to: 04) office use only • business identification number (bin).

Filers, enter 1, 2, 3, or 4 to indicate the tax quarter in the quarter box. The stt is calculated based on the employee's wages as defined in ors 316.162. All employers who are subject to withholding must complete this form.

The most secure digital platform to get legally binding, electronically signed documents in just a few seconds.

2

.jpg)

Or – Statewide Transit Tax Das

Oregon Statewide Transit Tax

Or Stt A – Fill Online Printable Fillable Blank Pdffiller

2

Oregons New Statewide Transit Tax – Southland Data Processing

What Is The Oregon Transit Tax How To File More

Payroll Systems Attn Oregon – Statewide Transit Tax Effective July 1 – Payroll Systems

2

Or Form Or-tm Instructions 2020-2021 – Fill Out Tax Template Online Us Legal Forms

State Of Oregon Form Wr Form – Fill Out And Sign Printable Pdf Template Signnow

2

Oregon Statewide Transit Tax

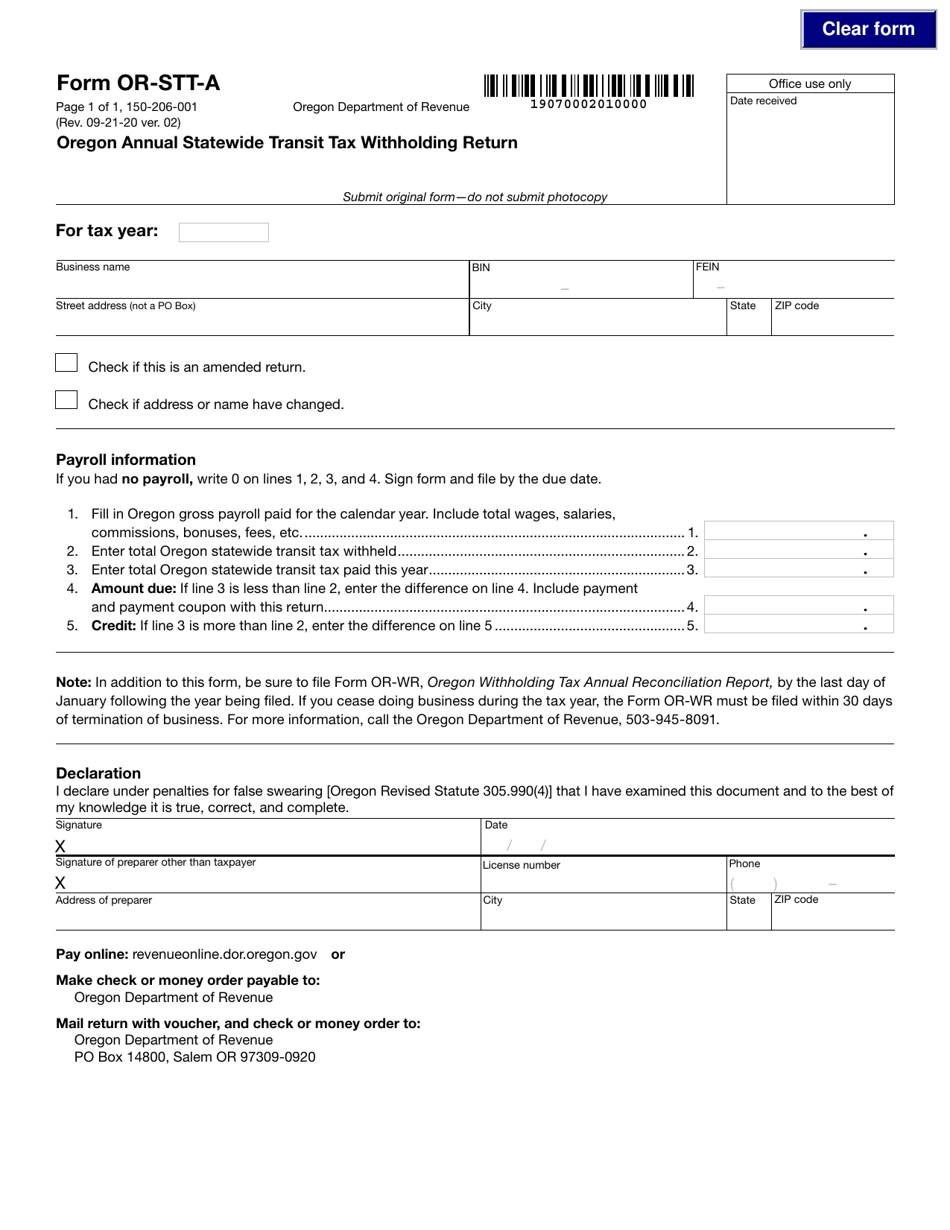

Form Or-stt-a 150-206-001 Download Fillable Pdf Or Fill Online Oregon Annual Statewide Transit Tax Withholding Return Oregon Templateroller

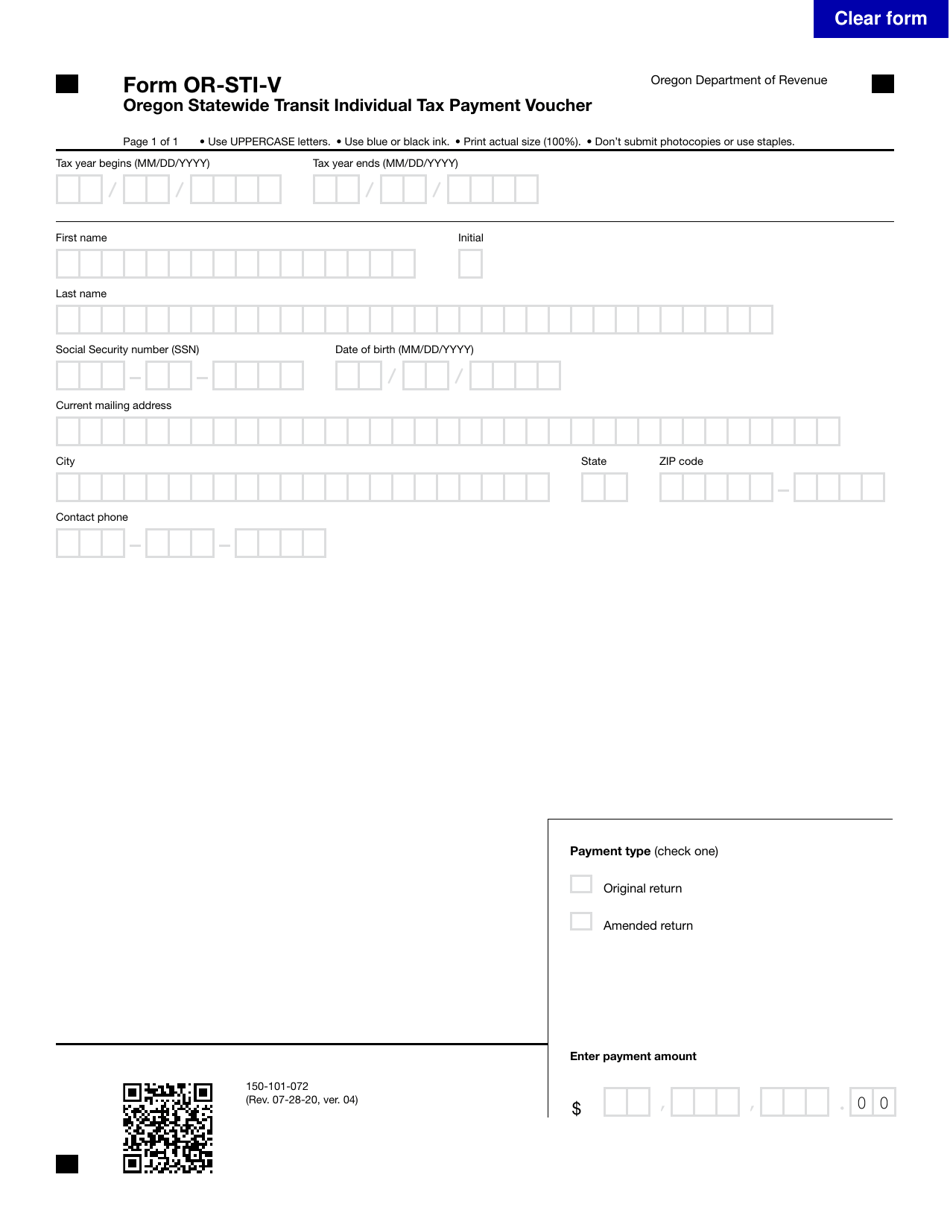

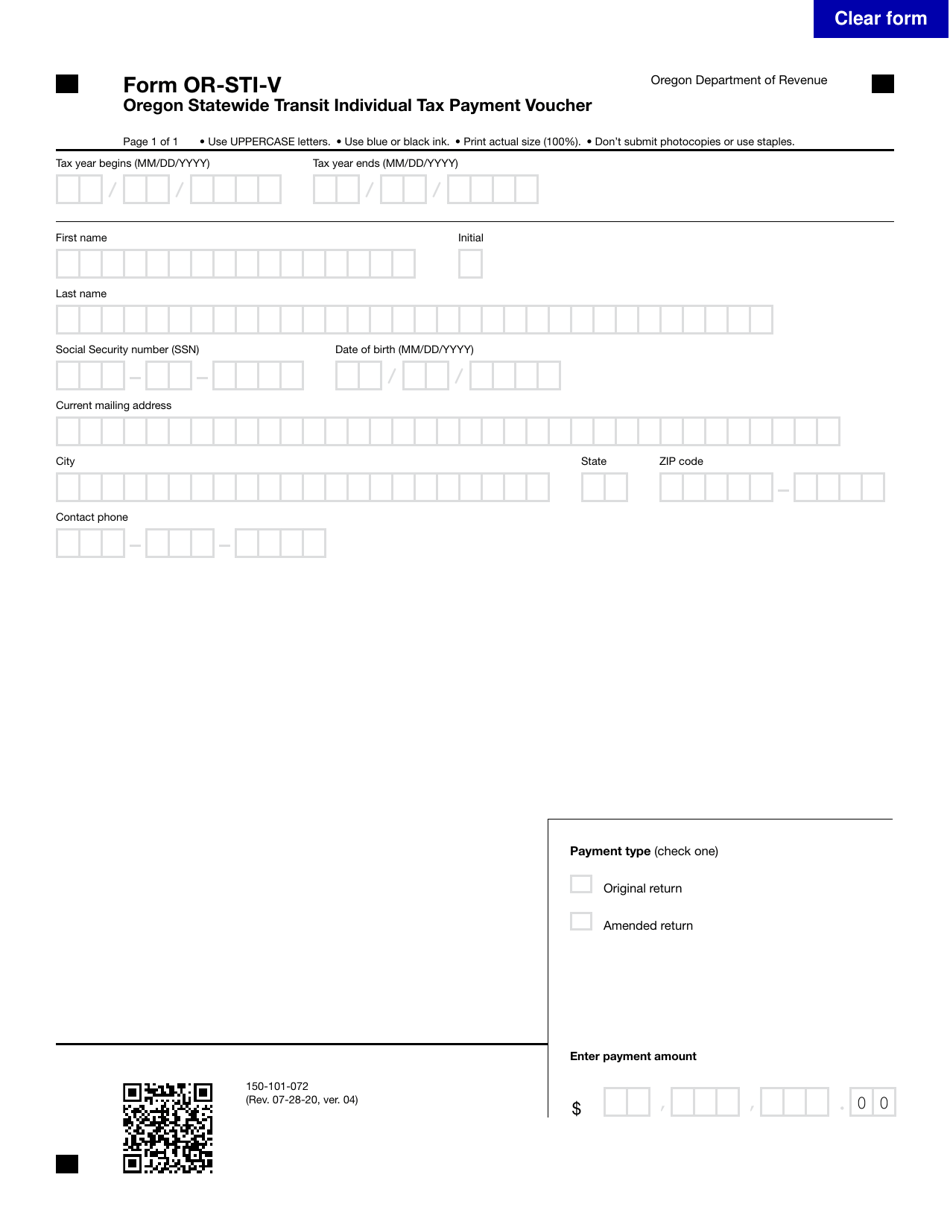

Form Or-sti-v 150-101-072 Download Fillable Pdf Or Fill Online Oregon Statewide Transit Individual Tax Payment Voucher Oregon Templateroller

What Is The Oregon Transit Tax How To File More

2018-2021 Form Or Or-stt-2 Fill Online Printable Fillable Blank – Pdffiller

Or Stt 1 – Fill Out And Sign Printable Pdf Template Signnow

Download Instructions For Form Or-stt-a 150-206-001 Oregon Annual Statewide Transit Tax Withholding Return Pdf Templateroller