All rates will be updated using the best information dor has available. The gary courthouse, 15 w.

Additional Information On Property Taxes

The department of local government finance (dlgf), in partnership with the indiana business research center (ibrc) at indiana university, has created the above tax bill projection utility for indiana taxpayers.

Lake county tax bill indiana. This site requires that your browser support frames. Find a county licensed contractor. Lake county collects, on average, 1.37% of a property's assessed fair market value as property tax.

A copy of your tax bill will appear in a new. Lake county tax collector's office our office is focused on providing swift service with accuracy and exceptional customer service. Median property taxes (mortgage) $1,752:

For example, 2019 taxes are payable and billed in 2020. Information on your property's tax assessment; Search lake county property tax and assessment records by address, parcel number, tax id or owner name.

(remember you will only receive 1 tax bill for the year. The collection begins on november 1st for the current tax year of january through december. Amends the lake county innkeeper's tax statute concerning:

And (3) authority to enter into leases for the construction, acquisition, and equipping of a convention center. Please refer to the microsoft home page

or the <a. 124 main rather than 124 main street or doe rather than john doe).

For best search results, enter a partial street name and partial owner name (i.e. The lake county health department supports the current cdc and indiana department of health covid control guidelines. The treasurer sends out tax bills and collects and distributes funds for all lake county taxing districts.

Renew vehicle registration search and pay property tax pay tourist tax run a real estate report run a tangible property report If you are having trouble searching, please visit assessor property cards to lookup the address and parcel number. Food and beverage tax (fab) local income tax (lit) all counties will have a lit rate, but not all counties have cit or fab taxes.

(1) uses of the innkeeper's tax; The median property tax in lake county, indiana is $1,852 per year for a home worth the median value of $135,400. The exact property tax levied depends on the county in indiana the property is located in.

Yearly median tax in lake county. Lake county has one of the highest median property taxes in the united states, and is ranked 540th of. Our team has a vast array of knowledge and experience to assist you with property taxes, driver license or motorist services, motor vehicle registrations, concealed weapon permits and many other services.

Newton county's 2021 fall property taxes are due november 10, 2021. Lake county property tax payments (annual) lake county indiana; Make sure the tax year is set to the right year.

Median property taxes (no mortgage) $1,395: Pay your water & sewer bill in lake county, indiana the average water & sewer bill paid on doxo in lake county, indiana was $74 Find lake county tax records.

The county mailed provisional bills in early october so property owners could pay half their taxes, but the state didn't release the tax rates on. Apply for a building permit. To print a tax bill.

You can contact the lake county assessor for: After reviewing the tax summary, click on “tax bill” in the right hand column. Checking the lake county property tax due date;

(2) removal of a member of the lake county convention and visitor bureau; The lake county assessor is responsible for appraising real estate and assessing a property tax on properties located in lake county, indiana. These figures are calculated by the county auditor and certified before final tax bills are mailed.

Additionally, some municipalities within the counties may have their own fab tax. Lake county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in lake county, indiana. The sales tax for the entire state of indiana is 7%.

Hamilton county collects the highest property tax in indiana, levying an average of $2,274.00 (1.08% of median home value) yearly in property taxes, while orange county has the lowest property tax in the state, collecting an average tax of $515.00 (0.57%. These real estate taxes are collected on an annual basis by the lake county tax collector's office. While taxpayers pay their property taxes to the lake county treasurer, lake county government only receives about seven percent of the average tax bill payment.

Property owners can pay their bills at the treasurer's offices at the lake county government complex, 2293 n. Search all services we offer. It is the responsibility of each property owner to see that their taxes are paid, and that they do indeed receive a tax bill.

Lake county health department school masking guidance. School districts get the biggest portion (about 69 percent). Request child support payment history.

Search by address search by parcel number. Disable your popup blocker, and click “go.”. These records can include lake county property tax assessments and assessment challenges, appraisals, and income taxes.

We strongly recommend that all schools follow the masking, contact tracing and quarantining practices described in the guidelines.

Lake County Indiana Property Tax Records – Property Walls

Lake County Indiana Property Tax Records – Property Walls

Lake County Il Property Tax Information

Clerk

The New Age In Indiana Property Tax Assessment

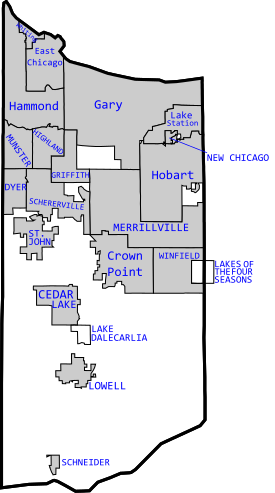

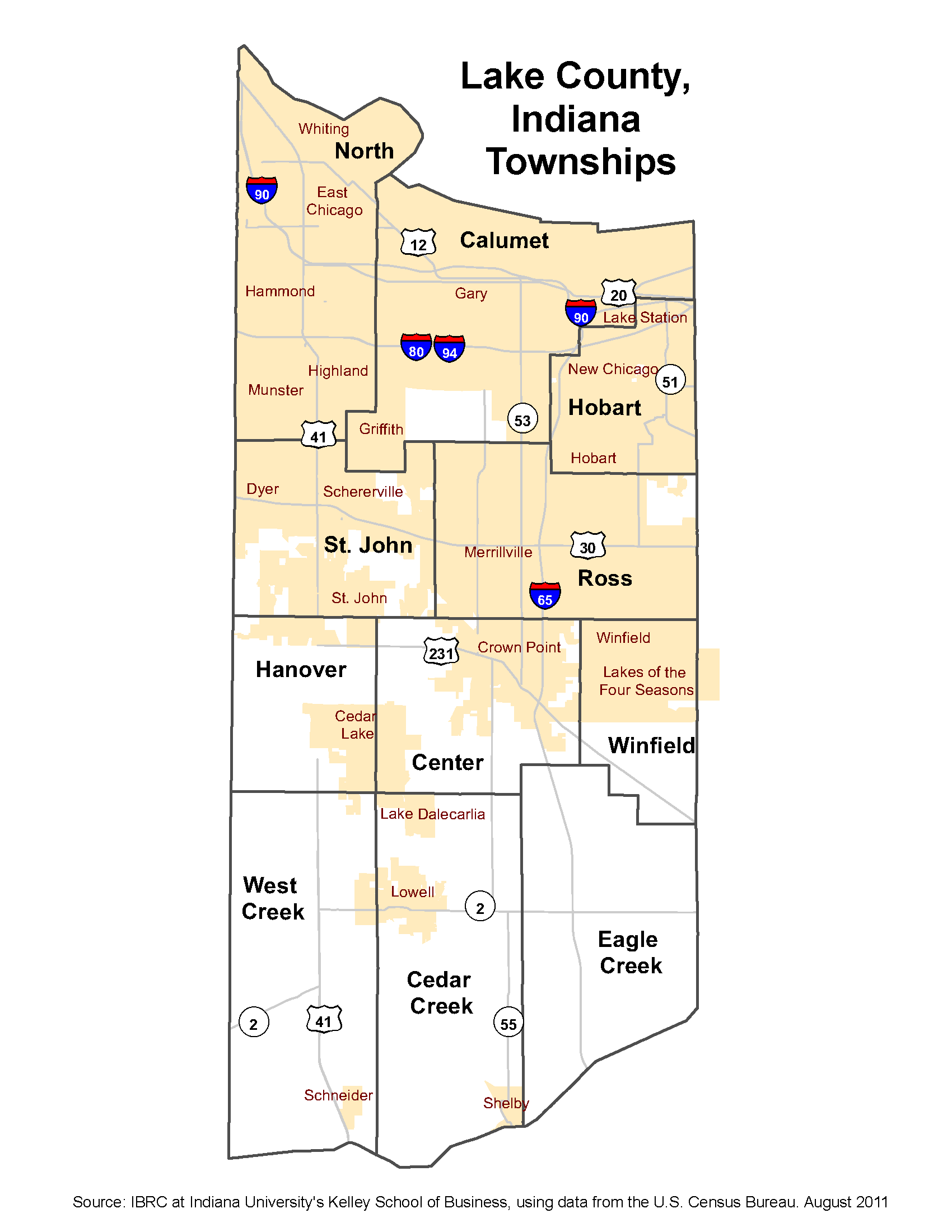

Lake County Indiana

Lake County Indiana

The New Age In Indiana Property Tax Assessment

Property Owners Get 60-day Grace Period To Pay Taxes Penalty Free Lake County News Nwitimescom

Lake County Indiana Property Tax Records – Property Walls

Directory Lake County Il Civicengage

Lake County Portion Of Property Tax Rate To Decrease By 3 In 2020 – Chicago Tribune

Assessor

The New Age In Indiana Property Tax Assessment

Lake County Indiana Property Tax Records – Property Walls

Lake County Indiana Property Tax Records – Property Walls

Lake County Treasurer Peggy Katona Now Permits Tax Payments By Credit Card Lake County News Nwitimescom

Treasurer

The New Age In Indiana Property Tax Assessment