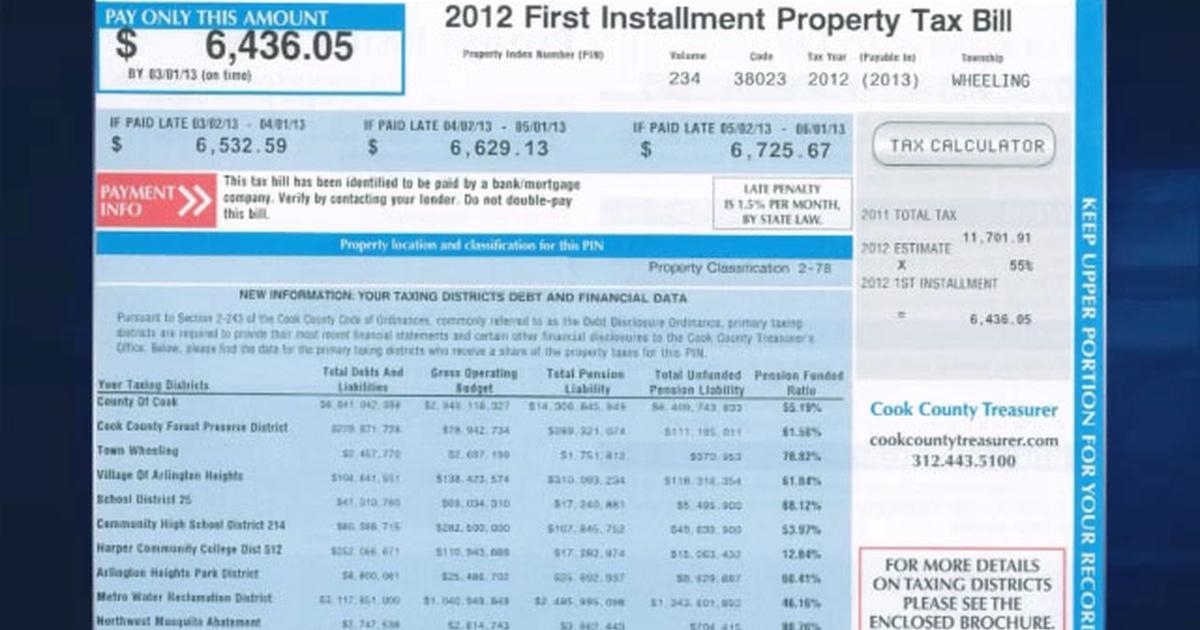

The treasurer's office is responsible for management, distribution and receipt of public funds. Even though known taxes are prorated between the buyer and seller during escrow and proper credit is given to each, all annual property taxes may not have been paid to the tax collector at that time.

Paying Your Taxes Online – Jackson County Mo

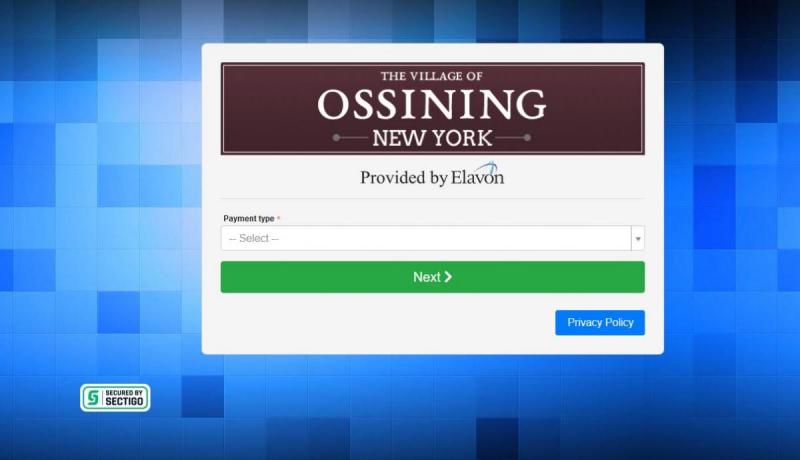

Need the personal identification number (pin), which is printed on any original tax bill.

La county tax collector duplicate bill. The treasurer and tax collector's website provides current year unsecured tax amounts. Please use the envelope enclosed with your unsecured property tax bill and include the payment stub from your tax bill. Please be advised any notices sent by the department of tax and collections will have the county seal and the department of tax and collections contact information.

Board of supervisors hilda l. These refunds are processed and issued by the treasurer and tax collector’s office. This website provides current year unsecured tax information and is available between march 1 and june 30 only.

You can pay your bill using checking account or credit/debit card. *drop box at both la porte and michigan city courthouses. Do not attach staples, clips, tape, or correspondence.

Los angeles county tax collector p.o. Leah castro was elected in 2012, 2016 and 2020 by the voters of la paz county. Forms used should contain all information required by statute.

225 north hill street, room 115, los angeles, california90012. La plata county treasurer hours: The taxpayer is responsible for delinquent fees and penalties resulting from such unavailability.

Po box 99, durango co 81302 phone: View and pay your los angeles county secured property tax bill online using this service. We are located on the first floor in room 122.

This publication is provided by the state controller's office, property tax standards unit, as a general resource for california’s county tax collectors. Please put “duplicate tax bill” in the subject heading of your email and include the assessor id no. All lenders & title companies without the original tax bill must include $5 for a duplicate bill fee per parcel.

Penalty cancellation form pay property tax. The office also issues annual tax bills and is responsible for the collection, management and distribution of property taxes levied by various entities within la paz county. Hill street, los angeles, ca 90012.

Notices such as these, are not authorized, nor sent by the county of santa clara, department of tax and collections. Payments will no longer be processed without the $5 fee. You will need to present your tax coupon along with your payment.

The mission of the los angeles county treasurer and tax collector is to bill, collect, disburse, invest, borrow, and safeguard monies and properties. You must mail your property tax payments to: Lake county tax collector 255 n forbes street, rm 215 lakeport, ca 95453.

Senior citizen property tax assistance. Delinquent unsecured tax information is only available by telephone or in person. For a duplicate bill, email us at info@ttc.lacounty.gov.

The department also provides enforcement, auditing, consulting, education, estate administration, and public information services. The county tax collector’s office may use the sample forms or they may create their own forms. Do not mail your payments to any other address.

If there are any remaining unpaid property taxes, and if you did not receive an annual secured property tax bill from either the previous owner or the treasurer and tax collector, you may request a copy by calling the treasurer and tax collector’s automated substitute secured property tax bill request line at 213.893.1103. If you pay the same bill twice or overpay taxes, a refund may result. (ain) in the body of the email.

You will need your assessor's identification number (ain) to search and retrieve payment information. The county tax collector is responsible for the collection and accounting of all property taxes levied on the real, personal and operating property tax rolls. View or pay property tax online.

Duplicate tax bills for homeowners available at no charge. County of los angeles treasurer and tax collector kenneth hahn hall of administration. There is no charge for electronic check payments.

It is also the responsibility of the tax collector to provide notice to every taxpayer, his agent or representative the amount of property tax due no later than the 4th monday in november. Send all mailing address change requests to:

County Of Los Angeles Assessment Appeals Board

County Of Los Angeles Assessment Appeals Board

2

Adjusted Annual Property Tax Bill Los Angeles County – Property Tax Portal

Tax Certificate And Tax Deed Sales – Pinellas County Tax

Village Tax Information Ossining Ny

2

Chicago Tonight Cook County Treasurer Ups Transparency Season 2013 Pbs

2

How To Read Your Property Tax Bill La County Property Tax Los Angeles Real Estate Bills

2

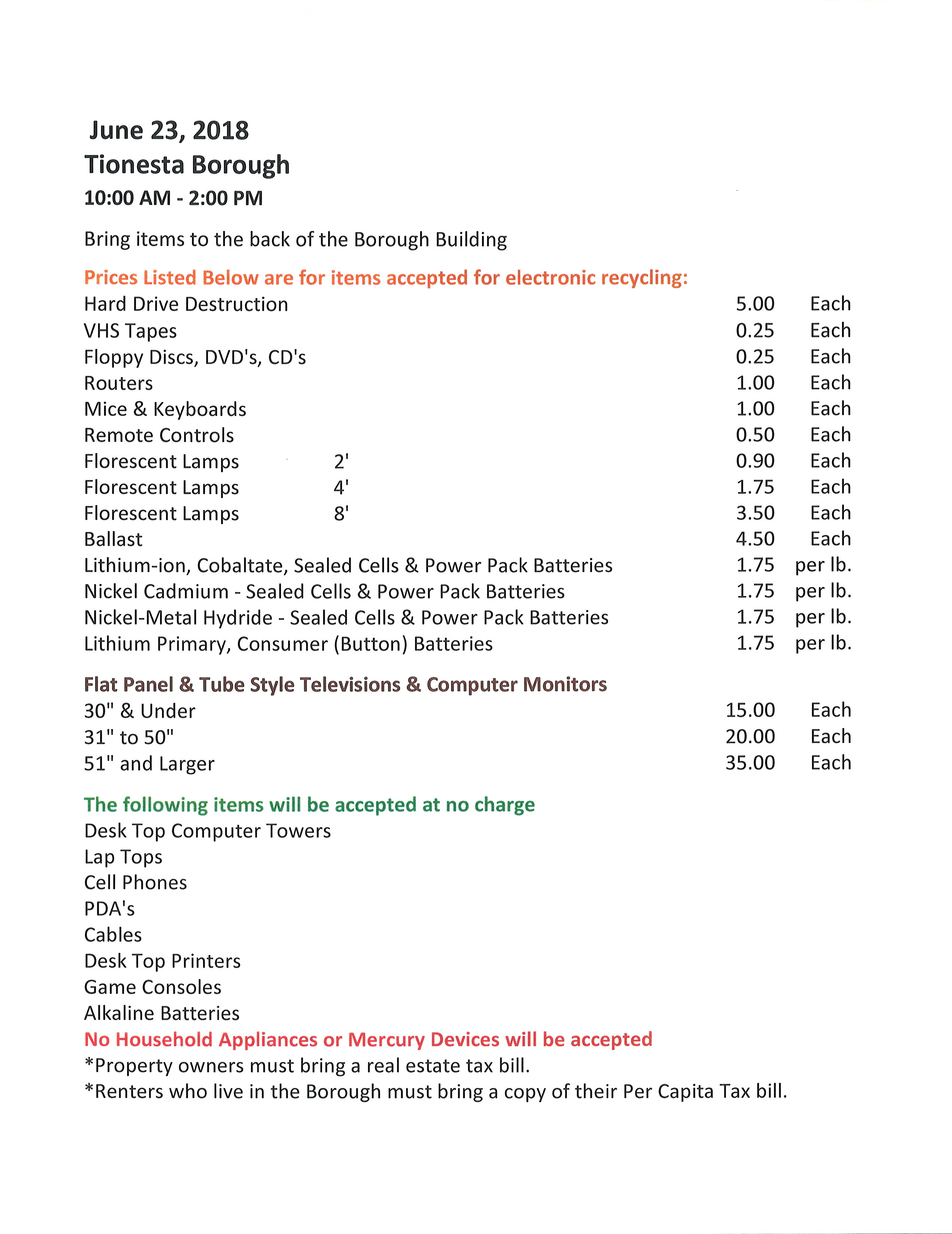

Real Estate Taxes

Tionesta Borough Small Town Living On The Allegheny

Assessors Office – City And County Of Denver

We Make You A Customized Fake Receipt For Online Or In-store Purchases Or A Personal Or Business Invoic Receipt Template Free Receipt Template Money Template

Paying Your Taxes Online – Jackson County Mo

Online Payments St Lucie Tax Collector Fl

Pin By Rootamental On Chumash Nation Native American Symbols Pueblo Pottery Tribal Art

2