Taxing unrealized gains would be a red flag that would undermine the entire incentive for americans of all stripes to participate in the market, scott inferred. In russia, you would pay 20% in taxes.

The Billionaire Tax Proposal A No-good Awful Terrible Idea – Youtube

The constitution forbids “direct taxes” unless they are apportioned among the states according to population.

Tax on unrealized gains uk. For instance, in france, you will pay a third of your capital gains as taxes! Not having to pay taxes on capital gains can make it much easier to retire early in switzerland. Let’s say for a moment however that you are a billionaire (congratulations, how does it feel?).

If your home was worth $200,000 last year and $300,000 this year, you have an unrealized capital gain of $100k. Taxing unrealized capital gains is an exceptionally bad idea. 1.) without a shadow of a doubt, this new tax will apply to you within a handful of years.

That’s not the bigger objective,” schachtel remarked. Reuters obtained the statement, saying, according to the proposal, about 700 of the country’s richest will be forced to pay unrealized gains from their assets. Avoidin g capital gains tax on property uk:

Under frs102 we need to show the investments at market value at year end which is easy to do as they are. The rate started at just 1% and only applied to the wealthiest 3% of. Commenting on a washington post article stating that he would “pay as much as $50 billion under the tax over its first five years, while bezos could pay as much as $44 billion,” the tesla ceo tweeted to his 61.7 million followers:

The point which the gain becomes a realised gain). The homeowner has two options to remedy their $40,000 tax liability. The irs taxes capital gains when they are realized, whether they are reinvested in another fund or transferred to an account holder’s bank for liquid access.

The proposal also calls for a minimum tax of 15% of the country’s most profitable companies. A new annual tax on billionaires’ unrealized capital gains is likely to be included to help pay for the vast social policy and climate package lawmakers hope to finalize this week, senior democrats said sunday. However, they have to pay 28% cgt on any gains in a property.

The wall street journal described a proposed tax that is supported by treasury secretary janet yellen and the democrats: Where will the other 90% come from? Democrats to tax unrealized gains held by the country's roughly 700 billionaires, his.

“according to their own estimates, this tax only covers ~10% of the $3.5 trillion spending bill. The accounts will also show unrealised gains or losses where such assets or liabilities exist at the end of the period of account and are retranslated into sterling at the closing rate (see bim39510). The high rates and additional rates taxpayers will pay 20% cgt on chargeable assets.

Not at all silly.why should rapid gains in capital wealth (almost exclusively the already wealthy) remain totally tax free whilst paye (usually poorer working people) pay tax on every penny they earn. Most countries will tax your capital gains. As with the rest of the bill, the details remain vague, but the idea is to tax unrealized gains — in essence, the appreciated value of property that hasn't been sold —.

There are some situations where you can avoid capital gains tax on the property in the uk. A 15% tax bill on that value increase means the homeowner would have to. Unrealized capital gains are not income, they are simply increases in value.

Unrealized capital gains tax is frankly bananas. If one does not have an extra $40,000, the homeowner will need to borrow the money to pay their tax. Taxing unrealized gains grants the government the ability to monitor your each and every move.

The short answer to the question of how the unrealized capital gains rule would affect you is that it probably won’t, because it only applies to billionaires…for now. Fifth, a tax on unrealized capital gains is flatly unconstitutional. And in some countries, capital gains tax is very high.

Independent journalist jordan schachtel explained that “taxing unrealized gains is only minimally about taxation itself. You also do not have to pay capital gains tax if all your gains in a. That would be impossible with wyden’s wealth tax for the simple reason that there are many more billionaires in new york and california than in mississippi.

Our auditors have disagreed with this, saying that corporation tax is due on the gain made in each financial year, regardless of whether it is a realised or unrealised gain. Tax expenditures, unrealized capital gains would be taxed when assets are transferred at death. How would it impact you?

This means you made a gain of £20,000 (£25,000 minus £5,000). The tax would begin to be enforced in 2022. A decedent’s final income tax return would include unrealized capital gains from all assets held at death.

Under current law, however, unrealized capital gains on assets held at the owner’s death are not subject to income tax. And that corporation tax will only become due on gains in the investment value at the point which the investment is sold (i.e.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

Cointracking Bitcoin Digital Currency Portfoliotax Reporting Bitcoin Tax Season Blockchain Cryptocurrency

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

19 Taxation Of Enterprises And Their Owners In Tax Law Design And Drafting Volume 2

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2021 Propertycashin

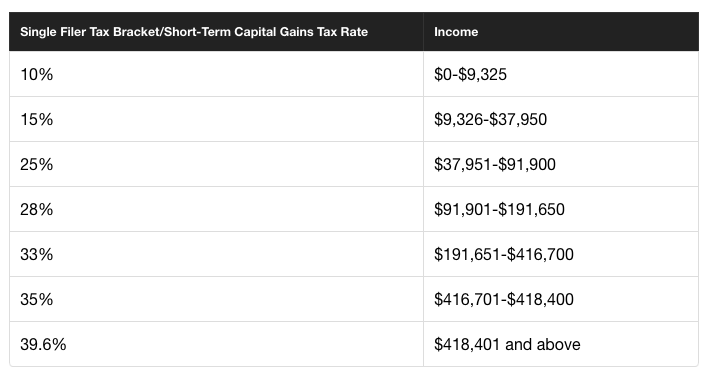

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

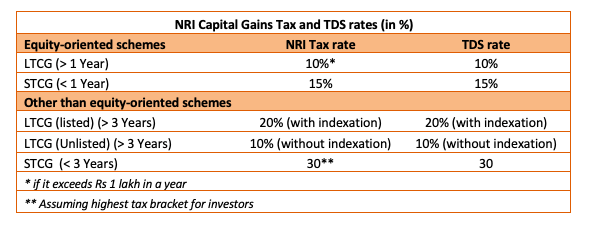

What Should You Know About Taxation As An Nri Mutual Fund Investor Scripbox

Treatment Of Foreign Currency Option Gains

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

Tax-loss Harvesting Using Losses To Enhance After-tax Returns Bny Mellon Wealth Management

19 Taxation Of Enterprises And Their Owners In Tax Law Design And Drafting Volume 2

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

Heres How To Get The Most Out Of Your Pre-ipo Stock Options – Secfi

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2021 Propertycashin

19 Taxation Of Enterprises And Their Owners In Tax Law Design And Drafting Volume 2

What Is Capital Gains Tax – Quora