Posted by roberta bartel on february 27, 2020. The energy efficient homes credit is a 45l tax credit that offers $2,000 per dwelling unit to multifamily developers and single family home builders.

45l Energy Efficient Tax Credits Engineered Tax Services

Any unused credits can be carried over for up to 20 years.

45l tax credit multifamily. The bill extends the tax credit for another two years, through the end of 2013 and. Another green building tax incentive to prepare for in the likely event that it is renewed in 2015 is the section 45l tax credit. The credit is $2,000 per home/dwelling unit to be claimed in the tax year each unit is first sold or leased.

Cheers 45l gives raters the freedom they need to process tax credits wherever and whenever. Key provisions impacting the multifamily industry include the following: However, spec houses, manufactured homes and multifamily developers can gain huge tax credits for buildings 50% above the 2006 iecc code.

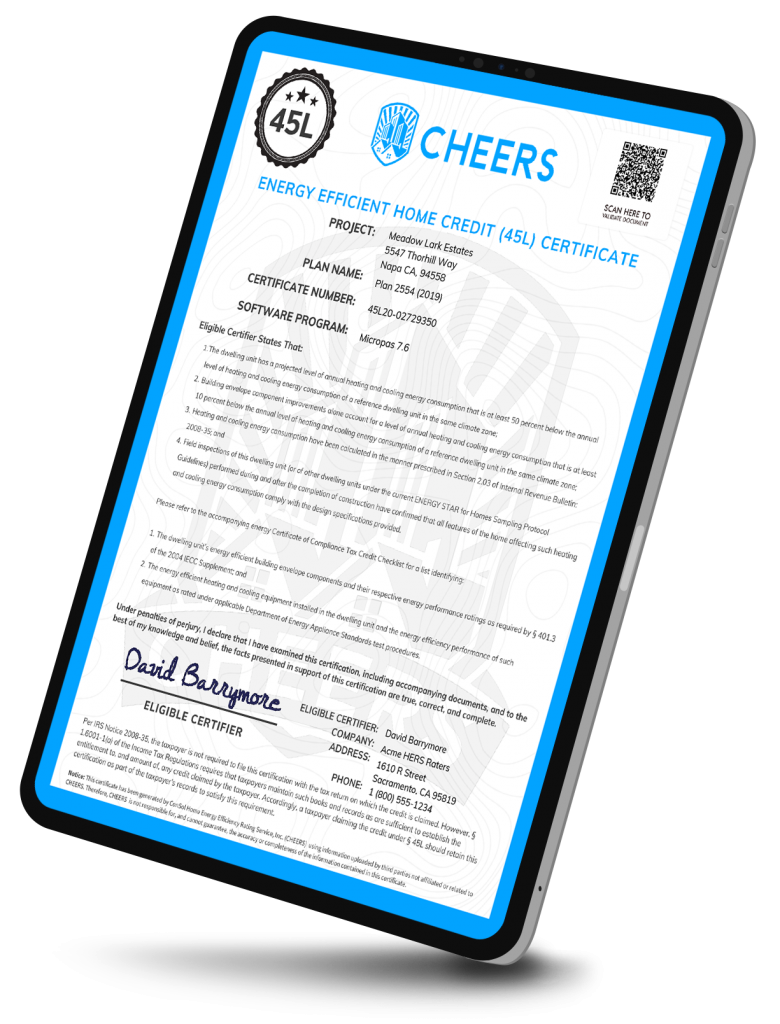

The section 45l tax credit which rewards multifamily developers with tax credits of $2,000 per energy efficient apartment unit. This tax credit is equal to $2,000 per residential unit or dwelling to the developers and/or eligible contractors of energy efficient buildings. An energy efficient homes tax credit (irc section 45l):

The 45l residential tax credit has recently been extended through the end of 2020. This free cpe webinar will cover: Capturing the 45l tax credit.

The tax credit was retroactively extended in late 2019 for 2018 and 2019 through the end of 2020. Ascent multifamily accounting professionals have experience in helping owners and developers secure various types of tax credits for their multifamily developments. Taxpayers also have the ability to amend returns to claim missed tax credits from previous years.

The section 45l tax credit had expired at the end of 2011 but this bill extends the tax credit for two years, through 2013. Cheers 45l is the only software built specifically for 45l tax credits with raters in mind. Section 45l tax credit newly constructed or renovated apartments and condominium developments of three stories or less that meet certain criteria are eligible for a $2,000 credit per unit under section 45l of the internal revenue.

Each newly contractor built, energy efficient residential dwelling, purchased from the contractor and used as a residence over the last few years is eligible for the 45l tax credit of $2,000. Through recent passage of a new tax extenders bill, the energy efficient home credit (the 45l credit) which provides eligible contractors with a $2,000 tax credit for each energy efficient dwelling unit, is retroactively available for projects placed in service from 2018 to 2020, and through the. The act has extended the 45l credit for qualifying units initially leased or sold through december 31, 2021.

45l tax credits for multifamily dwellings tax credit for energy efficient residential buildings the new energy efficient home tax credit, code section 45l, has been extended to december 31, 2011. Among other extensions, this bill retroactively extends the code section 45l tax credit providing multifamily/apartment builders with a tax credit of $2,000 per energy efficient unit. This credit applies to single family and multifamily dwelling units that measure three stories or less.

Home builders and multifamily building owners who outfit their properties with energy efficient technologies, there is a significant tax credit available in the form of the 45l tax credit. The 45l energy efficient home credit offers builders & developers a $2,000 federal tax credit per energy efficient home. It can be a great incentive for those looking to offer homeowner efficient spaces without breaking the bank.

This tax credit may be advantageous to developers/owners of sip built.

45l Tax Credit – Cheers

Iacl 45 L Tax Credit Program – Iacl 45l Tax Credit

Ema Brayn Consulting Llc Cohosting Webinar On Tax Incentives For Energy Efficient Designers 2021-05-19 Building Enclosure

Tax Credit Extended For Home Builders Multifamily Developers Bkd Llp

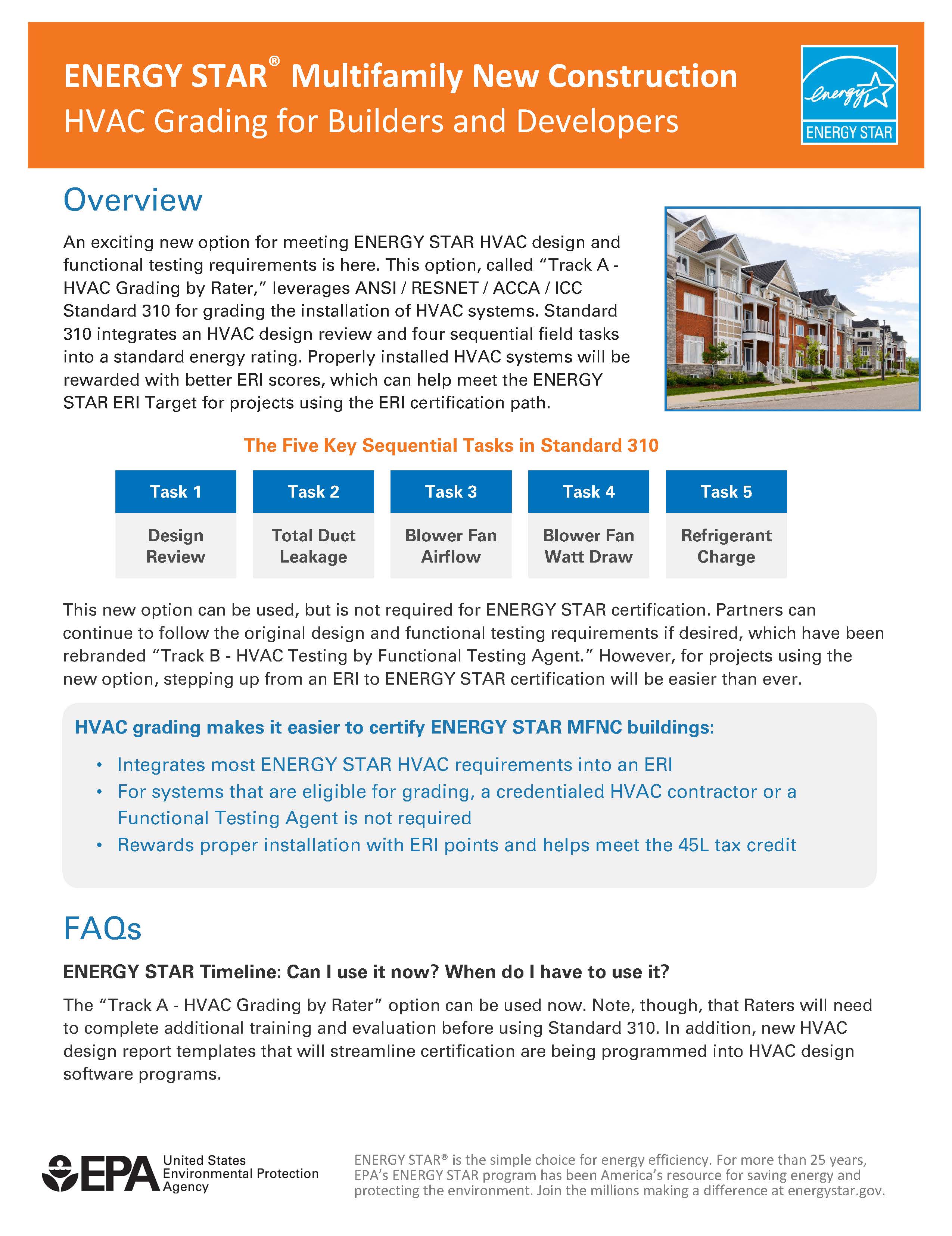

Community Developers Energy Star

Requirements To Claim The 45l Home Energy-efficient Tax Credit Engineered Tax Services

45l Tax Credit Energy Efficient Home Credit For Developers – Baker Tilly

45l Tax Credit – Cheers

The Proposed Build Back Better Act Makes Significant Changes To The 45l And 179d Energy Efficiency Tax Incentives – Ics Tax Llc

179d Tax Deductions 45l Tax Credits – Source Advisors

Tax Benefits For Multifamily Rehabilitation Property Projects

Tax Benefits For Multifamily Rehabilitation Property Projects

45 L Tax Credit Multi-family Hayley Capital

45l Tax Credit Energy Efficient Tax Credit 45l

Section 45l Tax Incentive For The Real Estate Industry Extended Through December 2020 Tax Point Advisors

News Updates – Asset Environments – Asset Environments

45l The Energy Efficient Home Credit Infographic

45l Tax Credit Extended For 2021 Homes – Ducttesters Inc

Kbkg Tax Insight Bipartisan Bill Proposes Retroactive Extension And Updates To 45l Tax Credit Through 2022