Corporations may also pay excise tax online through masstaxconnect. The payments can only be made from the mtc login page;

Upload An Excel Spreadsheet And Make A Payment For Paid Family And Medical Leave Massgov

Department of revenue recommends using masstaxconnect to make tax payment online.

Mass tax connect make estimated payment. (faqs on new may 17, 2021 deadline, mass. If the corporate excise tax exceeds $1,000, your corporation is required to pay estimated tax payments on expected income. The statewide sales tax rate of 6.25% is among the 20 lowest in the country (when including the local taxes collected in many other states).

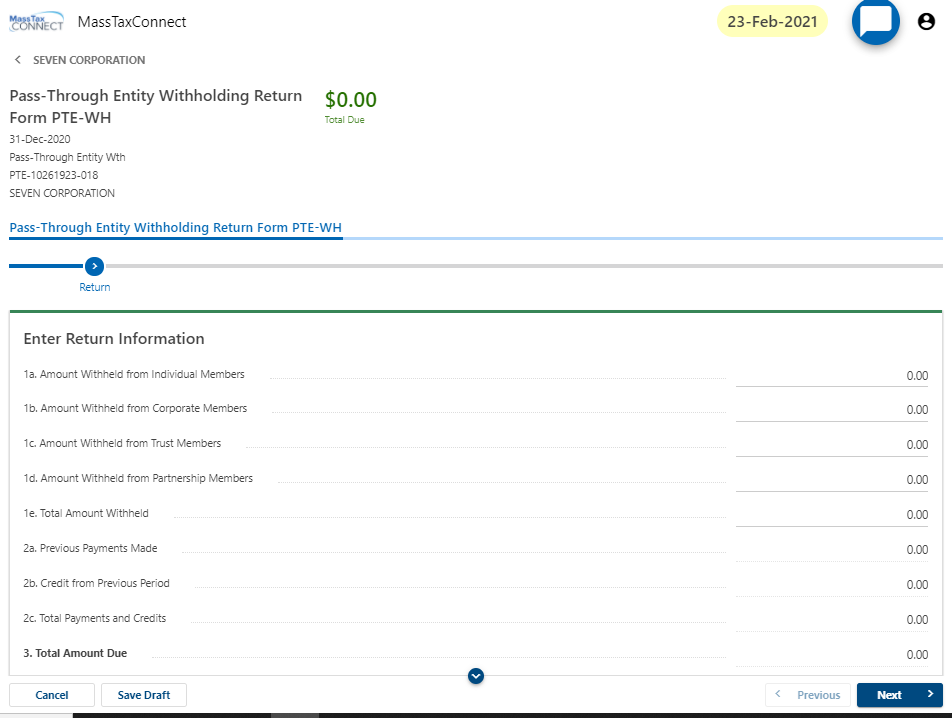

$8,130.24 + $12,716.59 = $20,846.83 (stephanie’s total estimated taxes). From the masstaxconnect homepage, select the make a payment hyperlink in the quick links section. Are estimated payments required for the pte excise?

It is not an option if logged in to mtc. The department of revenue (dor) has guidelines to determine if you are someone who must pay estimated taxes. Select the business payment type radio button].

As with other taxpayers, an electing eligible pte must make estimated tax payments if the pte’s required annual payment is $400 or greater. Click the individual payment link, then the estimated payment button on the next screen after you enter the required information boxes. Business and fiduciary taxpayers must log in to make estimated, extension, or return payments.

1) go to the masstaxconnect site to submit your estimated payment directly to the state tax agency. Individuals and fiduciaries can make estimated tax payments online through masstaxconnect. Paying online through masstaxconnect allows you to:

Select individual for making personal income tax payments or quarterly estimated income tax payments. Business taxpayers can make bill payments on masstaxconnect without logging in. Taxpayers who have already filed their personal income tax returns, but have not made the associated payment, will have until may 17, 2021 to make the payment.

The massachusetts income tax rate is 5.00%. Note that there is a fee for credit card payments. Estimated payments are due for a taxable year even though the chapter 63d election for the taxable year cannot be made until the return is filed.

You do no need an account. Have 24/7 access to view your payment history; The form that you need is the massachusetts income tax payment voucher (form pv).

Under quick links select make a payment (in yellow below). $20,846.83/4 = $5,211.71 (stephanie’s quarterly tax payment). You can make your personal income tax payments without logging in.

The portal allows users to file and amend returns, view balances, make payments, view correspondence, register new accounts, update information, submit documents and applications, and more! Masstaxconnect (mtc) can now accept estimated payments from individual taxpayers for 2018. If making both 2017 and 2018 payments, the process would be repeated.

You can use your credit card or electronic fund transfer (ach debit) from either your checking or saving account. All estimated excise payments made by a combined filing group should be reported under the principal reporting entity’s tax account. Paid in full on or before the 15th day of the third month of the corporation's taxable year or

Estimated taxes must either be: Online mass dor tax payment process. Go to my turbotax at the top left;

The system defaults to a 2017 payment but provides a checkbox to choose a 2018 payment instead. Go to masstax connect at www.mass.gov/masstaxconnect for more information. There are different massachusetts tax forms mailing addresses for each of the various excise tax documents corporations must file.

Of rev., 03/23/2021.) march 17, 2021 The most significant taxes in massachusetts are the sales and income taxes, both of which consist of a flat rate paid by residents statewide. The agency's new online portal to manage accounts for taxpayers, tax professionals, and other dra customers!

Myconnect is the new connecticut department of revenue services’ (drs) online portal to file tax returns, make payments, and view your filing history. Most corporations must make estimated payments electronically. Use this link to log into mass department of revenue's site.

Freelancers, contractors, and any professional who doesn’t have taxes withheld from paychecks may be required to make an estimated tax payment at the end of each quarter in massachusetts. Estimated payments due april 15, 2021 are not impacted by the date change and remain due on april 15, 2021. Schedule payments in advance and cancel or change scheduled.

All corporations that reasonably estimate their corporate excise to be in excess of $1,000 for the taxable year are required to make estimated tax payments to massachusetts. Choose one of these options: Make estimated payments and immediately confirm that dor has received your payment;

Sign into your online account;

Residential Solar Project In Headingly – 816 Kw Residential Solar Solar Projects Best Solar Panels

2

2

2

12 Job Estimate Templates Word Excel Pdf Templates Estimate Template Word Template Business Letter Template

State Income Tax Filing Deadline Extended To May 17 Massgov

Pin By Victoria Leon On The Small Business Pinterest Connection Pinterest For Business Small Business Resources Social Media Pinterest

Alianza Del Pacifico Y Mercosur Representan Mas De 80 Del Comercio Exterior Regional Economy Infographic Infographic Business Infographic

You Need To Brand Yourself As Well As Your Company This Makes You Realize That You And Your Company Are Forever Small Business Trends Brand Strategy Branding

Tax Guide For Pass-through Entities Massgov

2

Cash Flow Quadrant 4 Ways To Produce Income Be Careful What You Look And Wish Foryou Just Might Rich Dad Poor Dad Quotes Cashflow Quadrant Rich Dad Poor Dad

New On Thelotter For Android My Lottery Results Widget Get The Latest Winning Numbers Next Jackpot And Lottery Ticke Lottery Results Lotto Numbers Lottery

Massachusetts Sales Tax – Taxjar

Geembi In 2021 Throw Blanket Sofa Throw Blanket Blanket

2

2

Property Record For 355 Essex St Salem Ma 01970 Estimated Value 519100 Monthly Value Change 22 Bedroomss Property Records Essex Salem

Taxation Of Your Benefit – Mtrs